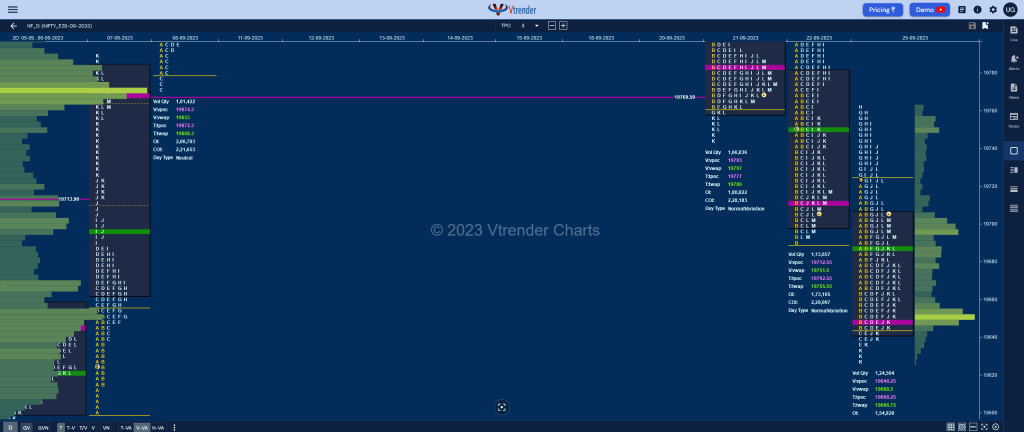

Nifty Sep F: 19700 [ 19763 / 19626 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 10,488 contracts |

| Initial Balance |

|---|

| 77 points (19722 – 19645) |

| Volumes of 25,274 contracts |

| Day Type |

|---|

| Neutral (NeuD) – 137 points |

| Volumes of 1,24,504 contracts |

NF made an OH (Open=High) start at 19722 and probed lower making a look down below previous lows confirming the multi-day FA at 19825 and went on to test 07th Sep’s PBL of 19647 while hitting 19645 in the B period after which it made a typical C side extension to 19639 which was swiftly rejected giving a bounce back to day’s VWAP at 19679.

The auction made similar highs of 19679 in the D TPO also as could not get any fresh demand at VWAP triggering another move to the downside and even making a fresh RE in the E period making marginal new lows of 19635 but saw big buying coming in as the dPOC shifted lower to 19649 and more confirmation came in the F where it scaled above VWAP and followed it up with a big RE to the upside in the G TPO confirming a FA at lows.

The H period saw new highs for the day at 19763 being tagged which was just short of 22nd Sep’s SOC (Scene Of Crime) which was at 19765 plus the 1 ATR objective of today’s FA which came to 19766 forcing the buyers to liquidate resulting in a reversal of the probe to the downside as the J period swiped through the day’s Value and K went on hit new lows for the day at 19626 but once again was met with good responsive buying as NF not only got back above VWAP but went on to make a look up above IBH hitting 19728 but could not take out today’s SOC of 19732 and closed in the middle of the profile.

We have a Neutral Day today with mostly lower Value with the level of 19690 once again being the reference for the next open along with 19728-19765 being the zone to watch on the upside along with the FA of 19824 whereas on the downside, the mini responsive buying tail from 19635 to 19626 will need to be negated by initiative selling activity for that pending probe to 19561.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19648 F and VWAP of the session was at 19688

- Value zones (volume profile) are at 19642-19648-19704

- HVNs are at 19612 / 19770** / 20022 / 20174 (** denotes series POC)

- NF confirmed a FA at 20234 on 18/09 and completed the 2 ATR objective of 19983 on 20/09. This FA is currently on ‘T+4’ Days

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and is no longer a valid support

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

Monthly Zones

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively

Business Areas for 26th Sep 2023

| Up |

| 19722 – IBH (25 Sep) 19765 – SOC (22 Sep) 19824 – 2-day VAH (21-22 Sep) 19869 – IB singles mid (21 Sep) 19907 – Gap singles mid (21 Sep) 19951 – Tail from 20 Sep |

| Down |

| 19690 – Weekly IBL 19648 – dPOC (25 Sep) 19612 – Weekly VPOC (01-07 Sep) 19561 – 2 ATR from 19825 19517 – D TPO POC (04 Sep) 19464 – Ext Handle (01 Sep) |

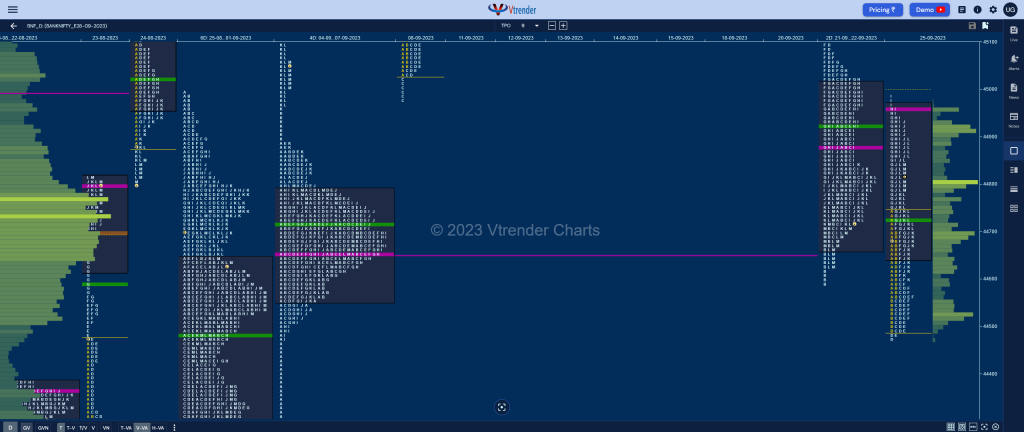

BankNifty Sep F: 44812 [ 44991 / 44469 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 10,173 contracts |

| Initial Balance |

|---|

| 249 points (44740 – 44491) |

| Volumes of 25,875 contracts |

| Day Type |

|---|

| Neutral Extreme (NeuX) – 522 points |

| Volumes of 1,47,034 contracts |

BNF made an OA (Open Auction) start on less than average volumes as it could not sustain above 44695 and completed the 80% Rule in the 4-day composite (04th-07th Sep 2023) while making a low of 44562 in the A period and continued the downmove in the B where it hit 44491 but could not find fresh supply.

The C TPO was a rare narrow range inside bar confirming exhaustion to the downside after which the auction made an attempy to extend lower in the D but could only manage to tag 44469 taking support exactly at that composite’s buying tail from 44470 to the freak tick of 44160 and formed another narrow range inside bar in the E.

The F period reversed the PLR (Path of Least Resistance) to the upside by leaving a SOC (Scene Of Crime) at 44580 and getting back into the 2-day Value and followed it up with a big RE in the G period as it left an extension handle at 44740 and not only confirmed a FA at lows but also completed the 1 ATR objective of 44918 while making a high of 44937 and continued forming higher highs in the H & I TPOs where it hit 44991 completing the 2 IB target of 44989 to the dot which saw big profit booking by the buyers as the dPOC shifted higher to 44957 marking the end of the upside for the day.

BNF then made a large retracement down to 44595 in the K period taking support just above the SOC of 44580 triggering a short covering bounce back to 44896 in the L before settling down to close around the HVN of 44802 leaving a Neutral Extreme Day Up with completely overlapping Value and a FA at lows.

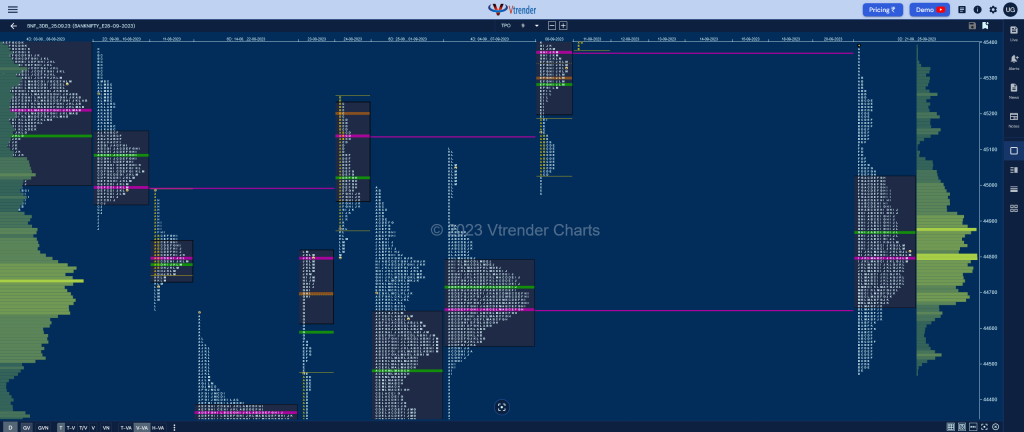

The 3-day composite in BNF is now a smoother ‘b’ shape profile with Value at 44662-44801-45020 and an extension handle at 45118 which continues to be the upside reference along with the initiative selling tail from 45300 to 45395 where as on the downside, today’s SOC of 44580 along with the FA of 44469 will be the important levels to hold below which 01st Sep’s Extension Handle of 44340 could come into play. (Click here to view the composite profile only on Vtrender Charts)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44957 F and VWAP of the session was at 44729

- Value zones (volume profile) are at 44645-44957-44967

- HVNs are at 44656** / 44736 (** denotes series POC)

- BNF confirmed a FA at 44469 on 25/09 and tagged the 1 ATR objective of 44918 on the same day. The 2 ATR target comes to 45366

- BNF confirmed a FA at 44976 on 08/09 and tagged the 2 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and closed below so is now a supply point

- BNF confirmed a FA at 44760 on 06/09 and 1 ATR objective to the downside comes to 44366. This FA got negated on 07/09 and tagged the 2 ATR upside target of 45577 on 11/09

Monthly Zones

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively

Business Areas for 26th Sep 2023

| Up |

| 44801 – 3-day POC (21-25 Sep) 44957 – dPOC from 25 Sep 45035 – H TPO POC (22 Sep) 45118 – Ext Handle (21 Sep) 45266 – PBH from 21 Sep 45394 – Weekly IBH |

| Down |

| 44765 – Weekly IBL 44662 – 3-day VAL (21-25 Sep) 44580 – SOC from 25 Sep 44469 – FA from 25 Sep 44340 – Ext Handle (01 Sep) 44225 – SOC from 01 Sep |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.