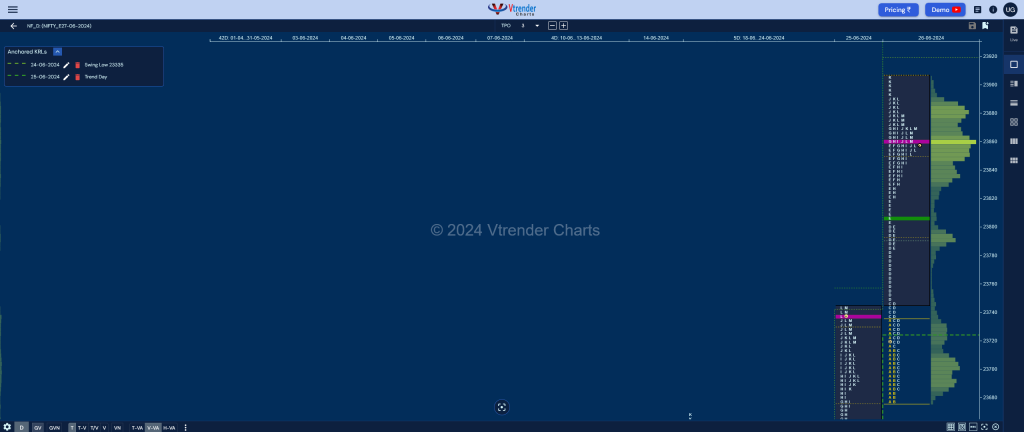

Nifty Jun F: 23868 [ 23906 / 23676 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 16,088 contracts |

| Initial Balance |

|---|

| 59 points (23735 – 23676) |

| Volumes of 49,332 contracts |

| Day Type |

|---|

| Double Distribution – 231 pts |

| Volumes of 2,28,932 contracts |

NF made a slow start on low volumes as it remained below previous day’s POC of 23737 in the first hour as it left poor lows at 23676 holding above the negated FA of 23669 indicating that the PLR (Path of Least Resistance) remained to the upside and made a big RE (Range Extension) to the upside in the D period triggering a One Time Frame probe higher till the K not only completing the 3 IB objective of 23584 but going on to make new ATH of 23906 but saw profit booking coming in with the POC shifting higher to 23860 where the auction eventually closed leaving a Double Distribution Trend Day Up making it a hat-trick so can expect to take a pause in the coming session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23860 F and VWAP of the session was at 23806

- Value zones (volume profile) are at 23746-23860-23904

- NF has confirmed a FA at 23669 on 19/06 and the 1 ATR objective on the downside comes to 23302. This FA was taken out on 25/06 and closed above hence triggering the 1 ATR target of 24038 on the upside.

- HVNs are at 21960 / 22745 / 23398** (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (14-20 Jun) – NF has formed a Normal Variation weekly profile in a narrow range of 319 points with completely higher Value at 23463-23572-23598 with the VWAP at 23525 and has couple of HVNs at 23456 & 23572 so needs a move away from one of them on initiative volumes in the coming week for a imbalance in that direction

- (07-13 Jun) – NF has formed a composite ‘p’ shape profile for the week with completely higher value at 23248-23998-23435 and has closed around the POC which will be the opening reference for the new settlement with VWAP of 23291 being an important support

- (31 May-06 Jun) – to be updated…

Monthly Zones

- The settlement day Roll Over point (June 2024) is 22645

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

Business Areas for 27th Jun 2024

| Up |

| 23880 – M TPO high 23917 – 1 ATR (VPOC 23546) 23968 – 1 ATR (VAH 23597) 24001 – 1 ATR (WFA 23335) 24047 – 1ATR (PDL 23676) 24102 – Weekly ATR |

| Down |

| 23860 – POC (26 Jun) 23806 – VWAP (26 Jun) 23760 – D TPO h/b (26 Jun) 23717 – C TPO h/b (26 Jun) 23676 – PDL 23625 – Ext Handle (25 Jun) |