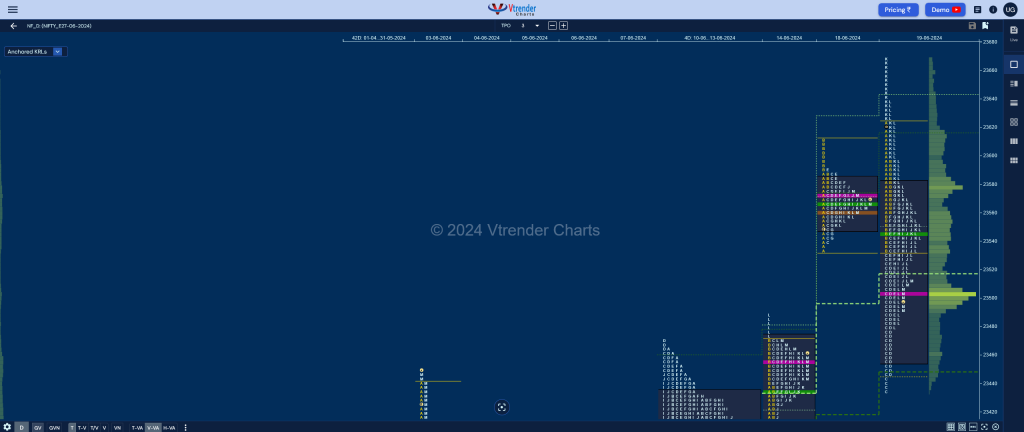

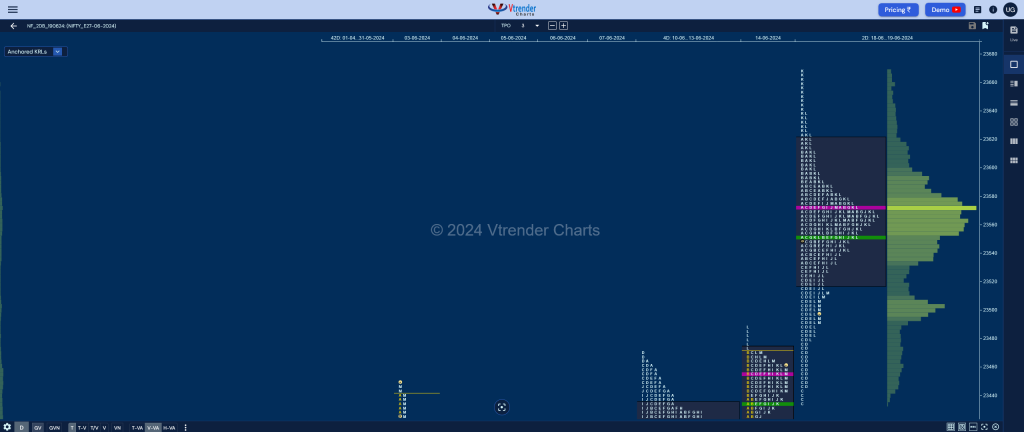

Nifty Jun F: 23503 [ 23669 / 23432 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 24,427 contracts |

| Initial Balance |

|---|

| 94 points (23625 – 23531) |

| Volumes of 59,846 contracts |

| Day Type |

|---|

| Neutral Centre – 237 pts |

| Volumes of 3,12,950 contracts |

NF opened with a look up above previous highs but could manage only 23625 unable to scale above the 2SD VWAP of 23629 triggering a move to the downside not only for the rest of the IB (Initial Balance) where it hit 23531 but went on to make a big C side extension tagging 14th Jun’s VPOC & VWAP of 23456 & 23436 respectively while making a low of 23432.

The auction however saw demand coming back in this support zone and made a probe back into the IB and followed it up with a RE (Range Extension) to the upside in the important K TPO where it made new ATH of 23669 but ended up leaving a responsive selling tail and a liquidation break down to 23492 into the close confirming a FA (Failed Auction) at top. The day’s range and value have both formed outside bars hence giving a nice 2-day balance with Value at 23517-23573-23619

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23504 F and VWAP of the session was at 23544

- Value zones (volume profile) are at 23455-23504-23581

- NF has confirmed a FA at 23669 on 19/06 and the 1 ATR objective on the downside comes to 23302

- HVNs are at 21960 / 22745 / 23398** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (07-13 Jun) – NF has formed a composite ‘p’ shape profile for the week with completely higher value at 23248-23998-23435 and has closed around the POC which will be the opening reference for the new settlement with VWAP of 23291 being an important support

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 20th Jun 2024

| Up |

| 23531 – IBL (19 Jun) 23573 – 2-day POC (18-19 Jun) 23619 – 2-day VAH (18-19 Jun) 23669 – Failed Auction (19 Jun) 23716 – Weekly 3 IB 23771 – 1 ATR (4-day POC 23398) |

| Down |

| 23492 – PBL (19 Jun) 23446 – Buy tail (19 Jun) 23412 – PBL (14 Jun) 23360 – Buy Tail (14 Jun) 23291 – Weekly VWAP (07-13 Jun) 23244 – A TPO POC (11 Jun) |

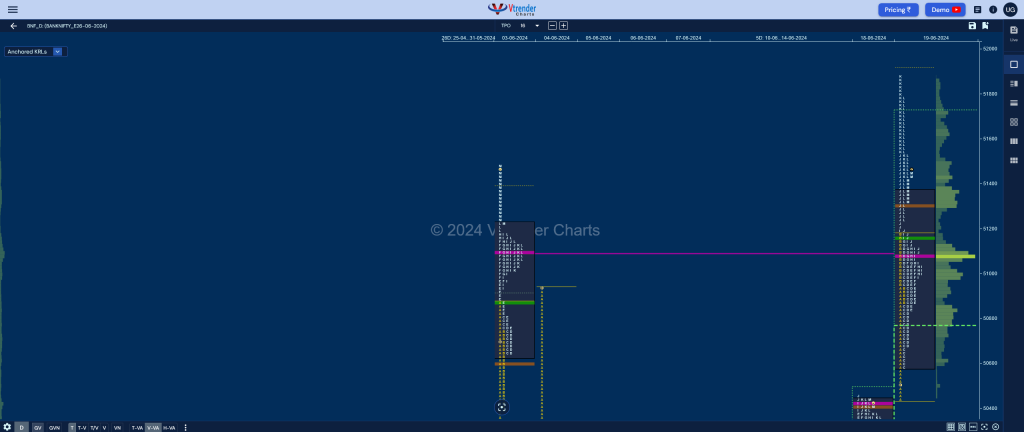

BankNifty Jun F: 51353 [ 51885 / 50444 ]

| Open Type |

|---|

| OD (Open Drive) |

| Volumes of 30,048 contracts |

| Initial Balance |

|---|

| 740 points (51184 – 50444) |

| Volumes of 91,312 contracts |

| Day Type |

|---|

| Double Distribution – 1441 pts |

| Volumes of 3,89,687 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51084 F and VWAP of the session was at 51158

- Value zones (volume profile) are at 50590-51084-51371

- HVNs are at 49110 / 49931** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (13-19 Jun) – BNF started the week continuing the balance it had been forming previously for the first 2 days building a prominent POC at 50025 and gave a move away signaling the start of a fresh imbalance over the next 2 sessions forming a Triple Distribution Trend Up profile with overlapping to higher Value at 49750-50025-50650 with the important VWAP at 50671 and the 2 extension handles at 50449 & 51197 respectively.

- (23-29 May) – BNF has formed a Normal Variation weekly profile getting rejected from previous week’s POC of 49110 forming overlapping to higher Value at 49611-49931-50236 with a close around the prominent POC so can give a move away from here in the coming week

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 20th Jun 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.