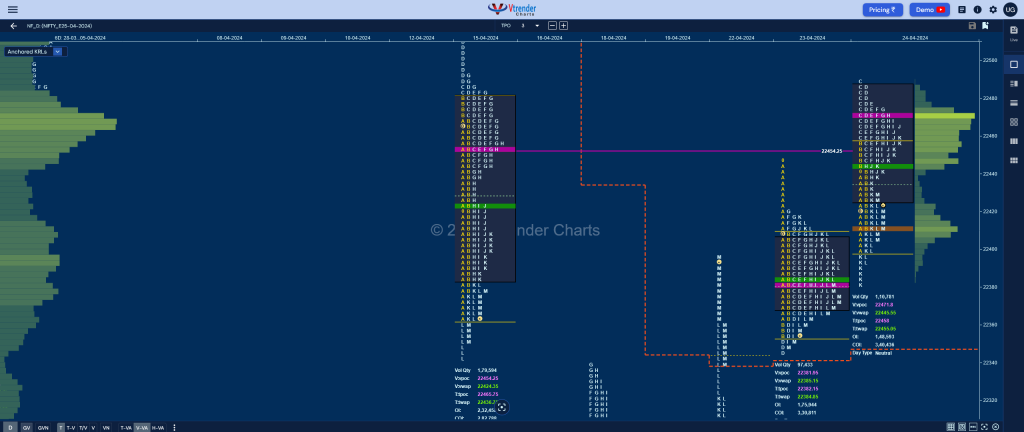

Nifty Apr F: 22414 [ 22488 / 22382 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 6,554 contracts |

| Initial Balance |

|---|

| 58 points (22455 – 22397) |

| Volumes of 24,807 contracts |

| Day Type |

|---|

| Neutral – 106 pts |

| Volumes of 1,11,041 contracts |

to be updated…

.Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22471 F and VWAP of the session was at 22445

- Value zones (volume profile) are at 22426-22471-22487

- NF confirmed a FA at 22845 on 09/04 and tagged the 2 ATR objective downside of 22476 on 15/04

- NF confirmed a FA at 22517 on 15/04 and tagged the 2 ATR objective downside of 22178 on 16/04.

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (12-18 Apr) – NF opened the week stalling right at previous week’s POC of 22768 and as expected filled up the DD zone while negating the buying singles from 22662 to 22600 and went on to make a Trend Down profile for the week in an expanded range of 740 points making lower lows on all day as it broke below the weekly VPOC of 22354 (22-28 Mar) and went on to tag the HVN of 22080 (15-21 Mar) while leaving similar lows of 22027 and completly lower value at 22027-22213-22322 with this week’s VWAP of 22348 now being a swing sell side reference for the rest of the series.

- (05-11 Apr) – NF has formed a Double Distribution (DD) Trend Up profile on the weekly with completely higher Value at 22669-22768-22837 with the VWAP at 22707 which will be a zone of support along with the DD singles from 22662 to 22600 for the coming week where as on the upside it needs to sustain above 22837 to continue recording new ATHs

- (01-04 Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 25th Apr 2024

| Up |

| 22433 – SOC (24 Apr) 22471 – POC (24 Apr) 22503 – D TPO POC (15 Apr) 22552 – 6-day VWAP (28Mar-05Apr) 22604 – VPOC (12 Apr) |

| Down |

| 22410 – Closing HVN 22368 – VAL (23 Apr) 22338 – M TPO low (22 Apr) 22286 – VPOC (22 Apr) 22233 – HVN (22 Apr) |

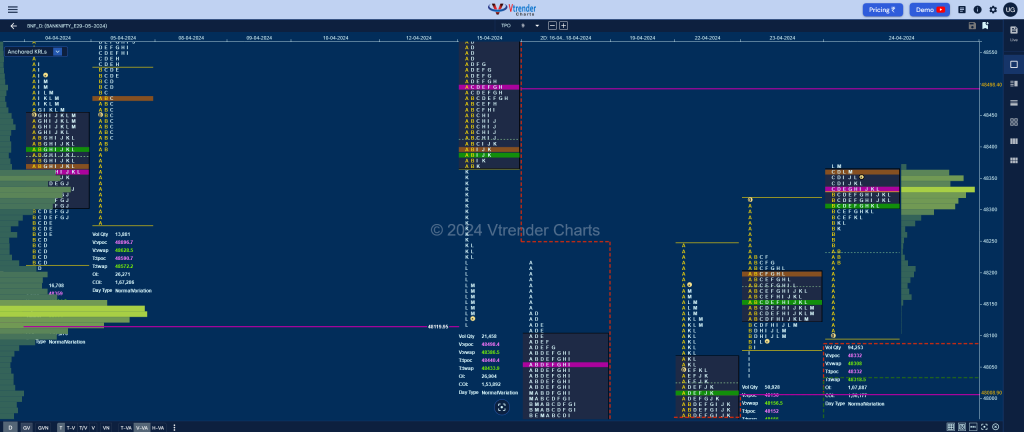

BankNifty May F: 48350 [ 48369 / 48102 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 7,374 contracts |

| Initial Balance |

|---|

| 220 points (48322 – 48102) |

| Volumes of 23,218 contracts |

| Day Type |

|---|

| Normal – 267 points |

| Volumes of 94,253 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48322 F and VWAP of the session was at 48308

- Value zones (volume profile) are at 48304-48322-48362

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47929 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 25th Apr 2024

| Up |

| to be updated… |

| Down |

| to be updated… |