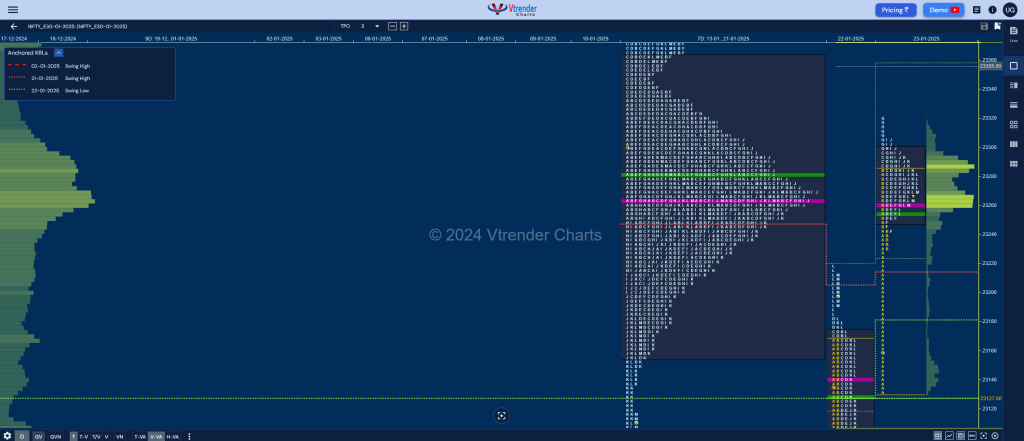

Nifty Jan F: 23263 [ 23319 / 23127 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 14,670 contracts |

| Initial Balance |

|---|

| 161 points (23288 – 23126) |

| Volumes of 51,265 contracts |

| Day Type |

|---|

| Normal (‘p’ shape) – 193 pts |

| Volumes of 1,61,222 contracts |

NF opened lower and expectedly took support at the NeuX VWAP of 23129 and confirmed an ORR start giving a rare follow up to a NeuX profile as it made a high of 23288 in the Initial Balance (IB) after which it made a typical C side extension to 23298 triggering a retracement back to day’s VWAP even breaking below it briefly but saw buyers coming back to defend the morning extension handle of 24241.

The auction then made an RE (Range Extension) attempt in the G TPO as it hit new highs of 23319 but could not sustain as the weekly settlement came into play and the option players forced a close around the prominent POC of 23261 leaving a ‘p’ shape profile for the day.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23255 F and VWAP of the session was at 23261

- Value zones (volume profile) are at 23248-23261-23298

- HVNs are at 23264** / 23645 / 23798 / 24113 / 24285 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (17-23 Jan) – NF has formed a Neutral Centre weekly profile with overlapping to lower Value at 23110-23266-23332 and has a good chance of moving away from the prominent 2-week overlapping POC provided it gets some initaitive volumes in the final weekly settlement of Jan

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 23915

- The VWAP & POC of Dec 2024 Series is 24193 & 24621 respectively

- The VWAP & POC of Nov 2024 Series is 23978 & 24185 respectively

- The VWAP & POC of Oct 2024 Series is 24776 & 24400 respectively

Business Areas for 24th Jan 2025

| Up |

| 23266 – Weekly POC 23306 – Sell tail (23 Jan) 23358 – 2SD AVWAP (22 Jan) 23398 – F TPO POC (21 Jan) 23435 – Sell Tail (21 Jan) 23495 – HVN (10 Jan) |

| Down |

| 23261 – POC (23 Jan) 23229 – Buy Tail (23 Jan) 23183 – AVWAP (22 Jan) 23129 – NeuX VWAP (22 Jan) 23077 – J TPO VWAP (22 Jan) 23027 – Buy tail (22 Jan) |

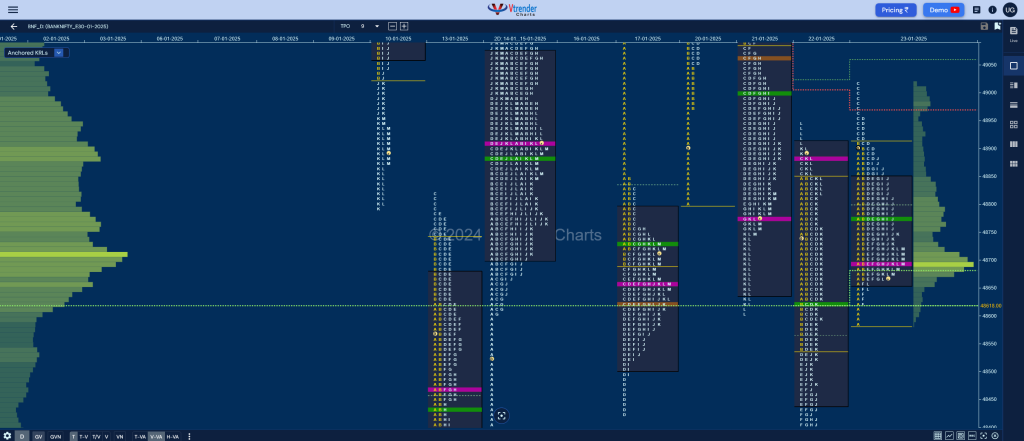

BankNifty Jan F: 48696 [ 49022 / 48586 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 7,713 contracts |

| Initial Balance |

|---|

| 328 points (48914 – 48586) |

| Volumes of 22,157 contracts |

| Day Type |

|---|

| Normal (3-1-3) – 436 pts |

| Volumes of 85,814 contracts |

BNF formed a narrow range 3-1-3 Gaussian Curve stalling at the higher AVWAP of 49011 from 20th Jan but took support at the NeuX VWAP of 48621 from 22nd leaving tails at both ends so can give a move away in the coming session provided one of these zones is taken out by initiative volumes.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48700 F and VWAP of the session was at 48777

- Value zones (volume profile) are at 48656-48700-48850

- HVNs are at 51491 / 49529 / 48716** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (17-23 Jan) – BNF has formed a Neutral Centre weekly profile with overlapping to lower Value at 48482-48698-49130 and has a good chance of moving away from here provided it gets some initaitive volumes in the final weekly settlement of Jan

Monthly Zones

- The settlement day Roll Over point (Jan 2025) is 51750

- The VWAP & POC of Dec 2024 Series is 52436 & 53355 respectively

- The VWAP & POC of Nov 2024 Series is 51417 & 52129 respectively

- The VWAP & POC of Oct 2024 Series is 51559 & 51239 respectively

Business Areas for 24th Jan 2025

| Up |

| to be updated… |

| Down |

| to be updated… |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.