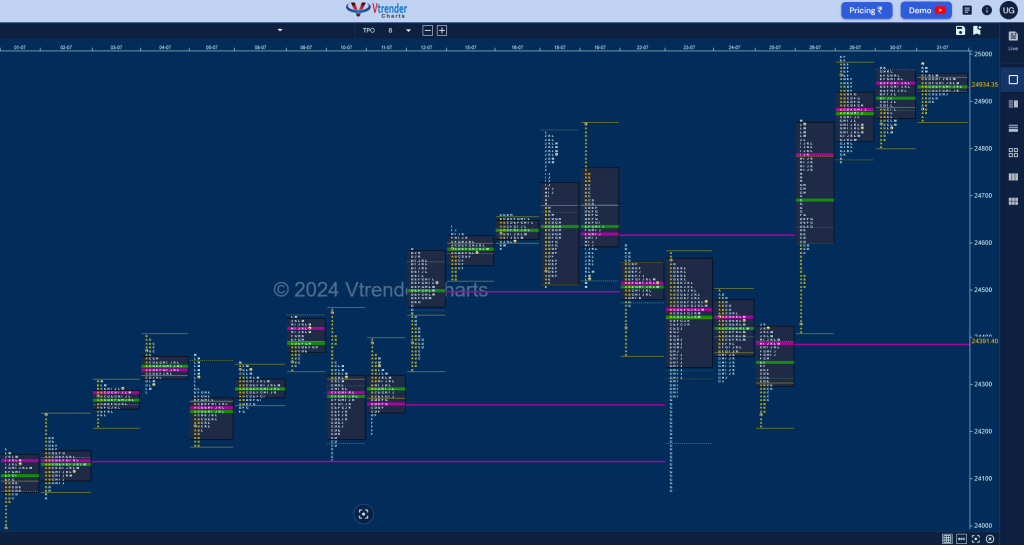

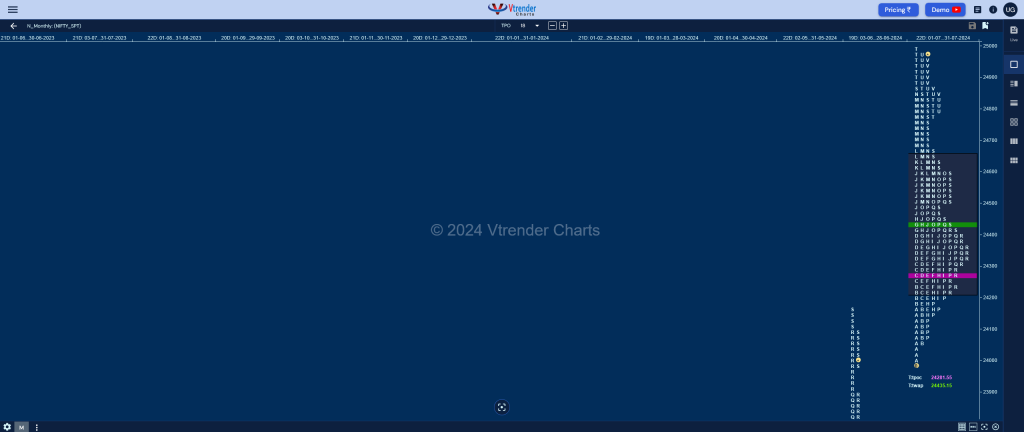

Nifty Spot: 24951 [ 24999 / 23992 ]

Previous month’s report ended with this ‘The monthly profile is an elongated 2893 point one with a close around the highs which has moved away from the 4-month composite high of 23110 which will be the Swing reference for the rest of the year along with 07th Jun’s halfback of 23054 with the immediate support being at 27th’s VPOC of 23950 and the lower one at this month’s POC of 23536 whereas on the upside, Nifty will have to sustain above the July Roll Over point of 24110 to continue in this unchartered territory. June’s Value area zone is at 22267-23535-23753‘

Nifty opened the month with an initiative buying tail from 24056 to 23992 on 01st Jul which got tested & validated the very next day clearly indicating that the buyers continued to control the bigger time frame auction as it went on to form a bullish Normal Variation profile for the month with completely higher Value at 24218-24338-24657 with the series VWAP at 24470 which is around where even the Roll Over point of August futures came in (RO point at 24460) and will be the important Swing support for the coming month but the immediate reference as we enter into August would be the 3-day closing POC of 24935 below which we have the 26th Jul Trend Day extension handles of 24721, 24656 & 24610 along with the A period buying tail from 24511 to 24410.

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 24460

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22469 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

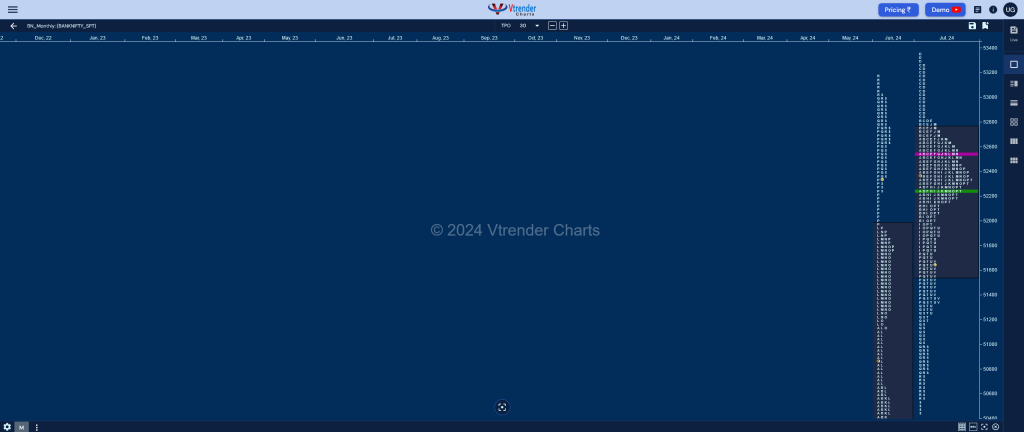

BankNifty Spot: 51553 [ 53357 / 50438 ]

Previous month’s report ended with this ‘The monthly profile is a expanded one in an humungous range of 7103 points which extended on both sides with regard to May’s profile forming an outside bar both in terms of range and value with an important responsive buying tail from 46446 to 46077 at the lows and couple of extension handles at 51133 & 51957 which will be the support levels going forward with the POC of 49947 being the Swing reference where as on the upside, the responsive selling tail from 53030 to 53180 would be the immediate zone to watch. June’s Value area zone is at 47499-49947-51966‘

BankNifty opened the month with an equal fight between the OTF (Other Time Frame) buyers and sellers as it made a sequence of ‘p’ shape profile followed by a ‘b’ shape one over the first 4 days and left an important A period selling tail from 53225 to 53357 on 04th Jul when it recorded new ATH after which it remained below that day’s POC of 52961 forming a Normal Variation Down profile for the month which went on to test June’s series VWAP of 50519 as it made a low of 50438 on the 26th and left an opposing A period buying tail till 50617 marking the end of the downside and forging a Trend Day Up as it made a sharp bounce back to 51398 and continued this imbalance resulting in a bounce back to 52340 on 29th where it tagged 23rd Jul’s VPOC of 52195 but stalled at the developing monthly POC of July and coiled for the last 2 days of the month closing around the 3-day POC of 51550. Value for the month was overlapping to higher at 51567-52233-52747 but the close has been at the lower end so the PLR for the coming month could continue to be lower with 52233 being a Swing reference on the upside with the August RollOver point of 51845 being the immediate supply level on watch.

Monthly Zones

- The settlement day Roll Over point (Aug 2024) is 51845

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48367 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 48176 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively