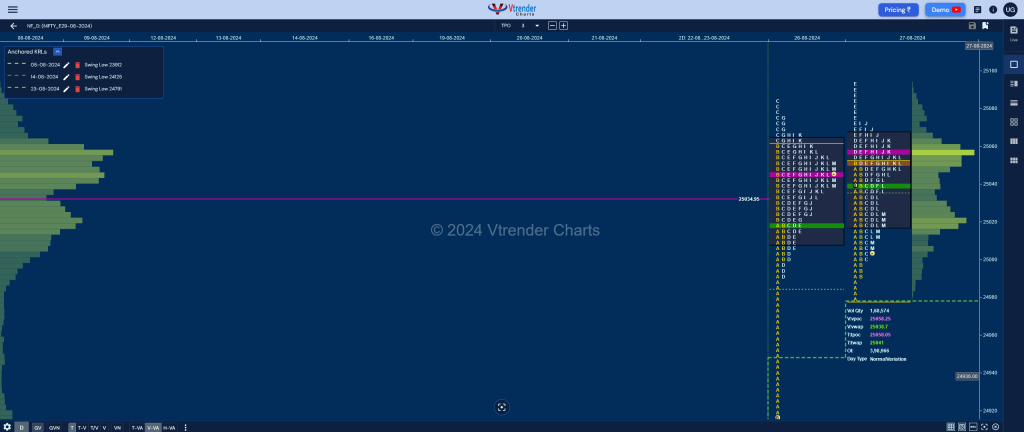

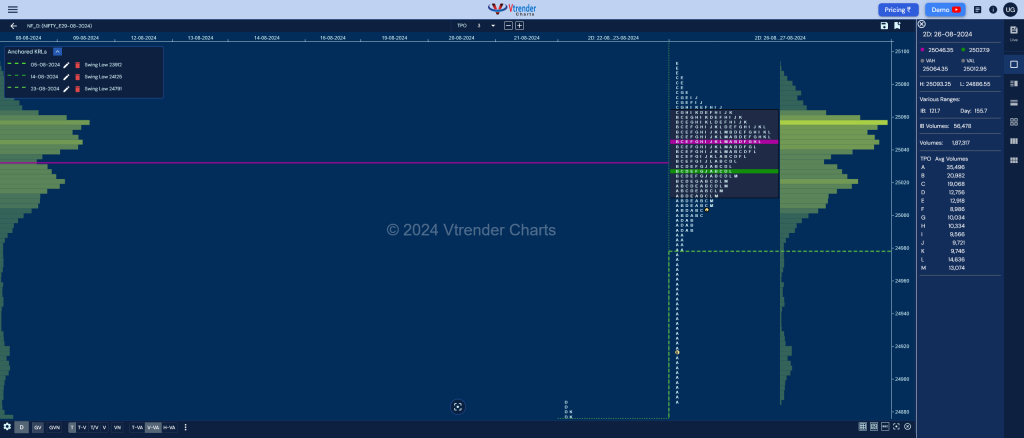

Nifty Aug F: 25017 [ 25095 / 24980 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 12,414 contracts |

| Initial Balance |

|---|

| 72 points (25052 – 24980) |

| Volumes of 42,300 contracts |

| Day Type |

|---|

| Normal Variation – 115 pts |

| Volumes of 1,68,667 contracts |

NF made a test of previous buying tail and took support at 24980 in the A period after which it went on to swipe through the value completing the 80% Rule and even went on to make new highs for the week at 25095 with the help of a RE in the E but could not sustain leaving a responsive selling tail.

The auction then went on to probe lower breaking below VWAP in the L TPO and made a low of 25001 before closing in the middle of a 3-1-3 profile for the day with overlapping value so we have a 2-day composite balance at 25013-25046-25064

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 25058 F and VWAP of the session was at 25038

- Value zones (volume profile) are at 25019-25058-25068

- HVNs are at 24271 / 24342** / 24930 / 24996 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (16-22 Aug) – NF opened the week around previous VWAP of 24317 & tested previous week’s VAL of 24237 making a low of 24233 and found OTF stepping in as it not only completed the 80% Rule to the upside and left an extension handle at 24489 leaving a NeuX Up profile of 373 points but went on to form a Triple Distribution Weekly profile for the current week recording higher highs on all days testing the weekly selling tail of 24862 to 25032 while making a high of 24873. Value was completely higher at 24550-24836-24869 with this week’s VWAP at 24603 and the other 2 HVNs being at 24710 & 24592 so as long as the auction stays below the above mentioned selling zone can fill up the zones between the HVNs in the coming week

- (09-14 Aug) – The weekly profile is a Neutral Extreme one to the downside with a selling tail at top from 24500 to 24530 and an extension handle at 24240 as it made lows of 24122 building volumes at 24175 into the close leaving overlapping to higher Value at 24237-24403-24528 and this week’s VWAP of 24317 will be an important supply point for the rest of the series.

- (02-08 Aug) – NF opened with a gap down of 200+ points on Friday well below the POC & VWAP of previous week and left an A period selling tail and formed lower value which was followed by another big gap down of 323 points on Monday where it went on to form a Trend Day Down making a low of 29312 and remained in this range for the rest of the week leaving a FA at 24398 on Wednesday and completing the 1 ATR of 24121 on Thursday where it closed with a mini spike leaving a Double Distribution (DD) Trend Down profile for the week with completely lower Value at 24075-24271-24387 and the DD zone from 24398 to 24700 which could see filling up in the coming week if the FA of 24398 gets negated with this week’s VWAP of 24296 being an important supply point in between whereas on the downside, the HVNs of 24088 & 24063 would be the immediate support levels below which the responsive buying tails of 24012 & 23950 could come into play

- (26Jul – 01Aug) – NF has formed a composite ‘p’ shape profile on the weekly timeframe representing weak Market Structure as after starting last Friday with a big Trend Day Up of 487 points it remained in a narrow range for the rest of the days indicating poor trade facilitation at these new ATH levels. Value for the week was completely higher at 24853-24996-25042 and the auction will need to show initiative buying above 25042 in the coming week to continue higher with this week’s VWAP of 24909 being the swing reference on the downside below which it could go in for a test of the Trend Day VWAP of 24748 and the Halfback of 24696 along with extension handles of 24637 & 24576

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22462 & 22479 respectively

Business Areas for 28th Aug 2024

| Up |

| 25038 – VWAP (27 Aug) 25075 – Sell tail (26 Aug) 25110 – Sell Tail (01 Aug) 25160 – 2SD band (AVWAP 23 Aug) 25227 – 1 ATR (yVWAP 25038) 25264 – 1 ATR (RS 25075) |

| Down |

| 24992 – Buy Tail (27 Aug) 24950 – A TPO VWAP (26 Aug) 24907 – A TPO POC (26 Aug) 24858 – VPOC (23 Aug) 24825 – PBL (23 Aug) 24790 – Weekly IBL |

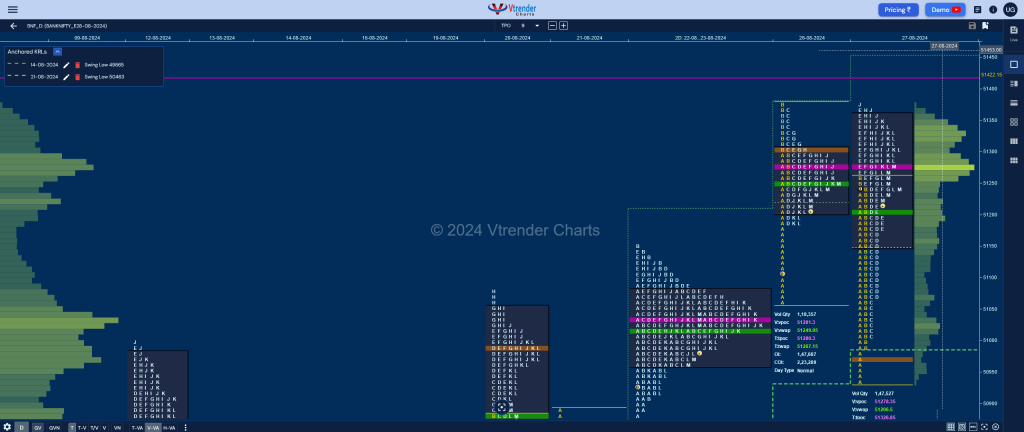

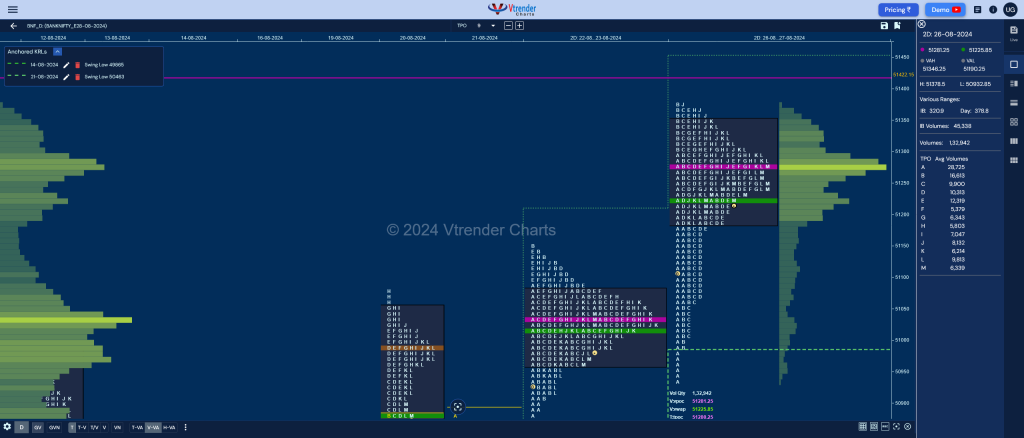

BankNifty Aug F: 51256 [ 51388 / 50931 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 15,797 contracts |

| Initial Balance |

|---|

| 332 points (51263 – 50931) |

| Volumes of 48,955 contracts |

| Day Type |

|---|

| Normal Variation – 457 pts |

| Volumes of 1,47,583 contracts |

BNF made an ORR start getting rejected from just below previous VWAP as it not only negated the buying singles but swiped through the 2-day value (22-23 Aug) making a low of 50931 in the A period but saw the dPOC shifted lower to 50970 indicating profit booking by the early sellers.

The auction then went on to get back above VWAP catching the late sellers off guard and went on to make new highs in the B TPO which was followed by couple of REs as it made a look up above PDH but could only manage to tag 51388 in the not-so-reliable J period and went on to retrace back to day’s VWAP into the close leaving an Outside Day both in terms of range and value

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 51278 F and VWAP of the session was at 51206

- Value zones (volume profile) are at 51147-51278-51360

- BNF confirmed a FA at 49960 on 16/08 and completed the 2 ATR objective of 51218 on 26/08

- HVNs are at 49954 / 50258 / 51616** / 51422 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (16-21 Aug) – BNF opened the week with a probe lower but took support just above previous week’s POC of 49954 confirming a FA at 49960 which marked the change of PLR to the upside as it not only completed the 1 ATR objective of 50591 but went on to make a look up above last week’s high while hitting 51081 but could not sustain in this supply zone giving a retracement down to 50463 into the last day of the week forming a nice balanced weekly profile with overlapping to higher Value at 50425-50630-50867 and VWAP at 50617 staying above which can expect a test of the selling tail from 51338 in the coming week

- (08-14 Aug) – BNF has formed a Neutral profile this week with completely inside Value at 49895-49954-50591 after a look up into previous week’s DD singles saw supply coming back as it made a high of 50998 and formed a HVN at 50867 from where it formed a Trend Day Down on Tuesday hitting a low of 50005 & dropped further down to 49865 at open on Wednesday breaking below the VPOC of 49923 and saw profit booking by the sellers as the POC shifted down to 49954 and can come back again on a bounce near this week’s VWAP of 50397

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 51845

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48300 & 47726 respectively

Business Areas for 28th Aug 2024

| Up |

| 51281 – 2-day POC (26-27 Aug) 51422 – VPOC (02 Aug) 51509 – VWAP (02 Aug) 51675 – J TPO POC (02 Aug) 51779 – VPOC (01 Aug) 51867 – VWAP (01 Aug) |

| Down |

| 51190 – 2-day VAL (26-27 Aug) 51048 – RB (27 Aug) 50970 – HVN (27 Aug) 50851 – Weekly IBL 50734 – L TPO VWAP (21 Aug) 50611 – VPOC (21 Aug) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.