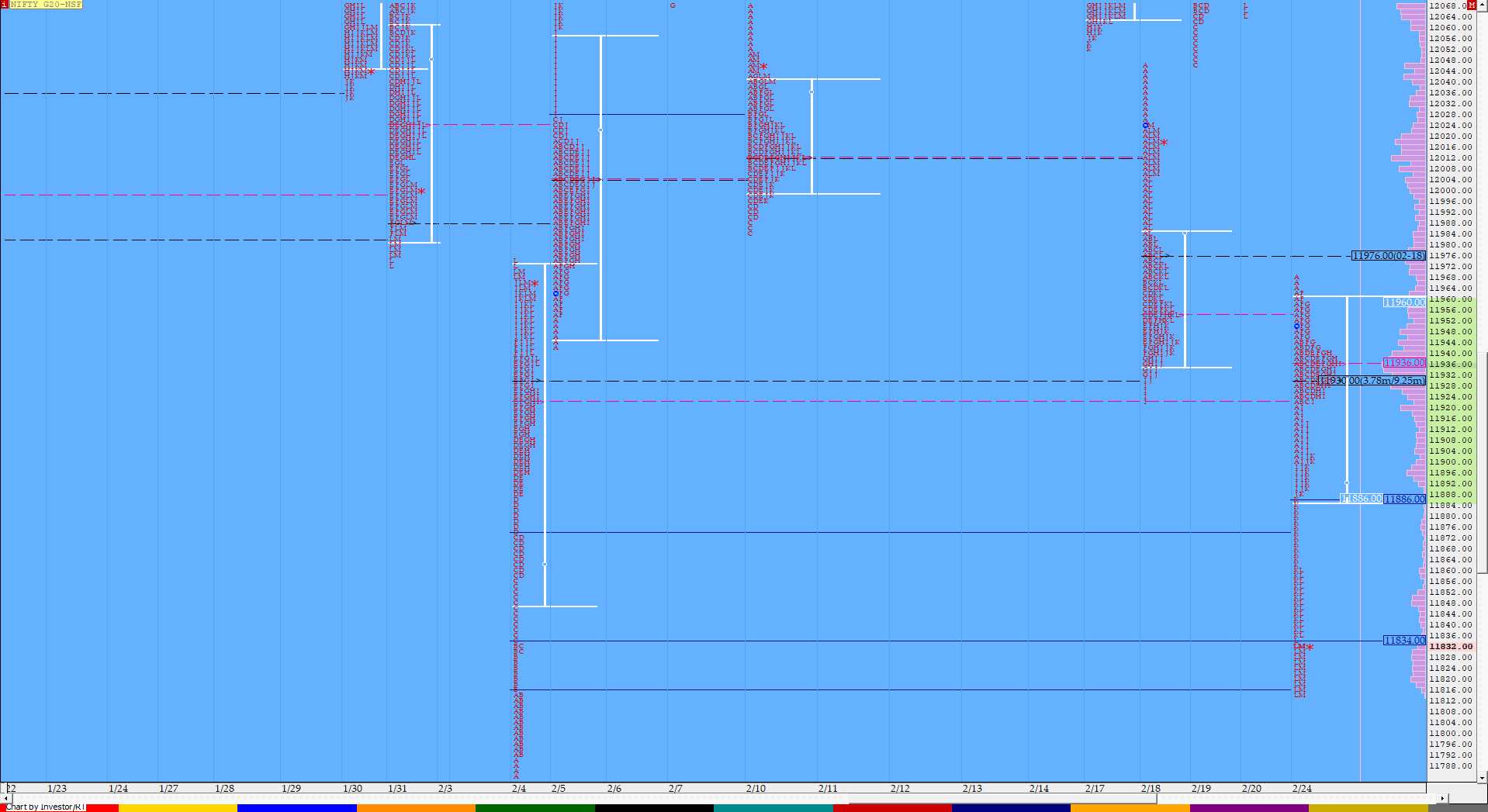

Nifty Feb F: 11827 [ 11970 / 11814 ]

HVNs – 11830 / (11898) / 11930 / (11976) / 12012 / 12080 / 12111 / 12130

Previous day’s report ended with this ‘NF closed the day at 12079 but has given a second successive Neutral Extreme profile though in opposite directions leaving a nice 2-day balanced profile and could lead to a trending move down as the seller seems to be taking control..’

NF opened with a huge gap down of more than 125 points as it negated that FA of 12047 and went on to tag the 1 ATR objective of 11909 in the IB (Initial Balance) itself as it made lows of 11901 and left singles at both ends. The auction then displayed typical character of an OAOR (Open Auction Out of Range) as it remained in a narrow range for the first part of the day taking mechanical support in multiple periods at previous week’s low of 11923 which was also the start of the morning buying tail from 11923 to 11901. With the downside probe showing exhaustion, NF then made a probe higher as it got into the selling tail of the morning but got rejected at 11962 where it confrimed a PBH (Pull Back High) in the ‘F’ period and this gave more power to the sellers as they not only broke into the buying tail but went on to make a RE (Range Extension) to the downside in the ‘I’ period after which it left an extension handle at 11888 in the ‘K’ period and spiked lower into the close to tag 11814 completing the 2 IB objective of 11833. Spike rules would apply for the next session with the spike zone being from 11837 to 11814 which if taken out, NF has another supply zone in form of the selling tail from 11861 to 11888 which would come into play.

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day – Down with a spike close (NV)

- Largest volume was traded at 11930 F

- Vwap of the session was at 11909 with volumes of 136.9 L and range of 156 points as it made a High-Low of 11970-11814

- NF confirmed a FA at 12047 on 19/02 and the 1 ATR objective comes to 12186. This FA was negated on 24/02 & it tagged the 1 ATR objective of 11909 to the downside. The 2 ATR move down comes to 11771.

- The 14th Feb VWAP of 12169 will be the immediate reference on any upside.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11885-11930-11961

Main Hypos for the next session:

a) NF needs to sustain above 11830-835 for a bounce to 11853-860 / 11880-888 / 11910-918 & 11930-936

b) The auction has immediate support at 11820 below which it could test lower levels of 11805*-791 / 11771-763 & 11745-722

Extended Hypos:

c) Above 11936, NF can probe higher to 11960-970 / 12005-011 & 12044-047

d) Below 11722, the auction can move lower to 11705-685 / 11665-644 & 11628

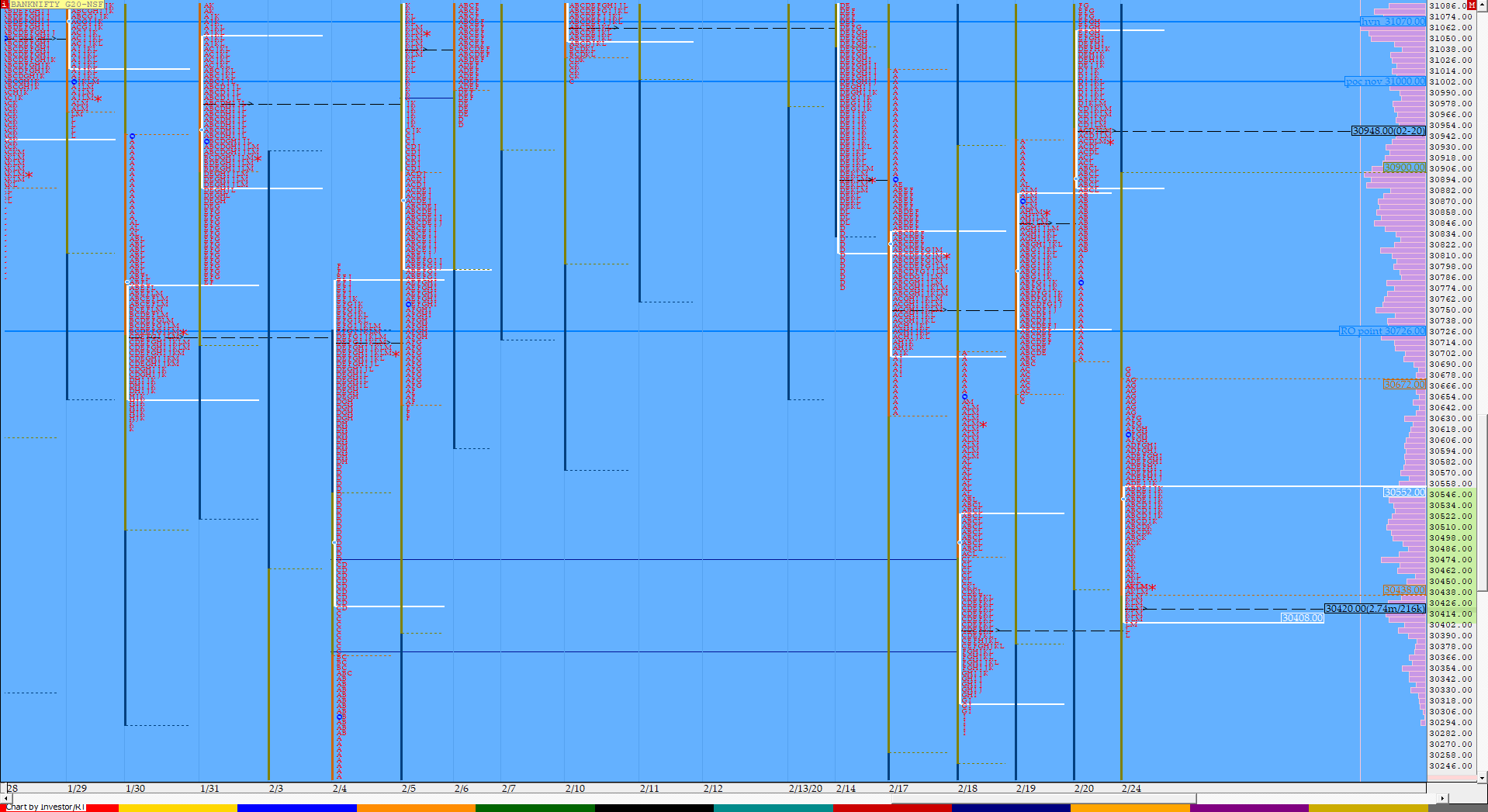

BankNifty Feb F: 30423 [ 30689 / 30393 ]

HVNs – (29970) / (30360) / 30420 / 30540 / (30630) / 30720 / 30795 / 30890 / 31040

Previous day’s report ended with this ‘on the downside, acceptance below 30950 could lead to a test of 30885 below which the buying tail of 30819 to 30698 could come into play….’

BNF also opened with a big gap down of more than 300 points and in doing so negated that buying tail of 30698 to 30819 which meant that there was more downside to come and it continued to probe lower tagging 30443 in the first 15 minutes and stayed in this 231 point range of 30443 to 30674 till the ‘F’ period. The auction then attempted a RE to the upside in the ‘G’ period as it made new highs for the day at 30689 but was unable to sustain above IBH and the failure to get into previous day’s range re-confirmed that the PLR is still to the downside. BNF then made a OTF (One Time Frame) move lower into the close as it went on to make a RE to the downside in the ‘K’ period which confirmed a new FA at 30689 and made lows of 30393 in the ‘L’ period before closing at 30423 leaving a Neutral Extreme profile for the day. The immediate reference for next open would be from 30393 to 30460 with the PLR firmly to the downside for that 1 ATR target of 30233 from today’s FA and the 1 ATR objective of 30197 from the negated FA of 30652.

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 30540 F

- Vwap of the session was at 30538 with volumes of 31.2 L and range of 295 points as it made a High-Low of 30689-30393

- BNF confirmed a FA at 30689 on 24/02 and the 1 ATR objective comes to 30233.

- BNF confirmed a multi-day FA at 30652 on 20/02 and almost tagged the 1 ATR objective of 31107 on the same day. This FA got negated on 24/02 & the 1 ATR target on downside comes to 30197.

- The 14th Feb VWAP of 31067 will be the immediate reference on any upside. This reference was briefly taken out on 20/02 but the was not able to close above it.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30453-30540-30603

Main Hypos for the next session:

a) BNF needs to sustain above 30445-455 for a rise to 30504-540 / 30600 / 30645-674 & 30726-752

b) The auction gets weak below 30400 and could test lower levels of 30320-310 / 30285-233 / 30197-163 & 30102

Extended Hypos:

c) Above 30752, BNF can probe higher to 30812-859 / 30935-948* / 30985 / 31020-050 & 31095-143

d) Below 30102, lower levels of 30060-040 / 29960-951 / 29890-873 / 29825 & 29778-752 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout