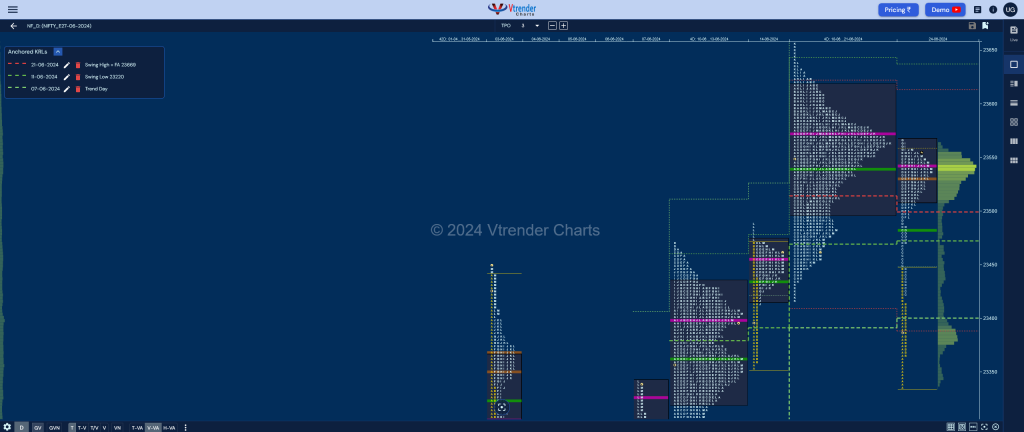

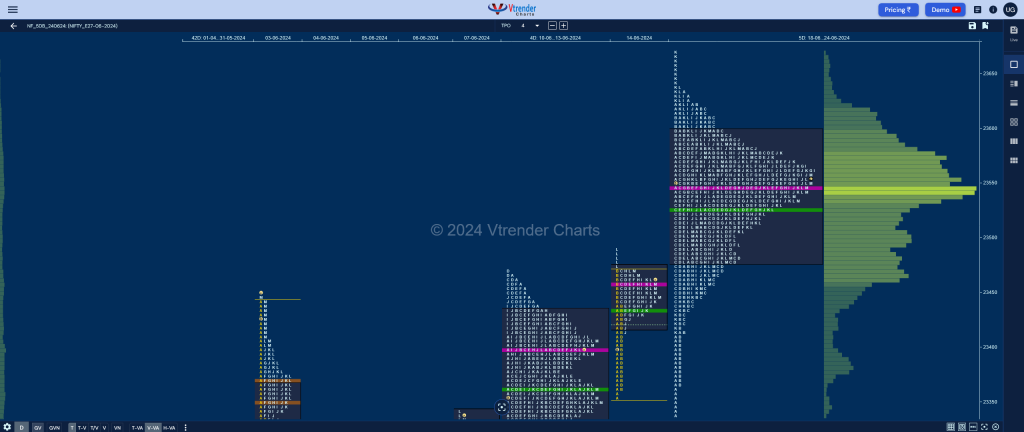

Nifty Jun F: 23543 [ 23565 / 23335 ]

| Open Type |

|---|

| OAOR (Open Auction) |

| Volumes of 32,040 contracts |

| Initial Balance |

|---|

| 110 points (23445 – 23335) |

| Volumes of 76,665 contracts |

| Day Type |

|---|

| Double Distribution – 230 pts |

| Volumes of 2,59,606 contracts |

NF opened lower making an attempt to move away from the 4-day composite even breaking below the Swing Low of 23350 from 14th Jun but took support at 23335 and left a small but important A period buying tail to get back into the composite and went on to almost tag the POC of 23571 while making a high of 23565 leaving a Double Distribution Trend Day Up.

The value however was once again overlapping so we now have a 5-day Gaussian Curve with the composite value at 23477-23546-23597 and the failure of the downside probe today can lead to one test of the highs of the composite with the FA point of 23669 in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23542 F and VWAP of the session was at 23481

- Value zones (volume profile) are at 23510-23542-23565

- NF has confirmed a FA at 23669 on 19/06 and the 1 ATR objective on the downside comes to 23302

- HVNs are at 21960 / 22745 / 23398** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (14-20 Jun) – NF has formed a Normal Variation weekly profile in a narrow range of 319 points with completely higher Value at 23463-23572-23598 with the VWAP at 23525 and has couple of HVNs at 23456 & 23572 so needs a move away from one of them on initiative volumes in the coming week for a imbalance in that direction

- (07-13 Jun) – NF has formed a composite ‘p’ shape profile for the week with completely higher value at 23248-23998-23435 and has closed around the POC which will be the opening reference for the new settlement with VWAP of 23291 being an important support

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 25th Jun 2024

| Up |

| 23546 – 5-day POC (18-24 Jun) 23597 – 5-day VAH (18-20 Jun) 23669 – Failed Auction (19 Jun) 23715 – 1 ATR (Buy tail 23338) 23775 – 1 ATR (4-day POC 23398) 23810 – |

| Down |

| 23530 – HVN (24 Jun) 23481 – VWAP (24 Jun) 23445 – Ext Handle (24 Jun) 23405 – B TPO VWAP (24 Jun) 23365 – Buy Tail (24 Jun) 23291 – Weekly VWAP (07-13 Jun) |

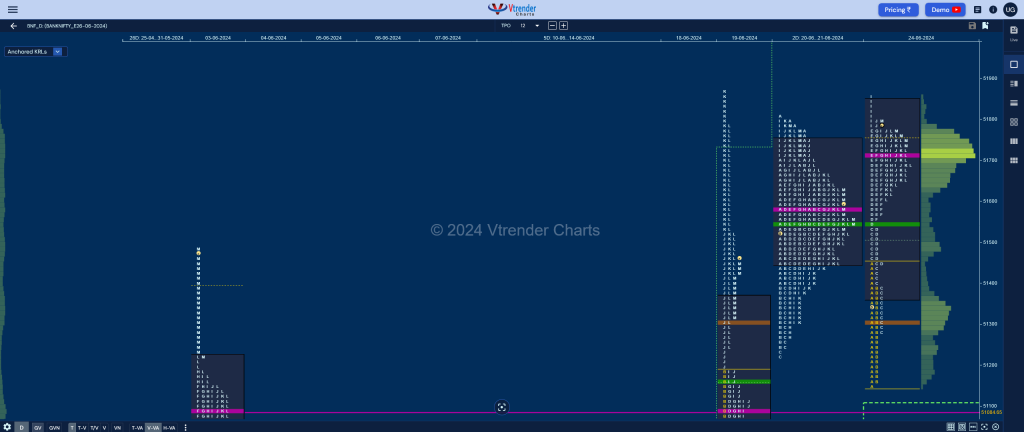

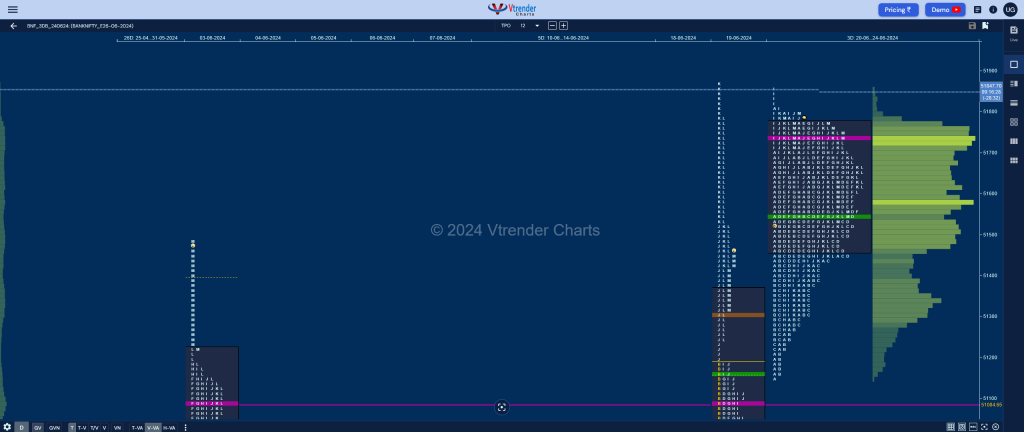

BankNifty Jun F: 51751 [ 51865 / 51150 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 20,687 contracts |

| Initial Balance |

|---|

| 300 points (51450 – 51150) |

| Volumes of 45,174 contracts |

| Day Type |

|---|

| Double Distribution – 715 pts |

| Volumes of 1,55,814 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51719 F and VWAP of the session was at 51545

- Value zones (volume profile) are at 51369-51719-51840

- HVNs are at 49110 / 49931** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (13-19 Jun) – BNF started the week continuing the balance it had been forming previously for the first 2 days building a prominent POC at 50025 and gave a move away signaling the start of a fresh imbalance over the next 2 sessions forming a Triple Distribution Trend Up profile with overlapping to higher Value at 49750-50025-50650 with the important VWAP at 50671 and the 2 extension handles at 50449 & 51197 respectively.

- (23-29 May) – BNF has formed a Normal Variation weekly profile getting rejected from previous week’s POC of 49110 forming overlapping to higher Value at 49611-49931-50236 with a close around the prominent POC so can give a move away from here in the coming week

Monthly Zones

- The settlement day Roll Over point (June 2024) is 49047

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

Business Areas for 25th Jun 2024

| Up |

| 51778 – 3-day VAH (20-24 Jun) 51885 – Swing High (19 Jun) 52041 – 1 ATR (SOC 50946) 52179 – 1 ATR (VPOC 51084) 52363 – 1 ATR (SOC 51268) 52442 – PWR |

| Down |

| 51719 – POC (24 Jun) 51545 – VWAP (24 Jun) 51442 – C TPO VWAP 51300 – HVN (24 Jun) 51166 – Buy Tail (24 Jun) 51084 – VPOC (19 Jun) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.