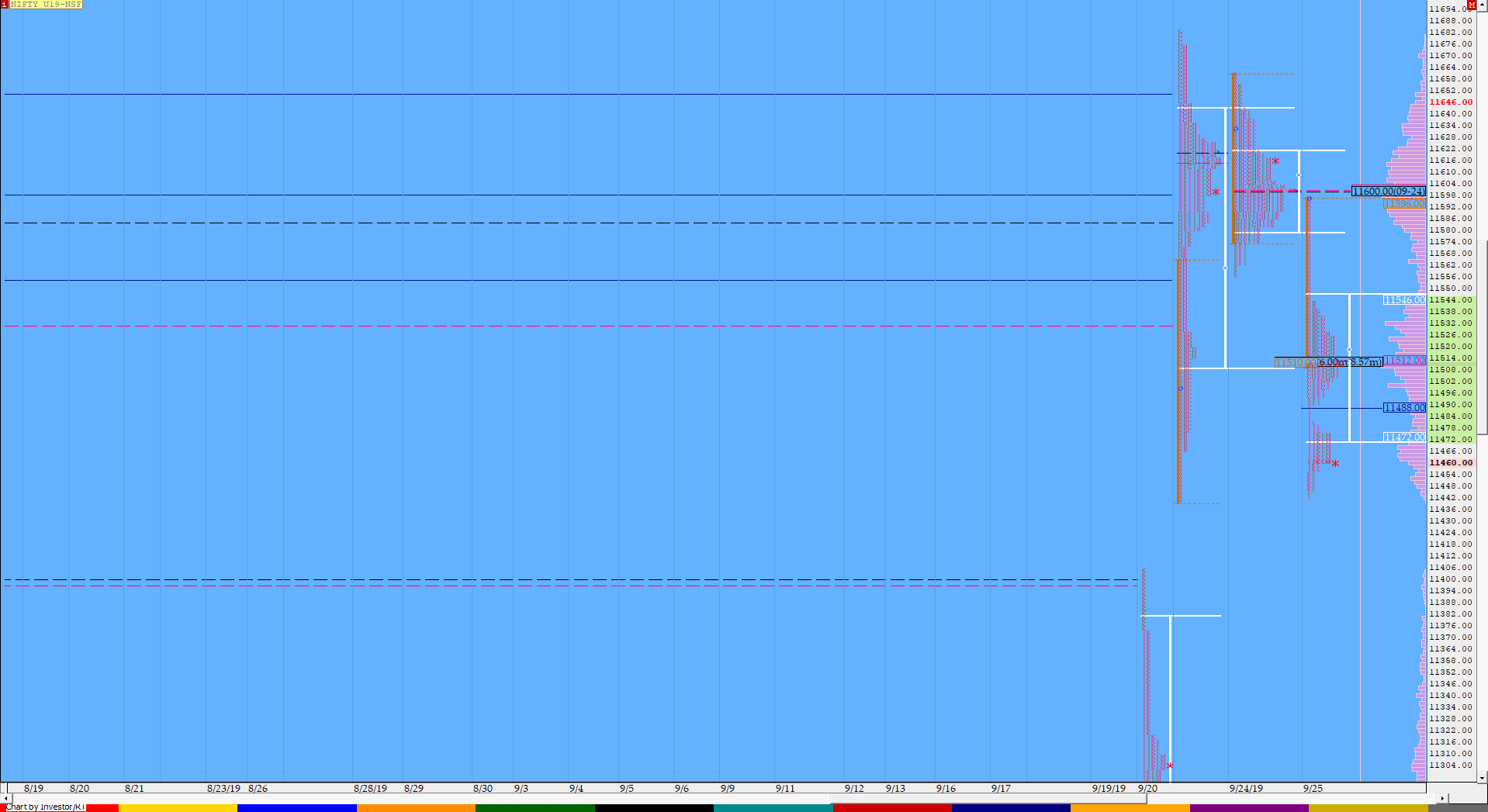

Nifty Sep F: 11469 [ 11596 / 11442 ]

Yesterday’s report ended with this ‘NF has formed a composite ‘p’ shape profile over the last 2 days with the composite POC at 11599 and could continue to balance in this zone unless it gives a drive away from this POC in the coming session(s).‘‘

NF gave an OH (Open=High) start today just below the yPOC of 11599 and drove lower though on lower volumes as it moved away from the 2 day balance breaking below PDL (Previous Day Low) in the first 5 minutes itself setting up the PLR (Path of Least Resistance) for the day to the downside. The auction continued to probe lower in the IB (Initial Balance) as it made a low of 11512 in the ‘B’ period to leave a similar IB range of 85 points as it did yesterday but whereas yesterday the auction was inside previous day’s Value hence there was not much expectation on the range expansion front, today was a different scenario as NF was moving away from balance with an initiative selling tail from 11543 to 11614 and therefore chances were more of getting a good range extension (RE). The RE to the downside happened in the dreaded ‘C’ period as NF made new lows of 11494 but ‘D’ period then made an inside bar getting rejected just below VWAP after which it made fresh REs down in the next 2 periods but made similar lows of 11491 & 11490 suggesting that the probe lower is getting exhausted. The ‘G’ period then stalled the OTF move down since open as it made a higher high for the first time in the day scaling above VWAP but then got rejected just below the morning selling tail to leave a PBH (Pull Back High) of 11539 and this rejection meant that the auction was now ready to move lower. The ‘H’ period then made an inside bar but stayed below VWAP & as it frequently does, the ‘I’ period took over the initiative as it made a fresh RE leaving an extension handle at 11490 and probed lower completing the 1.5 IB move down as it hit lows of 11460 after which the next 3 period made lower lows but remained in a narrow range as NF made lows of 11442 in the ‘L’ period and was looking good for a spike lower into the close but it didn’t happen as most probably some demand was coming in at the weekly gap zone. The auction made a small balance below the extension handle of 11490 which will be the immediate supply point & closed around the HVN of 11465 giving a Double Distribution profile with lower Value and a tail at top. Acceptance below 11465 would made NF weaker for more downside whereas taking out the extension handle of 11490 would open up higher levels of 11512 & 11540.

(Click here to view this week’s auction in NF)

- The NF Open was an Open Drive Down (OD) on lower volumes

- The day type was a Normal Variation Day – Down (‘b’ profile with a spike lower)

- Largest volume was traded at 11512 F

- Vwap of the session was at 11503 with volumes of 156.7 L and range of 154 points as it made a High-Low of 11596-11442

- The Trend Day POC & VWAP of 20/09 at 11210 & 11125 are now now important support levels.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside. NF has closed above both of these on 23/09.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11010

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11474-11512-11549

Hypos / Estimates for the next session:

a) NF needs to get above 11480-490 for a move to 11512-518 / 11534-535 & 11560-565

b) Immediate support is at 11450-445 below which the auction can test 11405 & 11373

c) Above 11565, NF can probe higher to 11599 / 11620 & 11642-649

d) Below 11373, auction becomes weak for 11345 / 11328 & 11295-290

e) If 11649 is taken out, the auction can rise to 11680-685 / 11705 & 11721-727

f) Break of 11290 can trigger a move lower to 11254 / 11210 & 11185

BankNifty Sep F: 29639 [ 30081 / 29511 ]

BNF also gave an initiative move away at open as it not only opened lower getting rejected just below the yPOC of 30096 and like in the case of NF, broke below the PDL in the first 5 minutes itself setting up the tone for a good move lower as it made a low of 29753 in the ‘A’ period. The ‘B’ period remained in a narrow range confirming a selling tail from 29877 to 30250 in the IB after which the auction made a RE to the downside in the C period making lows of 29664 but did not extend it further in the next 3 periods which were all inside the range of ‘C’ indicating short term exhaustion in this probe down. The ‘F’ period moved higher breaking above this contracting range which was followed by a big move in the ‘G’ period as BNF got above VWAP & got into the selling tail but was rejected around the PDL as it left a pull back high of 29940 which meant the auction is now ready for new lows. BNF then made an inside bar in the H period but broke lower in the I period making new lows for the day & followed it with lower lows in the next 2 periods tagging 29511 in the ‘K’ period and went on to make an outside bar in the period as it made highs of 29685. BNF closed the day around the HVN of 29630 leaving a ‘b’ shape profile with lower value so the PLR remains down below this HVN.

(Click here to view this week’s action in BNF)

- The BNF Open was an Open Drive Down (OD) on lower volumes

- The day type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 29860 F

- Vwap of the session was at 29735 with volumes of 39.8 L and range of 570 points as it made a High-Low of 30081-29511

- The Trend Day POC & VWAP of 20/09 at 28968 & 28423 are now now important support levels.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point is 27450

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 29674-29860-29823

Hypos / Estimates for the next session:

a) BNF needs to get above 29685 for a rise to 29735 / 29790-800 & 29850-860

b) The auction has immediate support at 29630 below which it could test 29550-528 & 29425

c) Above 29860, BNF can probe higher to 29925-945 / 30035-50 & 30096

d) Below 29425, lower levels of 29350 / 29285 & 29200-190 could come into play

e) Sustaining above 30096, BNF can give a fresh move up to 30195 / 30250 & 30310

f) Break of 29190 could trigger a move down 29020 & 28960

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout