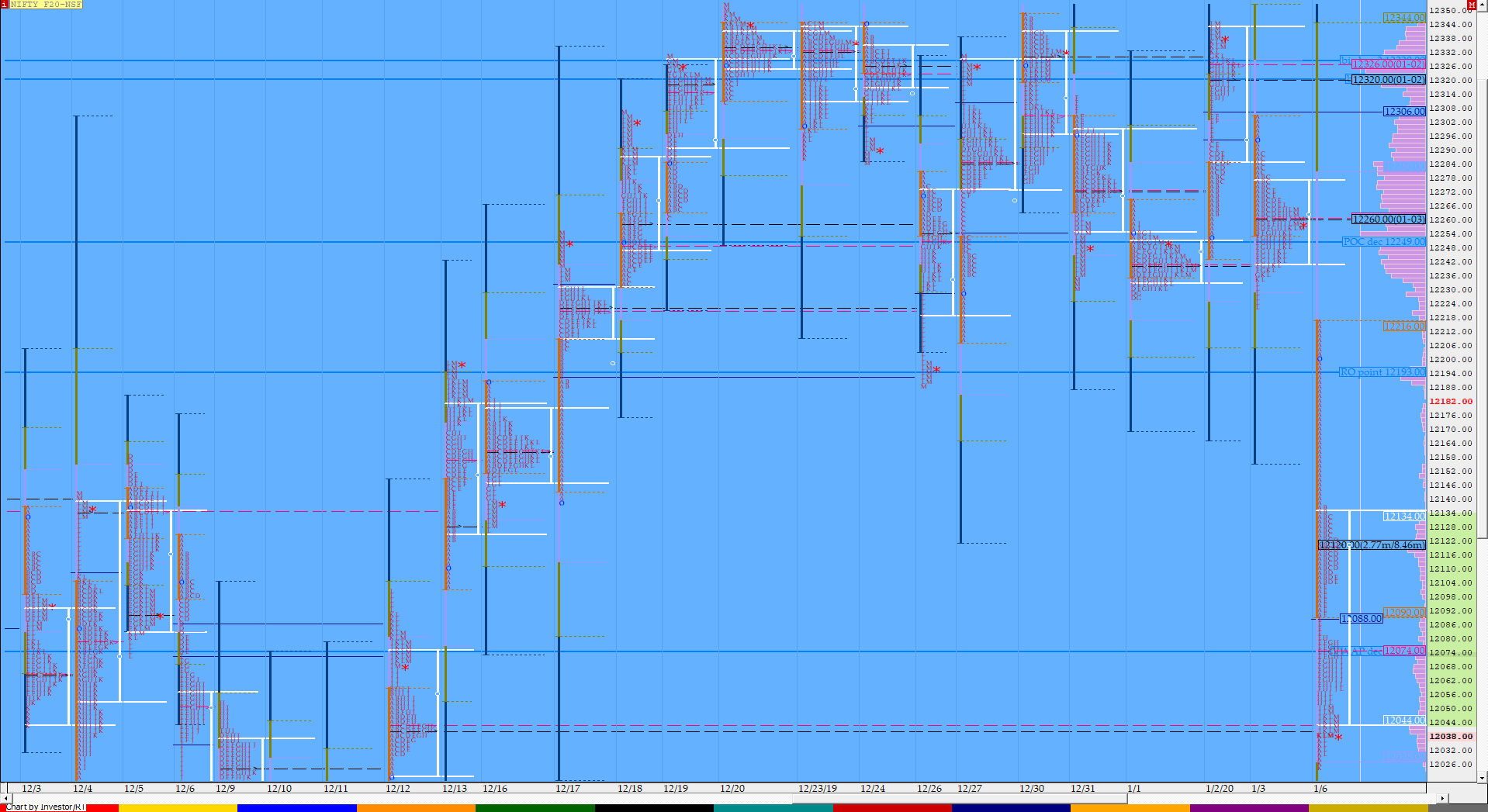

Nifty Jan F: 12044 [ 12218/ 12025 ]

HVNs – (11946-964) / 11994 / 12040 / 12120 / 12193 / 12260 / 12327

Report to be updated…

- The NF Open was an Open Drive – Down (OD)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 12120 F

- Vwap of the session was at 12088 with volumes of 117.1 L and range of 193 points as it made a High-Low of 12218-12025

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12048-12120-12156

Hypos / Estimates for the next session:

a) NF has immediate supply at 12060 above which it could rise to 12081-91 / 12110-125 & 12138

b) Sustaining below 12042, the auction could fall to 12012 / 11994* & 11977-*964*

c) Above 12138, NF can probe higher to 12155 / 12170-180 & 12200

d) Below 11964, auction could probe lower to 11949* / 11930-922 & 11904-886

e) If 12200 is taken out, the auction go up to to 12220-234 / 12252* & 12282-290

f) Break of 11886 can trigger a move lower to 11863 / 11848-843 & 11816*-810

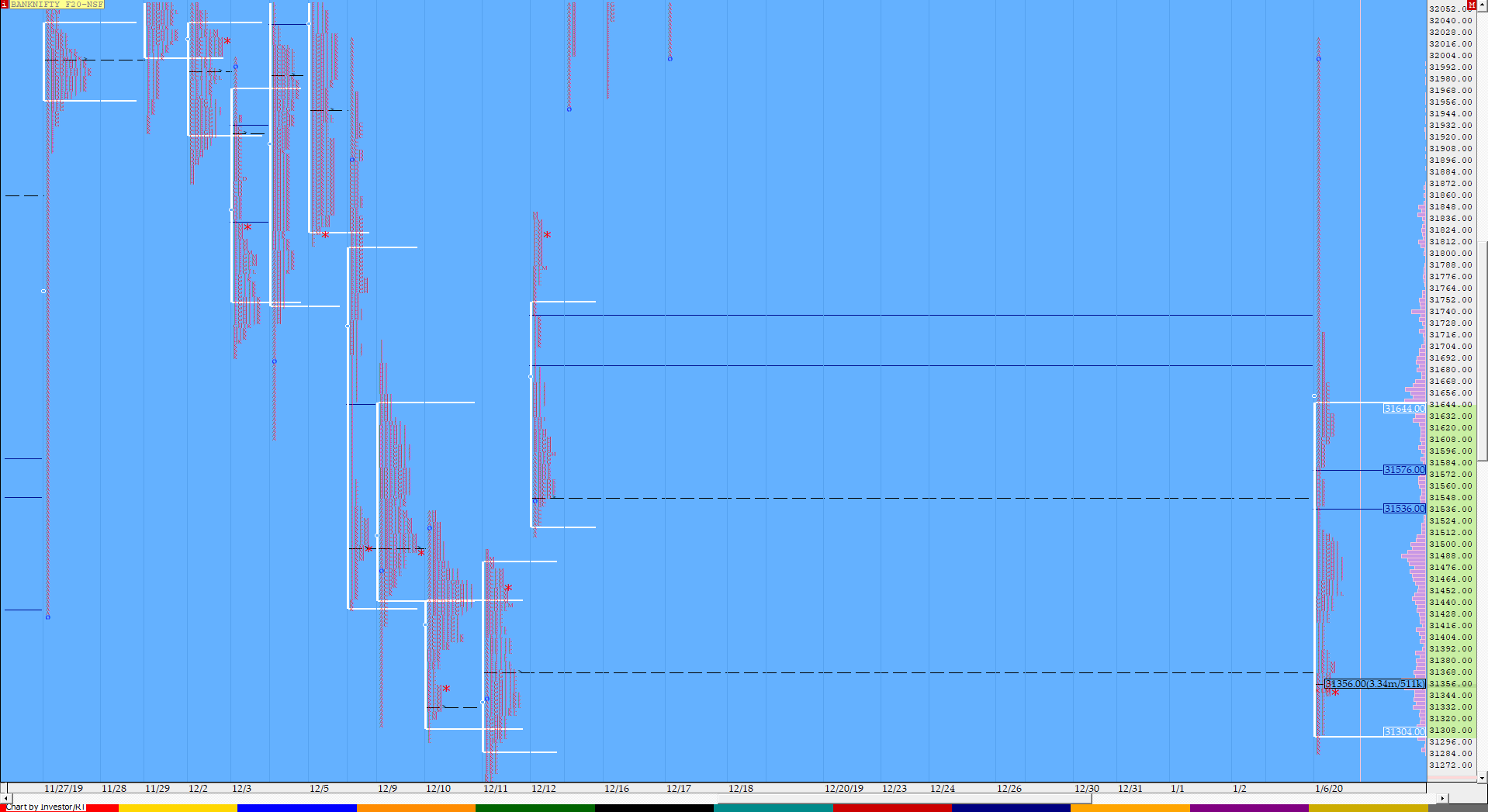

BankNifty Jan F: 32161 [ 32489 / 32060 ]

HVNs – 30880 / 31244 / 31355 / (31490) / (31660) / 32160 / 32210 / 32380 / (32420) / 32550-565

Report to be updated…

- The BNF Open was an Open Drive – Down (OD)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 31355 F

- Vwap of the session was at 31519 with volumes of 39.6 L and range of 738 points as it made a High-Low of 32024-31286

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA is currently on ‘T+6‘ Days.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31292-31355-31635

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31370 for a rise to 31452 / 31490-520 & 31580

b) Immediate support is at 31340 below which the auction could test 31264-244 & 31180-169

c) Above 31580, BNF can probe higher to 31660 / 31716 & 31750-800

d) Below 31169, lower levels of 31104 / 31065 & 30985 could be tagged

e) If 31800 is taken out, BNF can give a fresh move up to 31855-875 / 31930 & 32000-034

f) Break of 30985 could trigger a move down to 30880 / 30805*-741 & 30666

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout