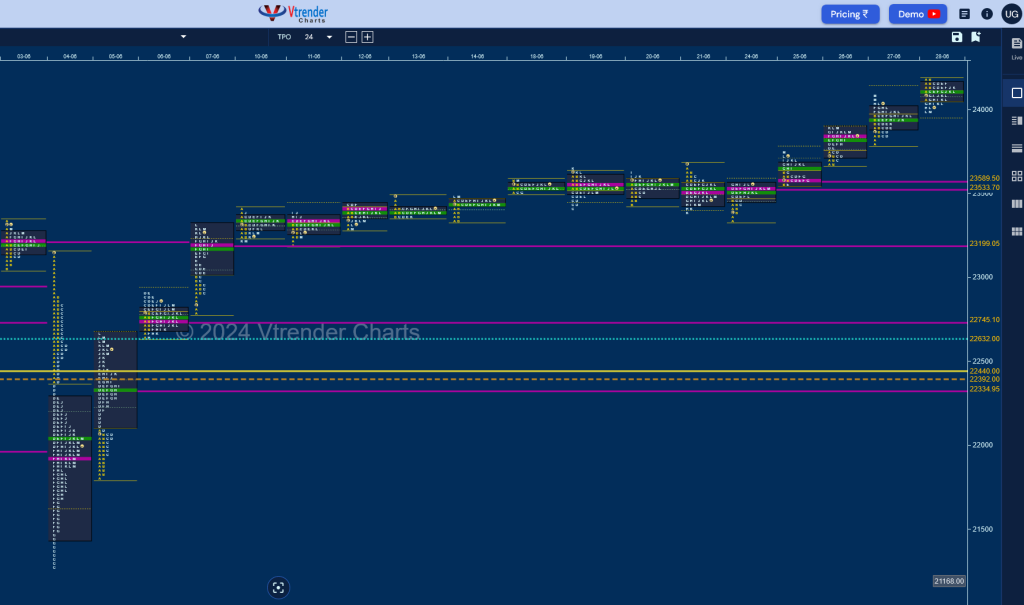

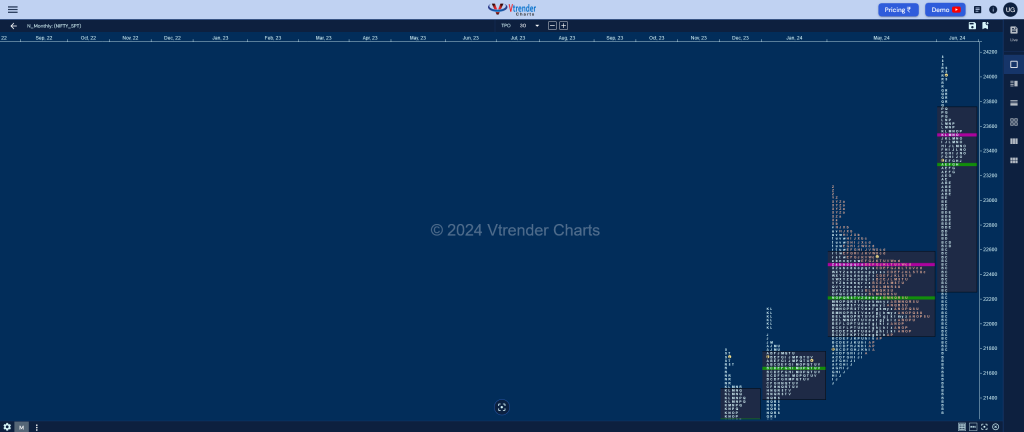

Nifty Spot: 24010 [ 24174 / 21281 ]

Previous month’s report ended with this ‘On the bigger timeframe, we have a huge 4-month balance which has been forming with the composite Value at 21903-22481-22577 so we need to get some definite cues of a move away from this which can result in a fresh imbalance with objectives of 23250, 23520 & 23925 on the upside whereas on the downside, below 21903 the lower targets would be 21500, 21229 & 20555 for the month of June‘

Nifty opened the month with a big gap up of 807 points on 03rd Jun hitting the first objective of 23250 on the upside but made an OH (Open=High) start at 23338 which was followed by a huge drop lower on 04th June which was the election results day where it tagged the weekly VPOC of 21300 (12th to 16th Feb 2024) almost completing the second objective downside of 21229 while making a low of 21281 where it left a long responsive buying tail till 21481 signalling secure lows for the month.

The auction then followed it up with an initiative buying tail on 05th forming a Trend Day Up which confirmed that the PLR (Path of Least Resistance) had changed to the upside and went on to forge a trending profile higher for the rest of the month completing the other 2 objectives of 23520 & 23925 as it got above the BRN (Big Round Number) of 24000 and hitting new ATH of 24174 at open on the last day of June.

The monthly profile is an elongated 2893 point one with a close around the highs which has moved away from the 4-month composite high of 23110 which will be the Swing reference for the rest of the year along with 07th Jun’s halfback of 23054 with the immediate support being at 27th’s VPOC of 23950 and the lower one at this month’s POC of 23536 whereas on the upside, Nifty will have to sustain above the July Roll Over point of 24110 to continue in this unchartered territory. June’s Value area zone is at 22267-23535-23753

Monthly Zones

- The settlement day Roll Over point (Jul 2024) is 24110

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22469 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

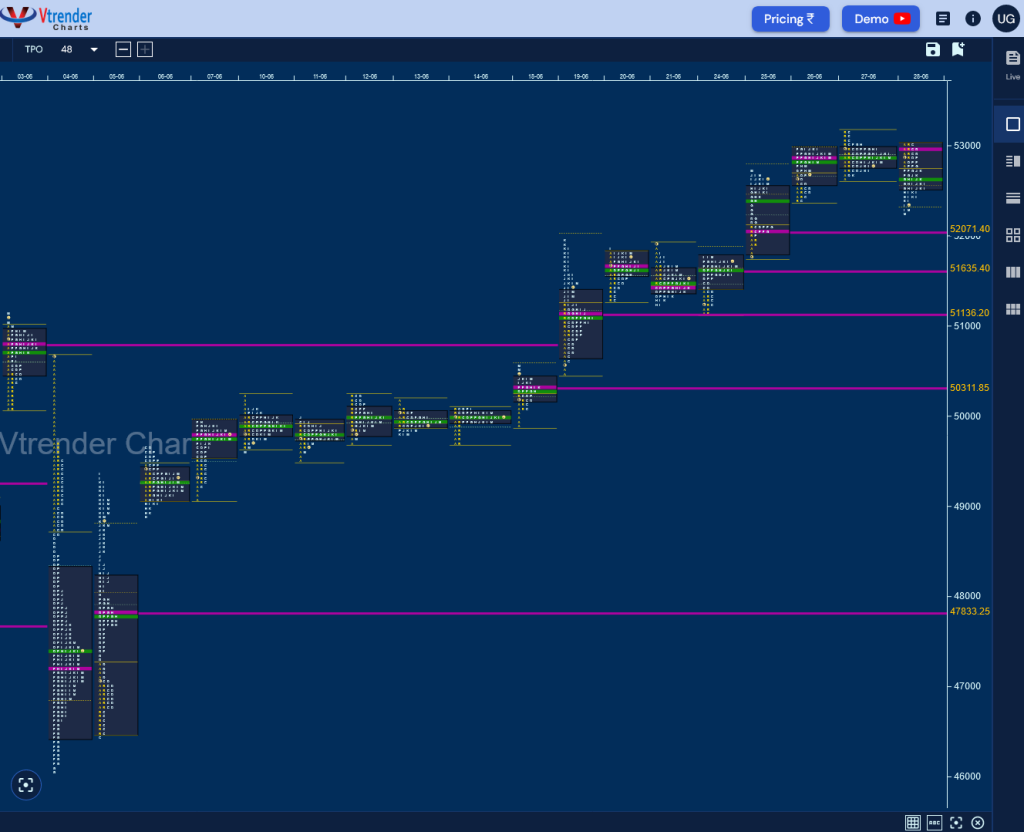

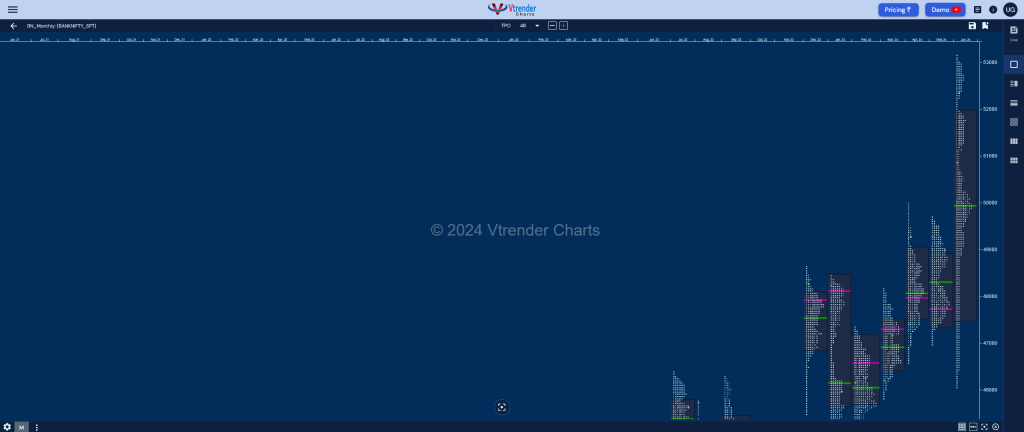

BankNifty Spot: 52342 [ 53180 / 46077 ]

Previous month’s report ended with this ‘The Monthly profile is a Neutral Centre One which was completely inside previous range and has formed mostly inside Value at 47374-47726-48881 showing rejection at the extremes of April as seen in the responsive tails once again in May with the lower one being from 47313 to 46983 whereas the one at top from 49607 to 49688 with a close around the VAH but below the RO point of 49047 which will be the immediate reference on the upside staying above which a probe towards ATH of 49974 & 50720 will be a probability whereas on the downside, this month’s VAH of 48881 will be the immediate support below which the series VWAP of 48367 & POC of 47726 would be the lower levels on watch and a break of which would give a test of the tail at lows‘

BankNifty was expected to give a trending move after the inside bar it made in May 2024 but what happened was more of a Tsunami than a wave as it first opened the month with a huge gap up of almost 2000 points and hit new ATH of 51133 with a spike close on 03rd Jun which not only got rejected but confirmed a weekly FA (Failed Auction) on the important day of 04th Jun triggering a massive drop of 4589 points as the auction not only completed the 2 ATR objective of 48492 but went on to break below the last 2 month’s responsive buying tails from 47313 (May) and 46982 (Apr) and almost tagged the March 2024 singles from 46022 as it made a low of 46077 marking the end of the downside giving more than a 1000 points bounce back to 48083 into the close.

The auction gave more confirmation of the PLR turning to the upside as it left a FA on 05th Jun at 46446 which was right near a weekly VPOC of 46438 (18-22 Mar) and promptly completed the 2 ATR target on the same day and went on to make a high of 49363 after which it followed up with a series of higher value formation on the daily timeframe even negating the 03rd Jun’s Swing reference of 51133 forming a POC right there on 19th Jun as it went on to record new ATH of 51957.

The big imbalance then led to a balance being formed between 20th to 24th Jun as BankNifty took support at right at the reference of 51133 and went on to form a composite POC at 51627 from where it gave a fresh move away in the final week culminating with new ATH of 53180 on 27th Jun confirming a Swing High on the daily timeframe as the last day of the month saw big profit booking resulting in a drop down to 52242 into the close.

The monthly profile is a expanded one in an humungous range of 7103 points which extended on both sides with regard to May’s profile forming an outside bar both in terms of range and value with an important responsive buying tail from 46446 to 46077 at the lows and couple of extension handles at 51133 & 51957 which will be the support levels going forward with the POC of 49947 being the Swing reference where as on the upside, the responsive selling tail from 53030 to 53180 would be the immediate zone to watch. June’s Value area zone is at 47499-49947-51966

Monthly Zones

- The settlement day Roll Over point (Jul 2024) is 52830

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48367 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 48176 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively