Nifty Feb F: 11994 [ 12124 / 11973 ]

HVNs – 11994 / (12021) / 12055 / 12078 / 12160 / 12230 / 12310 / 12395

NF opened with a gap up at 12103 and continued to probe higher testing the previous day’s selling tail of 12110 to 12146 where it faced supply once again after making a high of 12124 in the opening 10 minutes from where it not only retraced the opening move higher but also went on to make new lows as it closed the gap too in the ‘B’ period making a low of 12058 leaving yet another selling tail from 12086 to 12124 which meant the sellers were looking to take control. The auction then made an OTF (One Time Frame) move lower over the next 4 periods making multiple REs (Range Extension) as it made lows of 11985 in the ‘F’ period completing the 2 IB move down & almost tagging the VPOC of 11982 which saw some profit booking by the sellers and this led to a retracement of the entire move down from ‘C’ period as NF replicated the OTF move to the upside for the next 5 periods scaling above VWAP & matching the highs of ‘C’ period where it got stalled at 12083 leaving a PBH (Pull Back High) there to signal that the sellers were back in the same in this zone. This led to a spike lower into the close leading to new lows of 11973 as NF closed the day at 11994 marking a very bearish start to the new series. Value for the day was overlapping and extending lower and we have a 2-day composite at 12024-12057-12093 which will be the reference for the upside in the coming session.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal VaRiation Day (NV)

- Largest volume was traded at 12055 F

- Vwap of the session was at 12039 with volumes of 141.8 L and range of 151 points as it made a High-Low of 12124-11973

- The 20th Jan Trend Day VWAP of 12336 would be important supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12001-12055-12084

Hypos / Estimates for the next session:

a) NF needs to sustain above 11994 for a move to 12010-024 / 12040-057 & 12078-086

b) Immediate support is at 11973 below which the auction could fall to 11956-949 / 11936 & 11904

c) Above 12086, NF can probe higher to 12102 / 12120-130 / 12146 & 12159-165

d) Below 11904 auction gets weak for a test of 11886-869 / 11850 & 11816-810

e) If 12165 is taken out, the auction go up to to 12185-189 / 12210-215 / 12230 & 12258

f) Break of 11810 can trigger a move lower to 11792 / 11771-767 & 11749-744

Nifty SPOT Hypos for rest of the week:

A) Nifty needs to get above 12156 and sustain for a move to 12194-211 & 12230-266

B) Immediate support is at 12103-100 below which the auction could test 12055-46 & 12002-11991

C) Above 12266, Nifty can probe higher to 12295 / 12322-340 & 12377

D) Below 11991, lower levels of 11955-936 & 11881 could come into play

E) If 12377 is taken out, Nifty can have a fresh leg up to 12395-400 / 12433 & 12458-485

F) Break of 11881 could bring lower levels of 11856-836 & 11794-772

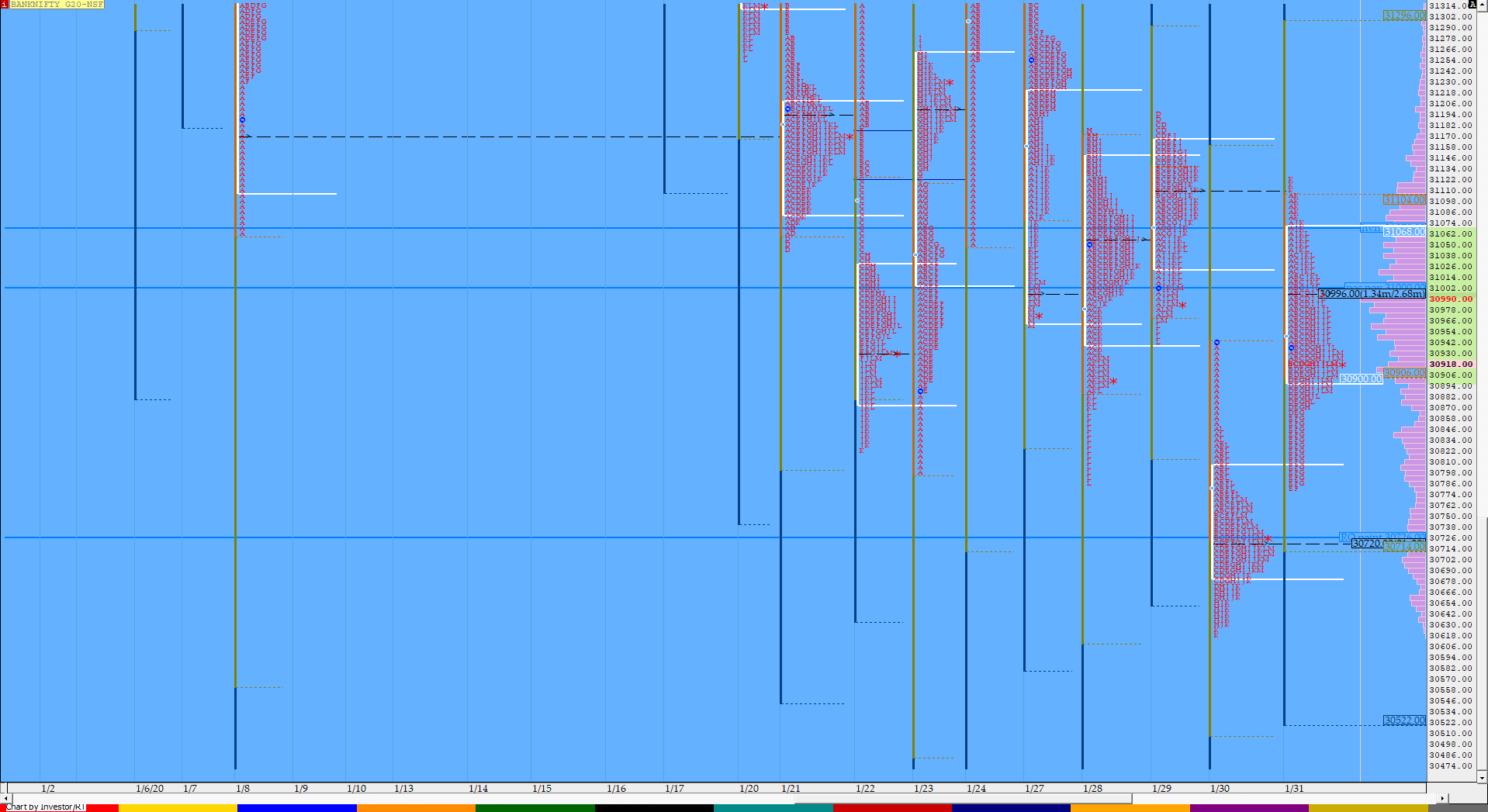

BankNifty Feb F: 30937 [ 31126 / 30780 ]

HVNs – 30726 / 30984 / (31070-115) / 31440 / 32260

BNF opened stronger than NF with a gap up of almost 200 points as it stayed above the PDH (Previous Day High) for most part of the ‘A’ period and went on to make a high of 31104 almost tagging the VPOC of 31110 which seemed to be the objective of this upmove as the auction then probed lower making a low of 30910 in the ‘B’ period leaving a selling tail from 31019 to 31104 in the IB (Initial Balance). The auction then made an attempt in the ‘C’ period to test this selling tail but got rejected after leaving a PBH of 31040 which led to a short OTF move lower for the next 3 periods as BNF made multiple REs and signalled exhaustion of the move down by making similar lows of 30781 & 30780 in the ‘E’ & ‘F’ periods as it took support around yVAH. This triggered a short covering move higher over the next 5 periods as BNF went on to make new highs for the day at 31126 in the ‘K’ period but was immediately rejected back into the IB and went on to complete the 80% Rule in the day’s developing Value as it made lows of 30874 and in the process confirming a FA (Failed Auction) at day highs. Value was higher for the day but the FA at top hints to be a short term swing high with the reference at the downside being the VPOC of 30724 which is also the 1 ATR objective of the FA.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 31000 F

- Vwap of the session was at 30951 with volumes of 42 L and range of 345 points as it made a High-Low of 31126-30780

- BNF confirmed the first FA of the new series at 31126 on 31/01 and the 1 ATR objective comes to 30735.

- The 20th Jan Trend Day VWAP of 31500 would be important supply point.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30680-30726-30797

Hypos / Estimates for the next session:

a) BNF needs to sustain above 30930 for a rise to 30984 / 31050-080 & 31126

b) The auction gets weak below 30910 for a test of 30855 / 30780 & 30726-695

c) Above 31126, BNF can probe higher to 31190-201 / 31250-285 & 31330

d) Below 30695, lower levels of 30630 / 30560 & 30500 could be tagged

e) If 31330 is taken out, BNF can give a fresh move up to 31383 / 31447 & 31500-515

f) Break of 30500 could trigger a move down to 30448-432 / 30345 & 30280

g) Taking out 31515, the auction could further rise to 31565-587 / 31625-650 & 31720

h) BNF below 30280 could bring a fall to 30201-190 / 30150-131 & 30072-050

BankNifty SPOT Hypos for rest of the week:

A) BankNifty needs to sustain above 30890-923 for a move to 30972 / 31026-065 & 31115-153

B) Immediate support is at 30863-840 below which the auction could test 30761-729 / 30660 & 30602

C) Above 31153, BankNifty can probe higher to 31227-246* & 31330

D) Below 30602, lower levels of 30550-538 / 30450 & 30364 could come into play

E) If 31330 is taken out, BankNifty could rise to 31403*-418 / 31488 & 31531

F) Break of 30364 could trigger a move lower to 30302-277 / 30235-204* & 30105-090

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout