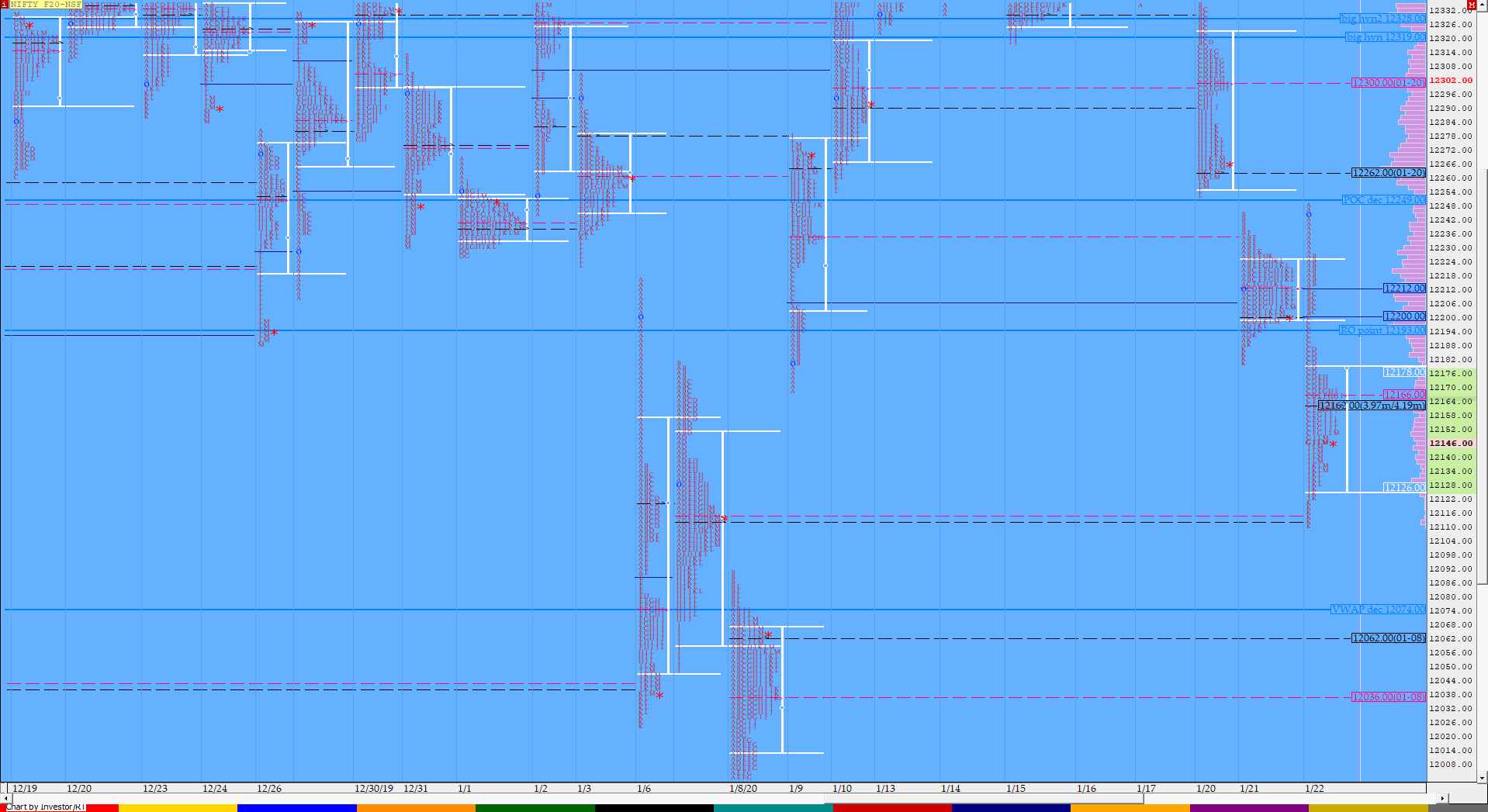

Nifty Jan F: 12145 [ 12250 / 12110 ]

HVNs – 11994 / 12040 / 12062 / 12113 / (12150-165) / 12265 / 12305 / 12357 / 12380

NF opened with a gap up above PDH (Previous Day High) as it tagged 12250 in the opening minutes but could not sustain and got back into the previous day’s range confirming yet another ORR (Open Rejection Reverse) start on the daily which indicated presence of initiative sellers in the market. The auction then left an extension handle at 12215 as it entered the Value of the previous day’s Gaussian profile thus initiating the 80% Rule and went on to complete the same in the IB (Initial Balance) itself as it made a low of 12203 leaving a narrow IB range of just 46 points. An initiative seller at open plus a narrow IB range is a nice set up for a multiple IB day and NF obliged in the ‘C’ period itself by making a RE (Range Extension) lower as it left the second extension handle of the day at 12203 and made a quick swipe down on huge volumes to hit the 2 IB objective of 12157 as it made lows of 12151 in the C period itself. NF then formed a balance below the last extension handle for the next 6 periods but left a PBH (Pull Back High) at 12175 in the ‘H’ period which led to a fresh RE lower in the ‘J’ & ‘K’ periods as the auction tagged the VPOC of 12112 which also marked the completion of the 3 IB objective and gave a bounce from there to close around the DPOC of 12150 leaving a ‘b’ shape profile with lower Value.

Click here to see imbalance returning in NF with a 3 IB Day

- The NF Open was an Open Rejection Reverse – Down (ORR)

- The day type was a Normal Variation Day – Down (3 IB)

- Largest volume was traded at 12150 F

- Vwap of the session was at 12169 with volumes of 85.2 L and range of 140 points as it made a High-Low of 12250-12110

- NF confirmed a FA at 12319 on 15/01 and tagged the 1 ATR target of 12415 on 20/1. This FA was negated on 20/01 and the 2 ATR move down of 12127 got tagged on 22/01.

- The 20th Jan Trend Day VWAP of 12308 would be important supply point.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12126-12150-12178 was tagged

Hypos / Estimates for the next session:

a) NF needs to sustain above 12150 for a bounce to 12165-173 / 12188-190 & 12210-220

b) Immediate support is at 12140 below which the auction could fall to 12111 & 12090-079

c) Above 12220, NF can probe higher to 12241 / 12268* & 12300-308

d) Below 12079 auction could probe lower to 12062* / 12045-42* & 12023-005

e) If 12308 is taken out, the auction go up to to 12320-330 / 12352-365 & 12380

f) Break of 12005 can trigger a move lower to 11990-974 / 11956* & 11930-926

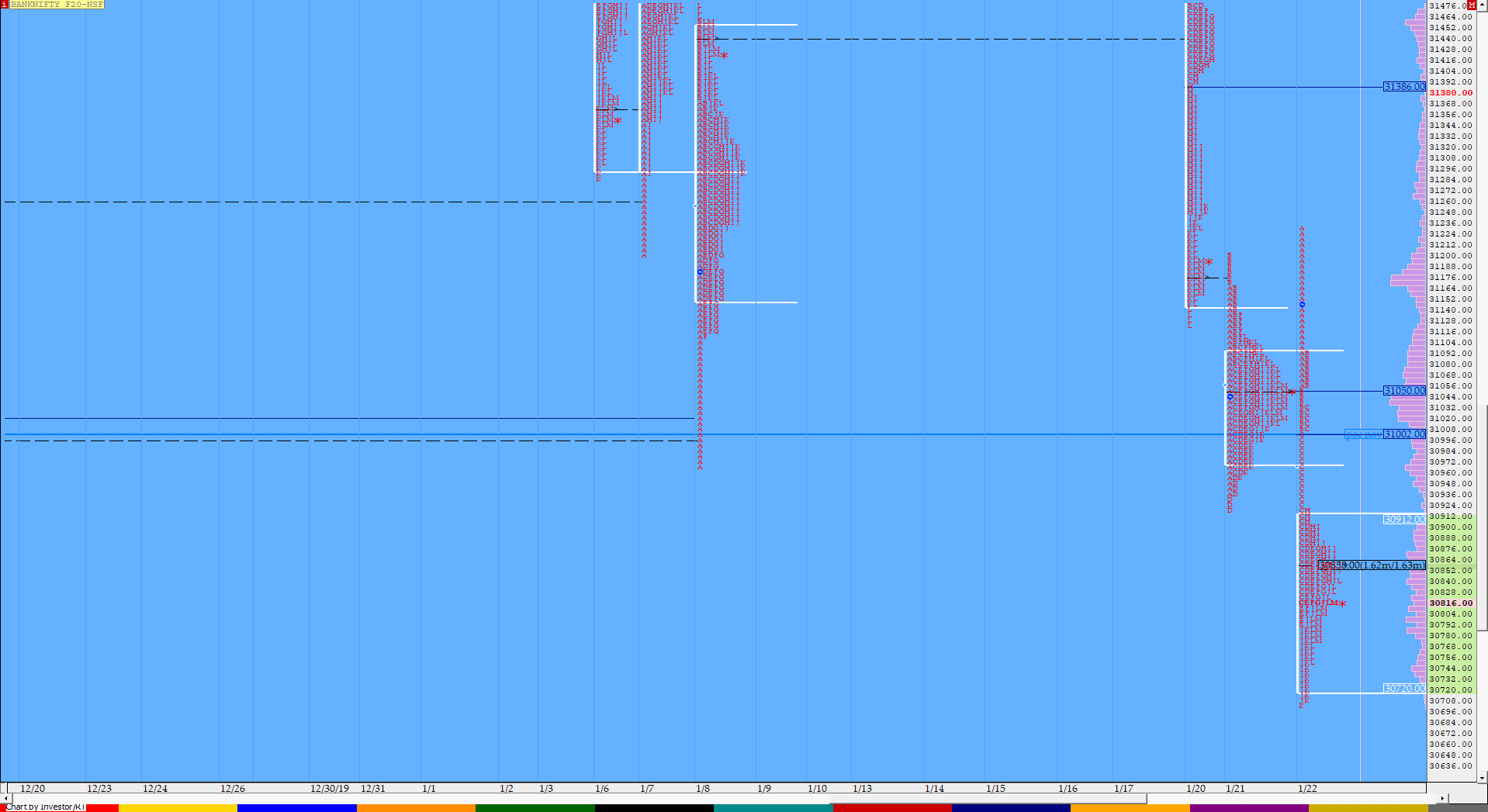

BankNifty Jan F: 30803 [ 31230 / 30705]

HVNs – 30860 / 31050 / 31175 / 31455 / 31525 / 31770 / 31840 / 31935

BNF also opened higher and continued to probe up as it got above PDH of 31200 while making highs of 31230 but was not able to sustain these new highs as it got back into the previous day’s range confirming an ORR start after which like in NF, it left an extension handle at 31061 & went on to complete the 80% Rule in the well balanced profile it had left yesterday as it made lows of 31011 in the IB. The auction then left a second extension handle of the day at 31011 indicating that the sellers were pushing it down with good force resulting in a fall of more than 200 points as it made lows of 30797 in the ‘E’ period tagging the VPOC of 30805 and almost completing the 2 IB objective of the day. This imbalance then led to a retracement over the next 3 periods as BNF made an attempt to get back into previous day’s range but was rejected as it confirmed a PBH at 30921 in the ‘H’ period which meant that the probe to the downside could continue. The auction then made a fresh RE lower in the ‘J’ period and followed it up by new lows of 30705 in the ‘K’ period after which it gave a brief bounce to 30845 before closing at 30802 leaving a ‘b’ shape profile for the day with the dPOC at 30860 which will be the reference for the next open.

View the MPLite chart of a Normal Day leading to an imbalance in BNF

- The BNF Open was an Open Rejection Reverse – Down (ORR)

- The day type was a Normal Variation Day – Down

- Largest volume was traded at 30860 F

- Vwap of the session was at 30888 with volumes of 33.8 L and range of 525 points as it made a High-Low of 31230-30705

- BNF confirmed a multi-day FA at 32260 on 14/01 and tagged the 2 ATR target of 31507 on 20/01. This FA has not been tagged and is now positional resistance.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The 20th Jan Trend Day VWAP of 31396 would be important supply point.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30733-30860-30906

Hypos / Estimates for the next session:

a) BNF needs to sustain above 30820 for a bounce to 30860 / 30912-921 & 30980-31011

b) Staying below 30800, the auction could test 30744 / 30695 & 30645-625*

c) Above 31011, BNF can probe higher to 31061-092 / 31150 & 31200-225

d) Below 30625, lower levels of 30560 / 30500 & 30435-430 could be tagged

e) If 31225 is taken out, BNF can give a fresh move up to 31275-304 & 31375-396

f) Break of 30430 could trigger a move down to 30350 / 30310-281* & 30225-190

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout