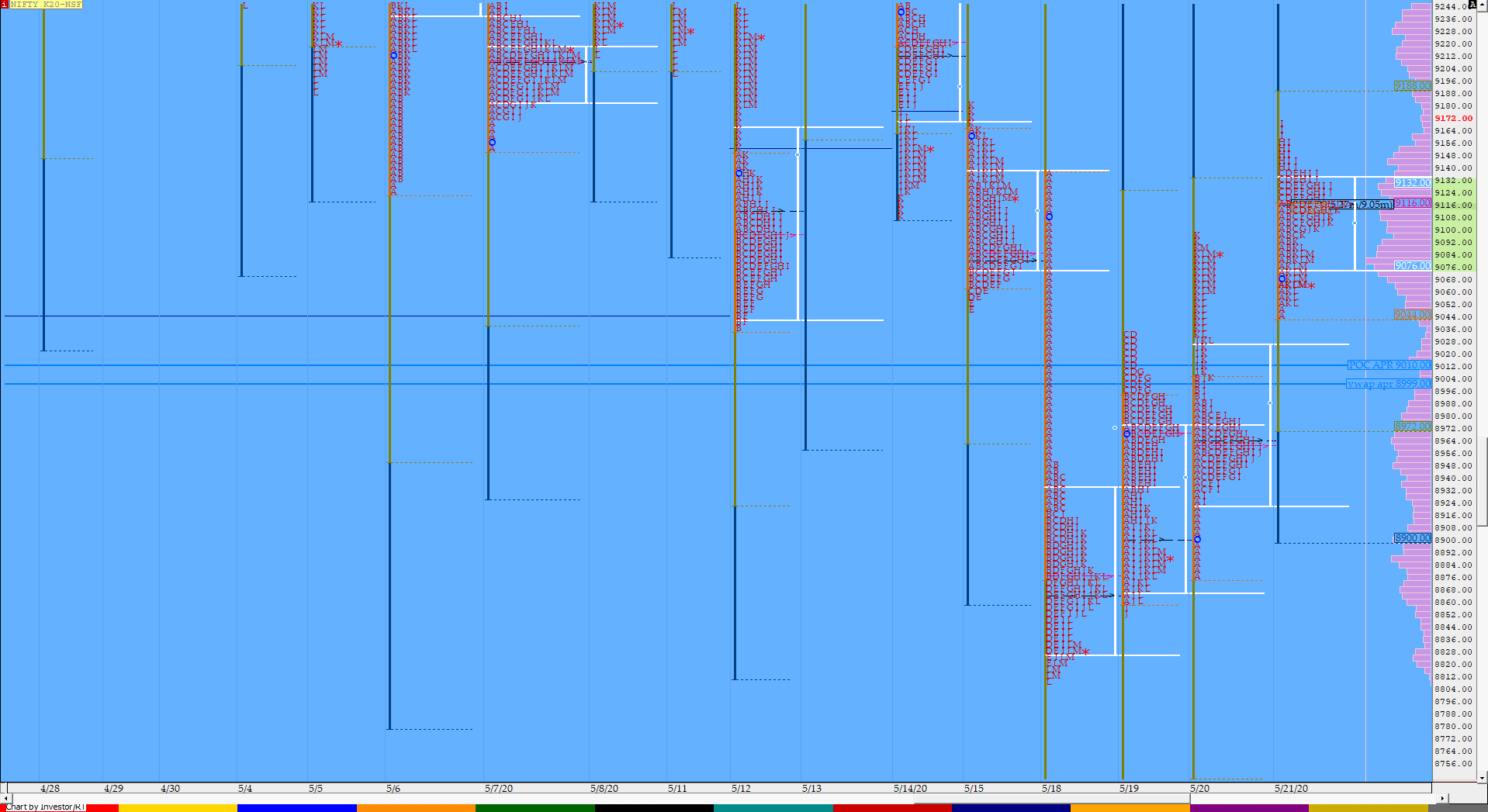

Nifty May F: 9075 [ 9169 / 9046 ]

HVNs – (8884) / (8965) / (9111) / (9180) / 9210 / 9306 / (9400)

As mentioned in previous day’s report, NF continued the imbalance at open today as it got above PDH & scaled higher in the initiative selling tail of Monday but on lower volumes giving a narrow range of just 74 points in the IB (Initial Balance) as it made a high of 9120. The auction then went on to make the dreaded C side extension higher as it hit 9139 matching the highs of the week but could not get above it leaving to a dip to VWAP as it left a PBL (Pull Back Low) 9100 taking support just above PDH which indicated that demand was still coming in here or that some late sellers were getting stuck. NF then made a short covering move in the next 2 periods as it made a fresh RE in the ‘H’ period completing the 1.5 IB objective of 9157 and made a higher high in ‘I’ period where it tagged 9169 where it got stalled just below the important reference of 9180 which was a multi-day FA and the bearish extension handle of 9183 it has left on 14th May. This meant that the supply was coming back in this zone which lead to a trending move lower into the close as the auction retraced the entire move up and went on to almost tag lows of the day as it hit 9052 before closing the day at 9075 leaving a balanced profile for the day. Value formed was completely higher but almost the same profile as it had left on 15th May from where there was a drive down open this week so remains to be seen if we get a similar open in the next session.

- The NF Open was a Open Auction (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 9110 F

- Vwap of the session was at 9108 with volumes of 152.6 L and range of 124 points as it made a High-Low of 9169-9046

- NF confirmed a multi-day FA at 8852 on 20/05 and tagged the 1 ATR objective of 9053 on the same day. The 2 ATR target comes to 9252

- NF confirmed a multi-day FA at 9180 on 18/05 and almost tagged the 2 ATR objective of 8810 on the same day. This FA is currently on ‘T+5’Days.

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8667 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9078-9110-9135

Main Hypos for the next session:

a) NF needs to sustain above 9080 for a rise to 9098 / 9111-35 / 9152-86 / 9200-13* / 9238-52 & 9272-82

b) The auction gets weak below 9069 and could test 9052-33 / 9007 / 8985-64* / 8943-24 / 8910 & 8888-60

Extended Hypos:

c) Above 9282, NF can probe higher to 9312-20 / 9356-66 / 9385-9400* / 9420 / 9444-60 & 9475-9503

d) Below 8860, the auction can fall further to 8826-10 / 8792-60* / 8721-06 / 8686 & *8667*-48

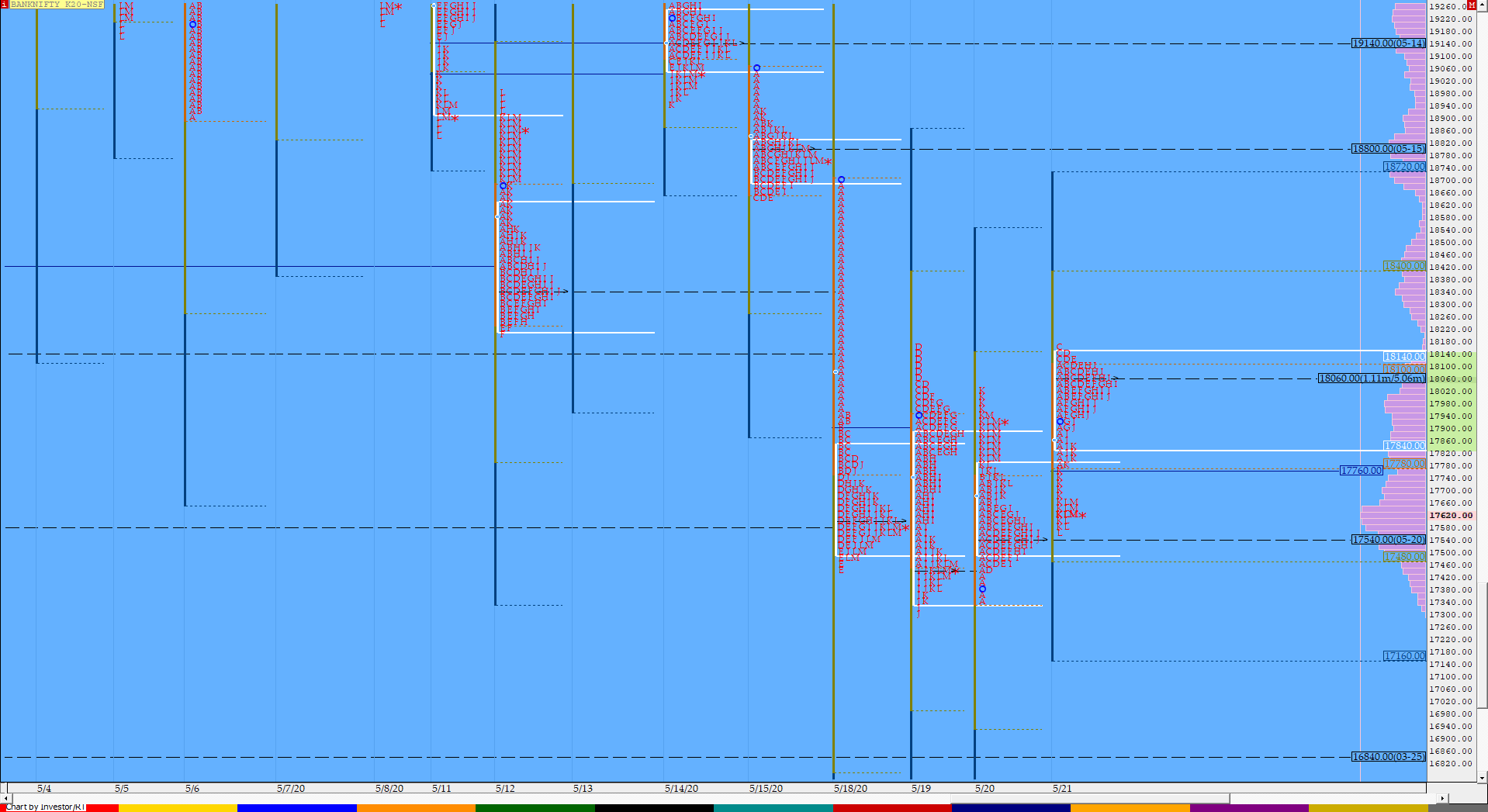

BankNifty May F: 17645 [ 18175 / 17565 ]

HVNs – (17620) / (18350) / 18800 / 19220 / 19620 / 19800

BNF opened higher & remained above the 3-day composite VAH of 17907 as it probed above PDH in the ‘A’ period and left a buying tail right from 18013 to 17797 in the IB. The auction gave the dreaded C side RE as it briefly went above Tuesday’s high of 18165 to tag 18175 but was swiftly rejected once again failing to test that monthly extension handle of 18209. BNF then got back into the IB playing and even broke into the morning singles as it got accepted below PDH and went on to make a low of 17919 in the ‘G’ period leaving a PBL right above the VAH of 17907 and this led to a probe higher as the auction got above VWAP and even went on to tag the IBH but was rejected from 18119 which was a sign that the supply was still persisting in this zone as a PBH high got confirmed in the ‘H’ period after which we got an inside bar in the ‘I’ period. BNF then began an aggressive move in the ‘J’ period as it broke below the PBL of ‘G’ period and entered the Value of the 3-day composite triggering the 80% Rule and as often happens took a fast swipe in the well balanced area as it tagged the POC of the composite at 17618 in the ‘K’ period & went on to make new lows of 17565 in the ‘L’ period looking set to tag the VAL of the composite but ran out of time as the day closed at 17645 leaving a Neutral Extreme profile. The reference for the next open would be from 17565 to 17797.

Click here to check today’s auction with respect to the 3-day composite on MPLite

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 18080 F

- Vwap of the session was at 17942 with volumes of 68.5 L and range of 609 points as it made a High-Low of 18175-17565

- BNF confirmed a FA at 18175 on 21/05 and the 1 ATR objective comes to 17407.

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA has not been tagged and is now positional supply point.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17872-18080-18149

Main Hypos for the next session:

a) BNF sustaining above 17670 could rise to 17748-784 / 17853-874 / 17910-970 / 18010-93 / 18144-150 / 18209-270 & 18358-416

b) The auction has immediate support at 17640 below which it could test 17586-540* / 17475-407 / 17360-321 / 17277-190 / 17115-095 / 17022-16970 & 16905-860*

Extended Hypos:

c) Above 18416, BNF can probe higher to 18475-535 / 18650 / 18711-751 / 18800*-882 / 18940-970 / 19080 & 19140*-170

d) Below 16860, lower levels of 16800-721 / 16675-600 / 16540-490 / 16395* / 16290 / 16209-170 & 16110 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout