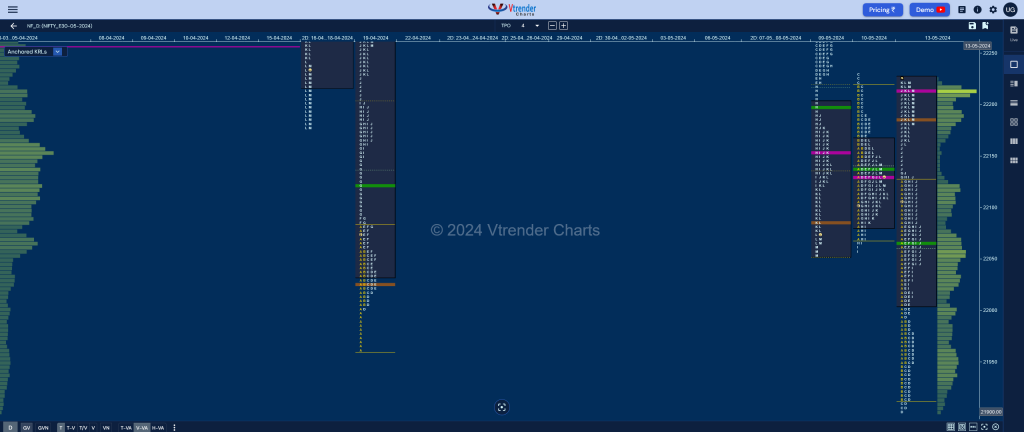

Nifty May F: 22140 [ 22230 / 22050 ]

| Open Type |

|---|

| OTD (Open Test Drive) |

| Volumes of 29,577 contracts |

| Initial Balance |

|---|

| 225 points (22140 – 21815) |

| Volumes of 91,239 contracts |

| Day Type |

|---|

| ‘Neutral Extreme‘ – 325 pts |

| Volumes of 3,41,795 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22214 F and VWAP of the session was at 22065

- Value zones (volume profile) are at 22004-22214-22225

- NF has immediate supply point at AVWAP of 22347 from Swing High of 22888 from 03/05

- NF confirmed a FA at 22230 on 10/04 and completed the 1 ATR objective of 22000 on 13/05. The 2 ATR target comes to 21769.

- NF confirmed a FA at 21900 on 13/04 and completed the 1 ATR objective of 22121 on the same day. The 2 ATR target comes to 22343.

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 14th May 2024

| Up |

| 22214 – POC (13 May) 22260 – G TPO VWAP (09 May) 22300 – Ext Handle (09 May) 22347 – AVWAP (03 May) 22390 – VPOC (08 May |

| Down |

| 22185 – HVN (13 May) 22140 – Ext Handle (13 May) 22101 – H TPO VWAP (13 may) 22065 – NeuX VWAP (13 May) 22012 – PBL (13 May) |

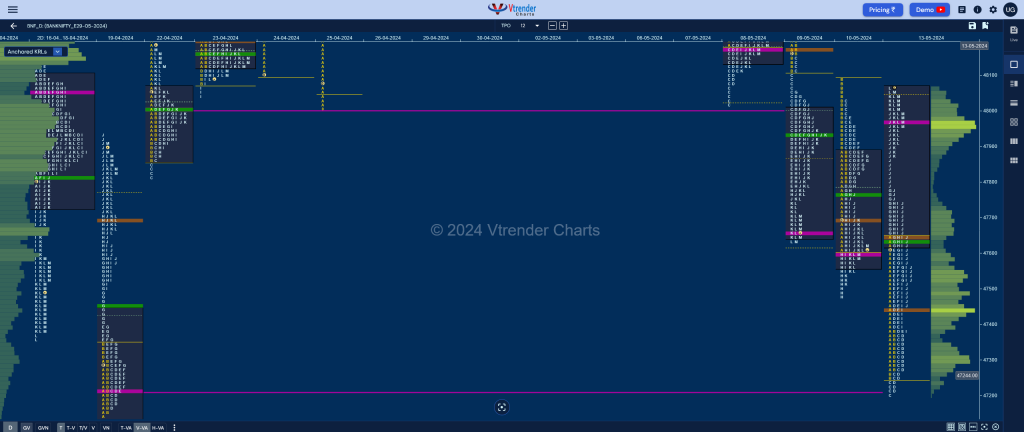

BankNifty May F: 48003 [ 48075 / 47200 ]

| Open Type |

|---|

| OTD (Open Test Drive) |

| Volumes of 14,677 contracts |

| Initial Balance |

|---|

| 392 points (47644 – 47252) |

| Volumes of 40,173 contracts |

| Day Type |

|---|

| ‘Neutral Extreme‘ -875 pts |

| Volumes of 1,89,173 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47967 F and VWAP of the session was at 47628

- Value zones (volume profile) are at 47620-47967-48069

- NF has immediate supply point at AVWAP of 48625 from Swing High of 49927 from 30/04

- BNF confirmed a FA at 47200 on 13/04 and completed the 1 ATR objective of 47813 on the same day. The 2 ATR target comes to 48425.

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 14th May 2024

| Up |

| 48061 – Sell tail (13 May) 48171 – HVN (09 May) 48300 – Sell Tail (09 May) 48416 – VPOC (07 May) 48553 – VWAP (07 May) 48665 – Ext Handle (07 May) |

| Down |

| 47967 – POC (13 May) 47871 – PBL (13 May) 47775 – Ext Handle (13 May) 47628 – NeuX VWAP (13 May) 47524 – I TPO POC (13 May) 47383 – PBL (13 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.