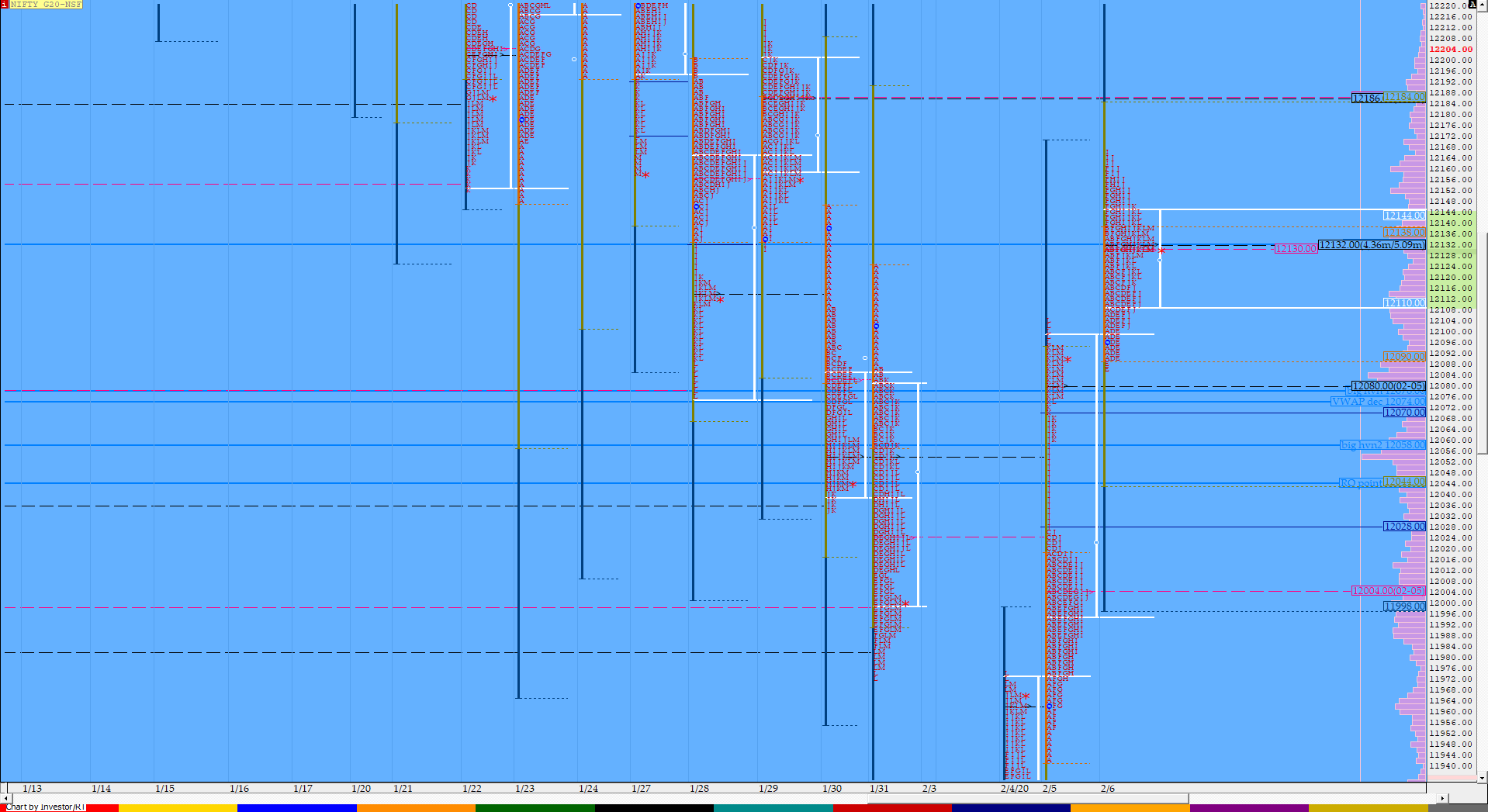

Nifty Feb F: 12086 [ 12104 / 11942 ]

HVNs – 11635 / 11685 / (11803) / 11932 / 11965-978 / 12012 / 12080

NF opened in previous day’s spike zone of 12069 to 12104 but stayed above the HVN of 12080 while taking support at 12091 after which it got above PDH (Previous Day High) and continued to probe on the upside making a high of 12138 leaving the narrowest IB (Initial Balance) range of just 47 points in over 2 weeks. The auction then broke below VWAP & moved lower for the next 3 periods as it made an attempt to make a RE (Range Extension) to the downside for the first time this week in the ‘E’ period as it tagged new lows for the day at 12087 but was swiftly rejected leading to a big move on the upside in the ‘F’ period as NF not only got above VWAP but went on to make a successful RE at the other extreme confirming a FA (Failed Auction) at lows as it tagged the 1.5 IB objective of 12161 but got stalled in this zone after making a high of 12167 in the ‘I’ period as the supply from the 29th Jan profile seem to have returned as the VWAP & VPOC of that day at 12176 & 12189 were defended. NF made a dip below VWAP in the ‘J’ period as it left a PBL (Pull Back Low) at 12102 before closing the day at the dPOC of 12132 leaving a nicely balanced Neutral profile with yet another day of higher Value. Balance seems to have returned after the imbalance seen this week which has been trending higher on all 4 days till now so we could expect another range bound day in the next session before the auction gives the next round of imbalance.

- The NF Open was an Open Auction (OA)

- The day type was a Neutral Day (Gaussian profile)

- Largest volume was traded at 12132 F

- Vwap of the session was at 12127 with volumes of 102 L and range of 80 points as it made a High-Low of 12167-12087

- NF confirmed the second FA of this series at 12087 on 06/02 and the 1 ATR objective comes to 12232

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12110-12132-12144

Hypos / Estimates for the next session:

a) NF has immediate supply at 12145 above which it could rise to 12165-170 & 12189*

b) The auction getting accepted below 12120 could test lower levels of 12102 & 12087-080*

c) Above 12189, NF can probe higher to 12210-215 / 12230 & 12258

d) Below 12080 auction gets weak for a test of 12063-060 / 12043-028 & 12012-003

e) If 12258 is taken out, the auction go up to to 12275 / 12297-309 & 12325-336

f) Break of 12003 can trigger a move lower to 11982-960 / 11942 & 11922

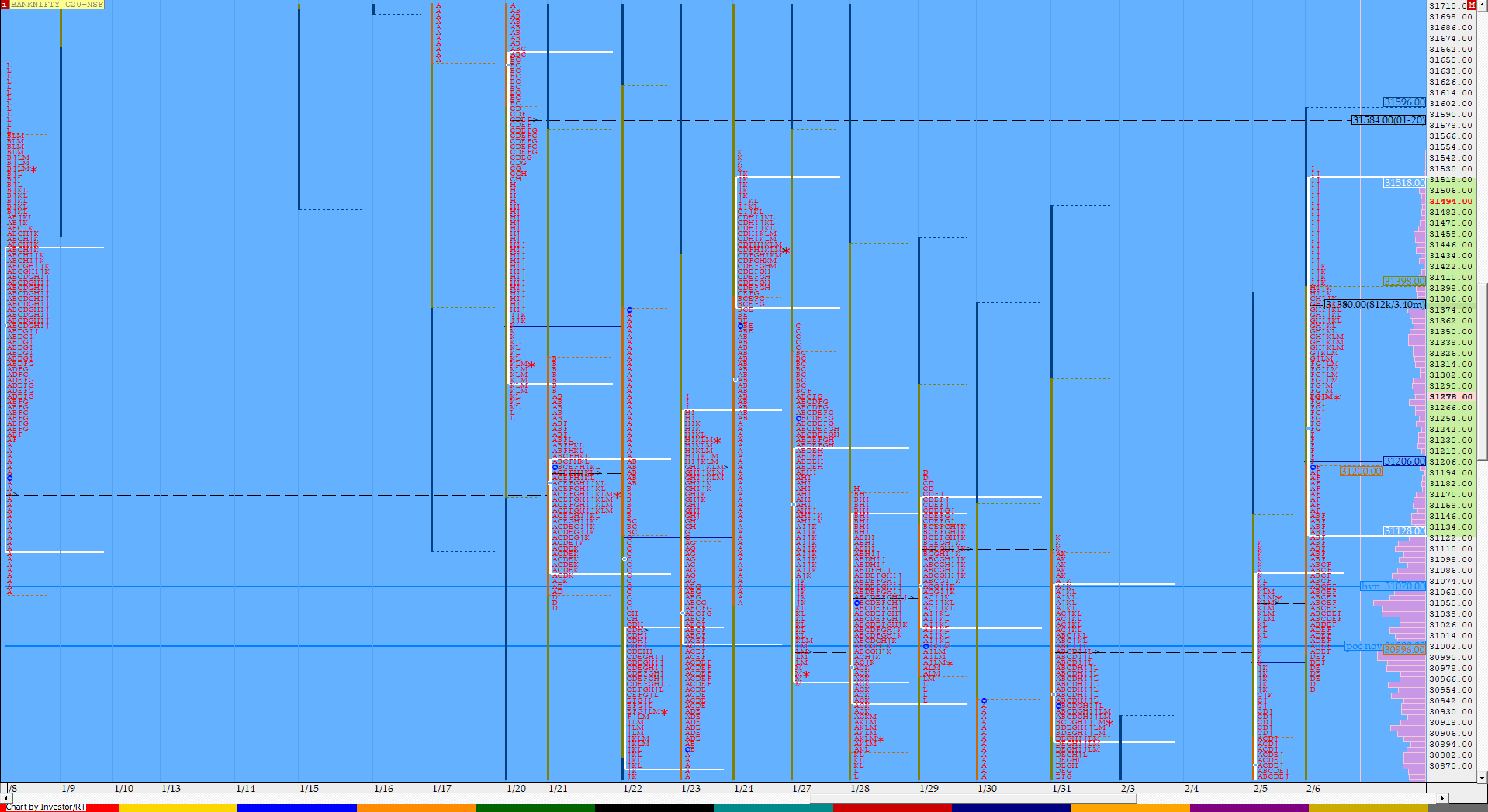

BankNifty Feb F: 31333 [ 31530 / 30956 ]

HVNs – 29900 / (30040) / (30150) / 30355 / 30720 / 30800 / 30870 / 31050 / 31345-380

BNF opened with a big gap up & a freak OH tick of 31200 and probed lower to get back into the previous day’s range & test the Neutral Extreme reference of 31116 to 30980 as it took support at 31000 in the IB. The auction continued to make Value in this spike zone for the first part of the day & even attempted a RE to the downside in the ‘E’ period as it made lows of 30956 but was swiftly rejected which meant that the previous day’s extension handle buyers were still active. BNF then stayed inside the IB in the E period getting back to VWAP & made a big move in the ‘F’ period just like NF as it made a successful RE higher confirming yet another FA of the new series at lows and kept trending higher for the next 3 periods completing the 1 ATR objective of 31453 as it tagged the 20th Jan Trend Day VWAP of 31500 while making a high of 31530 but just like it did on 24th Jan, was unable to stay above it and this led to a retracement back to VWAP into the close as it left a PBL at 31271 before closing the day at 31332 which was much below the dPOC of 31380 leaving another Neutral Day though the day’s profile also resembles a DD (Double Distribution Trend Day) with 2 balances being separated by a buying tail from 31247 to 31165 if we ignore the freak OH tick of 31200 and this zone of singles will be the reference for tomorrow to see if BNF continues to probe higher or starts to form a balance.

- The BNF Open was an Open Auction (OA)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 31380 F

- Vwap of the session was at 31231 with volumes of 43.3 L and range of 574 points as it made a High-Low of 31530-30956

- BNF confirmed the 4th FA of this series in 6 sessions at 30956 on 06/02 and tagged the 1 ATR objective of 31453 on the same day. The 2 ATR move from this FA comes to 31950

- BNF confirmed the third FA of this series in 5 sessions at 30631 on 05/02 and tagged the 1 ATR objective of 31116 on the same day. The 2 ATR move from this FA comes to 31600

- BNF confirmed the second FA of this series at 30990 on 01/02 and tagged the 2 ATR objective of 30217 on the same day. This FA was tagged on 05/02 which was the ‘T+4‘th Day.

- BNF confirmed the first FA of the new series at 31126 on 31/01 and tagged the 2 ATR objective of 30345 on 01/02. This FA is currently on ‘T+5‘ Days.

- The 20th Jan Trend Day VWAP of 31500 remains positional supply point.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31145-31380-31529

Hypos / Estimates for the next session:

a) BNF has supply in the zone of 31362-380 above which it could rise to 31426-472 / 31520 & 31584*-600

b) The auction would get weak below 31280 for a test of 31230 / 31165-160 & 31105-050

c) Above 31600, BNF can probe higher to 31650 / 31720 & 31775

d) Below 31050, lower levels of 30987-956 & 30870-855 could be tagged

e) If 31755 is taken out, BNF can give a fresh move up to 31850 / 31936-961 & 32040-057

f) Break of 30855 could trigger a move down to 30800 / 30720* & 30675-645

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout