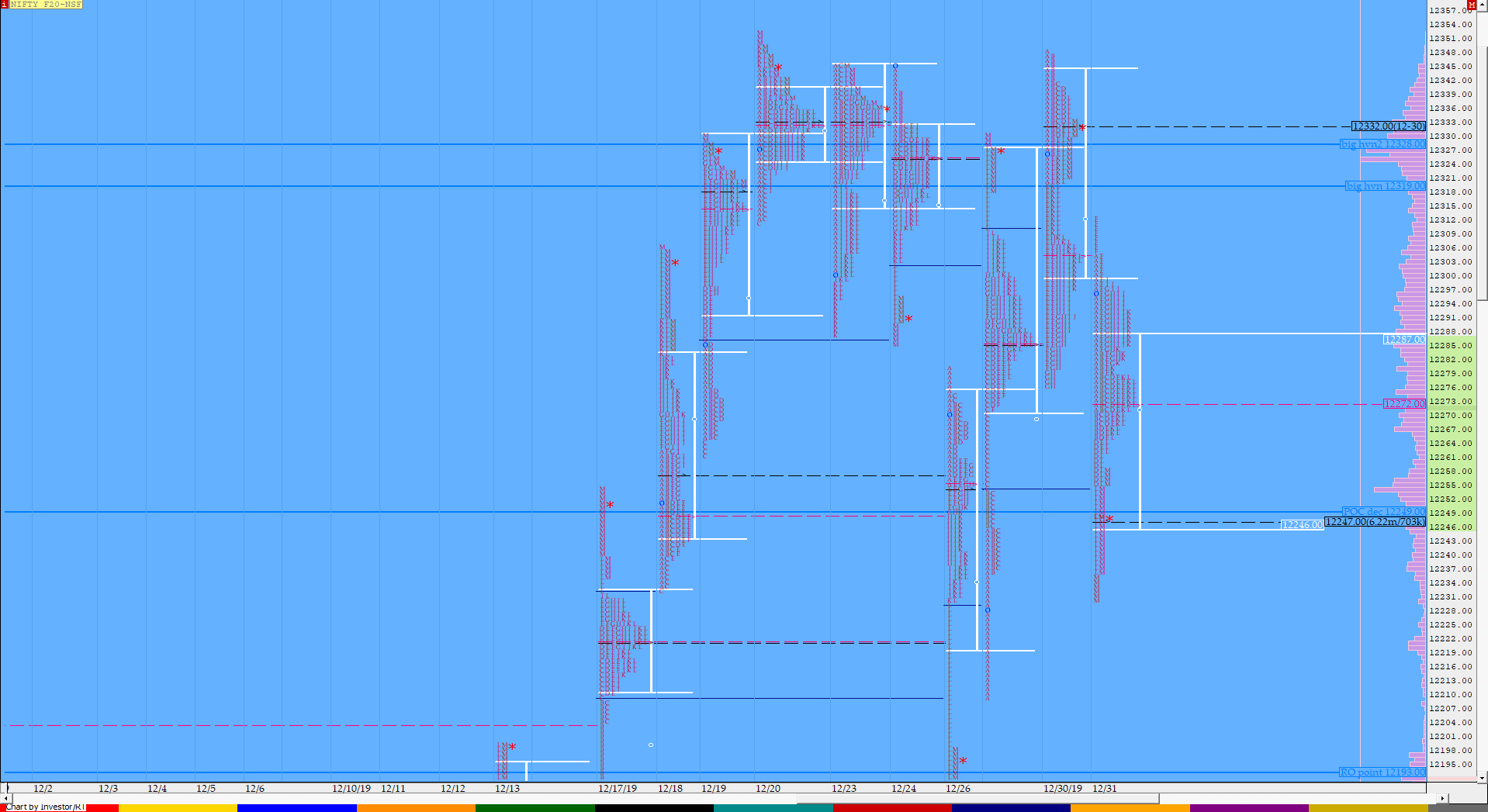

Nifty Jan F: 12246 [ 12313/ 12230 ]

HVNs – 12130 / 12160 / 12193 / 12247 / 12274 / 12330

NF opened with a gap down right at the HVN of the lower distribution of the previous day which was at 12994 and probed lower in the Initial Balance (IB) breaking below previous day’s poor lows of 12276 and went on to make a Range Extension (RE) to the downside in the ‘D’ period as it tagged 12255 stalling just above the extension handle of 12253 it had left on 27th Dec. The auction then got back to VWAP in the ‘E’ period & then gave a short squeeze move in the ‘F’ period as it went on to make a RE to the upside tagging new day highs of 12313 and in the process confirmed a Failed Auction (FA) at 12255. However, NF could not sustain above the previous day’s VWAP of 12311 which indicated that the initiative sellers of morning were still in control as they pushed the auction back into the IB as it went on to take support at the VWAP till the ‘J’ period forming a nice balanced profile for the day with rejections at both the ends. The ‘K’ period however broke below VWAP & this triggered a long liquidation move into the close as the auction went on to make new lows for the day in the ‘L’ period which saw it negating the morning FA of 12255 and confirming a new FA at highs of 12313 and it went on to tag the 1 ATR move down of 12230 in the ‘M’ period before closing at the HVN of 12246 leaving a Neutral Extreme profile. The reference for the first open of 2020 would be 12265 to 12230 above which 12274-278 will be an important zone in the coming sessions.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 12272 F

- Vwap of the session was at 12278 with volumes of 71.9 L and range of 82 points as it made a High-Low of 12313-12230

- NF confirmed a FA at 12313 on 31/12 and tagged the 1 ATR target of 12230. The 2 ATR target from this FA comes to 12147

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12246-12272-12287

Hypos / Estimates for the next session:

a) NF needs to sustain above 12255 for a move to 12273-278 / 12298 & 12313

b) Immediate support is at 12235 below which the auction could test 12220-204 / 12190 & 12173-162

c) Above 12313, NF can probe higher to 12332 / 12348-352 & 12368

d) Below 12162, auction could probe lower to 12147-144 / 12126-122 & 12101

e) If 12368 is taken out, the auction go up to to 12384-391 / 12414-420 & 12437

f) Break of 12101 can trigger a move lower to 12078-67 & 12042-31

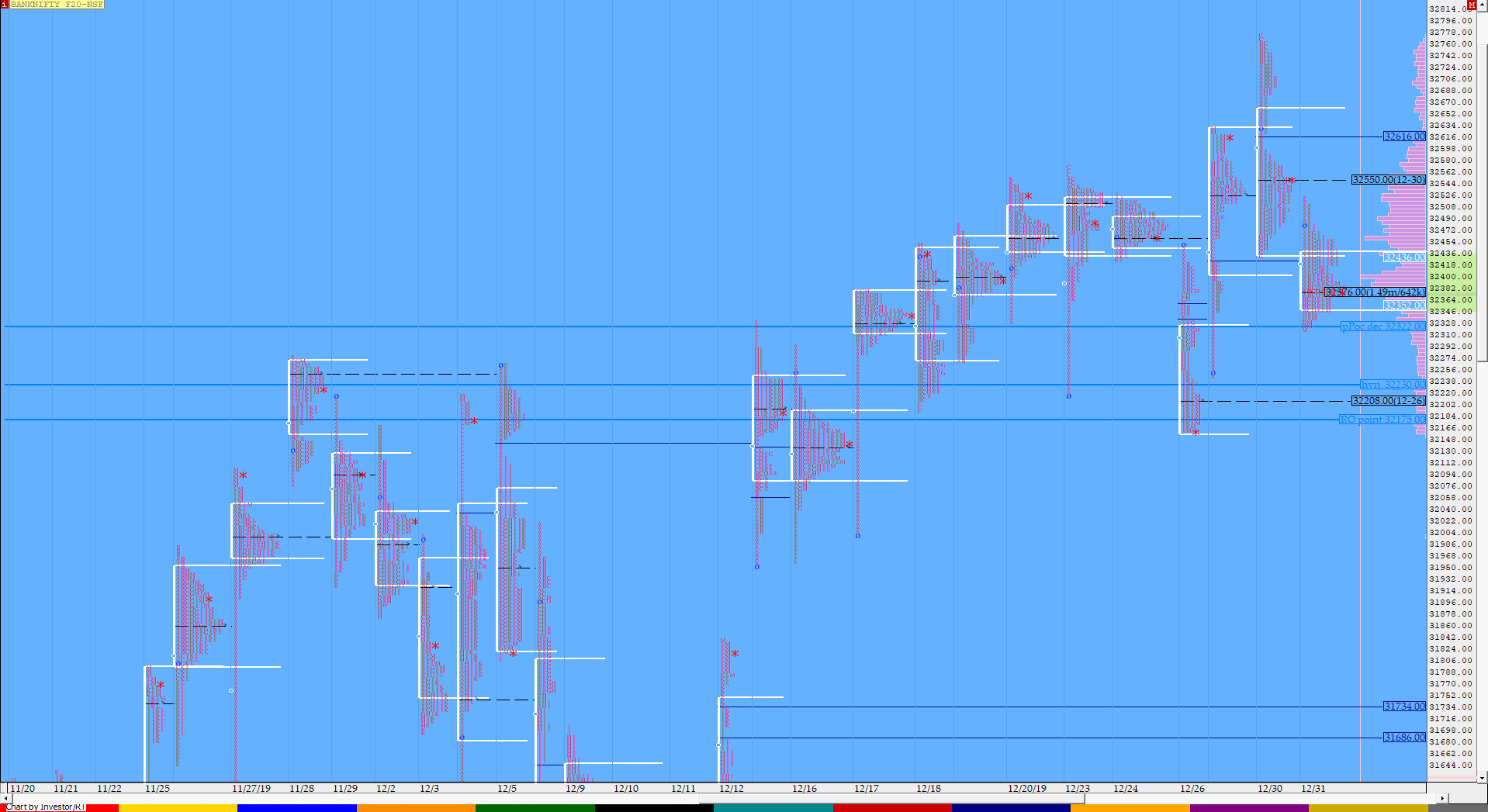

BankNifty Jan F: 32366 [ 32522 / 32320 ]

HVNs – 332125 / 32210 / 32380 / 32550

BNF also opened lower as it moved away from the prominent POC of the 2-day composite which was at 32550 at open making lows of 32350 in the IB. The auction then made a RE to the downside in the ‘D’ period as it got into the buying tail of 27th Dec (32348 to 32186) but was immediately rejected which triggered a good short covering move as BNF went on to make new highs for the day at 32522 in the ‘F’ period confirming a FA at 32326 but stalled just below that POC of 32550 and was pushed back into the IB indicating that the supply was coming back in this zone. Similar to NF, the auction then stayed above VWAP till the ‘J’ period but left a pull back high at 32480 in the ‘I’ period and once it broke below VWAP in the ‘K’ period BNF made new lows for the day at 32320 thereby negating the morning FA andconfirming a new FA at day highs as it closed around the dPOC of 32380 leaving a second successive Neutral Day of the week with a very narrow range of just 202 points.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 32380 F

- Vwap of the session was at 32410 with volumes of 23.3 L and range of 202 points as it made a High-Low of 32522-32320

- BNF confirmed a FA at 32774 on 30/12 and tagged the 1 ATR target of 32458. The 2 ATR target from this FA comes to 32142

- BNF confirmed a FA at 32522 on 31/12 . The 1 ATR target from this FA comes to 32223

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32351-32380-32436

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32380 for a rise to 32420-430 / 32480 & 32522-550*

b) Immediate support is at 32340 below which the auction could test 32280-260 / 32223-208* & 32168

c) Above 32550, BNF can probe higher to 32622-634 / 32712 & 32755

d) Below 32168, lower levels of 32130-088 / 32028 & 31976 could be tagged

e) If 32755 is taken out, BNF can give a fresh move up to 32821 / 32885 & 32930-945

f) Break of 31976 could trigger a move down to 31925-900 / 31840 & 31780

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout