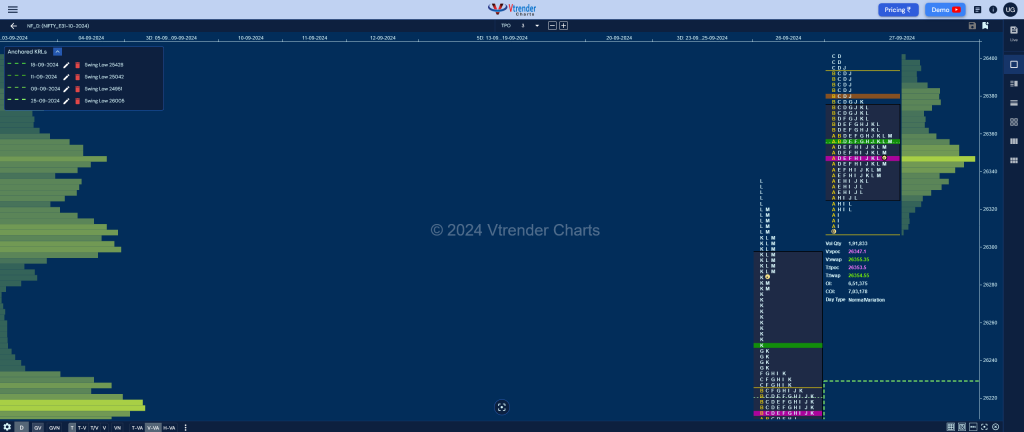

Nifty Oct F: 26345 [ 26403 / 26304 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 27,35 contracts |

| Initial Balance |

|---|

| 87 points (26391 – 26304) |

| Volumes of 59,235 contracts |

| Day Type |

|---|

| Normal – 99 pts |

| Volumes of 1,91,859 contracts |

NF continued previous session’s imbalance with a probe higher in the Initial Balance as it left an A period buying tail from 26355 to 26304 while recording new ATH of 26391 but made a typical C side extension to 26403 which marked the end of the upside for the day.

The auction then made a slow probe lower getting into the morning singles in the E, H & I TPOs but took support right at the RO (RollOver) point of 26310 triggering a bounce back above VWAP in the J TPO but could only manage to leave a PBH at 26395 before closing the day right at the prominent POC of 26347 shaping up a nice Gaussian Curve with completely higher value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 26347 F and VWAP of the session was at 26355

- Value zones (volume profile) are at 26326-26347-26375

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (20-26 Sep) – NF has formed an elongated trend up profile in a range of 764 points with 3 extension handles at 25921, 26155 & 26244 closing around the RO (RollOver) point of 26310 and has left completely higher Value at 25991-26216-26269 with the VWAP at 26091 which will be the Swing support for the new series going forward

Monthly Zones

- The settlement day Roll Over point (Oct 2024) is 26310

- The VWAP & POC of Sep 2024 Series is 25516 & 25415 respectively

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

Business Areas for 30thSep 2024

| Up |

| 26347 – POC (27 Sep) 26380 – HVN (27 Sep) 26426 – 1 ATR (AVWAP 26230) 26453 – Weekly 1.5 IB 26502 – Weekly 2 IB 26543 – 1 ATR (yPOC 26347) |

| Down |

| 26339 – M TPO low (27 Sep) 26304 – Weekly IBL 26268 – K TPO VWAP (26 Sep) 26213 – VPOC (26 Sep) 26175 – Buy Tail (26 Sep) 26135 – M TPO POC (25 Sep) |

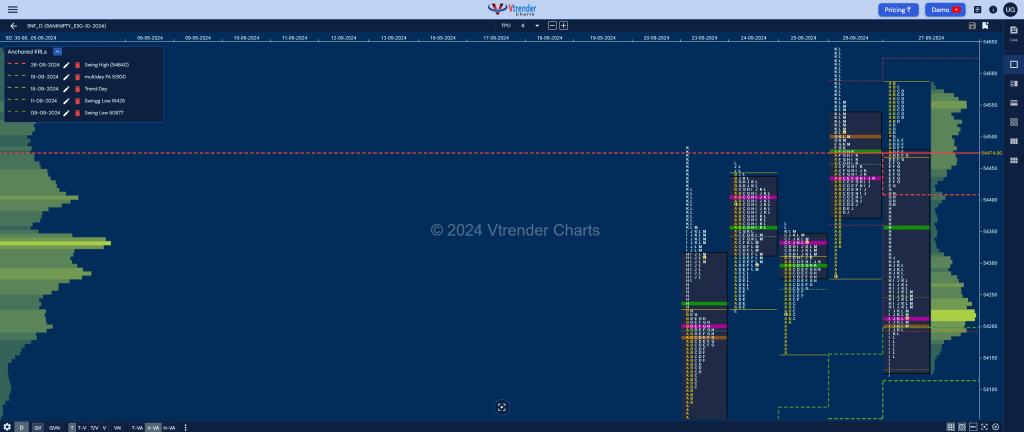

BankNifty Oct F: 54220 [ 54587 / 54125 ]

| Open Type |

|---|

| OAIR (Open Drive) |

| Volumes of 10,565 contracts |

| Initial Balance |

|---|

| 122 points (54587 – 54464) |

| Volumes of 22,176 contracts |

| Day Type |

|---|

| Double Distribution – 462 pts |

| Volumes of 1,08,857 contracts |

BNF made an OAIR start showing some demand at the lower HVN of 54500 as it left a buying tail from 54527 to 54464 in the IB (Initial Balance) but could not take out the RS (Responsive Selling) reference of 54600 on the upside leaving similar highs of 54585 & 54587 indicating lack of demand after which it formed a rare inside bar in the C period.

The auction then saw the sellers taking over from the D TPO onwards as they negated the morning singles & went on to tag yPOC of 54436 in the E before following it with an extension handle at 54420 in the G and making couple of big REs down to 54125 in the H & I periods completing the 3 IB objective of 54220 with ease but however saw the POC shifting down to 54214 as it left a small responsive tail at the lows completing a Double Distribution Trend Down profile.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 54214 F and VWAP of the session was at 54357

- Value zones (volume profile) are at 54130-54214-54476

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19 – 25 Sep) – BNF formed a DD (Double Distibution) Trend Up profile on the weekly with completely higher Value at 54291-54335-54485 with the important VWAP being at 54074 and the DD singles from 54080 to 53888 which will be the support zone to watch as the new series develops

Monthly Zones

- The settlement day Roll Over point (Oct 2024) is 54340

- The VWAP & POC of Sep 2024 Series is 52281 & 51404 respectively

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

Business Areas for 30th Sep 2024

| Up |

| 54224 – M TPO VWAP (27 Sep) 54320 – H TPO h/b (27 Sep) 54420 – Ext Handle (27 Sep) 54527 – SOC (27 Sep) 54682 – 1 ATR (yPOC 54214) 54825 – 1 ATR (yVWAP 54357) |

| Down |

| 54202 – AVWAP (19 Sep) 54074 – Weekly VWAP (19-25 Sep) 53990 – IB tail mid (23 Sep) 53844 – VPOC (20 Sep) 53761 – VWAP (20 Sep) 53628 – 20 Sep Halfback |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.