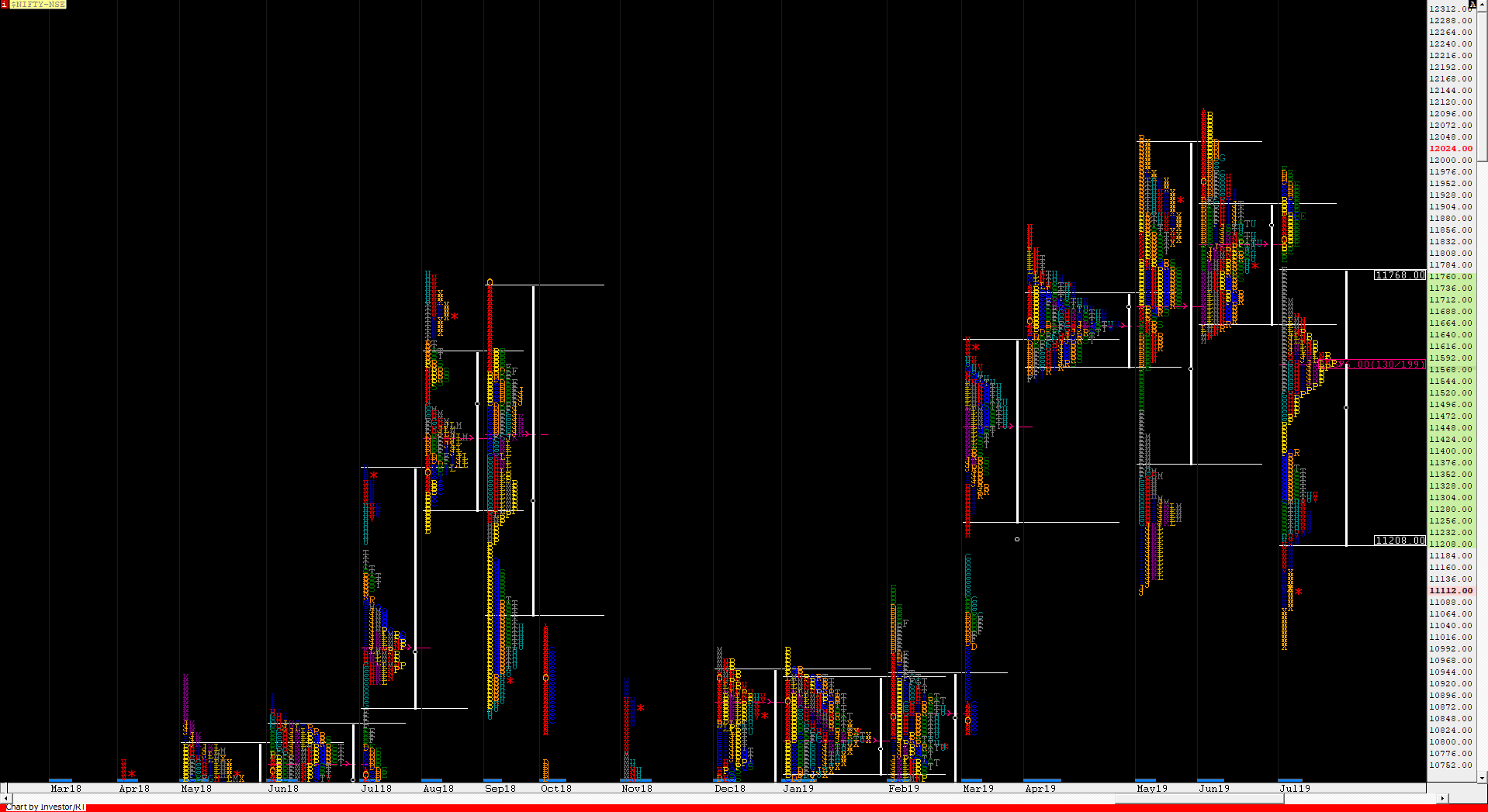

Nifty Spot – 11023 [ 11181 / 10637 ]

Monthly Profile (August)

Previous month’s report ended with this line ‘Nifty looks all set to tag the 2 ATR move down of 10776 from the monthly FA in the coming month. The monthly profile is that of a Triple Distrubution Trend Down with extension handles at 11797 & 11461 and with Value at 11208-11576-11768‘

Nifty opened this month with a drive down and probed lower making a low of 10782 on 5th August almost tagging that 2 ATR from monthly FA of 11981 which was at 10776 and having met this huge objective of a monthly time frame plus considering that the previous month was a trend down month, the auction then started to form a balance as it probed higher and went on to make new highs for the month at 11181 on 9th August where it stalled just below previous month’s Value which indicated that the upside for August could be limited. Nifty then remained in the range of 8th & 9th August for the next 6 sessions forming a nice balance before it gave another drive down open on 22nd August as it made a fresh probe lower and went on to make new lows for the month at 10718. This daily imbalance continued the next day as Nifty opened with a gap down to make lows of 10637 (which was an important reference for the fact that it was roughly the composite POC of the 4 month balance Nifty had formed from November 2018 to February 2019 before a new IPM took the auction to new lifetime highs of 12103 in June) and was swiftly rejected as it gave a rise of more than 200 points making a high of 10862 before closing at 10829. This rejection meant that Nifty was not ready to leave the balance it was forming for the month & thus turned the short term PLR to the upside as the auction rotated higher and went on to tag 11142 on 27th August confirming a FA (Failed Auction) at lows before making one final leg down as it tagged 10875 on the last day of the month to complete a nice Gaussian profile for August with and closed just above the monthly dPOC. The monthly Value was completely lower at 10856-10984-11080 with good chance that the next month could bring in an imbalance with a probable first target of 11258 on the upside if Nifty manages to sustain above 11080 which would also be the 1 ATR objective from the monthly FA. However, Nifty would remain weak if stays below 10984 for a test of 10870 below which it could move further down to test the recent lows & the FA of 10637 which if breaks could open up 10016 on the downside in the coming month(s).

Monthly Zones:

The vwap of the August series is at 10966 spot and the POC is at 10984

The settlement day (Sep) rollover volume point is at 11010 F.

The vwap of the July series is at 11547 spot and the POC is at 11576

The settlement day (Aug) rollover volume point is at 11315 F.

The vwap of the June series is at 11833 spot and the POC is at 11714

The settlement day (Jul) rollover volume point is at 11915 F.

The vwap of the May series is at 11613 spot and the POC is at 11696

The settlement day (Jun) rollover volume point is at 11980 F.

The vwap of the April series is at 11641 spot and the POC is at 11656

The settlement day (May) rollover volume point is at 11878 F.

The vwap of the March series is at 11327 spot and the POC is at 11448

The settlement day (Apr) rollover volume point is at 11673 F.

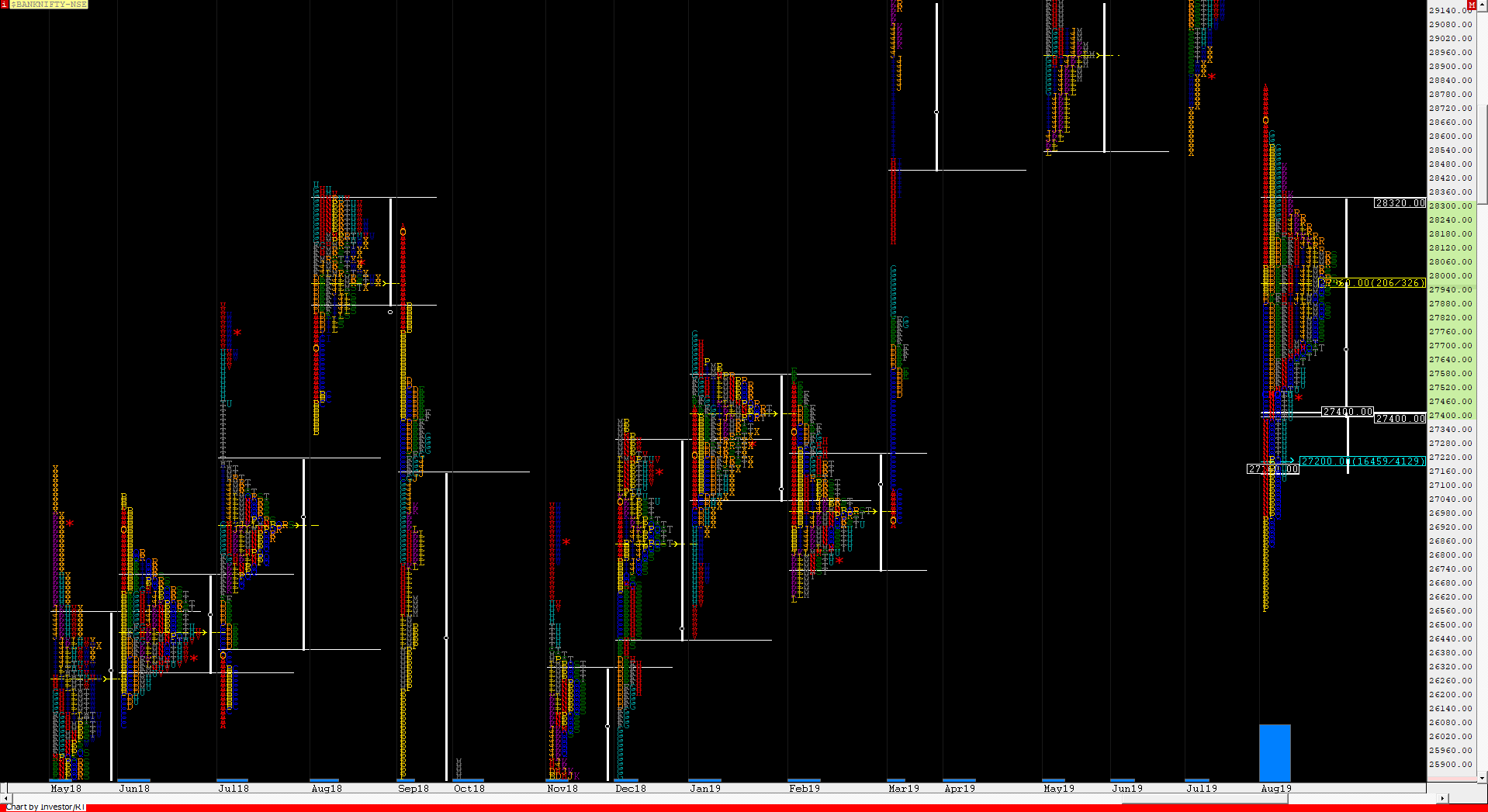

BankNifty Spot – 27428 [ 28819 / 26560 ]

Monthly Profile (August)

BankNifty gave a gap down opening in August continuing the imbalance of the previous month as it broke below previous month’s low on the first day itself and went on to tag 27389 on 5th August as it entered the singles of the monthly profile of March 2019 which was a Trend Up profile where it took support. The auction then started to form a balance making a slow rotation to the upside over the next few days as it made an attempt to get back into the previous month’s range but got rejected at 28602 where it left a daily swing high on 9th August after which BankNifty left a Trend Day Down on 13th August giving a 900 point drop as it made lows of 27683. However, this trend day did not give any follow up as the auction consolidated after the imbalance and made another slow rotation to the upside on a contracting range as it left a lower swing high of 28469 on 19th August and this was followed by another small consolidation and a spike lower on 21st August which paved way for another Trend Day down on 22nd as BankNifty went on to make new lows for the month and carried over the imbalance to the next day with a gap down open along with a drive lower as it made lows of 26560 on the 23rd from where it was swiftly rejected as it left a tail at lows of the monthly profile and gave a quick trending move to the upside as it logged the second biggest daily range of 2019 with 1136 points on 26th August and continued this imbalance on the 27th as it made a high of 28278 completing a bounce of 1700+ points from the lows. This huge move up was then retraced by over 1000 points in the last 3 days of the month as BankNifty made lows of 27122 on the 30th before closing at 27428 leaving a 3-1-3 profile on the monthly which has a selling tail from 28603 to 28819 and singles at lows from 26859 to 26560. The monthly Value was completely lower at 27400-27960-28320 and has a good chance of moving away from here over the next month(s).

Monthly Zones:

The vwap of the August series is at 27858 spot and the POC is at 27960

The settlement day (Sep) rollover volume point is at 27450 F.

The vwap of the July series is at 30425 spot and the POC is at 30560

The settlement day (Aug) rollover volume point is at 29250 F.

The vwap of the June series is at 30914 spot and the POC is at 30961

The settlement day (Jul) rollover volume point is at 31400 F.

The vwap of the May series is at 30211 spot and the POC is at 28940

The settlement day (Jun) rollover volume point is at 31644 F.

The vwap of the April series is at 30037 spot and the POC is at 29850

The settlement day (Apr) rollover volume point is at 29760 F.

The vwap of the March series is at 29061 spot and the POC is at 29778

The settlement day (Apr) rollover volume point is at 30500 F.