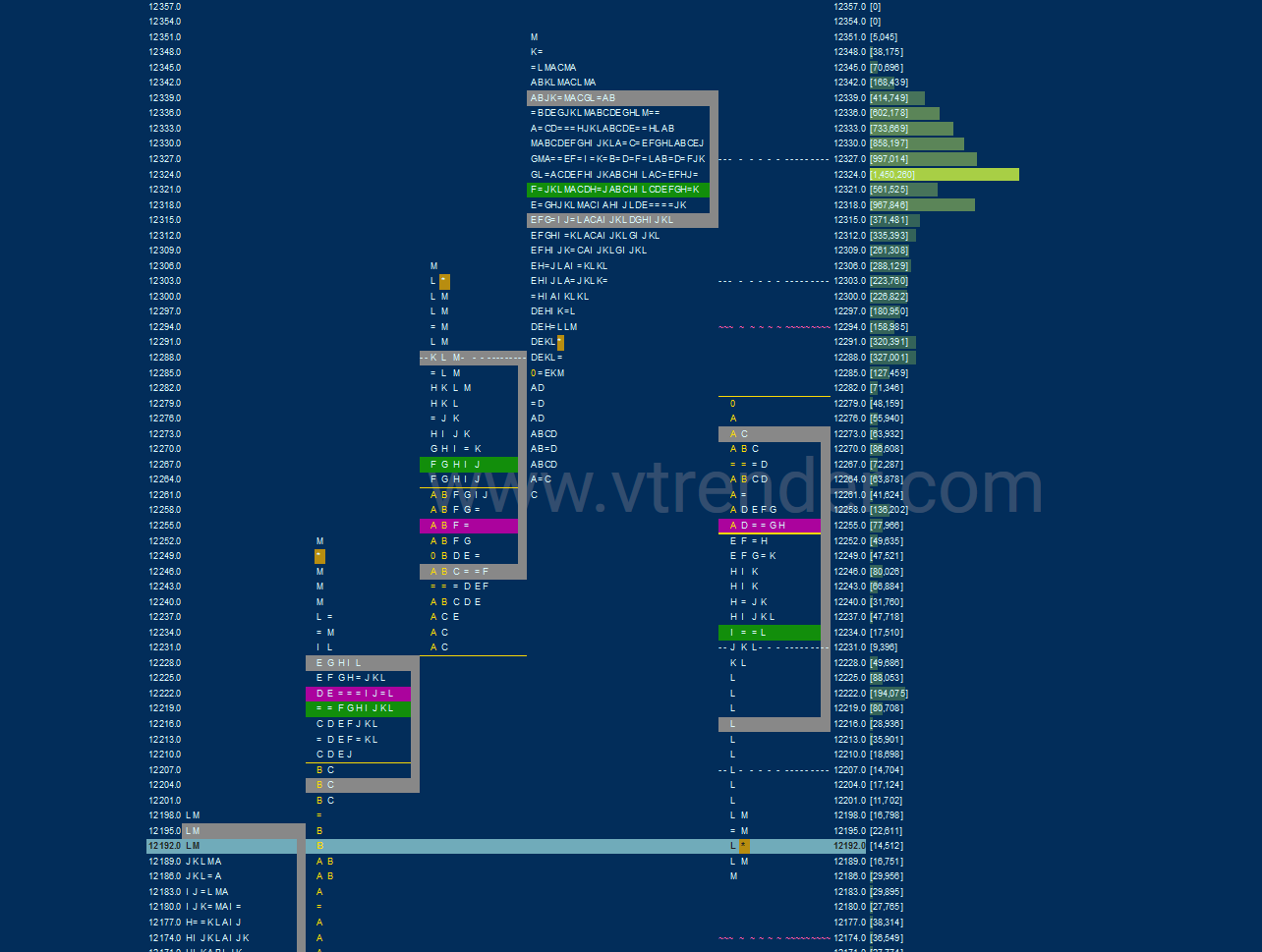

Nifty Jan F: 12196 [ 12280/ 12188 ]

HVNs – 11949 / 11995 / 12042 / 12130 / 12160 / 12193 / 12254 / 12327

NF opened with a small gap down & stayed below the PDL (Previous Day Low) as it confirmed an OAOR (Open Auction Out of Range) start but more importantly moved away from the 4-Day Gaussian profile with a selling tail from 12294 to 12274 as it stayed in a narrow IB (Initial Balance) range of just 25 points. The auction did make a small RE (Range Extension) to the downside in the ‘E’ period but could only extend the range by just 5 points as it made similar lows of 12250 for 3 consecutive periods playing out a typical OAOR. The ‘H’ period then saw a fresh RE lower which was followed by lower lows for the next 3 periods as NF completed the 2 IB move down of 12230 in the ‘K’ period and gave a bounce to VWAP leaving a PBH (Pull Back High) at 12251 which was the zone which was holding the auction in the first half. This rejection from VWAP then led to a spike down in the last 45 minutes as NF almost doubled the range of the day to hit lows of 12188 before closing at the HVN of 12195 with a spike zone of 12188 to 12231 which would be the reference for the open in the next session as spike rules will be at play.

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Slow Trend Day – Down (TD)

- Largest volume was traded at 12254 F

- Vwap of the session was at 12244 with volumes of 72.5 L and range of 92 points as it made a High-Low of 12280-12188

- The Trend Day VWAP of 26/12 at 12244 will be important reference on the upside.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12217-12254-12275

Hypos / Estimates for the next session:

a) NF needs to sustain above 12200 for a rise to 12215-217 / 12231 & 12245-254

b) Immediate support is at 12190 below which the auction could test 12170-162 / 12144 & 12126-122

c) Above 12254, NF can probe higher to 12270-274 / 12294-310 & 11327-332

d) Below 12122, auction could fall to 12078 & 12059

e) If 12332 is taken out, the auction go up to to 12346 / 12361-368 & 12391

f) Break of 12059 can trigger a move lower to 12042*-31 / 12015 & 11990-982

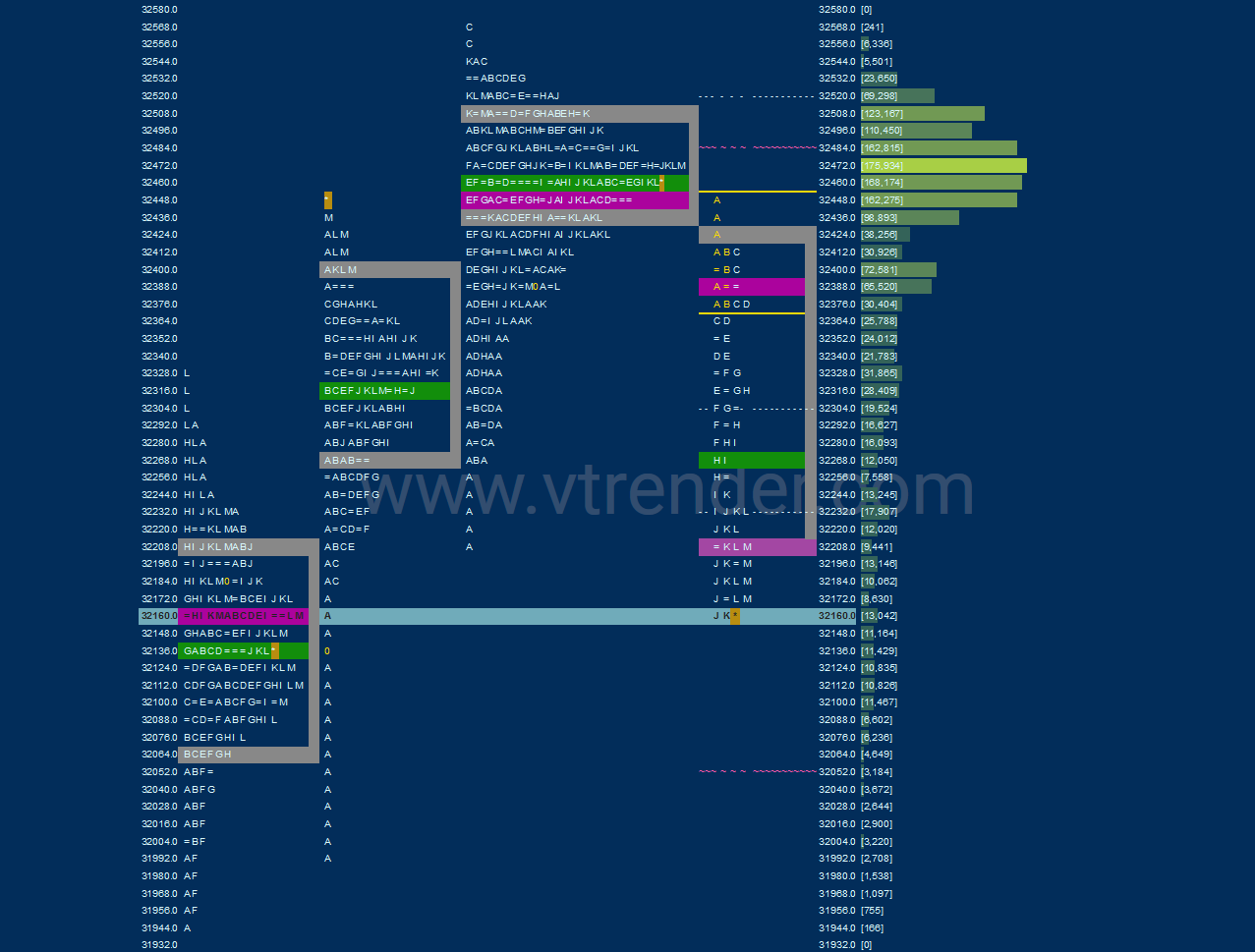

BankNifty Jan F: 32172 [ 32450 / 32160]

HVNs – 32125 / 32210 / 32290 / 32395 / 32485

BNF also gave an initiative move at open away from the 3-day composite it had formed with a small selling tail from 32460 to 32420 as it stayed below the PDL and gave a OTF (One Time Frame) move all day making lower highs in all the TPOs except in the ‘K’ period where it left a PBH at 32253 to leave a slow Trend Day Down as it made lows of 32160 and saw huge volumes at 32168 before closing the day at 32186. The dPOC of 32210 would be the first reference on the upside above which the combo of the PBH & the day’s VWAP of 32253 & 32281 would be the important levels going forward for the new series.

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Slow Trend Day – Down (TD)

- Largest volume was traded at 32210 F

- Vwap of the session was at 32281 with volumes of 13.3 L and range of 290 points as it made a High-Low of 32450-32160

- BNF confirmed a FA at 32568 on 23/12 and tagged the 1 ATR target of 32208. The 2 ATR objective on the downside comes to 31848

- The Trend Day VWAP of 26/12 at 32281 will be important reference on the upside.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32161-32210-32320

Hypos / Estimates for the next session:

a) BNF needs to scale above 32180-208 & sustain for a rise to 32250-253 / 32304 & 32345-364

b) Immediate support is at 32168 below which the auction could test 32130-127 / 32088-040 & 31976-960

c) Above 32364, BNF can probe higher to 32395-410 & 32460-476*

d) Below 31960, lower levels of 31900 & 31840 could be tagged

e) If 32476 is taken out, BNF can give a fresh move up to 32518-529 / 32570 & 32640

f) Below 31840 we could see lower levels of 31780 / 31741 & 31680

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout