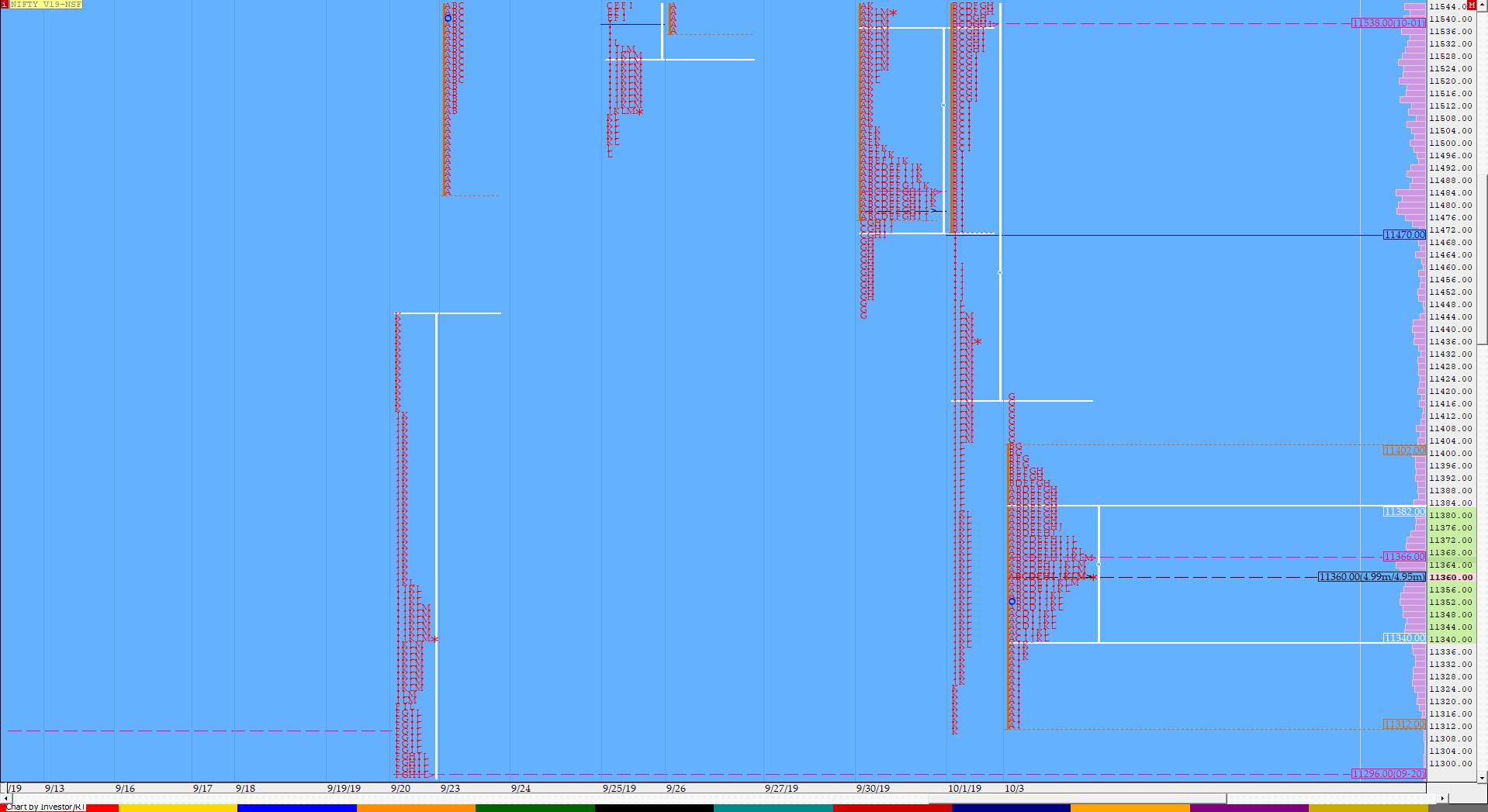

Nifty Oct F: 11362 [ 11418 / 11312 ]

Tuesday’s Double Distribution (DD) profile was not an ideal one in the sense that though NF had made a nice upper distribution after which it left an extension handle at 11472 and went on to make a low of 11310 the lower part of the profile seemed like an incomplete one and as it often happens in Market Profile, a particular zone needs to be fully auctioned before a move away and this is what happened today as NF made an inside bar in the lower part of the DD making a nice Gaussian profile for the day and on a 2 day composite, the profile now seems to be a more well defined DD with 2 balanced distributions and from where we could get a good move in the next session.

NF opened with a gap down and probed lower in the opening minutes to make a low of 11312 stopping just short of the PDL (Previous Day Low) which was the first indication that there was no initiative force in spite of the lower opening to push the auction lower after which it reversed to the upside making new highs for the day and went on to tag 11403 in the ‘B’ period to leave a relatively large IB range. The auction then made a nice balance in this range till the ‘F’ period before it made an attempt to extend higher in the ‘G’ period as it tagged 11418 but faced swift rejection indicating that it is not ready to probe higher too. This led to a rotation to the downside as NF broke below VWAP to made a quick probe to IBL over the next 2 periods making a low of 11313 in the ‘I’ period once again stalling at the day’s extreme to get back to VWAP and the dPOC of 11360 and eventually closed there leaving a nice Bell Curve for the day along with an inside bar.

(Click here to view the 2-day composite DD of NF)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day – Gaussian Profile

- Largest volume was traded at 11360 F

- Vwap of the session was at 11363 with volumes of 107.5 L and range of 106 points as it made a High-Low of 11418-11312

- The Trend Day POC & VWAP of 20/09 at 11330 & 11178 are now now important support levels. The Trend Day POC was tagged on 01/10 & 03/10 and NF promptly bounced from it.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11339-11360-11382

Hypos / Estimates for the next session:

a) NF needs to sustain above 11362 for a probe higher to 11400-409 & 11440-445

b) Sustaining below 11355, the auction becomes weak for 11328-310 & 11283

c) Above 11445, NF can probe higher to 11473-486 / 11501-510 & 11529-538*

d) Below 11283, auction becomes weak for 11255-245 / 11229-215 & 11189-*178*

e) If 11538 is taken out, the auction go up to to 11550*-565 / 11588-595 & 11610-618

f) Break of 11178 can trigger a move lower to 11142-127 & 11092-90

BankNifty Oct F: 28571 [ 28920 / 28368 ]

BNF made similar auction like NF filling up the lower distribution of Tuesday’s profile as it opened with a gap down of more than 200 points and probed lower making a low of 28433 in the opening minutes but unlike NF, it was able to close the gap as it made a high of 28920 in the ‘B’ period leaving a big IB range of 487 points. The auction stayed in this range for most part of the day making a nice balance but for an attempt to probe lower in the ‘I’ period as it made a new low of 28368 but was rejected back into the IB as it closed around the HVN of 28570 leaving a nice DD profile not just on the 2-day but also the 3-day composite which can be seen at the link given below.

(Click here to view this week’s DD profile in BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day – Bell Curve

- Largest volume was traded at 28600 F

- Vwap of the session was at 28625 with volumes of 49.6 L and range of 551 points as it made a High-Low of 28920-28368

- The Trend Day POC & VWAP of 20/09 at 29075 & 28548 are now now important support levels. The auction broke both these levels on 01/10 but was able to close above 28548.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28509-28600-28728

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28580 for a rise to 28664 / 28725-795 & 28850-860

b) Staying below 28560, the auction could test 28485-425 / 28375-345 & 28290

c) Above 28860, BNF can probe higher to 28920 / 28976-982 & 29069-140

d) Below 28290, lower levels of 28188 / 28110-090 & 28038 could come into play

e) Sustaining above 29140, BNF can give a fresh move up to 29222-283 / 29350*-400 & 29450

f) Break of 28038 could trigger a move down 27855 / 27650 & 27495

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout