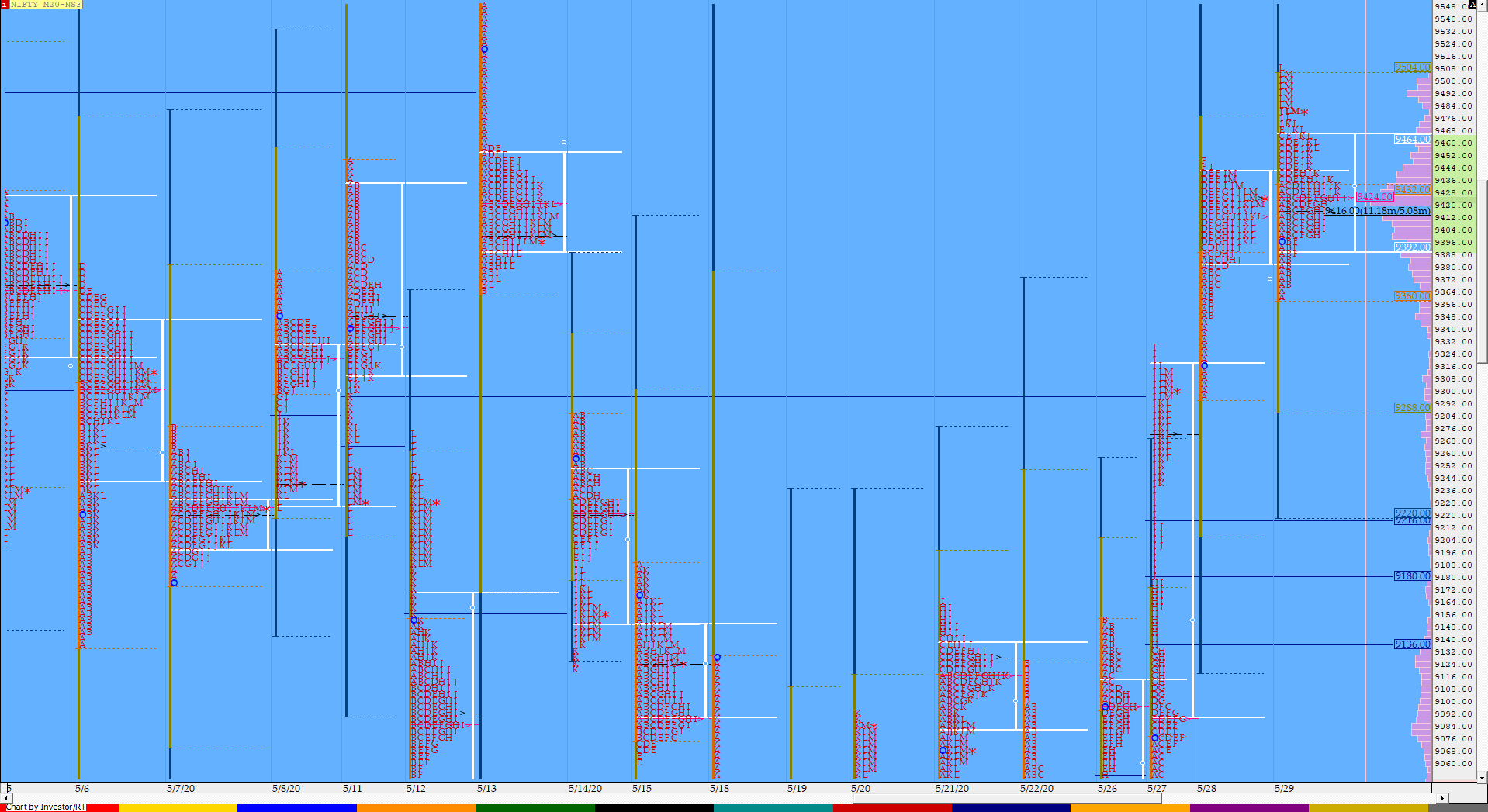

Nifty Jun F: 9494 [ 9509 / 9361 ]

HVNs – 9093 / 9275 / 9433

NF started the day continuing to form a balance in previous day’s Value before giving multiple REs (Range Extension) higher to complete the 2 IB objective as it made highs of 9509 before closing the day at 9494. Value for the day was overlapping to higher & the 2-day composite is giving a nice Gaussian profile suggesting a move away from here could happen in the coming session(s).

Click here to view the 2-day balance in NF on MPLite

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 9420 F

- Vwap of the session was at 9432 with volumes of 173.2 L and range of 148 points as it made a High-Low of 9509-9361

- The Trend Day VWAP of 9165 would be important support level.

- The settlement day Roll Over point (Jun) is 9426

- The VWAP & POC of May Series is 9183 & 9109 respectively.

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9388-9420-9462

Main Hypos for the next session:

a) NF needs to sustain above 9500-10 for a rise to 9530-59 / 9574-94 / 9616-25 / 9653-70 & 9690-94

b) The auction has immediate support at 9480 below which it could test 9462-55 / 9441 / 9400-9378 / 9361-36 & 9310-9292

Extended Hypos:

c) Above 9694, NF can probe higher to 9721-50 / 9772-78 / 9796-9800 / 9822 & 9840-48

d) Below 9292, the auction can fall further to 9275 / 9248-42 / 9216-04 / 9177-65 & 9135

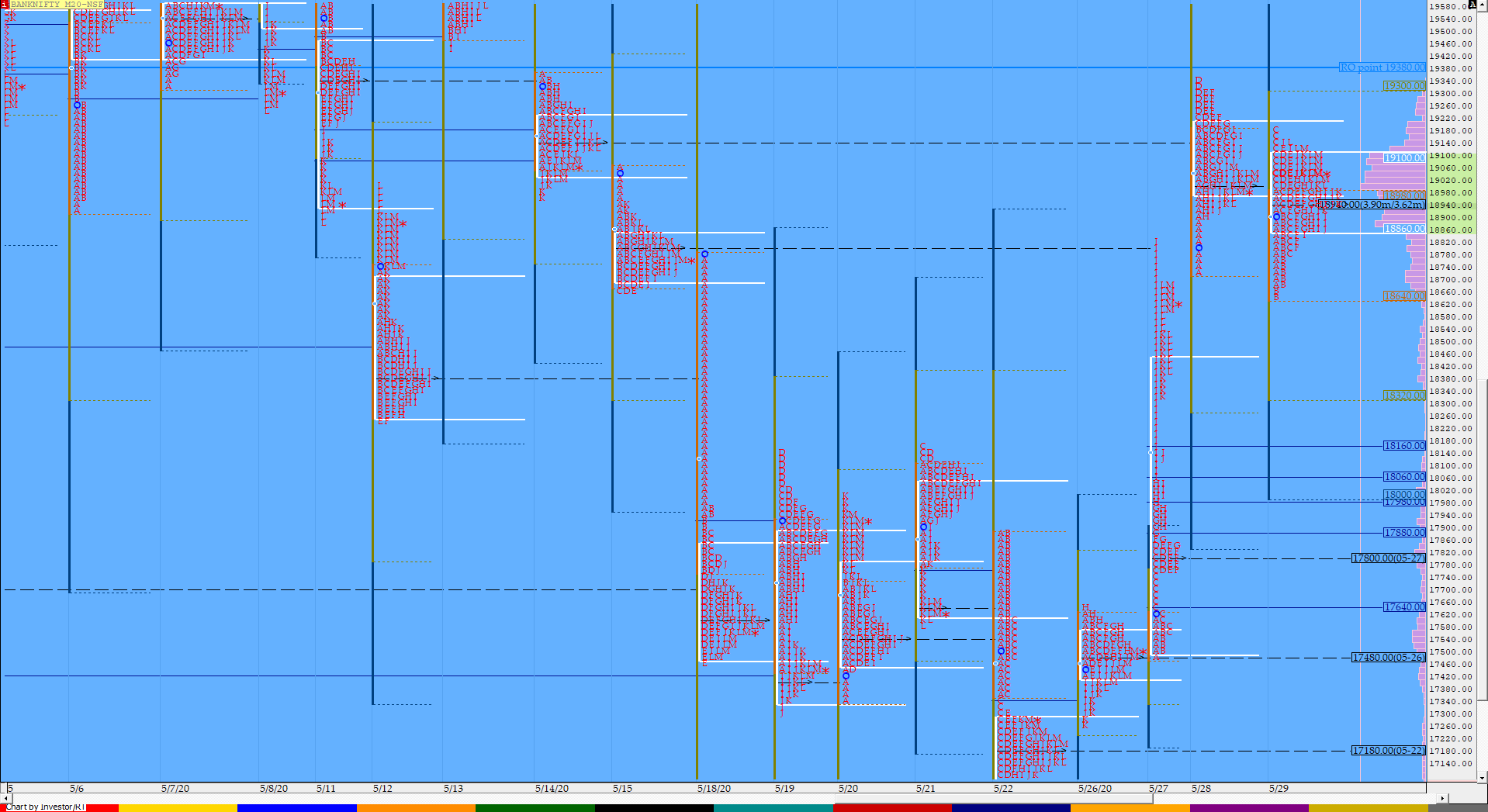

BankNifty Jun F: 19099 [ 19349 / 18721 ]

HVNs – 17800 / 19000 / 19186

BNF opened lower in the tail of previous day’s p’ shape profile & broke below PDL to make lows of 18655 before it reversed the probe to the upside where it got resisted at the HVN of 19186 in a ‘C’ side extension which turned out to be the day’s high as well as the auction formed a balance for the rest of the day forming a nice balanced profile with overlapping to lower Value and similar to NF, BNF also formed a nice Gaussian profile on the 2-day composite.

Click here to view the 2-day balance in BNF on MPLite

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 18943 F

- Vwap of the session was at 18946 with volumes of 81.5 L and range of 527 points as it made a High-Low of 19183-18655

- The Trend Day VWAP of 18138 would be important support level.

- The settlement day Roll Over point (Jun) is 19035

- The VWAP & POC of May Series is 18767 & 19633 respectively.

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 18835-18943-19089

Main Hypos for the next session:

a) BNF has immediate supply at 19134 above which it could rise to 19186 / 19260-330 / 19450-480 / 18560-650* / 19750 & 19812-840

b) The auction staying below 19090 could test 19015-18980 / 18935-870 / 18812-780 / 18720 / 18684-625 / 18535-450 & 18330

Extended Hypos:

c) Above 19840, BNF can probe higher to 19940-995 / 20103-140 / 20220 / 20324-396 / 20430 & 20535

d) Below 18330, lower levels of 18250 / 18198-138 / 18072-18 / 17960 / 17865-856 17800*-760 & 17648-632 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout