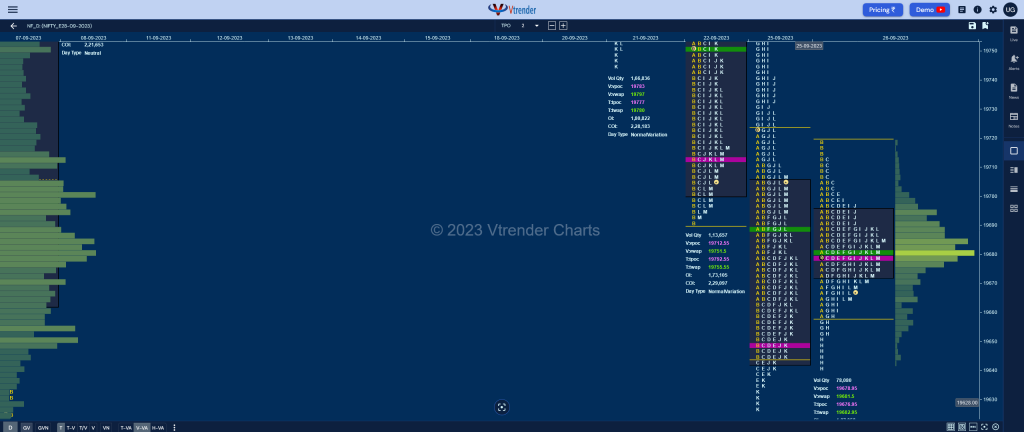

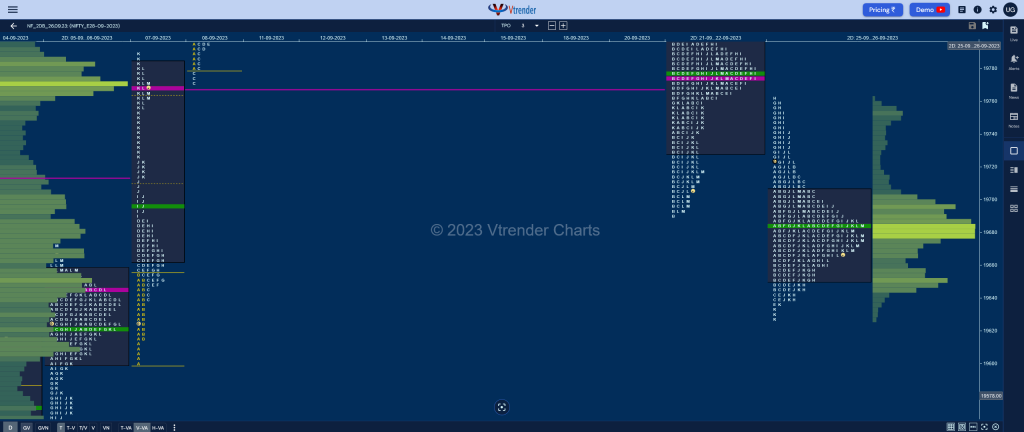

Nifty Sep F: 19677 [ 19720 / 19641 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 8,668 contracts |

| Initial Balance |

|---|

| 61 points (19720 – 19659) |

| Volumes of 16,550 contracts |

| Day Type |

|---|

| Normal (Gaussian) – 79 points |

| Volumes of 78,080 contracts |

NF made a sedate start inside previous range & value taking support just above yPOC of 19648 while making a low of 19659 in the A period after which it went on to probe higher in the B TPO after sustaining above 19690 as it hit 19720 stalling just below the Business Area of 19722 marking the end of the upmove for the day.

The auction then made a C side entry back into previous Value and completed the 80% Rule in the same with the help of 2 REs (Range Extension) in the G & H periods where it tagged the yPOC of 19648 while making a low of 19641 and left a small responsive buying tail triggering a bounce back to 19698 in the I after which it coiled for the rest of the day closing around the prominent dPOC of 19679.

We have an inside bar both in terms of Range & Value with small tails at both the ends leaving a 3-1-3 profile but even more interesting is the nice Gaussian Curve which has been forming on the 2-day composite with Value at 19652-19683-19704 and after today’s low volume grind in a range of just 79 points, NF looks ready for a move away from here in the coming session(s) and confirmation of which will come in form of initiative volumes at the open (Click here to view the composite profile only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19679 F and VWAP of the session was at 19681

- Value zones (volume profile) are at 19673-19679-19695

- HVNs are at 19612 / 19770** / 20022 / 20174 (** denotes series POC)

- NF confirmed a FA at 20234 on 18/09 and completed the 2 ATR objective of 19983 on 20/09. This FA is currently on ‘T+4’ Days

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and is no longer a valid support

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

Monthly Zones

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively

Business Areas for 27th Sep 2023

| Up |

| 19683 – 2-day POC (25-26 Sep) 19722 – IBH (25 Sep) 19765 – SOC (22 Sep) 19824 – 2-day VAH (21-22 Sep) 19869 – IB singles mid (21 Sep) 19907 – Gap singles mid (21 Sep) |

| Down |

| 19652 – 2-day VAL (25-26 Sep) 19612 – Weekly VPOC (01-07 Sep) 19561 – 2 ATR from 19825 19517 – D TPO POC (04 Sep) 19464 – Ext Handle (01 Sep) 19412 – Weekly POC |

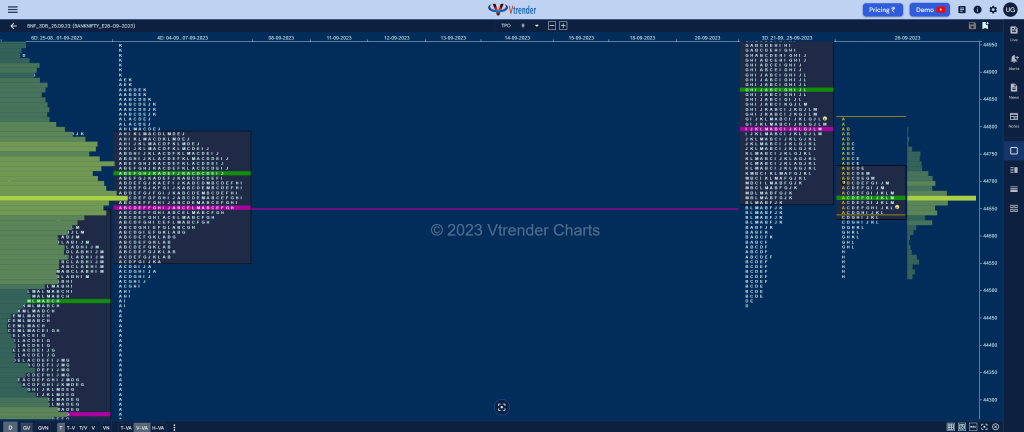

BankNifty Sep F: 44667 [ 44812 / 44523 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 9,067 contracts |

| Initial Balance |

|---|

| 249 points (44740 – 44491) |

| Volumes of 18,993 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 289 points |

| Volumes of 84,305 contracts |

BNF opened lower below this week’s IBL of 44765 and went on to test the 3-day VAL of 44662 while making a low of 44645 where it got swiftly rejected triggering a probe higher to the composite dPOC of 44801 which got tagged in the A period itself as it made a high of 44812 but was met with rejection here also seen in the tiny selling tail it confirmed from 44799 to 44812 at the close of the IB (Initial Balance).

The auction then made a slow grind lower making couple of marginal REs in the C & D TPOs at 44625 & 44614 and followed it by slightly bigger ones in the G & H where it completed the 1.5 IB objective of 44562 while making a low of 44523 but took support at previous session’s SOC of 44580 which could be seen in the small buying tail it left from 44583 to 44523.

BNF then made couple of attempts to get back above day’s VWAP but was unable to sustain forming a nice balanced profile for the day in a narrow range of 289 points closing right at the prominent dPOC of 44669 with the lowest volume of the series of just 84305 contracts and will need the volumes to come back in the coming session(s) for a fresh imbalance to begin.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44669 F and VWAP of the session was at 44667

- Value zones (volume profile) are at 44637-44669-44729

- HVNs are at 44674** / 44736 (** denotes series POC)

- BNF confirmed a FA at 44469 on 25/09 and tagged the 1 ATR objective of 44918 on the same day. The 2 ATR target comes to 45366

- BNF confirmed a FA at 44976 on 08/09 and tagged the 2 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and closed below so is now a supply point

- BNF confirmed a FA at 44760 on 06/09 and 1 ATR objective to the downside comes to 44366. This FA got negated on 07/09 and tagged the 2 ATR upside target of 45577 on 11/09

Monthly Zones

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively

Business Areas for 27th Sep 2023

| Up |

| 44729 – VAH from 26 Sep 44801 – 3-day POC (21-25 Sep) 44957 – VPOC from 25 Sep 45035 – H TPO POC (22 Sep) 45118 – Ext Handle (21 Sep) 45266 – PBH from 21 Sep |

| Down |

| 44669 – dPOC from 26 Sep 44579 – Buying tail (26 Sep) 44469 – FA from 25 Sep 44340 – Ext Handle (01 Sep) 44225 – SOC from 01 Sep 44103 – Buying Tail (01 Sep) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.