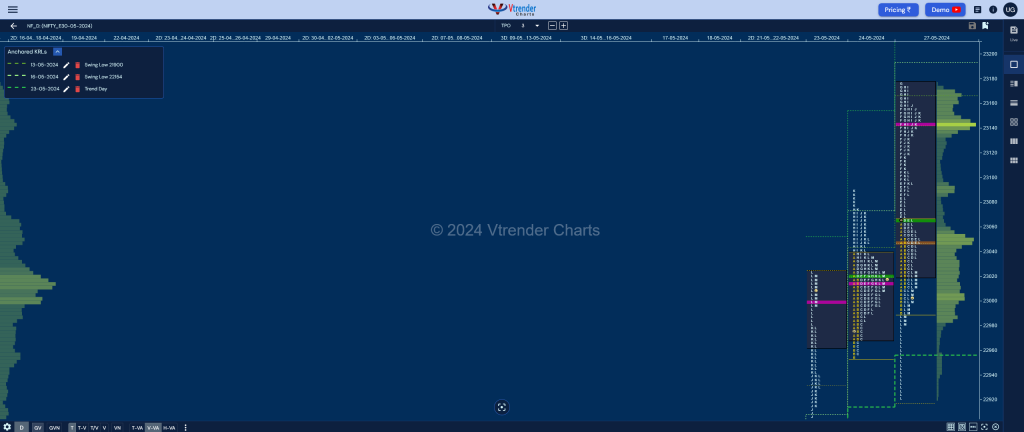

Nifty May F: 22981 [ 23177 / 22921 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 14,774 contracts |

| Initial Balance |

|---|

| 75 points (23065 – 22921) |

| Volumes of 46,774 contracts |

| Day Type |

|---|

| Neutral – 256 pts |

| Volumes of 2,31,983 contracts |

NF continued the balance mode for the first couple of hours after making an OAIR start staying in a narrow 75 point range IB (Initial Balance) before moving away with the help of 2 extension handles in the E & F TPOs as it hit the 2SD AVWAP (23 May) mark of 23154 and continued the upmove in the G period also but could only manage marginal new highs of 23177.

The auction then signalled the end of the OTF (One Time Frame) as it made lower lows in the H which was followed by a big liquidation break in the K & L periods negating the extension handles and breaking below day’s VWAP resulting in new lows of 22921 with the fall stalling just above the AVWAP (23 May) of 22916 leaving a Neutral Day which range wise is an outside bar and value overlapping to higher.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 23145 F and VWAP of the session was at 23064

- Value zones (volume profile) are at 23020-23145-23175

- NF has immediate support at AVWAP of 22956 from Trend Day from 23/05

- NF has next support at AVWAP of 22664 from Swing Low of 22154 from 16/05

- NF has swing support at AVWAP of 22524 from Swing Low of 21900 from 13/05

- NF confirmed a FA at 21900 on 13/04 and completed the 2 ATR objective of 22343 on 14/05. This FA has not been tagged hence is a postional swing support

- HVNs are at 22638 / 22778 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 28th May 2024

| Up |

| 23025 – M TPO high (27 May) 23064 – VWAP (27 May) 23096 – SOC (27 May) 23145 – POC (27 May) 23202 – Weekly 2 IB |

| Down |

| 22956 – AVWAP (23 May) 22914 – Ext Handle (23 May) 22861 – TD VWAP (23 May) 22816 – Ext Handle (23 May) 22748 – D TPO VWAP (23 May) |

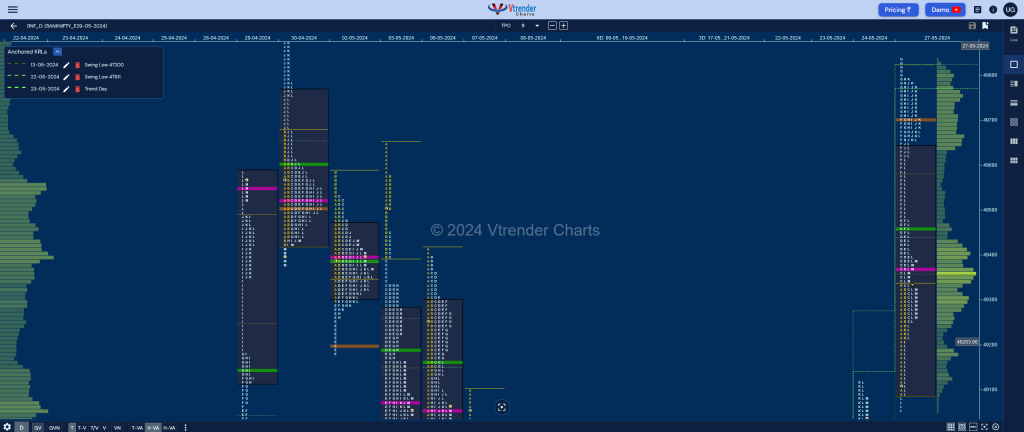

BankNifty May F: 49297 [ 49840 / 49050 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 9,520 contracts |

| Initial Balance |

|---|

| 265 points (49338 – 49073) |

| Volumes of 28,560 contracts |

| Day Type |

|---|

| Neutral – 790 pts |

| Volumes of 1,58,904 contracts |

BNF opened higher and continued the upside imbalance completing the 1 ATR objective of 49291 from the FA of 48702 leaving an A period buying tail and made big REs from the C to the G TPOs getting into beast mode and taking out the selling tail from 03rd May and looked set to hit the 2 ATR target of 49879 but stalled just below the important K TPO halfback of 49843 from 30th Apr.

The auction then got back into coil mode stopping the OTF move & building a HVN at 49700 and looked like will close as a Double Distribution (DD) Trend Day profile but saw some agressive selling coming in the L period which not only negated the DD singles of the day but went on to make new lows of 49050 before closing around the POC of 49369 leaving a Neutral Centre Day.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49369 F and VWAP of the session was at 49459

- Value zones (volume profile) are at 49090-49369-49641

- BNF has immediate support at AVWAP of 48926 from Trend Day of 23/05

- BNF has immediate support at AVWAP of 48613 from Swing Low of 47611 from 22/05

- BNF has immediate support at AVWAP of 48244 from Swing Low of 47200 from 13/05

- BNF confirmed a FA at 48702 on 24/05 and almost completed the 2 ATR objective of 49878 on 27/05.

- BNF confirmed a FA at 47200 on 13/04 and almost completed the 2 ATR objective of 48425 on 21/05. This FA has not been tagged and is now a positional Swing support .

- HVNs are at 47910 / 48637 / 49555 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 28th May 2024

| Up |

| 49323 – M TPO h/b (27 May) 49459 – VWAP (27 May) 49575 – SOC (27 May) 49700 – HVN (27 May) 49843 – K TPO h/b (30 Apr) |

| Down |

| 49260 – M TPO low (27 May) 49090 – Buy tail (27 May) 48926 – AVWAP (23 May) 48802 – Weekly IBH 48702 – FA (24 May) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.