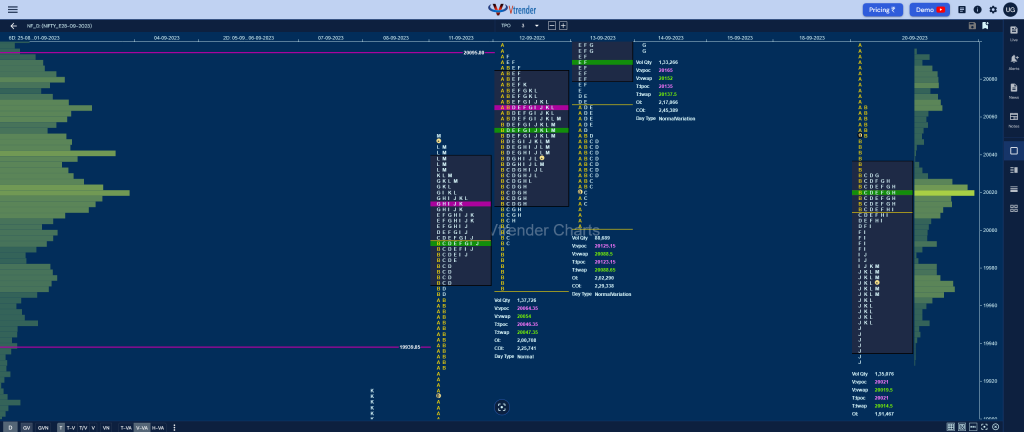

Nifty Sep F: 19972 [ 20094 / 19931 ]

NF gave more confirmation of the upside imbalance of the series coming to a pause with a big gap down open of 129 points as it opened below the 1 ATR objective of 20109 from 18th Sep’s FA of 20234 and continued to drive lower in the IB leaving an extension handle at 20055 and making a low of 20011 tagging the LVN from 14th Sep.

The auction then consolidated in a narrow range forming marginal new lows in the C & D periods after which it made an inside bar in the E building volumes at 20020 and made a fresh RE in the F TPO recording new lows of 19990 but left a small responsive buying tail resulting in a pull back to 20029 in the G which was the third time it stalled at this level after C & D had also made similar highs.

Unable to even tag the day’s VWAP, NF then not only negated the buying tail of F period but went on to leave a fresh extension handle at 19990 completing the 2 ATR target of 19983 from 20234 and made a bigger RE in the J TPO where it completed the 1 ATR objective of 19937 from the weekly FA of 20270 while making a low of 19931 which was just above the 2 IB mark of 19928 for the day and also the initiative buying tail from 08th Sep.

The last 3 TPOs remained inside the range of J leaving a fresh responsive buying tail from 19951 to 19931 and closed around the developing HVN of 19965 leaving a Double Distribution Trend Day Down with a good chance of this imbalance continuing in the coming session.

Click here to view the latest profile in NF on Vtrender Charts

- The NF Open was an Open Auction Out of Range (OAOR)

- The Day Type was a Double Distribution Trend Day – Down (DD)

- Largest volume was traded at 20021 F

- Vwap of the session was at 20019 with volumes of 67.5 L and range of 164 points as it made a High-Low of 20094-19931

- NF confirmed a FA at 20234 on 18/09 and completed the 2 ATR objective of 19983 on 20/09

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively.

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively.

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively.

You can check the monthly charts & other swing levels for Nifty here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19933-20021-20035

- HVNs are at 19612 / 20022** / 20174 (** denotes series POC)

Business Areas for 21st Sep 2023:

| Up | Down |

|---|---|

| 19982 – Closing PBH (20 Sep) 20019- DD VWAP (20 Sep) 20065 – Selling Tail (20 Sep) 20114 – Gap mid (20 Sep) 20162 – NeuX Low (18 Sep) 20190 – VPOC from 18 Sep | 19965 – Closing HVN (20 Sep) 19927 – Buying Tail (11 Sep) 19874 – VPOC from 08 Sep 19820 – SOC from 08 Sep 19788 – Ext Handle (08 Sep) 19724 – Ext Handle (07 Sep) |

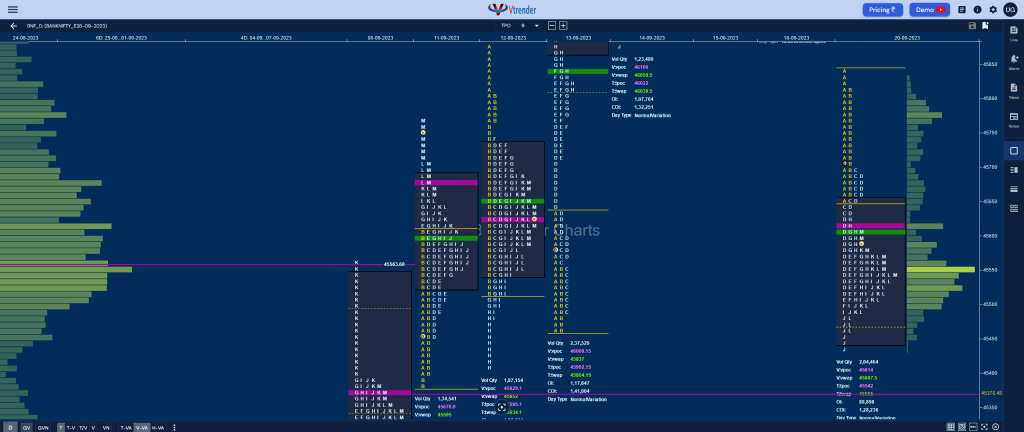

BankNifty Sep F: 45557 [ 45840 / 45440 ]

BNF also opened with a big gap down of 367 points and made a low of 45652 taking support just above 13th Sep’s initiative extension handle of 45635 and gave a bounce back to 45840 stalling right at that Trend Day’s VWAP of 45837 indicating change of polarity as the B period retraced the entire upmove of A forming an inside bar.

The auction then made a typical C side extension to 45630 but followed it up with a big RE in the D TPO leaving a selling extension handle right at previous demand zone signalling entry of aggressive sellers as it made a low of 45514 and made marginal new lows over E & F suggesting mild exhaustion on the downside leading to a bounce in the G & H periods which halted just below the extension handle of 45630 leaving a PBH at 45627.

BNF then made 2 more new REs to the downside in the I & J periods completing the 2 IB objective of 45464 and repairing the poor lows from 13th Sep while hitting 45440 but found support at previous week’s VWAP of 45454 leaving a small responsive buying tail and triggering a bounce back to the day’s VWAP of 45607 into the close leaving a ‘b’ shape long liquidation profile with completely lower Value.

Click here to view the latest profile in BNF on Vtrender Charts

- The BNF Open was an Open Auction Out of Range (OAOR)

- The Day Type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 45614 F

- Vwap of the session was at 45607 with volumes of 30.7 L and range of 400 points as it made a High-Low of 45840-45440

- BNF confirmed a FA at 44976 on 08/09 and tagged the 2 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point

- BNF confirmed a FA at 44760 on 06/09 and 1 ATR objective to the downside comes to 44366. This FA got negated on 07/09 and tagged the 2 ATR upside target of 45577 on 11/09

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively.

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively.

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively.

You can check the monthly charts & other swing levels for BankNifty here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 45442-45614-456486

- HVNs are at 44656** / 44736 (** denotes series POC)

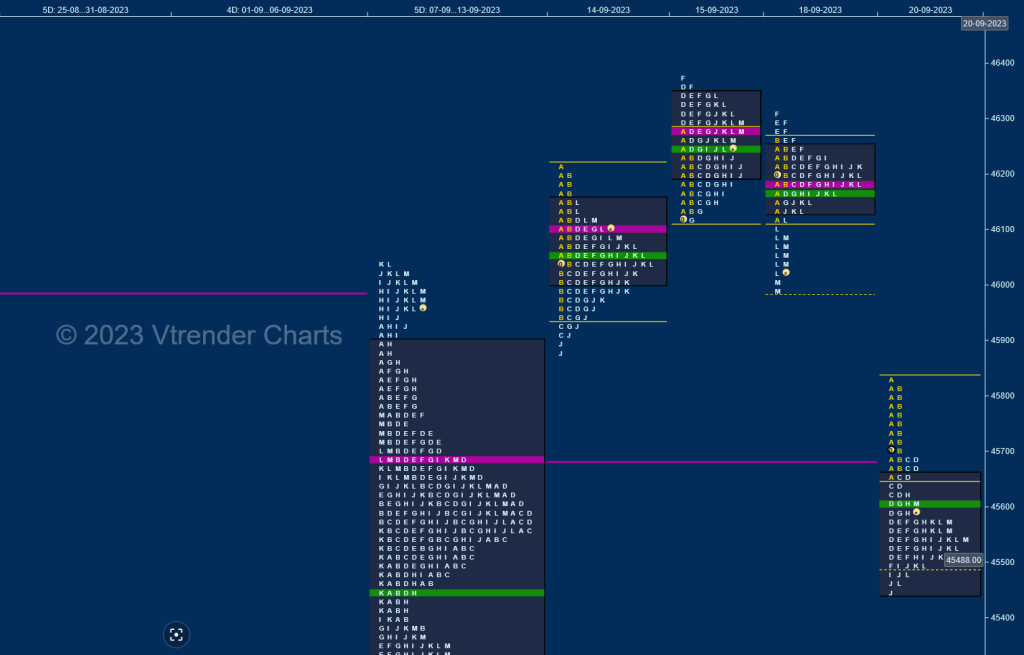

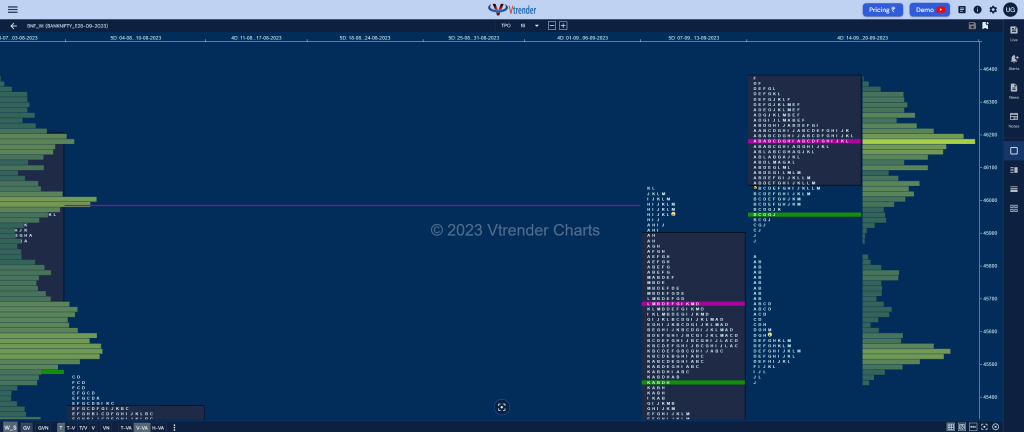

BNF (Sep) Weekly Settlement Profile (14th to 20th Sep 2023)

45557 [ 46375 / 45440 ]

BNF continued previous week’s imbalance to the upside as it made new highs of 46210 on Thursday but remained in a narrow 336 point range all day forming a Gaussian Curve with a prominent TPO POC at 46032 and formed another Bell profile with an even more narrower range of just 261 points on Friday where it made new highs of 46375 tagging the first upside obective of this week which was the weekly HVN of 46375.

The back to back narrow range days on low volumes displayed poor trade facilitation to the upside and more confirmation of this came via a Neutral Extreme Day Down on Monday where once again it was forming a narrow range balance for most part of the day with a prominent POC at 46190 from where it gave a late move away with an extension handle at 46128 signalling change of PLR to the downside as the last day of the week opened with a gap down of 367 points back in previous week’s Value and formed a ‘b’ shape long liquidation profile as it first tagged the weekly POC of 45681 and then went on to test the VWAP of 45454 while making a low of 45440 where it took support.

The weekly profile is a Neutral Extreme one to the downside though it resembles a Double Distribution Trend Down too although Value was completely higher at 46058-46188-46375 with a prominent POC at 46188 from where it has given a move away to the downside forming a lower HVN at 45535 which will be the important reference on the downside for the coming week as sustaining below it could see the filling up of the Trend Up weekly profile from 07th to 13th Sep and a test of the extension handle of 44883 along with the HVN & series POC of 44656 whereas on the upside, the intra-day extension handle of 45630 along with the daily one at 45874 will be the immediate levels to be taken out above which this week’s VWAP of 45957 and POC of 46188 could come into play.

Click here to view this week’s settlement profile in BNF on Vtrender Charts

Business Areas for 21st Sep 2023:

| Up | Down |

|---|---|

| 45579 – M TPO VWAP (20 Sep) 45630 – Ext Handle (20 Sep) 45715 – B TPO POC (20 Sep) 45810 – Selling Tail (20 Sep) 45941 – IB singles mid (20 Sep) 46082 – Closing singles | 45540 – Closing HVN (20 Sep) 45466 – Buying tail (20 Sep) 45370 – VPOC from 08 Sep 45283 – VWAP from 08 Sep 45183 – PBL from 08 Sep 45099 – Ext Handle (07 Sep) |