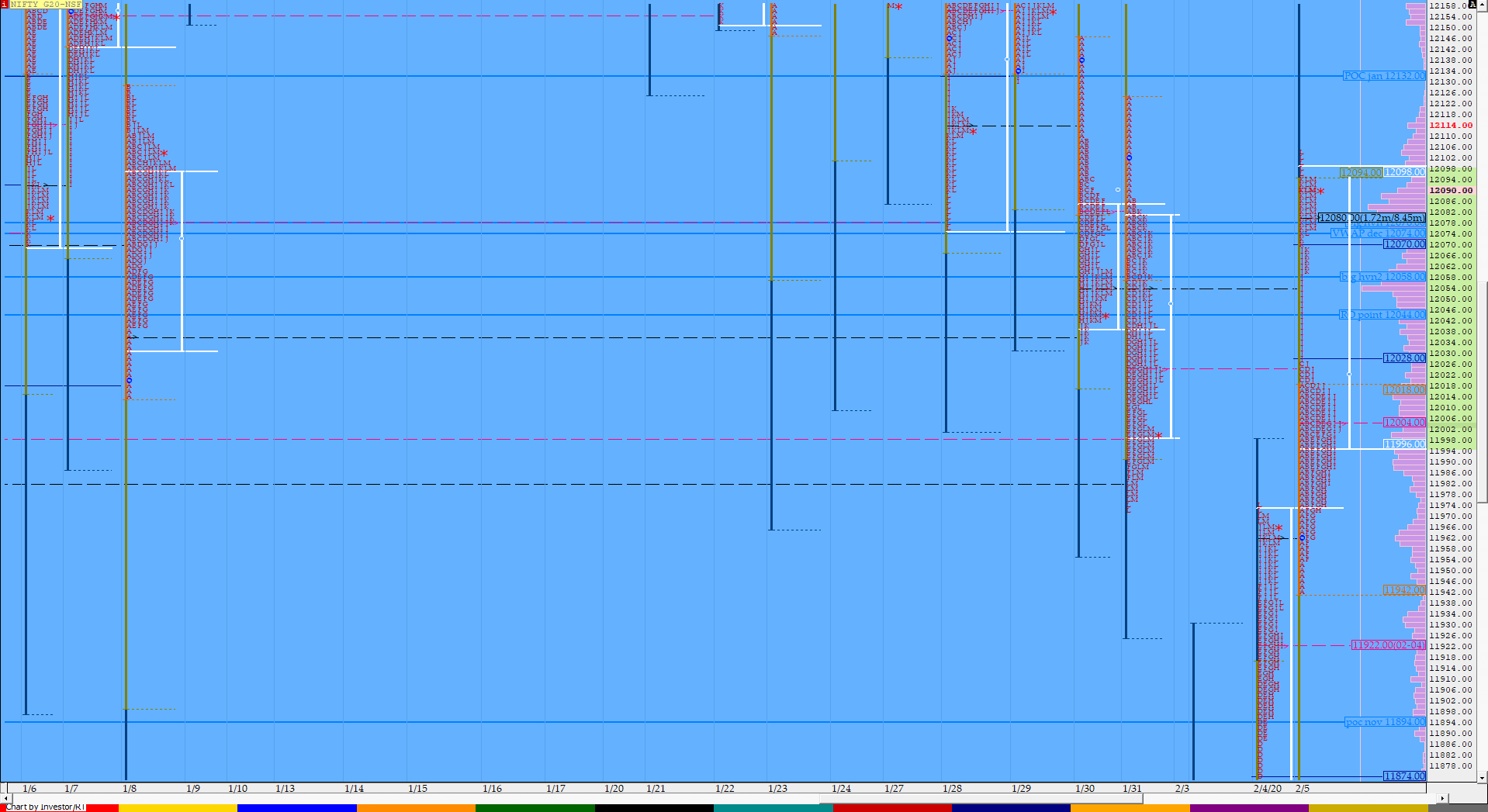

Nifty Feb F: 12086 [ 12104 / 11942 ]

HVNs – 11635 / 11685 / (11803) / 11932 / 11965-978 / 12012 / 12080

Previous day’s report ended with this ‘Acceptance Value for the day was higher with a gap so acceptance above 11970 in the coming session could see the higher VPOC of 12024 & the HVNs of 12055 & 12078 getting tagged‘

Report to be updated…

- The NF Open was an Open Test Drive – Up (OTD) on low volumes

- The day type was a Normal Variation Day – Up (with a spike close)

- Largest volume was traded at 12080 F

- Vwap of the session was at 12015 with volumes of 105.8 L and range of 162 points as it made a High-Low of 12104-11942

- NF confirmed the first FA of the new series at 12020 on 01/02 and tagged the 2 ATR objective of 11817 on the same day. This FA was tagged on 05/02 which was the ‘T+4‘ Day.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11997-12004-12099

Hypos / Estimates for the next session:

a) NF needs to sustain above 12102 for a move to 12120-130 / 12146-159 & 12173-189

b) Staying below 12080, the auction could test lower levels of 12063-060 / 12043-028 / 12012-003 & 11982

c) Above 12189, NF can probe higher to 12210-215 / 12230 & 12258

d) Below 11982 auction gets weak for a test of 11960-954 / 11932-922 & 11904

e) If 12258 is taken out, the auction go up to to 12275 / 12297-309 & 12336

f) Break of 11904 can trigger a move lower to 11888-881 / 11864-862 & 11826

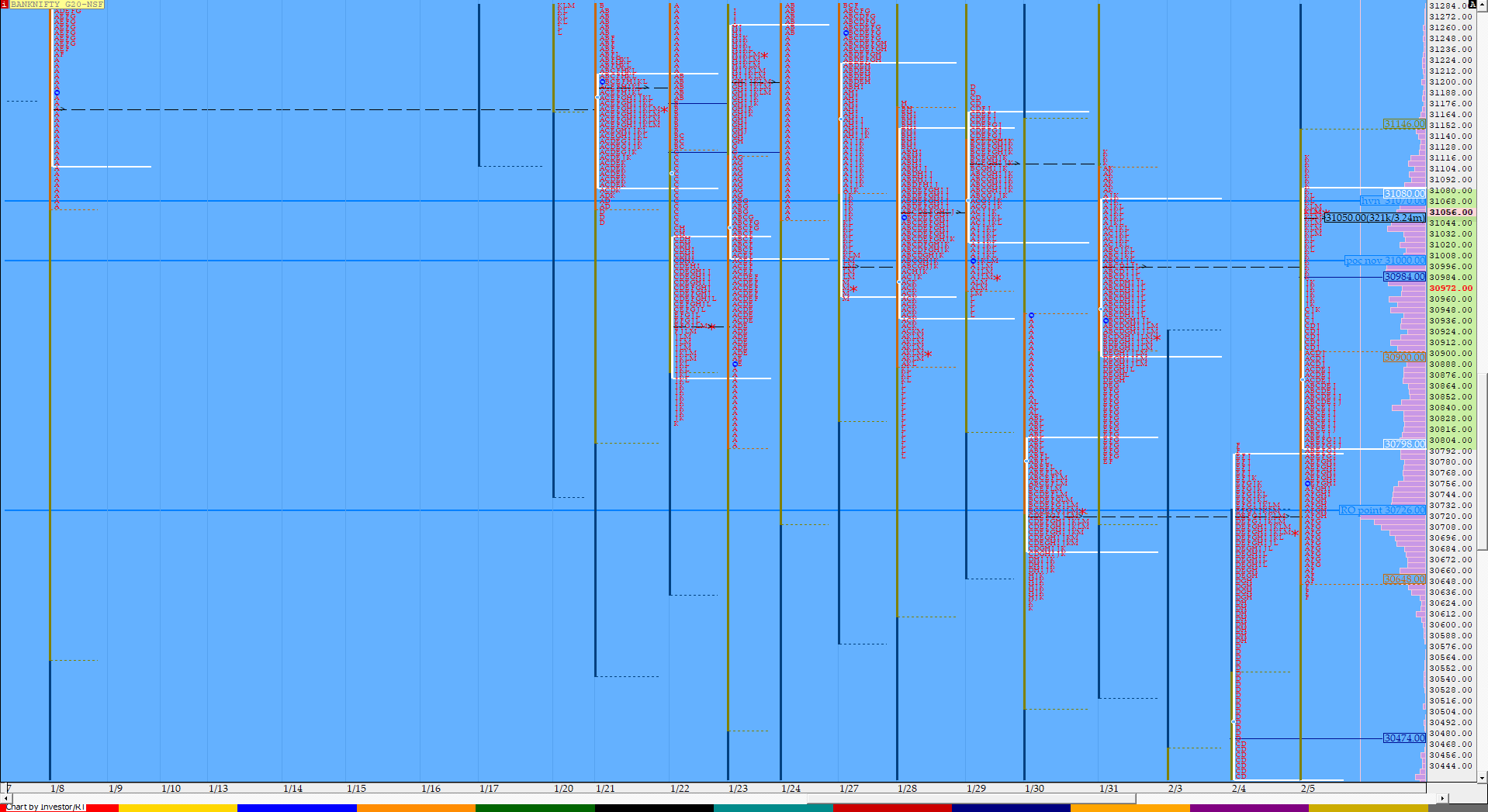

BankNifty Feb F: 31050 [ 31116 / 30631 ]

HVNs – 29900 / (30040) / (30150) / 30355 / 30720 / 30800 / 30870 / 31050

Report to be updated…

- The BNF Open was an Open Test Drive – Up (OTD) on low volumes

- The day type was a Neutral Extreme Day – Up (NeuX)

- Largest volume was traded at 31050 F

- Vwap of the session was at 30852 with volumes of 36.7 L and range of 485 points as it made a High-Low of 31116-30631

- BNF confirmed the third FA of this series in 5 sessions at 30631 on 05/02 and tagged the 1 ATR objective of 31116 on the same day. The 2 ATR move from this FA comes to 31600

- BNF confirmed the second FA of this series at 30990 on 01/02 and tagged the 2 ATR objective of 30217 on the same day. This FA was tagged on 05/02 which was the ‘T+4‘th Day.

- BNF confirmed the first FA of the new series at 31126 on 31/01 and tagged the 2 ATR objective of 30345 on 01/02. This FA is currently on ‘T+5‘ Days.

- The 20th Jan Trend Day VWAP of 31500 remains positional supply point.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30697-30850-30965

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31072 for a rise to 31116-126 / 31190-200 & 31250-285

b) Staying below 31050, the auction could test 30990-950 / 30870-855 & 30800

c) Above 31285, BNF can probe higher to 31330-383 / 31447 & 31500-515

d) Below 30800, lower levels of 30720 / 30675-645 & 30616-585 could be tagged

e) If 31515 is taken out, BNF can give a fresh move up to 31565-601 / 31650-720 & 31775-850

f) Break of 30585 could trigger a move down to 30500-475 / 30410-388 / 30328-313 & 30285-237

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout