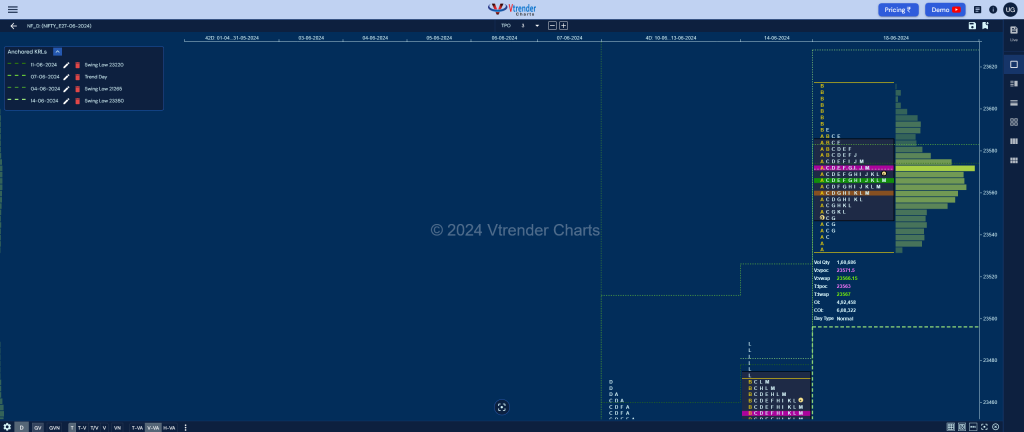

Nifty Jun F: 23568 [ 23610 / 23511 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 35,497 contracts |

| Initial Balance |

|---|

| 99 points (23610 – 23511) |

| Volumes of 74,676 contracts |

| Day Type |

|---|

| Normal – 99 pts |

| Volumes of 1,60,903 contracts |

NF continued the imbalance it started in the previous session with a higher open followed by new ATH of 23611 in the B period but remained in the narrow 99 point range Initial Balance for the rest of the day forming a rare Non-Trend Day with tails at both ends and closing around the prominent POC of 23571 and is expected to give a range expansion in the coming session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23571 F and VWAP of the session was at 23566

- Value zones (volume profile) are at 23548-23571-23584

- HVNs are at 21960 / 22745 / 23398** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (07-13 Jun) – NF has formed a composite ‘p’ shape profile for the week with completely higher value at 23248-23998-23435 and has closed around the POC which will be the opening reference for the new settlement with VWAP of 23291 being an important support

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 19th Jun 2024

| Up |

| 23589 – Sell Tail (18 Jun) 23629 – 2SD AVWAP (14 Jun) 23688 – 1 ATR (4-day VAL 23320) 23729 – 1 ATR (4-day VWAP 23361) 23766 – 1 ATR (4-day POC 23398) 23824 – 1 ATR (VPOC 23456) |

| Down |

| 23540 – Buy Tail (18 Jun) 23503 – IB tail mid (18 Jun) 23456 – VPOC (14 Jun) 23412 – PBL (14 Jun) 23360 – Buy Tail (14 Jun) 23291 – Weekly VWAP (07-13 Jun) |

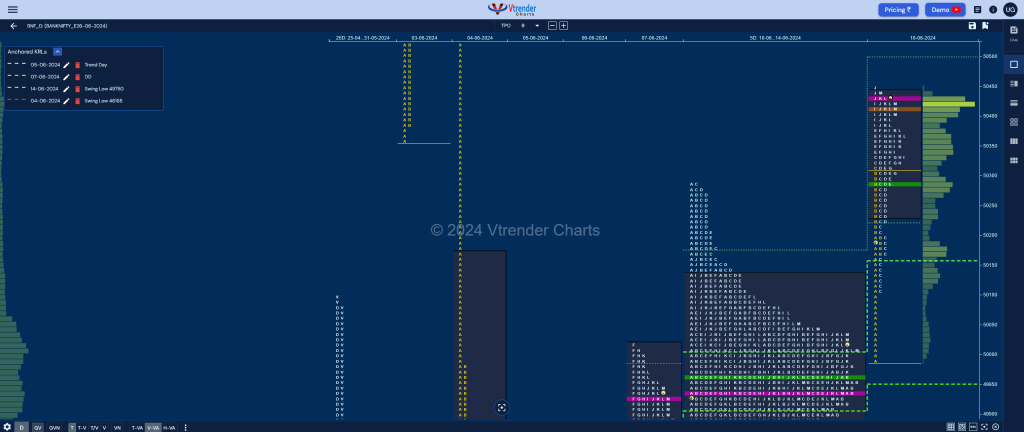

BankNifty Jun F: 50417 [ 50449 / 49990 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 15,758 contracts |

| Initial Balance |

|---|

| 324 points (50314 – 49990) |

| Volumes of 45,843 contracts |

| Day Type |

|---|

| Normal Variation – 459 pts |

| Volumes of 1,31,694 contracts |

BNF also opened higher but could not sustain forcing a probe back into the 5-day composite Value as it went on to make a low of 49990 taking support just above the VWAP of 49968 as the buyers finally came back strongly to give a move away from the balance in form of multiple REs (Range Extension) to the upside resulting in highs of 50449 in the J TPO but saw the POC shifting to the top indicating profit booking by the longs.

Value formed was completely higher hence there is a good chance that this imbalance can continue in the coming session(s) towards the 03rd Jun VPOC of 51094 and the ATH of 51486 as long as the auction remains above the 5-day composite.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 50427 F and VWAP of the session was at 50287

- Value zones (volume profile) are at 50230-50427-50439

- HVNs are at 49110 / 49931** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (23-29 May) – BNF has formed a Normal Variation weekly profile getting rejected from previous week’s POC of 49110 forming overlapping to higher Value at 49611-49931-50236 with a close around the prominent POC so can give a move away from here in the coming week

- (23-29 May) – to be updated…

- (30 May – 05 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 19th Jun 2024

| Up |

| 50439 – Sell tail (18 Jun) 50566 – B TPO h/b (03 Jun) 50725 – D TPO POC (03 Jun) 50867 – E TPO h/b (03 Jun) 50938 – PBL (03 Jun) 51095 – VPOC (03 Jun) |

| Down |

| 50415 – HVN (18 Jun) 50339 – H TPO VWAP (18 Jun) 50220 – 18 Jun H/B 50094 – A TPO h/b 49938 – 5-day VPOC (10-14 Jun) 49750 – Swing Low (14 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.