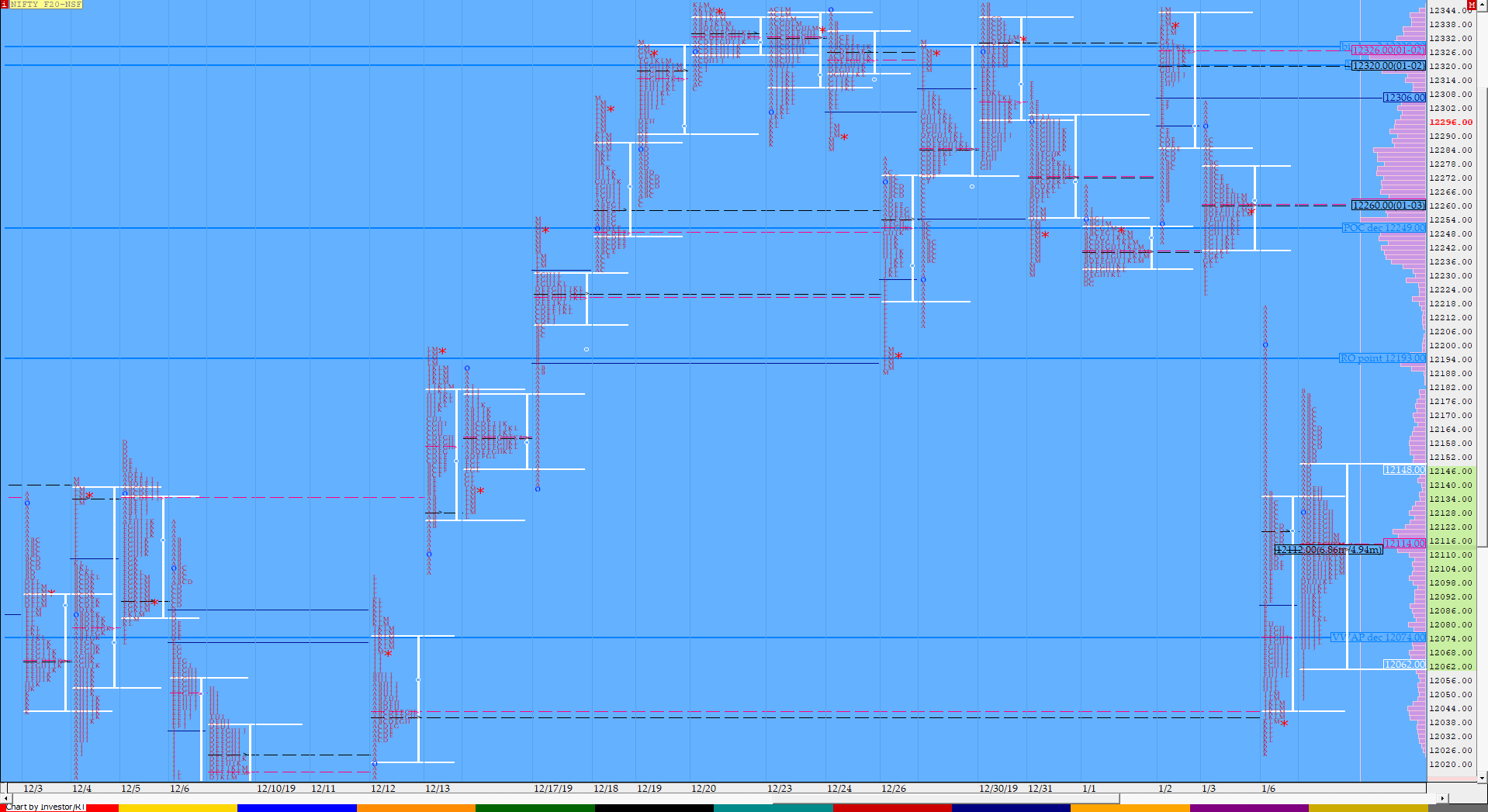

Nifty Jan F: 12107 [ 12182/ 12049 ]

HVNs – (11946-964) / 11994 / 12040 / 12113 / 12160 / 12260 / 12327

NF had made a range of 193 points the previous day which was the biggest in almost 3 months and this imbalance called for a balance to return to the auction as it opened with a big gap up of 85 points and not only that but also drove higher as it entered the previous day’s selling tail of 12138 to 12256 while making a high of 12182 in the Initial Balance (IB). The range however contracted in the first 3 periods with the C period making an inside bar of just 18 points which suggested that the trade facilitation at these higher levels was getting poor and more confirmation of the probe reversing came as NF closed below VWAP in the ‘C’ period. Failure of VWAP in an Open Drive leads a quick move to the other extreme which is what happened in the ‘D’ period as the auction negated the entire morning tail to make a range extension to the downside as it made new lows at 12094 stalling just above the previous day’s Trend Day VWAP of 12088. NF then remained in the range of ‘D’ for the next 3 periods as it stayed below VWAP with the range contracting once again as the ‘G’ period made a narrow inside bar of just 19 points indicating that another range expansion for the day could be on the cards. The ‘H’ period then began by probing higher and looked like could move towards the IBH but was swiftly rejected at VWAP as it left a Pull Back High at 12139 after which it went on to make a fresh RE to the downside followed by another one in the ‘I’ period as NF completed the 1.5 IB move as it made lows of 12049 taking support just above previous day’s HVN of 12040 as the ‘I’ period closed at 12071 leaving a small buying tail at lows from 12071 to 12049 hinting that the day’s low could be done. This view was strengthened as the next 2 periods probed higher almost tagging VWAP in the ‘K’ period as it made highs of 12115 but once again was rejected as it made a quick fall of 40 points in the ‘L’ period where it made lows of 12074 taking support just above the buying tail of the day and made another trip back to VWAP in the closing 30 minutes to close around 12115 which was also now the dPOC for the day. On the daily time frame, NF made an inside bar with Value also completely inside previous day’s Value and we now have a 2 day composite with Value at 12042-12120-12132 along with signs that there are 2 big opposite forces fighting out there as the volumes of the last 3 days have been above average and also been increasing so the auction can remain in this 2 day composite for some more time before giving the next move away.

View the MPLite chart of the 2-day composite of NF here

- The NF Open was an Open Auction In Range plus Drive – Up (OAIR + D)

- The day type was a Normal Variation – Down (NV)

- Largest volume was traded at 12113 F

- Vwap of the session was at 12113 with volumes of 123 L and range of 133 points as it made a High-Low of 12182-12049

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12057-12113-12145

Hypos / Estimates for the next session:

a) NF needs to sustain above 12113 for a move to 12132-140 / 12160-170 & 12185

b) The auction has immediate support at 12100-090 below which it could fall to 12069-60 / 12042 & 12012

c) Above 12185, NF can probe higher to 12200 / 12220-234 & 11252*

d) Below 12012, auction could probe lower to 11994* / 11977*-964 & 11949*

e) If 12252 is taken out, the auction go up to to 12282-290 / 12310 & 12327*

f) Break of 11949 can trigger a move lower to 11930-922 / 11904-886 & 11863

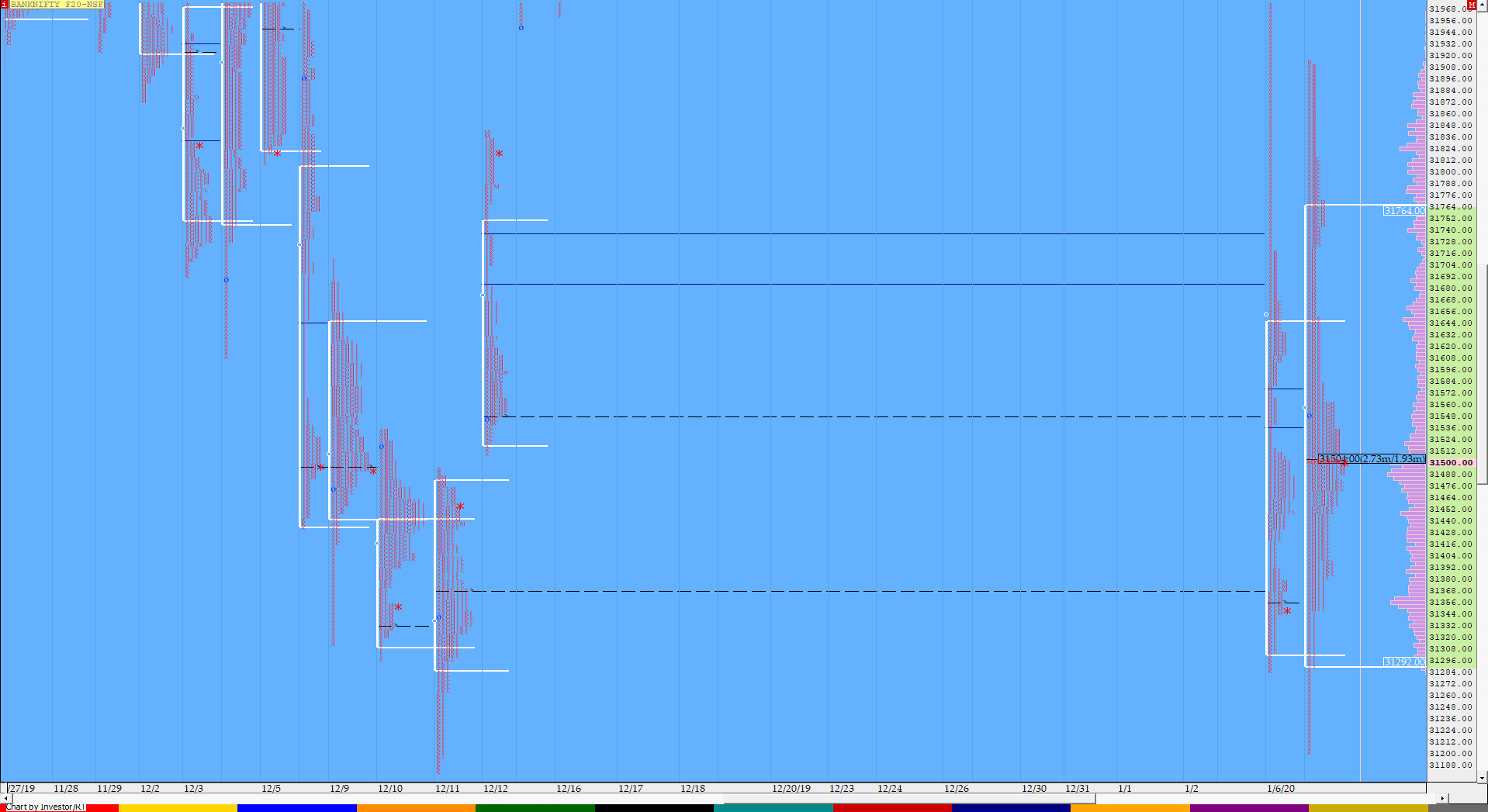

BankNifty Jan F: 31493 [ 31916 / 31290 ]

HVNs – 30880 / 31244 / 31355 / (31425) / 31500 / (31830) / 32160 / 32210

Similar to NF, BNF also opened with a big gap up of almost 200 points after making a 3-month high range of 738 points the previous day as it opened above the Trend Day VWAP of 31519 and drove higher in the IB eating up half of the big selling tail of 31716 to 32161 while making a high of 31916 in the IB but broke below VWAP which was a sign that there was no new demand coming in. The ‘C’ period then made a narrow range inside bar of just 70 points which was followed by a trending move to the downside starting from the ‘D’ period as the auction made multiple REs lower till the ‘I’ period as it not completed the 1.5 IB objective of 31367 effectively closing the gap up but also went on to test the previous day’s low as it made lows of 31290. However, BNF also left a small tail at lows in the ‘I’ period which led to a move back to VWAP as it made a high of 31532 in the last 15 minutes before closing the day around the dPOC of 31500. There was a freak tick of 31200 in BNF at open which can be ignored as there was no volumes there so effectively speaking, BNF also made an inside day and like NF has given a 2-day composite with Value at 31319-31490-31661 with volumes also increasing from the last 3 days with yesterday’s volumes of 47.6 L being the highest in the last 2.5 months suggesting that the range is likely to be on the higher side in the coming sessions.

View the MPLite chart of the 2-day composite of BNF here

- The BNF Open was an Open Auction In Range plus Drive – Up (OAIR + D)

- The day type was a Normal Variation – Down (NV)

- Largest volume was traded at 31500 F

- Vwap of the session was at 31555 with volumes of 47.6 L and range of 626 points as it made a High-Low of 31916-31290

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31476-31500-31912/strong>

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31500 for a rise to 31555-560 / 31616-661 & 31725

b) Staying below 31490, the auction could test 31430-425 / 31355-346 & 31290

c) Above 31725, BNF can probe higher to 31777-784 / 31826-830 & 31900-930

d) Below 31290, lower levels of 31244 / 31180-169 & 31104 could be tagged

e) If 31930 is taken out, BNF can give a fresh move up to 32000-034 / 32075-95 & 32160*

f) Break of 31104 could trigger a move down to 31065 / 30985 & 30880

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout