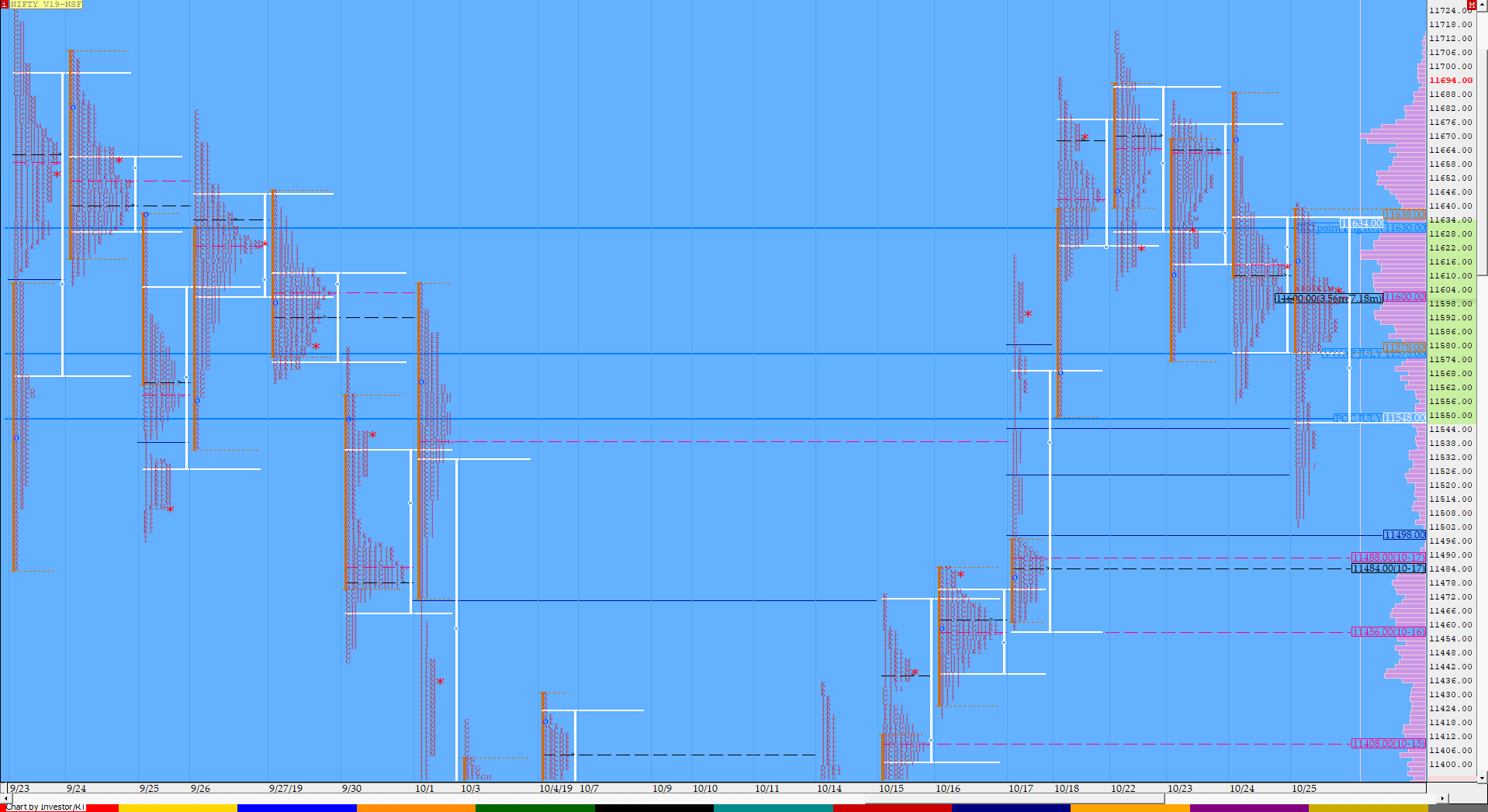

Nifty Oct F: 11609 [ 11640/ 11502 ]

HVNs – 11155 / 11250-253 / (11276) / 11330 / 11380 / [11410] / 11484 / 11605 / 11670

Report to be updated…

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down

- Largest volume was traded at 11605 F

- Vwap of the session was at 11580 with volumes of 108.1 L and range of 137 points as it made a High-Low of 11640-11502

- NF confirmed a multi-day FA at 11420 on 16/10 and completed the 1 ATR move up of 11575. The 2 ATR objective comes to 11731. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11458 on 17/10 and completed the 1 ATR move up of 11611. The 2 ATR objective comes to 11763. This FA is currently on ‘T+6’ Days

- NF confirmed a FA at 11113 on 09/10 and completed the 2 ATR move up of 11505. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 09/10 at 11224 will be important support and this held on 10/10 as well as on 11/10

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11554-11605-11638

Hypos / Estimates for the next session:

a) NF needs to sustain above 11620 for a rise to 11640 / 11661-664 / 11679 & 11700-705

b) Immediate support is at 11605 below which the auction could test 11590-580 / 11560-536 & 11520

c) Above 11705, NF can probe higher to 11725-731 / 11751-763 & 11787

d) Below 11520, auction becomes weak for 11484-478 / 11458 & 11442-439

e) If 11787 is taken out, the auction go up to to 11805-810 / 11822-843 & 11863

f) Break of 11439 can trigger a move lower to 11424-420 / 11395-*379* & 11364-360

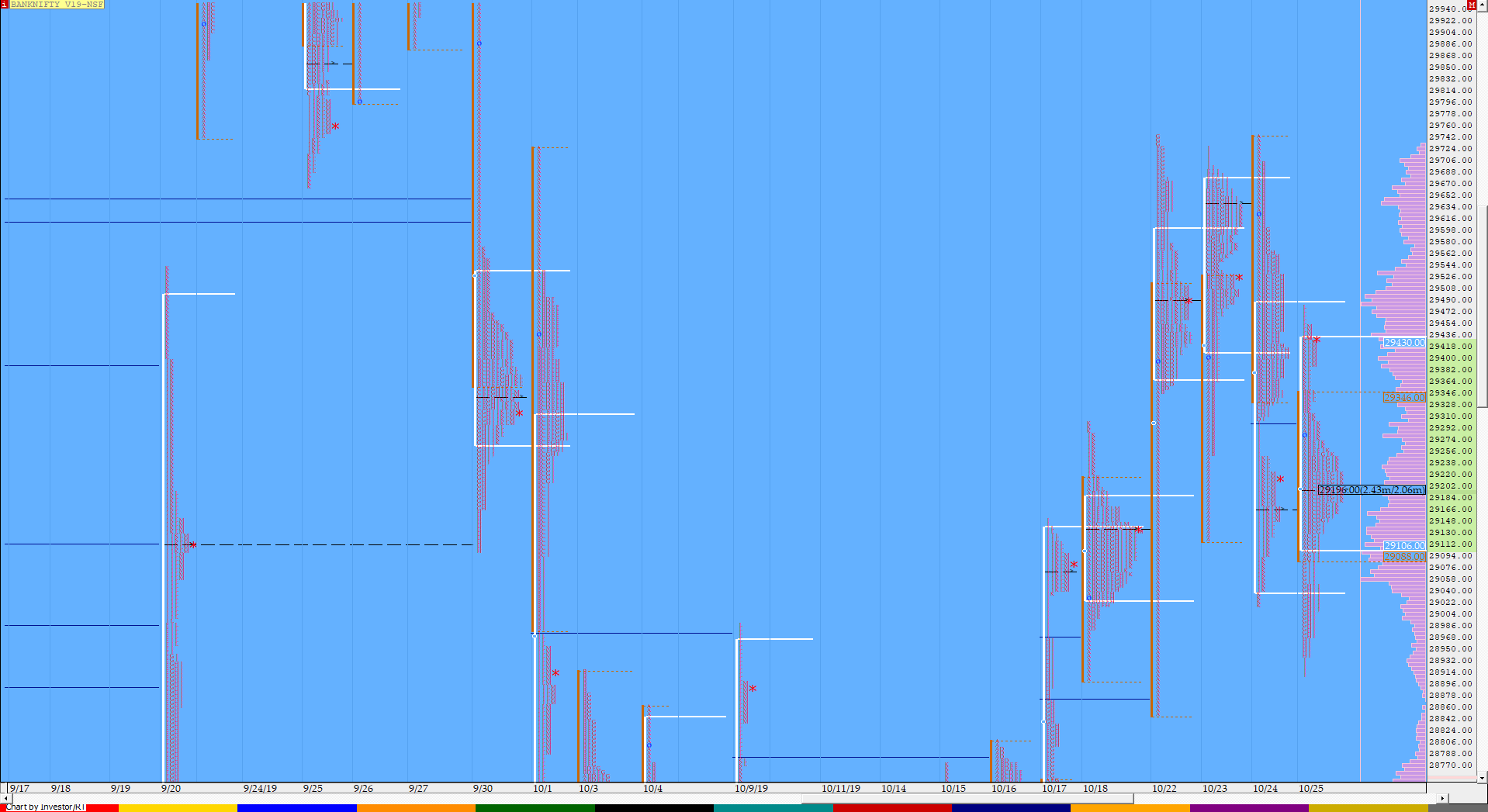

BankNifty Oct F: 29432 [ 29480 / 28912 ] ) ]

HVNs – 28025 / 28130 / 28330 / 28430 / 28625 / (29020) / 29200 / 29435 / 29490 / (29650)

Report to be updated…

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Extreme Day – Up

- Largest volume was traded at 29200 F

- Vwap of the session was at 29183 with volumes of 45.5 L and range of 567 points as it made a High-Low of 29480-28912

- BNF confirmed a FA at 27774 on 09/10 and completed the 2 ATR move up of 29653 on 22/10. This FA has not been tagged since & hence is now positional support

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 29092-29200-29400

Hypos / Estimates for the next session:

a) BNF has immediate supply at 29470-490 above which it could rise to 29544-555 / 29625-680 & 29745

b) Sustaining below 29430, the auction gets weak for a test of 29350-330 / 29230-200 & 29145

c) Above 29745, BNF can probe higher to 29805 / 29853-885 & 29928-950

d) Below 29145, lower levels of 29090-020 / 28940-935 & 28857-830 could come into play

e) If 29950 is taken out, BNF can give a fresh move up to 30025-77 / 30140-175 & 30216

f) Break of 28830 could trigger a move down 28760-703 / 28650-622 & 28541-500

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout