Nifty Sep F: 19708 [ 19825 / 19690 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,128 contracts |

| Initial Balance |

|---|

| 125 points (19815 – 19690) |

| Volumes of 33,868 contracts |

| Day Type |

|---|

| Normal Day (N) – 135 points |

| Volumes of 1,13,657 contracts |

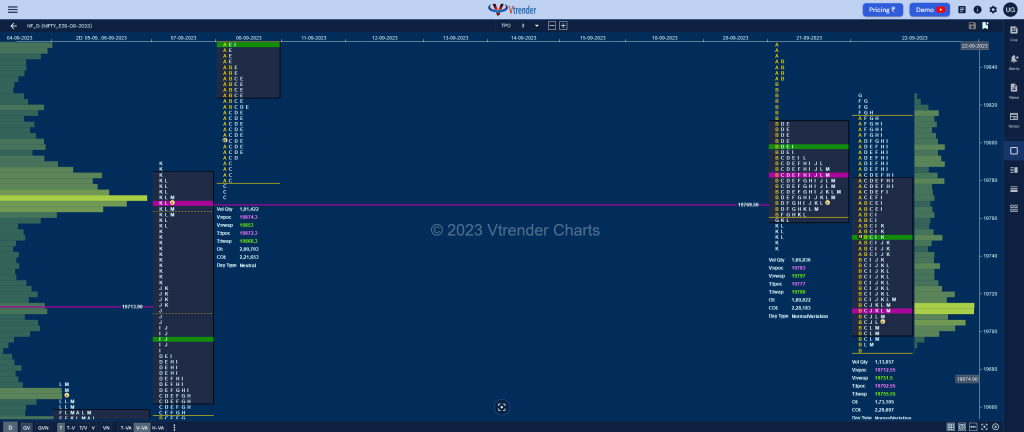

NF made an OAIR start taking support right at PDL of 19745 and probed higher testing the PBH of 19810 in the A period as it hit 19815 but could not sustain triggering a quick reversal for the rest of the IB as it went on to make new lows of 19742 in the A period followed by a big RE in the B as it not only negated 07th Sep’s DD extension handle of 19724 but went on to look down below its VWAP of 19697 while making a low of 19690 forming yet another large range IB of 124 points.

The auction then got back above day’s VWAP in the C TPO forcing the shorts to exit as it first completed the 80% Rule in previous value and made couple of attempts to extend higher in the F & G periods but could only manage marginal new highs of 19823 & 19825 indicating previous days sellers from the extension handle of 19835 were still holding this zone.

As observed on umpteen occassions, the inability to tag the 1.5 IB objective inspite of making multiple REs in a direction signals failure and makes way for a quick move in the opposite direction testing the other extreme and this set up played out once again as NF got back into the IB and left a SOC (Scene Of Crime) at 19765 in the I period and went on to almost tag the lows of the day while hitting 19693 in the L TPO leaving a Normal Day with overlapping to lower Value but the failue on the upside has left a probable multi-day FA at 19825 which gets confirmed if we get below 19690 at open in the next session for probable targets of 19561 & 19412 in the expiry week.

We have a 2-day composite ‘b’ shape profile in NF with the Value at 19729-19773-19824 with some filling needed in the zone between 19773 & 19710 in case the auction stays above 19690. (Click here to view the composite profile only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19712 F and VWAP of the session was at 19751

- Value zones (volume profile) are at 19700-19712-19780

- HVNs are at 19612 / 19770** / 20022 / 20174 (** denotes series POC)

- NF confirmed a FA at 20234 on 18/09 and completed the 2 ATR objective of 19983 on 20/09. This FA is currently on ‘T+4’ Days

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and is no longer a valid support

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

Monthly Zones

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively

Business Areas for 25th Sep 2023

| Up |

| 19712 – dPOC (22 Sep) 19765 – SOC (22 Sep) 19824 – 2-day VAH (21-22 Sep) 19869 – IB singles mid (21 Sep) 19907 – Gap singles mid (21 Sep) 19951 – Tail from 20 Sep |

| Down |

| 19690 – Weekly IBL 19647 – PBL from 07 Sep 19612 – Weekly VPOC (01-07 Sep) 19561 – 2 ATR from 19825 19517 – D TPO POC (04 Sep) 19464 – Ext Handle (01 Sep) |

BankNifty Sep F: 44677 [ 45099 / 44589 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 27,455 contracts |

| Initial Balance |

|---|

| 434 points (45024 – 44589) |

| Volumes of 67,187 contracts |

| Day Type |

|---|

| Normal Day (N) – 509 points |

| Volumes of 1,86,885 contracts |

BNF also made an OAIR as well as an OL (Open=Low) start at 44725 right above previous session’s spike high of 44720 making a move to the upside as it scaled above the yPOC & yVWAP of 44877 & 44987 respectively while making a high of 45024 in the A period but saw the B TPO form a rebel by not only retracing the entire upmove but swiping through the spike zone as it went on to tag the 4-day composite (04-07 Sep) VPOC of 44656 and almost completed the 80% Rule while making a low of 44589 forming a pretty big IB range of 434 points.

The C side got back in alignment with the A period leaving a buying tail at lows indicating some profit booking by the sellers which was followed by a RE to the upside in the D TPO as the auction hit 45099 stalling just below the selling extension handle of 45118 which meant that the supply was coming back in this zone which was getting absorbed initially as the range began to contract till the H period building up a ‘p’ shape profile for the day.

The sellers then made their second move breaking below day’s VWAP in the I TPO and sustaining as BNF went on to test the B period singles by falling further down to 44622 where it left a PBL and saw the dPOC shift lower to 44695 into the close where it eventually settled leaving a Normal Day with overlapping to lower value.

We are forming a 2-day composite in BNF also with the Value at 44666-44877-45014 with some filling needed in the zone between 44810 & 45030 in case the auction stays above 44695. (Click here to view the composite profile only on Vtrender Charts)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44695 F and VWAP of the session was at 44850

- Value zones (volume profile) are at 44641-44695-44963

- HVNs are at 44656** / 44736 (** denotes series POC)

- BNF confirmed a FA at 44976 on 08/09 and tagged the 2 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and closed below so is now a supply point

- BNF confirmed a FA at 44760 on 06/09 and 1 ATR objective to the downside comes to 44366. This FA got negated on 07/09 and tagged the 2 ATR upside target of 45577 on 11/09

Monthly Zones

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively

Business Areas for 25th Sep 2023

| Up |

| 44695 – dPOC (22 Sep) 44810 – LVN from 22 Sep 44946 – HVN from 22 Sep 45035 – H TPO POC (22 Sep) 45118 – Ext Handle (21 Sep) 45266 – PBH from 21 Sep |

| Down |

| 44666 – 2-day VAL (21-22 Sep) 44558 – 4-day VAL (04-07 Sep) 44443 – DD VWAP (01 Sep) 44340 – Ext Handle (01 Sep) 44225 – SOC from 01 Sep 44103 – Buying Tail (01 Sep) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.