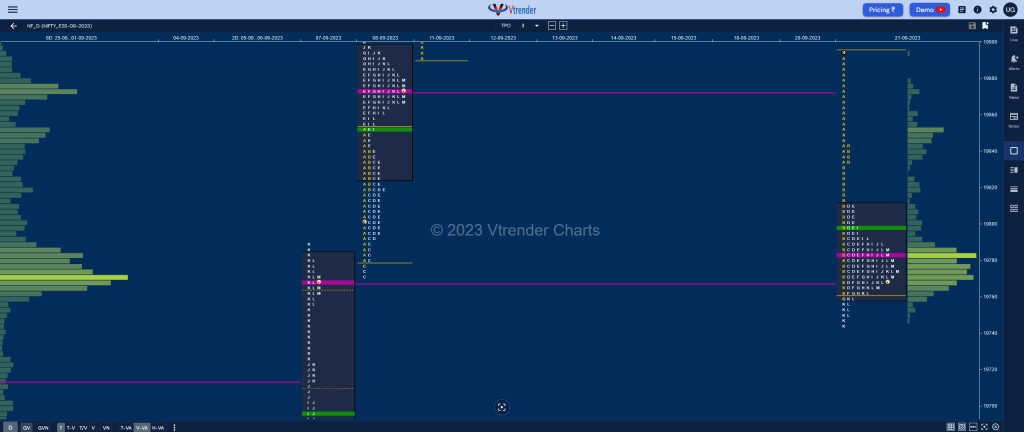

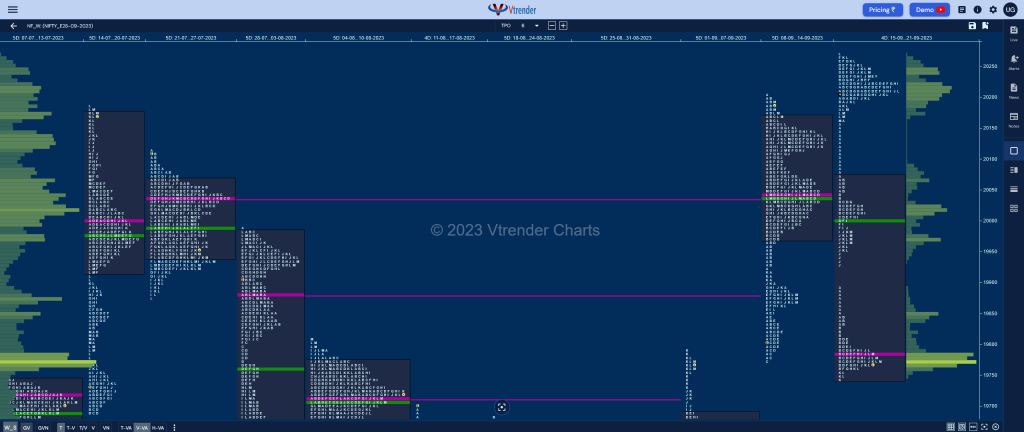

Nifty Sep F: 19778 [ 19895 / 19745 ]

NF continued previous day’s imbalance to the downside with yet another gap down open by 77 points after which it continued to drive lower all through the IB while leaving an extension handle at 19834 in the B period and went on to make a low of 19761 forming a large range of 134 points.

The auction then got back to balance for the rest of the day remaining in a narrow range of just 50 points while leaving similar highs at 19810 in the D & E TPOs forming a ‘b’ shape long liquidation profile for the day with couple of attempts to extend lower in the G & K periods could only manage marginal new lows of 19760 & 19745 respectively before closing right at the prominent POC of 19783 which will be the reference for the next open with the PLR being firmly on the downside.

Click here to view the latest profile in NF on Vtrender Charts

- The NF Open was an Open Auction Out of Range plus Drive Down (OAOR + D)

- The Day Type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 19783 F

- Vwap of the session was at 19797 with volumes of 83.4 L and range of 150 points as it made a High-Low of 19895-19745

- NF confirmed a FA at 20234 on 18/09 and completed the 2 ATR objective of 19983 on 20/09

- NF confirmed a FA at 19772 on 08/09 and tagged the 2 ATR objective of 20012 on 11/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and is no longer a valid support.

- NF confirmed a FA at 19508 on 04/09 and tagged the 2 ATR objective of 19756 on 07/09. This FA has not been tagged and is now a positional demand point

- NF confirmed a FA at 19542 on 30/08 and tagged the 1 ATR objective of 19417 on 31/08. This FA got revisted on 04/09 which was the ‘T+3’ Day and has closed above it and is now support

- The settlement day Roll Over point (September 2023) is 19410

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively.

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively.

- The VWAP & POC of Jun 2023 Series is 18739 & 18707 respectively.

You can check the monthly charts & other swing levels for Nifty here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19759-19783-19809

- HVNs are at 19612 / 19770** / 20022 / 20174 (** denotes series POC)

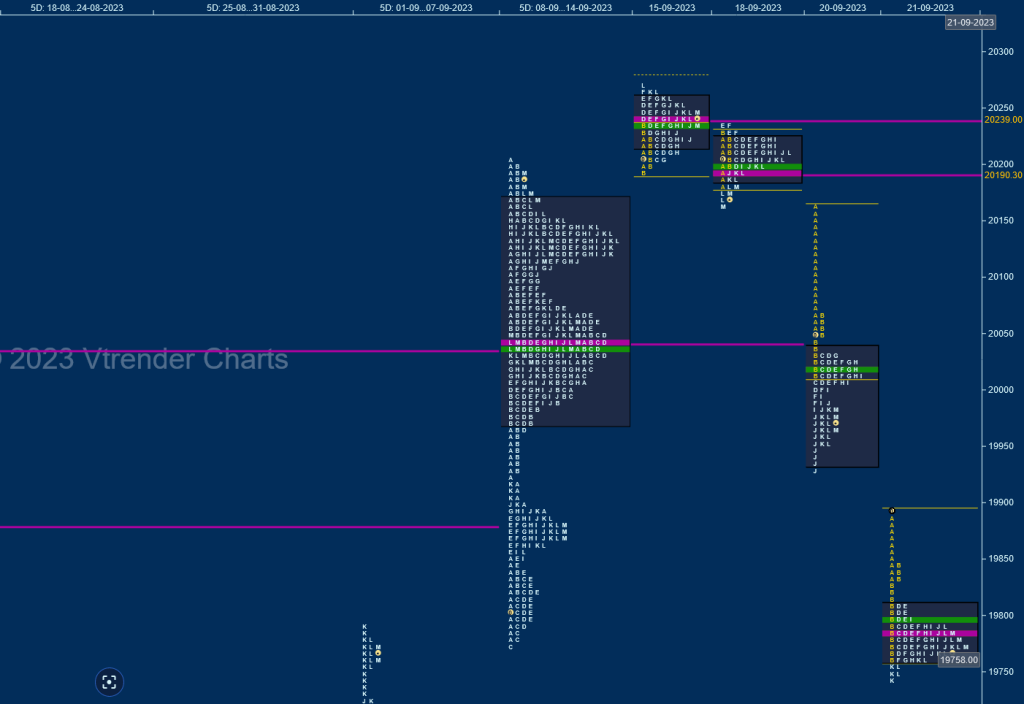

NF (Sep) Weekly Settlement Profile (15th to 21st Sep 2023)

19778 [ 20270 / 19745 ]

NF opened the week extending previous week’s Trend Day momentum by opening right at ATH of 20205 on Friday and hitting new highs of 20270 but remained in a very narrow 79 point range all day forming a Gaussian Curve with a prominent POC at 20239 indicating poor trade facilitation to the upside which got more confirmation on Monday as the auction formed yet another narrow range profile of just 72 points leaving a Neutral Extreme Day Down and confirming not just a daily FA at 20234 but also a weekly one at 20270 as it closed below 20180.

The next 2 days post the holiday on Tuesday saw a big trending move lower aided by 2 big gap down of 128 & 77 points on Wednesday & Thursday respectively as NF not only swiped through previous week’s Value and Range but went on to revisit the FA of 19772 making a look down below as it hit 19745.

The weekly profile is a Neutral Extreme one to the downside plus an Outside Bar in terms of range with the Value being overlapping to lower at 19745-19783-20070 and the VWAP of 20001 now being a positional reference for shorts to remain in control. The structure also represents a Triple Distribution with the upper HVN at 20215 which is seperated by a zone of singles from 20162 to 20065 below which comes the mid- portion HVN of 20021 followed by another zone of singles from 19951 to 19843 followed by the lower most HVN and this week’s POC of 19783 which will be the immediate reference for the upcoming final settlement week of this series staying below which the lower VPOC of 19612 could come into play along with 19603 which is the 2 ATR target from 20270 on the weekly timeframe.

Click here to view this week’s settlement profile in NF on Vtrender Charts

Business Areas for 22nd Sep 2023:

| Up | Down |

|---|---|

| 19783 – dPOC (21 Sep) 19810 – PBH (21 Sep) 19843 – Selling Tail (21 Sep) 19907 – IB singles mid (21 Sep) 19951 – Tail from 20 Sep 19982 – Closing PBH (20 Sep) | 19770 – Series POC (Sep) 19724 – Ext Handle (07 Sep) 19697 – DD VWAP (07 Sep) 19647 – PBL from 07 Sep 19616 – Buying Tail (07 Sep) 19580 – SOC from 06 Sep |

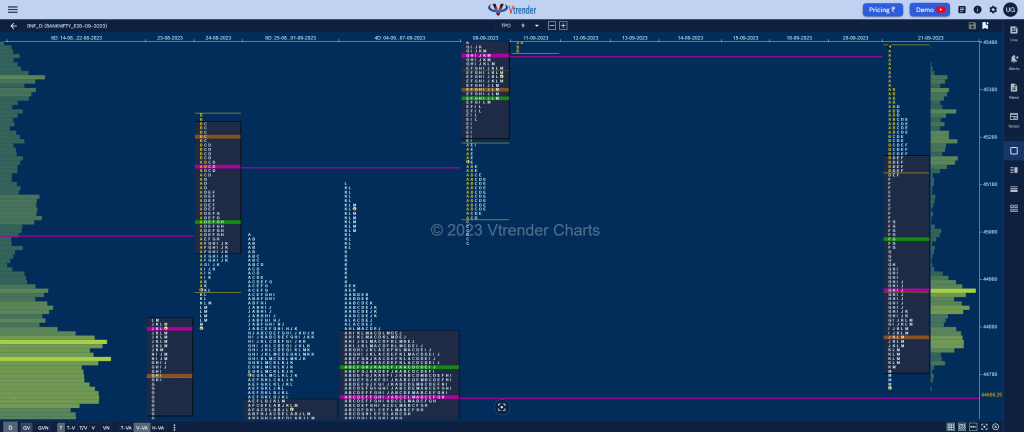

BankNifty Sep F: 44759 [ 45395 / 44671 ]

BNF also opened lower by 163 points and made an OH (Open=High) start at 45395 as it not only broke below 08th Sep’s VPOC of 45370 but went on to take out that day’s VWAP of 45283 & PBL of 45183 while making a low of 45132 in the IB forming a relatively big range of 263 points and leaving an initiative selling tail from 45300 to 45557.

The auction then consolidated for the next 3 TPOs leaving a PBH at the weekly HVN of 45266 in the D and made an attempt to extend lower but could only manage to tag 45118 taking support just above 08th Sep’s SOC of 45099 as E period also formed an inside bar but the sellers came back aggressively in the F leaving an extension handle and swiping through the rest of that NeuX profile even revisiting the FA of 44976 where it did not find any demand coming back resulting in another extension handle at 44968 in the G period where it made a low of 44810 almost completing the 2 IB target of the day.

Consolidation was seen in the H & I TPOs as BNF made marginal new lows of 44791 tapping the 4-day VAH (04-07 Sep) and getting ready for the 80% Rule which got triggered in the J & K periods as it entered the Value Area and completed the first part of the set up with a spike close from 44720 to 44671 almost tagging the composite VPOC of 44656 leaving a Double Distribution Trend Day Down with the imbalance set to continue at the next open.

Click here to view the latest profile in BNF on Vtrender Charts

- The BNF Open was an Open Auction Out of Range plus Drive Down (OAOR + D)

- The Day Type was a Double Distribution Trend Day – Down (DD)

- Largest volume was traded at 44877 F

- Vwap of the session was at 44987 with volumes of 29.7 L and range of 723 points as it made a High-Low of 45395-44671

- BNF confirmed a FA at 44976 on 08/09 and tagged the 2 ATR objective of 45794 on 12/09. This FA has not been tagged and is now a positional demand point. This FA got re-visited on 21/09 and closed below so is now a supply point

- BNF confirmed a FA at 44760 on 06/09 and 1 ATR objective to the downside comes to 44366. This FA got negated on 07/09 and tagged the 2 ATR upside target of 45577 on 11/09

- The settlement day Roll Over point (September 2023) is 44270

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively.

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively.

- The VWAP & POC of Jun 2023 Series is 43966 & 43986 respectively.

You can check the monthly charts & other swing levels for BankNifty here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 44711-44877-45161

- HVNs are at 44656** / 44736 (** denotes series POC)

Business Areas for 22nd Sep 2023:

| Up | Down |

|---|---|

| 44777 – HVN from 21 Sep 44877 – dPOC (21 Sep) 44987 – VWAP (21 Sep) 45118 – Ext Handle (21 Sep) 45266 – PBH from 21 Sep 45428 – IB singles mid (21 Sep) | 44720 – Spike High (21 Sep) 44656 – 4-day POC (04-07 Sep) 44558 – 4-day VAL (04-07 Sep) 44443 – DD VWAP (01 Sep) 44340 – Ext Handle (01 Sep) 44225 – SOC from 01 Sep |