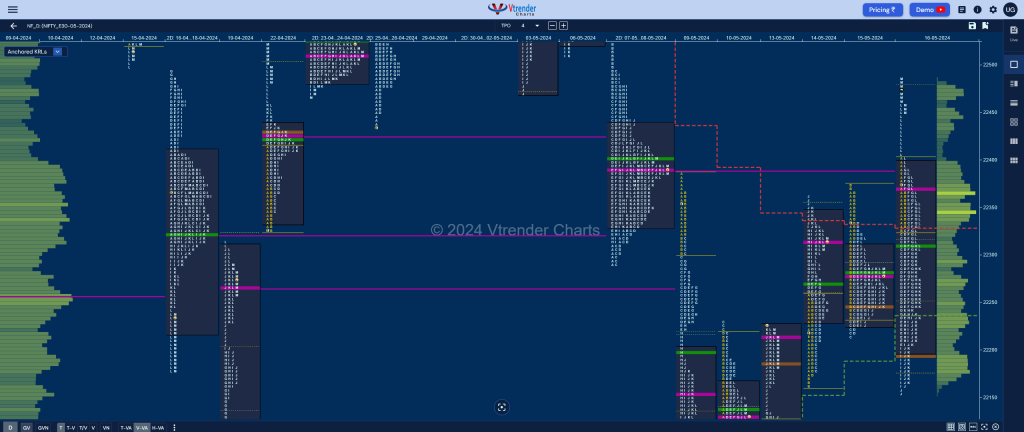

Nifty May F: 22452 [ 22485 / 22154 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 39,267 contracts |

| Initial Balance |

|---|

| 78 points (22400 – 22322) |

| Volumes of 81,936 contracts |

| Day Type |

|---|

| Neutral Extreme – 331 pts |

| Volumes of 5,54,977 contracts |

NF opened higher tagging the VPOC of 22390 while making a high of 22400 but could not sustain confriming an ORR (Open Rejection Reverse) start as sellers took advantage and drove it lower making big REs (RangeExtension) in the C, D & E periods swiping through previous balance while making a look down below PDL.

However, the auction saw a quick short covering move in the F & G TPOs as it got back above day’s VWAP and went on to test the selling tail while making a high of 22390 before sellers came back strongly once again tp push it back below VWAP and even made couple of fresh REs in the I & J periods making a low of 22154 which was the 3-day VPOC (09-13 May).

NF taking support just above the 13th May extension handle of 22140 meant that the buyers were defending this zone and sellers began to book out which eventually triggered a massive closing move from the K to the M TPOs forming a Neutral Extreme Day Up with an extension handle at 22400 and a high of 22485

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22368 F and VWAP of the session was at 22311

- Value zones (volume profile) are at 22199-22368-22400

- NF has closed above the AVWAP of 22331 from Swing High of 22888 from 03/05 for the first time on 16/05 and this level is expected to show change of polarity

- NF has immediate support at AVWAP of 22238 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05.

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 17th May 2024

| Up |

| 22459 – Sell tail (16 May) 22501 – B TPO VWAP (07 May) 22553 – Weekly VPOC (03-09 May) 22603 – G TPO h/b (06 May) 22648 – Sell Tail (06 May) |

| Down |

| 22449 – M TPO low (16 May) 22400 – Ext Handle (16 May) 22368 – POC (16 May) 22311 – NeuX VWAP (16 May) 22250 – K TPO VWAP (16 May) |

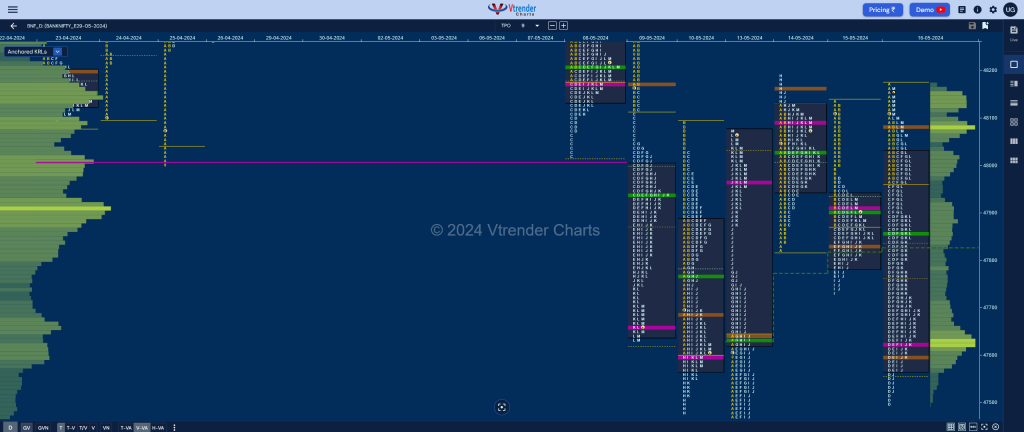

BankNifty May F: 48092 [ 48175 / 47500 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 24,604 contracts |

| Initial Balance |

|---|

| 215 points (48175 – 47960) |

| Volumes of 39,316 contracts |

| Day Type |

|---|

| Neutral – 675 pts |

| Volumes of 2,20,422 contracts |

BNF also opened higher but once again stalled at the supply level of 48175 and similar to NF confirmed an ORR back into the 2-day balance as it swiped lower making big REs in the C & D periods even leaving a freak low of 47063 but there were no volumes below 47500 which was the demand zone from 13th May

The auction saw the POC shift lower and gave a bounce higher in the G period back to 48060 and saw supply coming back making another attempt to go down in the J TPO but could only manage 47525 confirming that buyers were adding and this resulted in a probe higher into the close as it almost went on to tag 48175 leaving an elongated 675 point range outside day continuing to remain in the 5-day balance it had been in.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47627 F and VWAP of the session was at 47861

- Value zones (volume profile) are at 47566-47627-48027

- BNF has immediate supply point at AVWAP of 48457 from Swing High of 49927 from 30/04

- BNF has immediate support at AVWAP of 47832 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 47200 on 13/04 and completed the 1 ATR objective of 47813 on the same day. The 2 ATR target comes to 48425.

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 17th May 2024

| Up |

| 48120 – M TPO POC (16 May) 48205 – B TPO VWAP (09 May) 48300 – Sell Tail (09 May) 48416 – VPOC (07 May) 48553 – VWAP (07 May) |

| Down |

| 48079 – Closing HVN (16 May) 47999 – L TPO VWAP (16 May) 47861 – VWAP (16 May) 47720 – SOC (16 May) 47627 – POC (16 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.