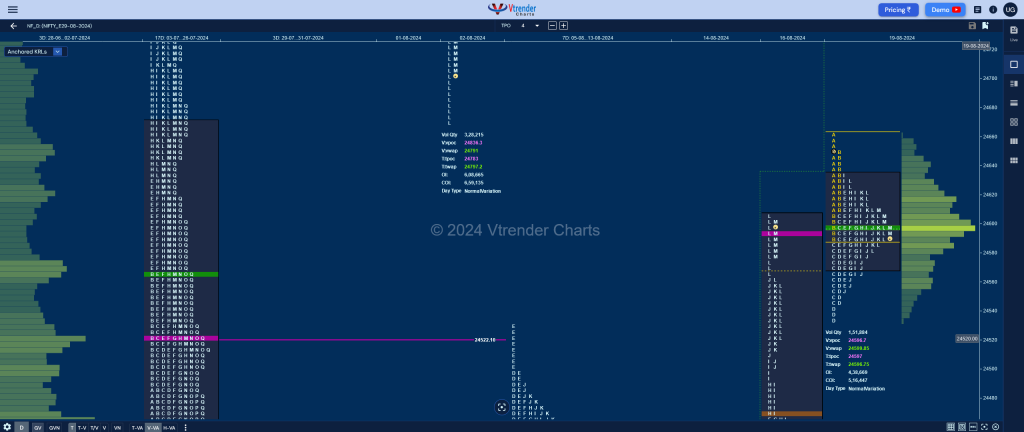

Nifty Aug F: 24595 [ 24661 / 24533 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 20,099 contracts |

| Initial Balance |

|---|

| 76 points (24661 – 24585) |

| Volumes of 50,405 contracts |

| Day Type |

|---|

| 3-1-3 Gaussian – 129 pts |

| Volumes of 1,51,933 contracts |

NF opened higher giving a rare follow up to a Neutral Extreme profile but then settled down to form a perfect 3-1-3 Gaussian Curve on the daily with an overlapping prominent POC at 24596 and looks set to give a move away from here provided we get initiative volumes in the next open.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 24596 F and VWAP of the session was at 24600

- Value zones (volume profile) are at 24571-24596-24632

- HVNs are at 24271 / 24342** / 24930 / 24996 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (09-14 Aug) – The weekly profile is a Neutral Extreme one to the downside with a selling tail at top from 24500 to 24530 and an extension handle at 24240 as it made lows of 24122 building volumes at 24175 into the close leaving overlapping to higher Value at 24237-24403-24528 and this week’s VWAP of 24317 will be an important supply point for the rest of the series.

- (02-08 Aug) – NF opened with a gap down of 200+ points on Friday well below the POC & VWAP of previous week and left an A period selling tail and formed lower value which was followed by another big gap down of 323 points on Monday where it went on to form a Trend Day Down making a low of 29312 and remained in this range for the rest of the week leaving a FA at 24398 on Wednesday and completing the 1 ATR of 24121 on Thursday where it closed with a mini spike leaving a Double Distribution (DD) Trend Down profile for the week with completely lower Value at 24075-24271-24387 and the DD zone from 24398 to 24700 which could see filling up in the coming week if the FA of 24398 gets negated with this week’s VWAP of 24296 being an important supply point in between whereas on the downside, the HVNs of 24088 & 24063 would be the immediate support levels below which the responsive buying tails of 24012 & 23950 could come into play

- (26Jul – 01Aug) – NF has formed a composite ‘p’ shape profile on the weekly timeframe representing weak Market Structure as after starting last Friday with a big Trend Day Up of 487 points it remained in a narrow range for the rest of the days indicating poor trade facilitation at these new ATH levels. Value for the week was completely higher at 24853-24996-25042 and the auction will need to show initiative buying above 25042 in the coming week to continue higher with this week’s VWAP of 24909 being the swing reference on the downside below which it could go in for a test of the Trend Day VWAP of 24748 and the Halfback of 24696 along with extension handles of 24637 & 24576

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

Business Areas for 20th Aug 2024

| Up |

| 24596 – POC (19 Aug) 24640 – A TPO POC (19 Aug) 24700 – Weekly Tail (05 Aug) 24752 – Ext Handle (02 Aug) 24791 – VWAP (02 Aug) 24836 – VPOC (02 Aug) |

| Down |

| 24580 – PBL (19 Aug) 24546 – Buy tail (19 Aug) 24508 – Ext Handle (16 Aug) 24470 – HVN (16 Aug) 24431 – NeuX VWAP (16 Aug) 24368 – SOC (16 Aug) |