Nifty Sep F: 19719 [ 19743 / 19543 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 8,939 contracts |

| Initial Balance |

|---|

| 99 points (19642 – 19543) |

| Volumes of 26,168 contracts |

| Day Type |

|---|

| DD (Double Distribution) – 200 points |

| Volumes of 1,16,186 contracts |

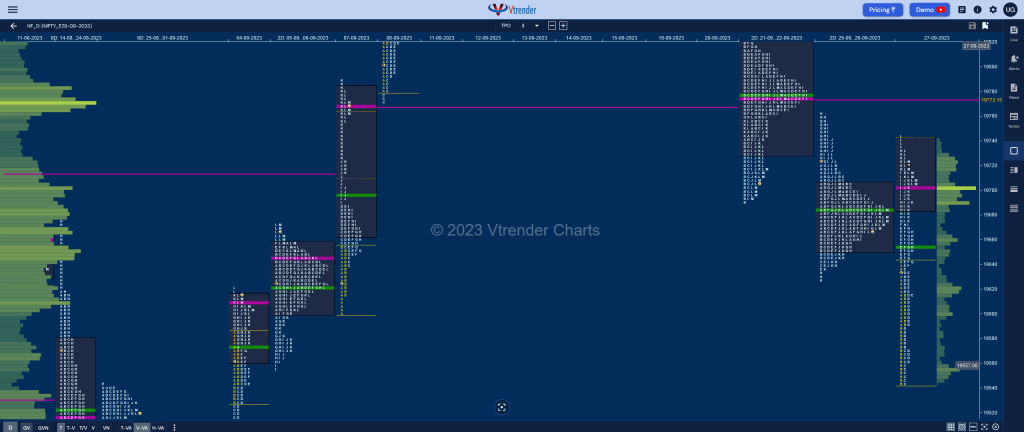

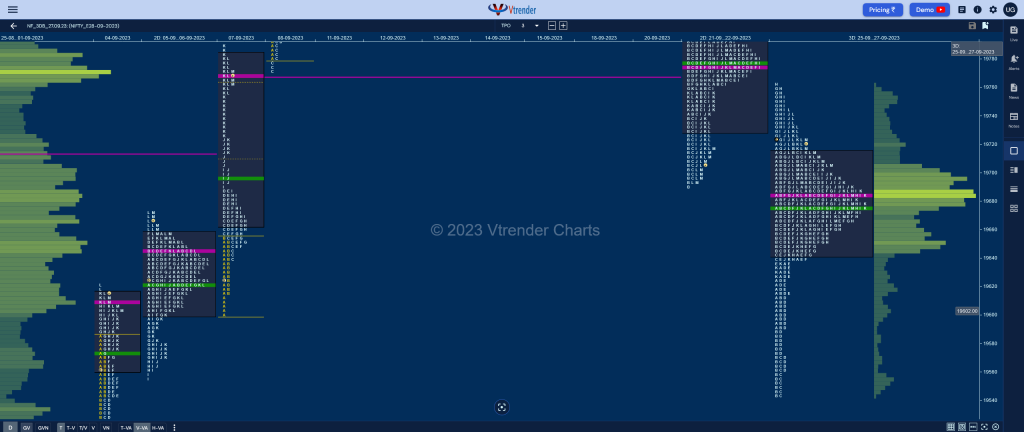

NF opened lower and stayed below PDL hinting at a move away from balance as it made a low of 19592 in the A period and went on to double the range in the B where it left a selling extension handle and made new lows of 19543 hitting the 04th Sep’s SOC of 19544 and forming a relatively large IB range of 99 points.

The C side then made an inside bar forming poor lows signalling exhaustion to the downside and more confirmation came in the form of the dPOC shifting down to 19555 after which the auction not only got above VWAP in the D TPO but negated the extension handle of 19592 indicating that the PLR (Path of Least Resistance) had changed to the upside.

The 80% Rule got triggered in the E period as NF got into the Value of the 2-day Gaussian Curve and followed it up with multiple REs (Range Extension) tagging the VAH of 19704 in the I TPO and even got above important level of 19722 in the K & L periods where it made a high of 19743 completing the 2 IB objective of the day but left a small selling tail at top showing that supply was coming back in this zone resulting in profit booking by the buyers which caused the dPOC to shift higher to 19701

The daily profile is an elongated Double Distribution type with couple of SOCs at 19570 & 19642 and the move back into previous Value means that we now have a 3-day composite with an ultra prominent POC at 19683 & the updated Value at 19643-19683-19715 which will be the immediate zone to watch on the downside as we have closed just above it whereas on the upside, NF will need to negate the selling zone from 19740 to 19760 for a move back to the earlier 2-day VAH of 19824 in the next session. (Click here to view the composite profile only on Vtrender Charts)

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19701 F and VWAP of the session was at 19654

- Value zones (volume profile) are at 19683-19701-19741

- HVNs are at 19612 / 19770** / 20022 / 20174 (** denotes series POC)

- NF confirmed a FA at 20234 on 18/09 and completed the 2 ATR objective of 19983 on 20/09. This FA is currently on ‘T+4’ Days

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and is no longer a valid support

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

Monthly Zones

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively

Business Areas for 28th Sep 2023

| Up |

| 19725 – L TPO VWAP (27 Sep) 19765 – SOC (22 Sep) 19800 – 2 ATR from PDL (19743) 19824 – 2-day VAH (21-22 Sep) 19869 – IB singles mid (21 Sep) 19907 – Gap singles mid (21 Sep) |

| Down |

| 19715 – 3-day VAH (25-27 Sep) 19683 – 3-day POC (25-27 Sep) 19643 – 3-day VAL (25-27 Sep) 19611 – LVN (27 Sep) 19570 – SOC from 27 Sep 19543 – PDL |

BankNifty Sep F: 44605 [ 44730 / 44149 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 10,986 contracts |

| Initial Balance |

|---|

| 395 points (44576 – 44182) |

| Volumes of 37,445 contracts |

| Day Type |

|---|

| Neutral Extreme (NeuX) – 581 points |

| Volumes of 1,44,352 contracts |

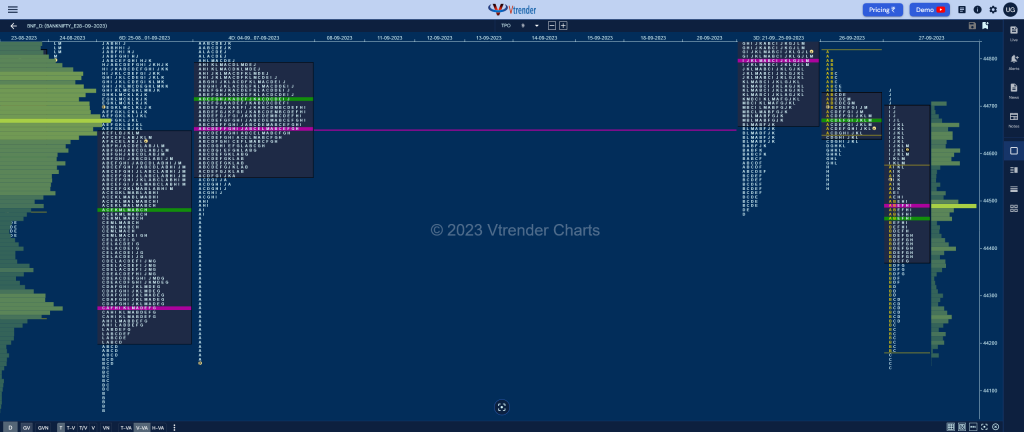

BNF opened lower negating previous session’s buying tail and even went on to re-visit 25th Sep’s FA of 44469 while making a low of 44460 in the A period and saw fresh aggressive selling coming in at the start of B in form of an extension handle causing a drop of 280 points as it negated 01st Sep’s buying handle of 44340 & broke below the SOC of 44225 while making a low of 44182 forming a large 395 point range IB (Initial Balance).

The auction then made a typical C side extension to 44149 which was swiftly rejected giving the expected bounce back to day’s VWAP but what came as a surprise was the D TPO leaving a SOC at 44289 to climb into the B period singles which was followed by the negation of the morning extension handle of 44460 in the E signalling change of character.

BNF remained above day’s VWAP thereafter and even made a big RE to the upside in the I period confirming a FA (Failed Auction) at lows and completed the 80% Rule in previous Value to the dot tagging 44730 in the J TPO but could not sustain triggering the reverse 80% Rule which it completed in the same TPO and went on to leave a PBL at 44525 in the K before closing the day just above IBH.

We have a Neutral Extreme profile though not an ideal one as it has left similar mini tails at both the ends with couple of SOCs at 44289 & 44515 which will be the levels to watch on the downside along with today’s VWAP of 44465 which was defended all day post the C period whereas on the upside, the auction would need buyers to show up above the L & J TPO RS (Responsive Selling) levels of 44624 & 44705 respectively for a probe higher to the 3-day composite POC of 44801 and 25th Sep’s VPOC of 44957 in the coming session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44489 F and VWAP of the session was at 44465

- Value zones (volume profile) are at 44373-44489-44699

- HVNs are at 44656** / 44736 (** denotes series POC)

- BNF confirmed a FA at 44149 on 27/09 and tagged the 1 ATR objective of 44586 on the same day. The 2 ATR target comes to 45022

- BNF confirmed a FA at 44469 on 25/09 and tagged the 1 ATR objective of 44918 on the same day. This FA got re-visited on 27/09 and is no longer a valid support.

- BNF confirmed a FA at 44976 on 08/09 and tagged the 2 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and closed below so is now a supply point

Monthly Zones

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively

Business Areas for 28th Sep 2023

| Up |

| 44624 – L TPO VWAP (27 Sep) 44705 – J TPO POC (27 Sep) 44801 – 3-day POC (21-25 Sep) 44957 – VPOC from 25 Sep 45035 – H TPO POC (22 Sep) 45118 – Ext Handle (21 Sep) |

| Down |

| 44576 – IBH from 27 Sep 44465 – NeuX VWAP (27 Sep) 44370 – LVN from 27 Sep 44289 – SOC from 27 Sep 44149 – FA from 27 Sep 44061 – Swing Low (01 Sep) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.