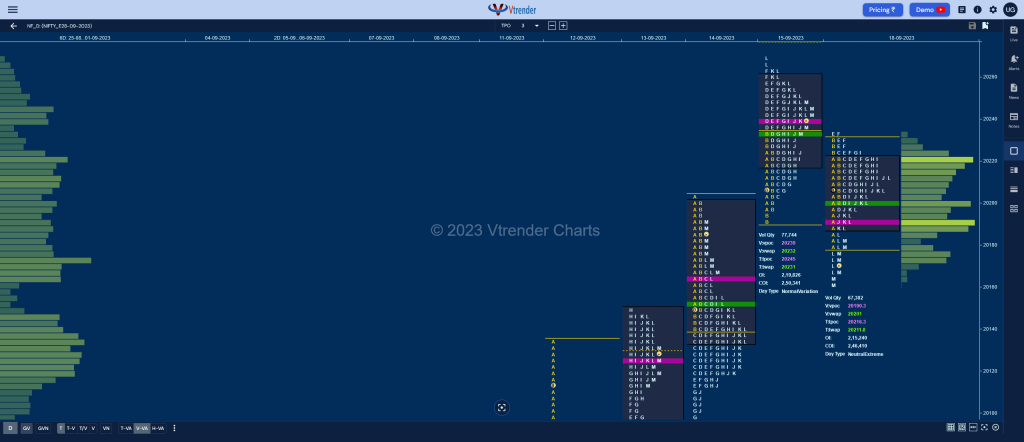

Nifty Sep F: 20178 [ 20234 / 20162 ]

NF opened lower and made a look down below previous lows as it hit 20180 but got rejected back into Friday’s range as it went on to make a high of 20229 in the B period forming another narrow 49 point range IB and contracted further in the C TPO where it formed an inside bar.

The auction then tested morning’s initiative buying tail while making a low of 20197 in the D peirod where it left a PBL and made couple of attempts to extend higher in the E & F TPOs but could only manage to tag 20233 & 20234 indicating failure by the buyers near the important reference & business area of 20232 which was followed by a slow probe lower and a re-test of the A period singles in the J & K TPOs where it hit 20187.

NF saw a swipe back to day’s VWAP at the start of the L period but once again failed to get any fresh demand triggering a quick drop into the close as it left an extension handle at 20180 and went on to tag 14th Sep’s VPOC of 20165 while making a low of 20162 leaving a Neutral Extreme Day Down with a FA confirmed at 20234 which means that the upside imbalance is now giving way to a balance on the higher timeframe as the series POC has shifted higher to 20174 & this is the first day it has closed below it and also previous day’s VWAP in the month of September.

Click here to view the latest profile in NF on Vtrender Charts

- The NF Open was an Open Auction (OA)

- The Day Type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 20190 F

- Vwap of the session was at 20201 with volumes of 33.7 L and range of 72 points as it made a High-Low of 20234-20162

- NF confirmed a FA at 20234 on 18/09 and the 1 ATR objective comes to 20109

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively.

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively.

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively.

You can check the monthly charts & other swing levels for Nifty here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 20188-20190-20222

- HVNs are at 19612 / 20041 / 20174** (** denotes series POC)

Business Areas for 20th Sep 2023:

| Up | Down |

|---|---|

| 20182 – Closing singles (18 Sep) 20234 – FA from 18 Sep 20262 – Selling tail (15 Sep) 20298 – Weekly 1.5 IB 20333 – Weekly 2 IB 20374 – Weekly ATR from 20041 | 20162 – NeuX Low (18 Sep) 20114 – LVN from 14 Sep 20088 – VWAP from 13 Sep 20046 – SOC from 13 Sep 20014 – Buying Tail (13 Sep) 19963 – Ext Handle (11 Sep) |

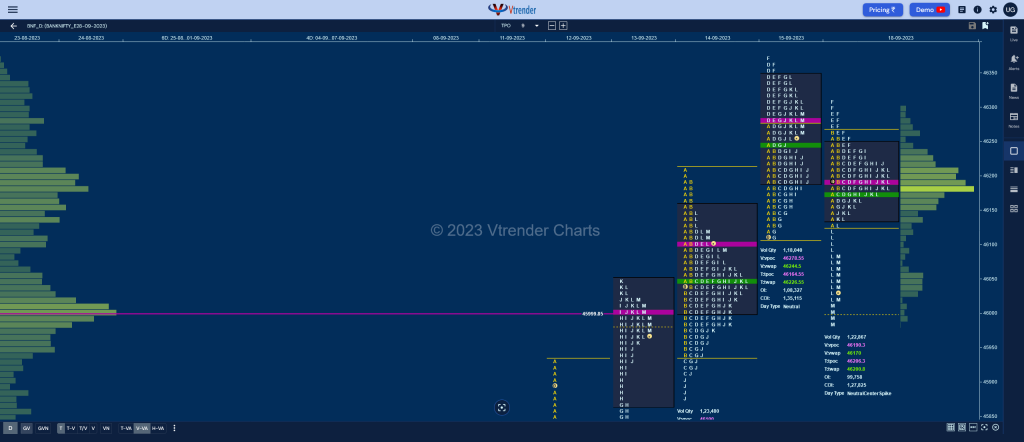

BankNifty Sep F: 46072 [ 46307 / 45986 ]

BNF opened lower and stalled around the yVWAP of 46244 on the upside as it broke below previous Value making a low of 46127 but confirmed an OAIR start on low volumes forming a narrow 132 point range IB with B period making new highs of 46260 stalling just below yPOC of 46278 after which it further contracted in the C & D TPOs.

The auction then made a RE to the upside in the E period as it scaled above 46278 and followed it up with higher highs of 46307 in the F but could not sustain n indicating no fresh demand coming in which then triggered a slow probe lower till the J period where it made a low of 46143 and the subsequent bounce back to VWAP in the K & L TPOs showed similar highs at 46210 & 46207.

BNF then made a spike lower in the closing 20 minutes leaving an extension handle at 46127 and completing the 80% Rule in 14th Sep’s Gaussian Curve as it made a low of 45986 leaving a Neutral Extreme Day Down and making a lower low on the daily timeframe only for the second time in this series.

Click here to view the latest profile in BNF on Vtrender Charts

- The BNF Open was an Open Auction (OA)

- The Day Type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 46160 F

- Vwap of the session was at 46170 with volumes of 18.4 L and range of 321 points as it made a High-Low of 46307-45986

- BNF confirmed a FA at 44976 on 08/09 and tagged the 1 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point

- BNF confirmed a FA at 44760 on 06/09 and 1 ATR objective to the downside comes to 44366. This FA got negated on 07/09 and tagged the 2 ATR upside target of 45577 on 11/09

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively.

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively.

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively.

You can check the monthly charts & other swing levels for BankNifty here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 46138-46160-46250

- HVNs are at 44656** / 44736 (** denotes series POC)

Business Areas for 20th Sep 2023:

| Up | Down |

|---|---|

| 46082 – Closing singles (18 Sep) 46210 – Weekly IBH 46359 – Selling tail (15 Sep) 46479 – Ext Handle (27 Jul) 46590 – VPOC (27 Jul) 46710 – Selling Tail (21 Jul) | 46018 – Buying tail (18 Sep) 45874 – Weekly IBL 45751 – Ext Handle (13 Sep) 45635 – Ext Handle (13 Sep) 45549 – SOC from 13 Sep 45462 – Buying tail (13 Sep) |