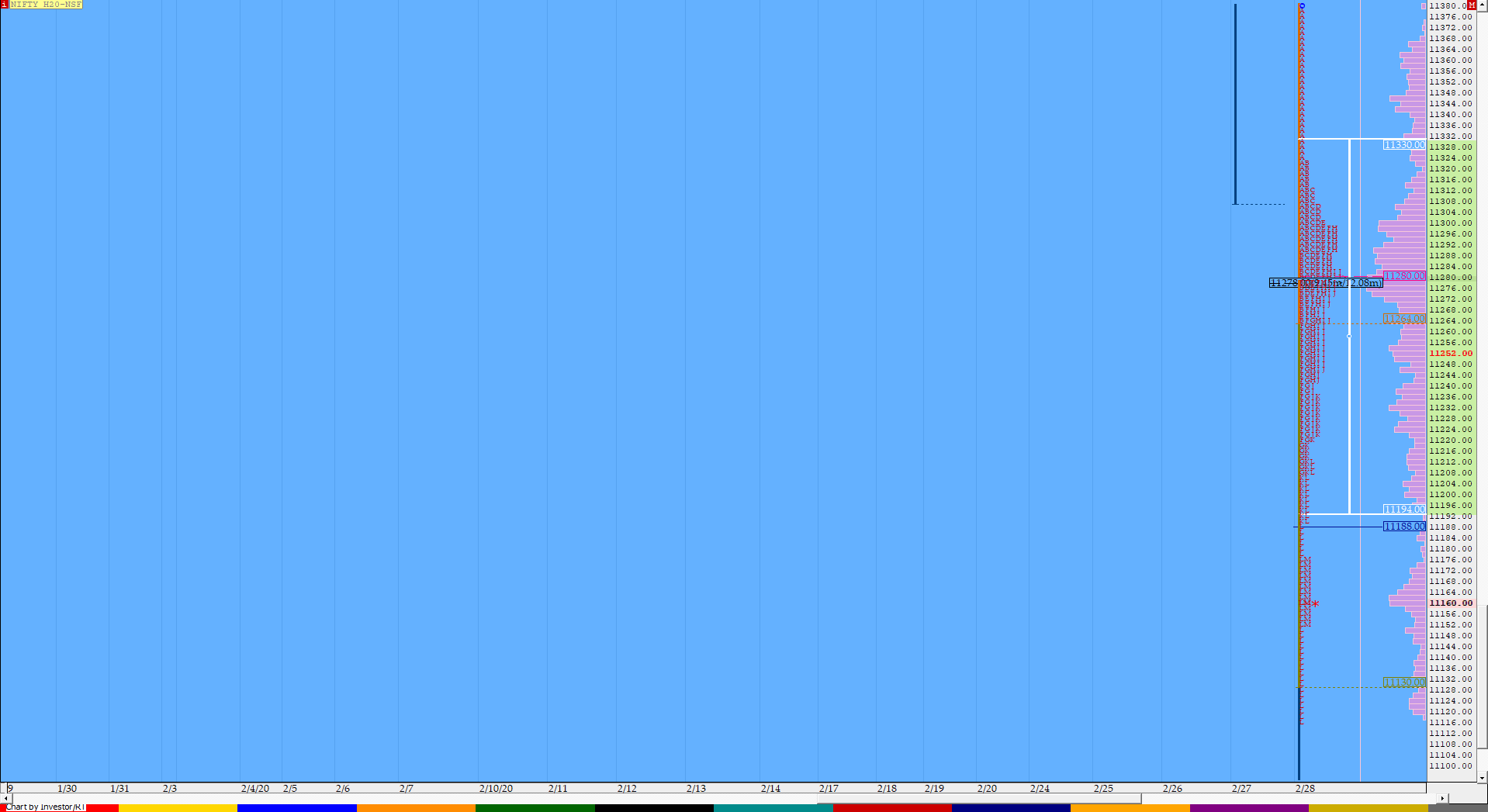

Nifty Mar F: 11145 [ 11418 / 11024 ]

HVNs – 11290 / (11330-340) / 11580 / 11631 / 11734 / 11850 / 11945

Report to be updated…

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Extreme – Down (NeuX)

- Largest volume was traded at 11330 F

- Vwap of the session was at 11287 with volumes of 208.2 L and range of 394 points as it made a High-Low of 11418-11024

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11270-11330-11398

Main Hypos for the next session:

a) NF needs to stay above 11175 for a rise to 11195-200 / 11230-258 / 11275-295 & 11330-343

b) The auction has immediate support at 11124 below which it could fall to 11100-090 / 11055-031 / 10985-974 & 10938

Extended Hypos:

c) Above 11343, NF can probe higher to 11370 / 11396-404 & 11424-442

d) Below 10938, the auction can move lower to 10921 / 10880 & 10857-840

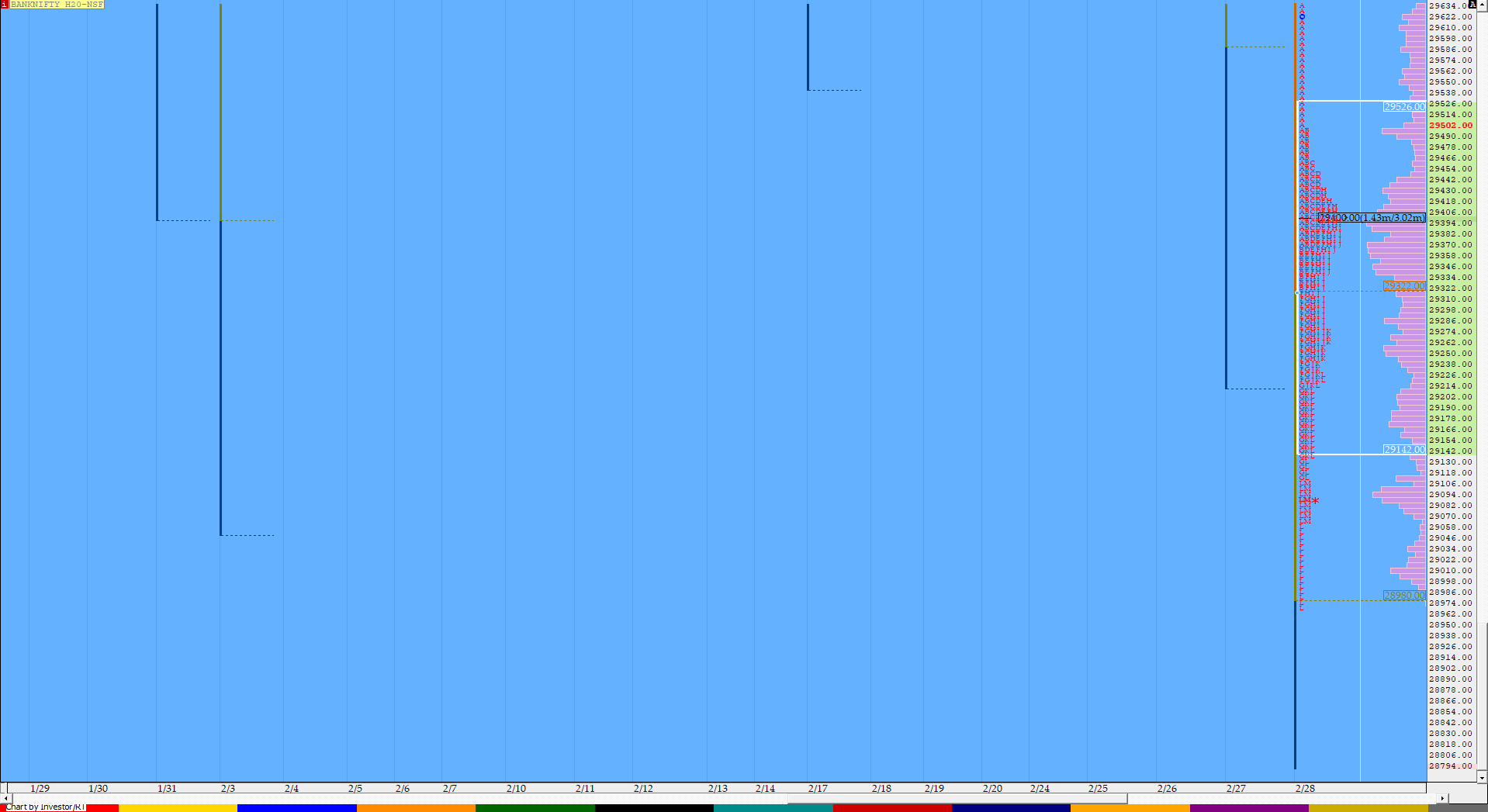

BankNifty Mar F: 28885 [ 29632 / 28600 ]

HVNs – (29100) / 29270 / 29350 / 29415-455 / 29550 / 30085 / 30260 / 30385 / 30560 / 30640

Report to be updated…

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Extreme – Down (NeuX)

- Largest volume was traded at 29435 F

- Vwap of the session was at 29407 with volumes of 49.2 L and range of 1032 points as it made a High-Low of 29632-28600 (if we ignore the freak tick of 29648 in the opening minute)

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 29365-29435-29597

Main Hypos for the next session:

a) BNF needs to sustain above 28920 for rise to 28990/ 29050-088 / 29175 / 29240-270 & 29340-365

b) The auction gets weak below 28880 and could fall to 28830-770 / 28696-648 / 28600-580 / 28537-500 & 28430-410

Extended Hypos:

c) Above 29365, BNF can probe higher to 29425-435 / 29500 / 29552-596 / 29632-680 & 29700-815/span>

d) Below 28410, lower levels of 28340-330 / 28284-250 / 28181-150 / 28083-025 & 27970 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout