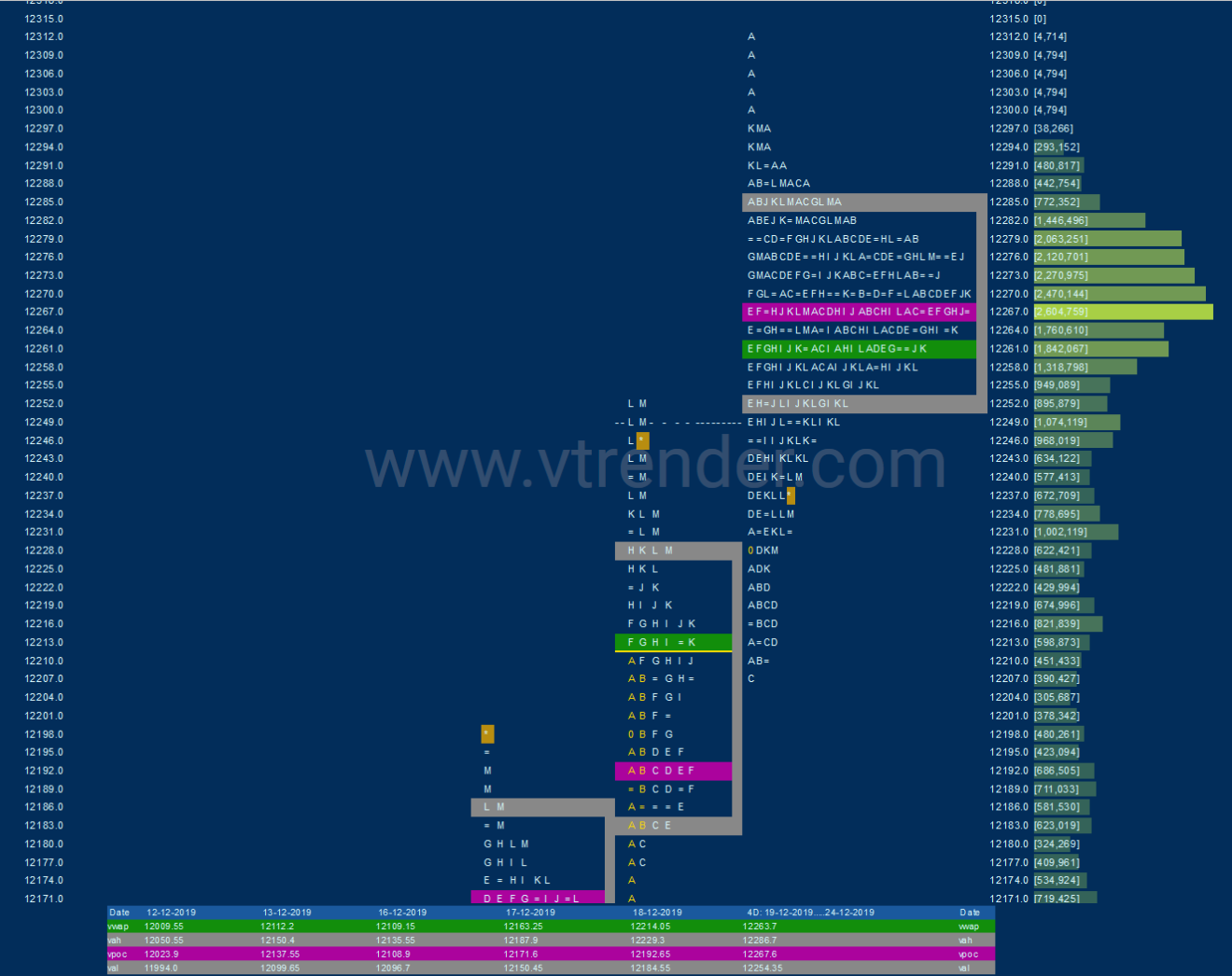

Nifty Dec F: 12238 [ 12285/ 12228 ] (freak high of 12315)

HVNs – 12024 / (12082) / 12112 / 12170 / 12190 / (12216) / 11268

NF opened with a freak tick at 12315 but was mostly an OAIR as it remained below 12285 and continued to form a balance in the Value of the 3-day composite for most part of the day before it gave a spike lower into the close leaving an extension handle at 12245 as it went on to make lows of 12228 stalling just above the PDL (Previous Day Low) of 12226. The 3-day composite ‘p’ shape is now a 4-day Gaussian profile with a prominent POC at 12268 which will be the important reference on the upside in the next session above the spike reference of 12228 to 12245. On the downside, we have the FA of 12207 below which are the vPOC of 12190 & HVN of 12170 which would come into play.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 12261 F

- Vwap of the session was at 12266 with volumes of 76.7 L and range of 57 points as it made a High-Low of 12285-12228

- NF confirmed a FA at 12207 on 19/12 and the 1 ATR objective comes to 12306. This FA is right now on ‘T+4’ Days.

- The failed attempt in the ‘C’ period in NF on 18/12 can be considered to be a FA which was at 12177 and the auction tagged 1 ATR objective of 12275 on 19/12. The 2 ATR target from this FA is at 12373. This FA is right now on ‘T+5’ Days.

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12260-12268-12280

Hypos / Estimates for the next session:

a) NF needs to sustain above 12246 for a rise to 12268-275 & 12292

b) Immediate support is at 12230 below which the auction could test 12216-207 / 12190 & 12170*

c) Above 12292, NF can probe higher to 12310 & 12342

d) Below 12170, auction could fall to 12150 / 12135-130 & 12112-102

e) If 12342 is taken out, the auction go up to to 12362-368 / 12384-393 & 12413

f) Break of 12102 can trigger a move lower to 12082-74 / 12054 & 12024-18

Jan NF Hypos for the next session:

a) NF needs to sustain above 12303-310 for a rise to 12327-332 / 12346 & 12361-368

b) Immediate support is at 12285-280 below which the auction could test 12262-258* & 12232-222*

c) Above 12368, NF can probe higher to 12391 & 12414

d) Below 12222, auction could fall to 12190 & 12162

e) If 12414 is taken out, the auction go up to to 12428-437 & 12460

f) Break of 12162 can trigger a move lower to 12144 & 12126-122

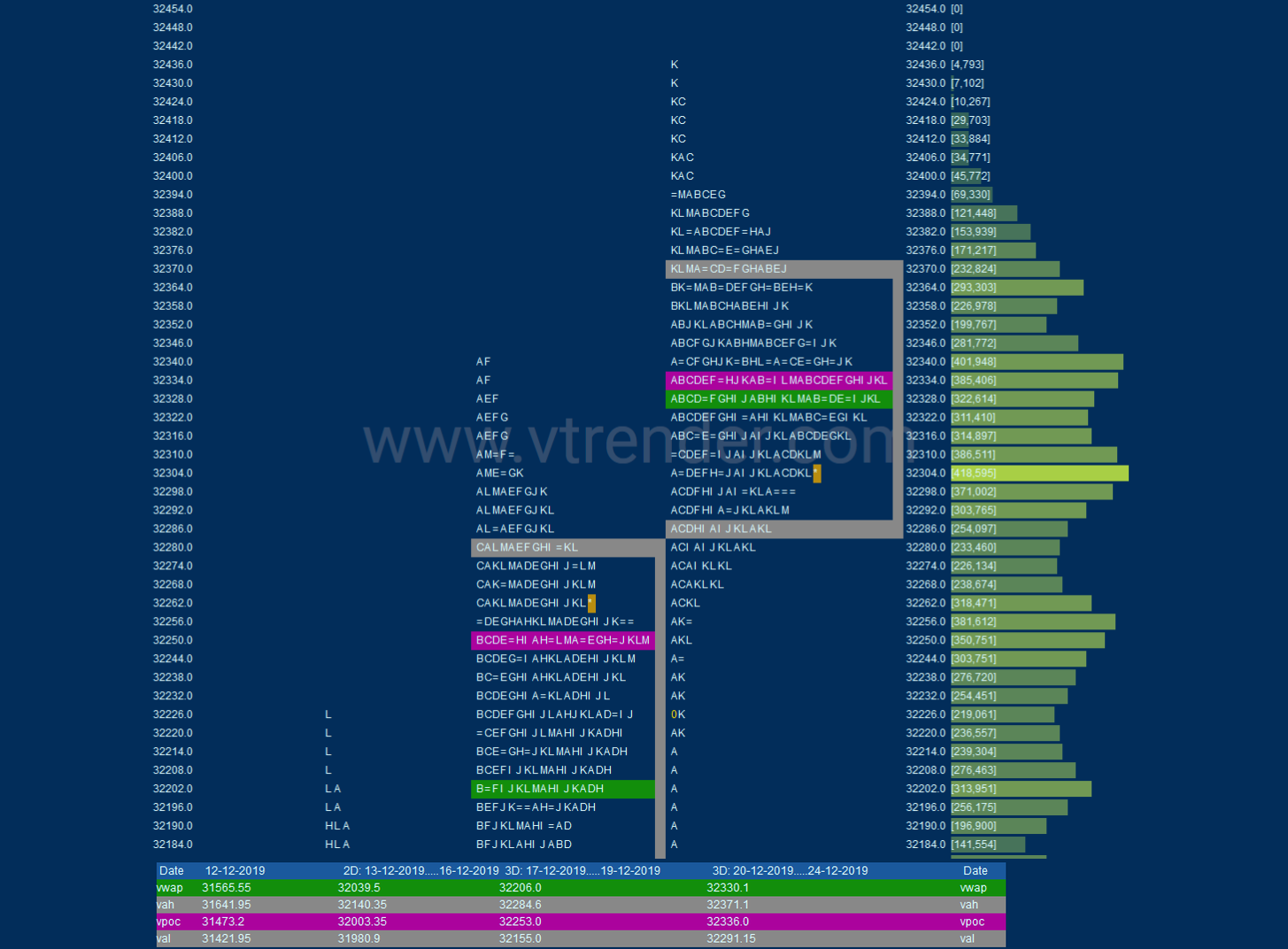

BankNifty Dec F: 32307 [ 32384 / 32270]

HVNs – 31855 / 31896 / 32040 / 32090 / 32200 / 32340

BNF had recorded the lowest range yesterday for this series (of just 205 points) & normally it leads to a bigger range which was the expectation at the open today but the auction not only made an OAIR start but also went on to make a rare Non-Trend Day with one of the lowest range of almost 2 years of just 114 points as it stayed inside the previous day’s range forming overlapping Value. We now have a 3-day composite balance in BNF with a prominent POC around 32340 which will be the important reference for the expiry session. If we get initiative volumes at open to move away from this POC, we could have a big move away else BNF could continue to rotate around this zone this week pushing the imbalance to the next week.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a slow Non Trend Day

- Largest volume was traded at 32300 F

- Vwap of the session was at 32336 with volumes of 15.7 L and range of 114 points as it made a High-Low of 32384-32270

- BNF confirmed a FA at 32425 on 23/12 . The 1 ATR target on the downside comes to 32065

- BNF confirmed a multi-day FA at 32055 on 18/12 and tagged the 1 ATR objective of 32431 on 20/12. The 2 ATR target comes to 32806. This FA is right now on ‘T+5’ Days.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32292-32300-32350

Hypos / Estimates for the next session:

a) BNF needs to scale above 32340 & sustain for a rise to 32385 / 32425 & 32502

b) Immediate support is at 32270-265 below which the auction could test 32200-195 / 32148 & 32090

c) Above 32502, BNF can probe higher to 32577 / 32628 & 32682

d) Below 32090, lower levels of 32040*-030 / 31980 & 31925-896 could be tagged

e) If 32682 is taken out, BNF can give a fresh move up to 32733 / 32785 & 32860

f) Below 31896 we could see lower levels of 31848 / 31805 & 31745-715

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout