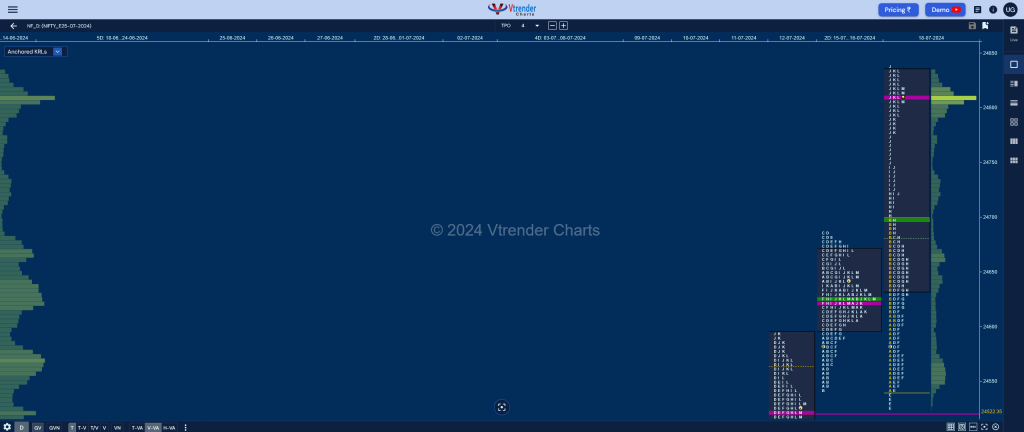

Nifty Jul F: 24809 [ 24838 / 24510 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 23,226 contracts |

| Initial Balance |

|---|

| 158 points (24699 – 24542) |

| Volumes of 70,175 contracts |

| Day Type |

|---|

| Neutral Extreme – 328 pts |

| Volumes of 3,77,525 contracts |

NF opened lower confirming an OAOR start as it made an attempt to tag the VPOC of 24522 but could only manage 24542 in the A period and saw a massive short covering move taking it back into previous day’s range & value as it not only completed the 80% Rule but went on to repair the poor highs by recording new ATH of 24699.

The auction however failed to get fresh demand at these new highs and the break of VWAP in the D TPO triggered a quick & big drop even resulting in a RE (Range Extension) in the E period where it finally tagged 24522 while making a low of 24510 but saw swift rejection as the POC shifted down to 24532 indicating profit booking by the sellers.

NF then got back above VWAP in the F TPO buoyed by some demand coming back and made a RE to the upside in the H period confirming a FA (Failed Auction) at lows and continued to trend higher till the J where it completed the 2 ATR objective of 24836 and saw profit booking coming in the closing TPOs as the POC shifted higher to 24809 leaving a Neutral Exteme Day Up with couple of extension handles at 24699 & 24746 which will be the support levels to watch for in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24810 F and VWAP of the session was at 24698

- Value zones (volume profile) are at 24634-24810-24835

- NF confirmed a FA at 24510 on 18/07 and completed the 2 ATR objective of 24836 on the same day

- HVNs are at 24201 / 24350** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12 – 18 Jul) – NF opened the week taking support at previous VAH of 24385 and left an extension handle at 24476 indicating that the PLR remained to the upside as it made higher highs on all 4 days of the week even leaving a FA at 24504 on the last day before leaving another extension handle at 24699 and closing in a spike from 24746 to 24837 and saw the weekly POC shift higher from 24621 to 24809 hinting at some profit booking by the longs. This week’s Value was completely higher at 24562-24809-24835 with the VWAP at 24620 which will be an important support for the last week

- (05 – 11 Jul) – NF has formed a narrow range balance & a Neutral Centre weekly profile taking support just above previous week’s prominent POC of 24201 filling up the upper half with the Value at 24256-24353-24385 while the VWAP is at 24348

- (28 Jun – 04 Jul) – NF has formed a Neutral Extreme profile to the upside leaving a FA at lows of 24082 which will be the swing reference for this series and has formed mostly higher Value at 24084-24201-24329 with this week’s VWAP at 24251 which will be the important support level going forward

Monthly Zones

- The settlement day Roll Over point (July 2024) is 24110

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

Business Areas for 19th Jul 2024

| Up |

| 24819 – M TPO high (18 Jul) 24860 – 2 ATR (VPOC 24522) 24915 – 1 ATR (EH 24746) 24965 – Monthly 3 IB 25017 – 3 ATR (FA 24510) |

| Down |

| 24804 – M TPO low (18 Jul) 24746 – Ext Handle (18 Jul) 24698 – NeuX VWAP (18 Jul) 24642 – H TPO POC (18 Jul) 24613 – SOC (18 Jul) |

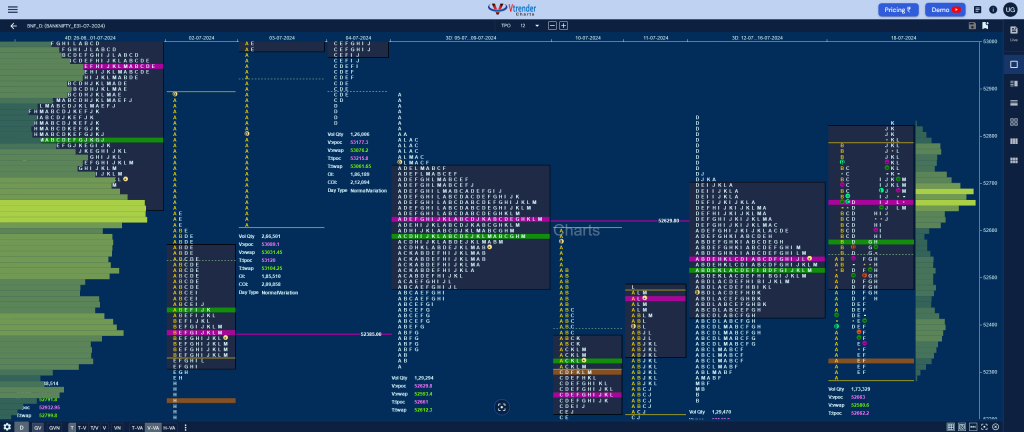

BankNifty Jul F: 52670 [ 52835 / 52282 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 14,828 contracts |

| Initial Balance |

|---|

| 498 points (52780 – 52282) |

| Volumes of 53,305 contracts |

| Day Type |

|---|

| Normal (Outside) – 553 pts |

| Volumes of 1,73,359 contracts |

BNF opened with an attempt to probe lower away from the 3-day composite balance but got demand coming back as it made a hat-trick of 80% Rule in the Value twice to the upside and one to the downside as it continued to build on the range stalling around the higher end of 52847 so will need to get an initiative move away from either end for a fresh imbalance to begin

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 52663 F and VWAP of the session was at 52580

- Value zones (volume profile) are at 52479-52663-52820

- HVNs are at 52653** / 53089 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (11 – 16 Jul) – BNF has formed a composite ‘p’ shape normal variation profile for the week with completely inside value at 52320-52548-52668 with the VWAP at 52420 and has a responsive selling tail at top from 52721 to 52847 which will be the zone to take out for more upside in the coming week

- (04 – 10 Jul) – BNF opened the week with new ATH of 53301 but could not sustain forming a Normal Variation profile to the downside breaking below the important support of 52793 and tested previous week’s responsive tail as it made a low of 52205 holding just above the buy side level of 52190 leaving a composite ‘b’ shape kind of a profile with mostly lower Value at 52300-52631-52777 with the VWAP at 52622

- (27 Jun -03 Jul) – BNF has formed a Neutral Centre weekly profile taking support at previous week’s VWAP of 52306 where it left a responsive buying tail and went on to make new ATH of 53249 on the last day before closing right at the POC of 53089. This week’s Value was overlapping to higher at 52630-53089-53194 with the VWAP at 52793 which will be an important support for the coming week

Monthly Zones

- The settlement day Roll Over point (July 2024) is 52830

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

Business Areas for 19th Jul 2024

| Up |

| 52712 – L TPO VWAP (18 Jul) 52847 – Swing High (12 Jul) 52955 – PBL (04 Jul) 53053 – 04 Jul Halfback 53177 – VPOC (04 Jul) 53301 – Swing High (04 Jul) |

| Down |

| 52663 – POC (18 Jul) 52559 – 18 Jul Halfback 52445 – SOC (18 Jul) 52329 – HVN (18 Jul) 52254 – J TPO VWAP (11 Jul) 52075 – HVN (11 Jul) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.