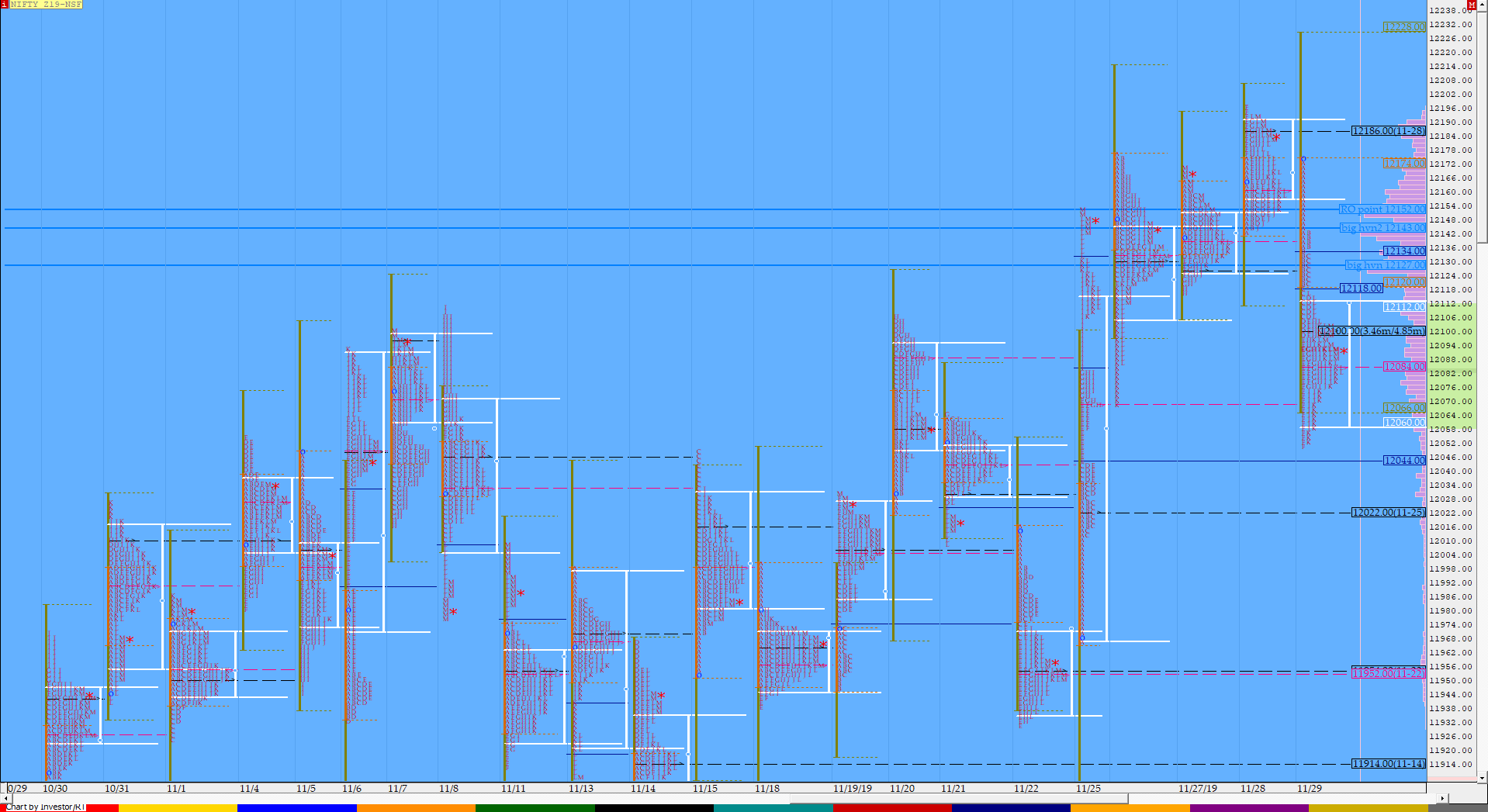

Nifty Dec F: 12100 [ 12175/ 12051 ]

HVNs – 11914 / 11954 / 12022 / 12100 / 12128-143 / 12192

NF made an OH (Open=High) start at 12175 making a slow drive down on low volumes as it moved away from the POC of the 4-day composite ‘p’ profile leaving a selling tail from 12142 to 12186 in the IB and after which it made multiple REs (Range Extension) lower and went on to break below the high volume zone of 12128-12143 and continued the OTF (One Time Frame) move lower till the ‘F’ period where it even broke below the Trend Day VWAP of 12088 and completed the 2 IB move down of 12068 while making lows of 12051 where it was met with rejection leaving a small buying tail from 12051 to 12076. The auction then probed higher over the next 2 periods but could not tag the VWAP which meant that the sellers were still in control as NF left an early PBH (Pull Back High) at 12104 and resumed the morning OTF down making lower lows till the ‘K’ period and it seemed there could be a fresh RE lower but NF ended up leaving poor lows indicating that the move down is exhausted. The auction then gave another retracement to VWAP and this time scaled above it trapping some late sellers as it left a new PBH at 12117 before settling down to close at the dPOC of 12100 leaving a ‘b’ shape profile with Value for the day being completely lower.

(Click here to view the NF move lower from the 4-day composite ‘p’)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 12100 F

- Vwap of the session was at 12094 with volumes of 88 L and range of 124 points as it made a High-Low of 12175-12051

- The Trend Day VWAP of 25/11 at 12088 will be important reference on the downside. This was tagged on 26/11 and once again and broken briefly on 29/11 but closed above it..

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12062-12100-12114

Hypos / Estimates for the next session:

a) NF needs to sustain above 12100 for a move to 12120 / 12136-142 & 12166-171

b) Immediate support is at 12080-75 below which the auction could test 12054 / 12040-22* & 12000

c) Above 12171, NF can probe higher to 12192 / 12206-215 & 12245

d) Below 12000, auction becomes weak for 11970 / 11955 & 11930

e) If 12245 is taken out, the auction go up to to 12281 / 12310 & 12340

f) Break of 11930 can trigger a move lower to 11914*-901 / 11885 & 11860-852

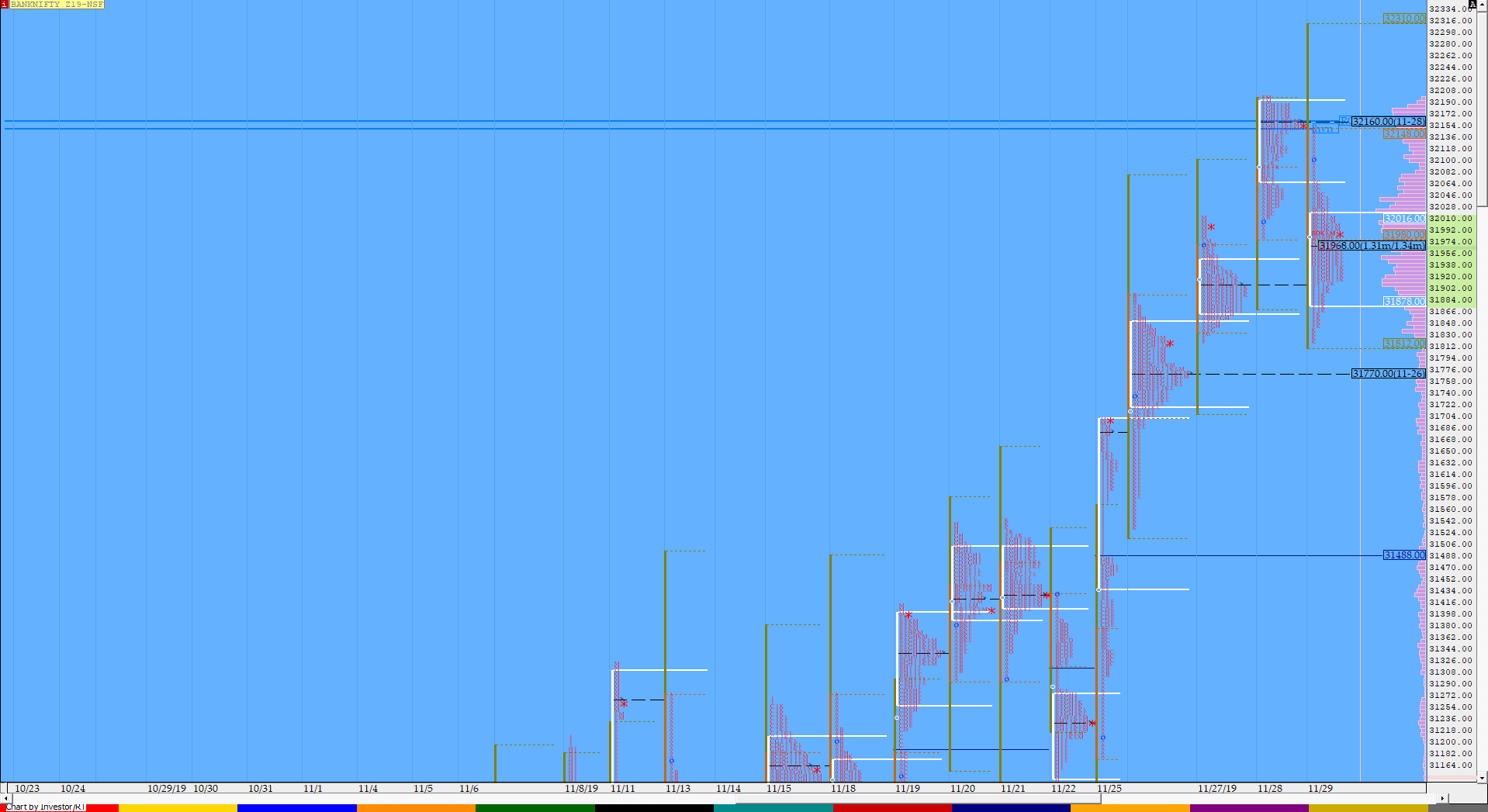

BankNifty Dec F: 32170 [ 32200 / 31981 ]

HVNs – 31426 / 31470 / (31628) / 31680 / 31770 / 31910] / 32000 / [32150-160]

BNF stayed below the HVZ (High Volume Zone) of 32150-160 to probe lower & took support exactly at the FA point of 31820 forming a balanced profile with a tail at top from 32068 to 32170 and HVNs at 32000 & 31965. Value for the day was lower so the auction remains weak if gets accepted below 31965 in the coming session.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 32000 F

- Vwap of the session was at 31963 with volumes of 27.9 L and range of 328 points as it made a High-Low of 32148-31820

- BNF confirmed a FA at 31820 on 27/11 and the 1 ATR target comes to 32218 This FA was tagged on 29/11 but was not broken.

- The Trend Day VWAP of 25/11 at 31532 will be important reference on the downside.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- BNF had confirmed a FA at 30175 on 06/11 and tagged the 2 ATR target of 31172. This FA has not been tagged since & hence is now positional support

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31912-32000-32045

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32025 for a rise to 32075 / 32120 & 32170-185

b) Immediate support is at 31965 below which the auction could test 31910-890 / 31850-845 & 31770*-758

c) Above 32185, BNF can probe higher to 32218 / 32260 & 32326

d) Below 31758, lower levels of 31700 / 31645 & 31585 could be tagged

e) If 32326 is taken out, BNF can give a fresh move up to 32395-400 / 32465 & 32503

f) Below 31585, we could see lower levels of 31532* / 31485 & 31426

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout