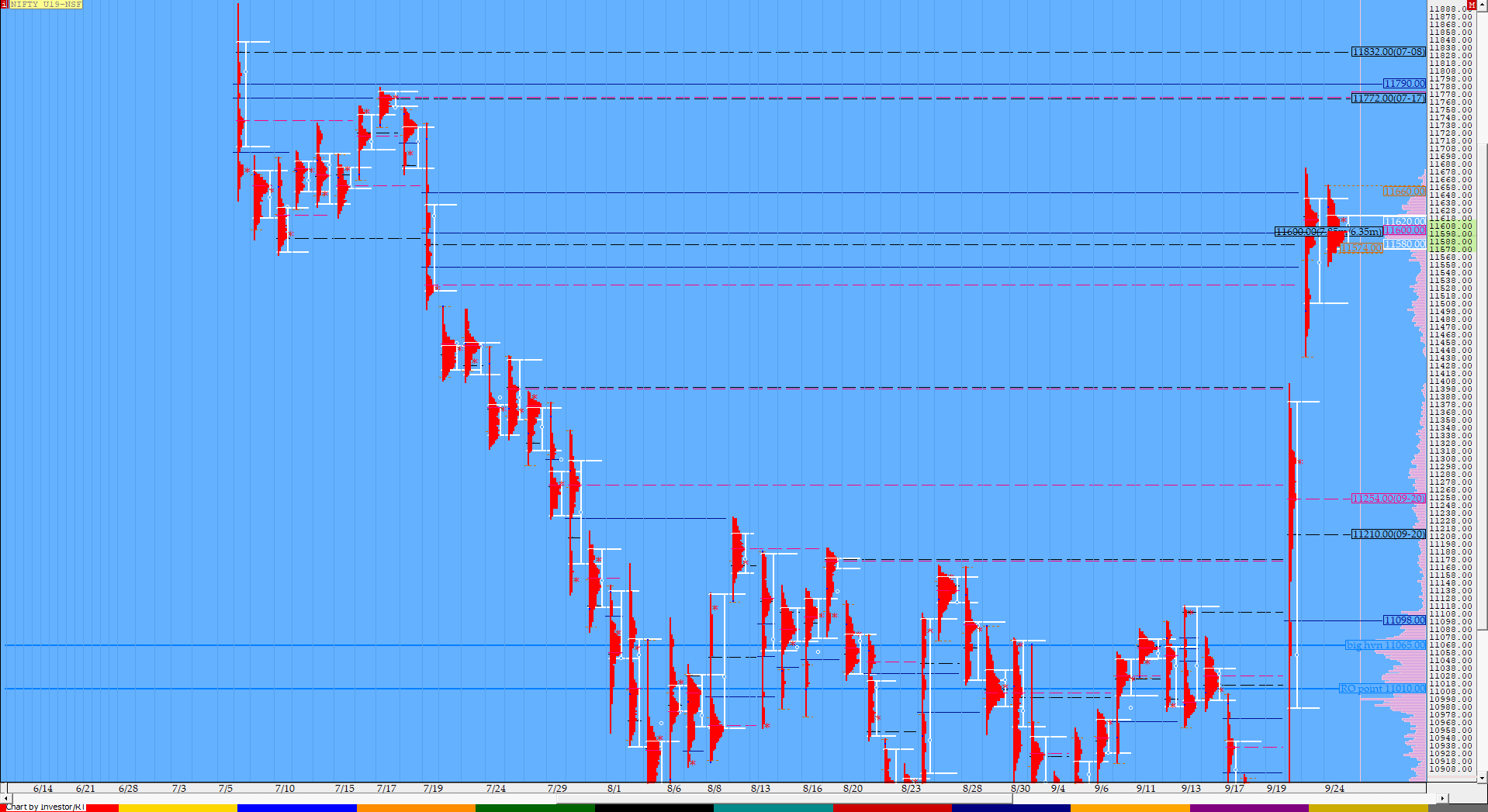

Nifty Sep F: 11614 [ 11660 / 11557 ]

NF opened above the HVN of 11620 & probed higher making a high of 11660 but was bot able to get above PDH settling down with an OAIR (Open Auction In Range) which indicated that the auction could be preparing for a balance after the imbalance of last 2 days which saw NF rising by almost 1000 points. After failing to break above PDH, NF then turned lower as it went on to break below VWAP & the HVN of 11620 giving a quick fall to 11575 just as the ‘B’ period started to leave a IB (Initial Balance) range of 85 points. The auction then continued to remain weak as it stayed below 11620 and even made an RE (Range Extension) to the downside in the E period making new day lows of 11562 and followed it with a lower low of 11557 in the F period but was swiftly rejected as it got back into the IB range and went on to get above VWAP in the ‘G’ period raising the possibility of a FA (Failed Auction) getting confirmed at lows but the upside probe got stalled exactly at the level of 11620. NF made another attempt to get above 11620 in the ‘H’ period but was once again rejected & this led to a rotation down as it got below the IBL in the ‘I’ period but ended up making a higher low indicating that only locals were present in the auction. The ‘K’ period saw NF taking support at the IBL & give a quick move to the upside as it went on to scale above 11620 and tagged high of 11655 stalling just below the day high which meant that this rise was more of an inventory adjustment move which saw the local shorts who were stuck exiting. The absence of new demand meant that the auction had only one way to go in the last 45 minutes & NF came down to test the VWAP & the dPOC leaving an Inside Day & a Gaussian profile with the Value also forming completely inside yesterday’s Value. NF has formed a composite ‘p’ shape profile over the last 2 days with the composite POC at 11599 and could continue to balance in this zone unless it gives a drive away from this POC in the coming session(s).

(Click here to view the 2-day composite)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (Gaussian Profile)

- Largest volume was traded at 11599 F

- Vwap of the session was at 11604 with volumes of 149 L and range of 102 points as it made a High-Low of 11660-11557

- The Trend Day POC & VWAP of 20/09 at 11210 & 11125 are now now important support levels.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside. NF has closed above both of these on 23/09.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11010

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11581-11599-11621

Hypos / Estimates for the next session:

a) NF needs to sustain above 11620 for a move to 11642-649 / 11680-685 & 11705

b) Immediate support is at 11598 below which the auction can test 11570-560 / 11534-530 & 11510

c) Above 11705, NF can probe higher to 11721-727 / 11751 & 11772-776

d) Below 11510, auction becomes weak for 11490-467 / 11440 & 11405

e) If 11776 is taken out, the auction can rise to 11803 / 11822-842 & 11863-894

f) Break of 11405 can trigger a move lower to 11373 /11345 & 11328

BankNifty Sep F: 30539 [ 30735 / 29591 ]

BNF also gave a OAIR start though it made almost a 400 point range in the opening 10 minutes as it broke below the HVN of 30380 at open and went on to make a low of 30287 but was swiftly rejected after which it probed higher to tag 30675 but once again was met with rejection which meant that the auction is turning from imbalance more to a balance. BNF then once again broke below 30380 and went on to make new lows for the day at 30128 in the ‘B’ period leaving a huge 547 points IB Range which also included a selling tail from 30450 to 30675. The auction then consolidated in the ‘C’ period making an inside bar but stayed below VWAP which meant the PLR (Path of Least Resistance) was to the downside and went on to make multiple REs lower in the ‘D’, ‘E’ & ‘F’ periods as BNF made new lows for the day at 29923 and looked set to tag the lower HVN of 29850. The ‘G’ period however stopped the OTF (One Time Frame) move lower since open as it made a higher high of 30325 to test VWAP but was rejected signalling that more downside could be in store. The ‘H’ period then made an inside bar but was once again rejected at VWAP as it made a lower high of 30244 after which BNF probed lower in the ‘I’ period but ended up making higher lows as it left a PBL (Pull Back Low) at 29980 and then a higher PBL of 30041 in the ‘K’ period which indicated that the downside probe is contracting and this led to a big bounce as BNF not only got above VWAP but went on enter the singles at top but was rejected after it left a PBH (Pull Back High) at 30492 and came back to VWAP to give a nice balanced profile for the day which also represented a ‘b’ shape which means long liquidation. The range & value both were inside previous day and the 2 day composite is giving a nice Gaussian profile so will need to check if the auction continues to smoothen the profile by remaining in a balance or gives a fresh move away from here.

(Click here to view the 2-day composite of BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down

- Largest volume was traded at 30100 F

- Vwap of the session was at 30195 with volumes of 51.9 L and range of 752 points as it made a High-Low of 30675-29923

- The Trend Day POC & VWAP of 20/09 at 28968 & 28423 are now now important support levels.

- The Trend Day VWAPs of 19/07 & 18/07 at 30085 & 30598 which were positional supply points have been taken out as BNF closed above it on 23/09.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point is 27450

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30045-30100-30365

Hypos / Estimates for the next session:

a) BNF needs to sustain above 30225 for a rise to 30310 / 30399-416 & 30492

b) The auction has support zone at 30225-195 below which it could test 30100 / 30050-35 & 29980-950

c) Above 30492, BNF can rise to 30580 / 30650-675 & 30735

d) Below 29950, lower levels of 29890 / 29755 & 29630 could come into play

e) Sustaining above 30735, BNF can give a fresh move up to 30792 / 30857-883 & 30935

f) Break of 29630 could trigger a move down 29590 / 29520-515 & 29425

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout