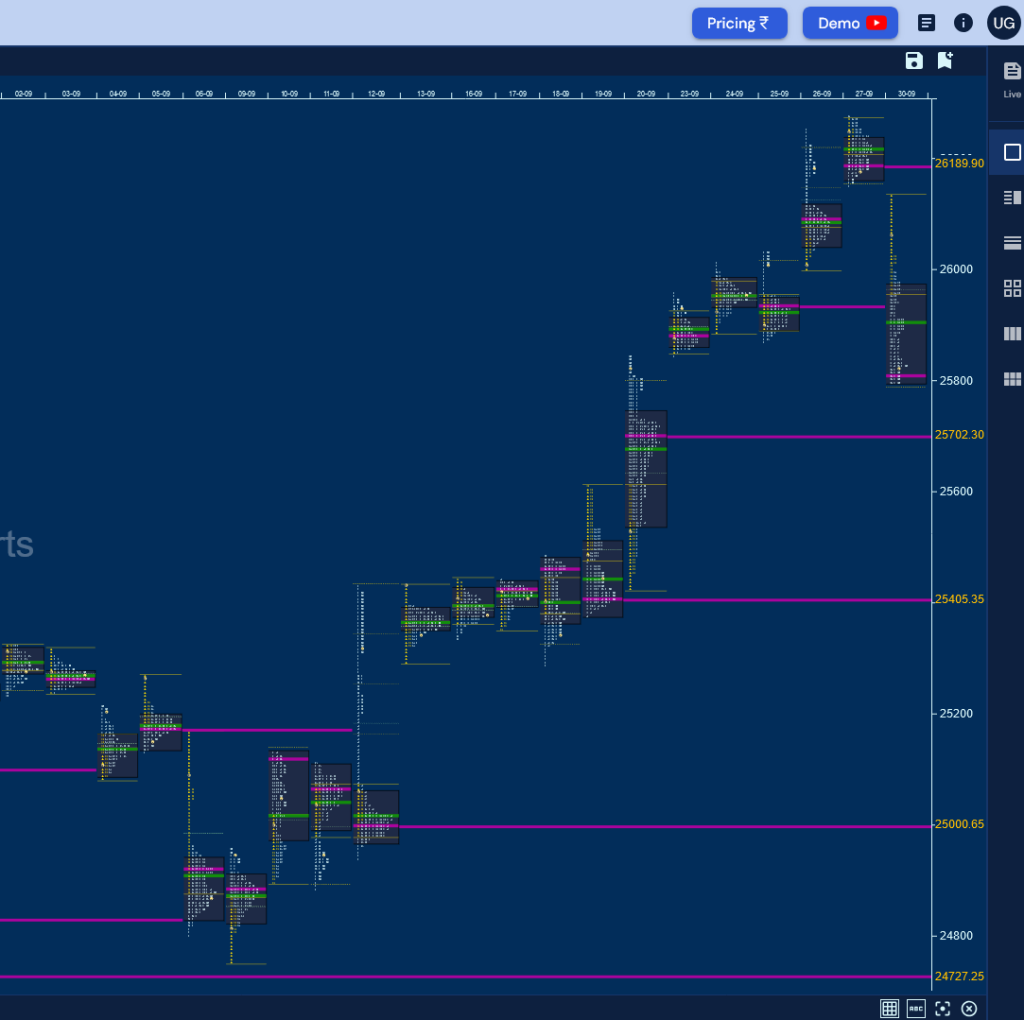

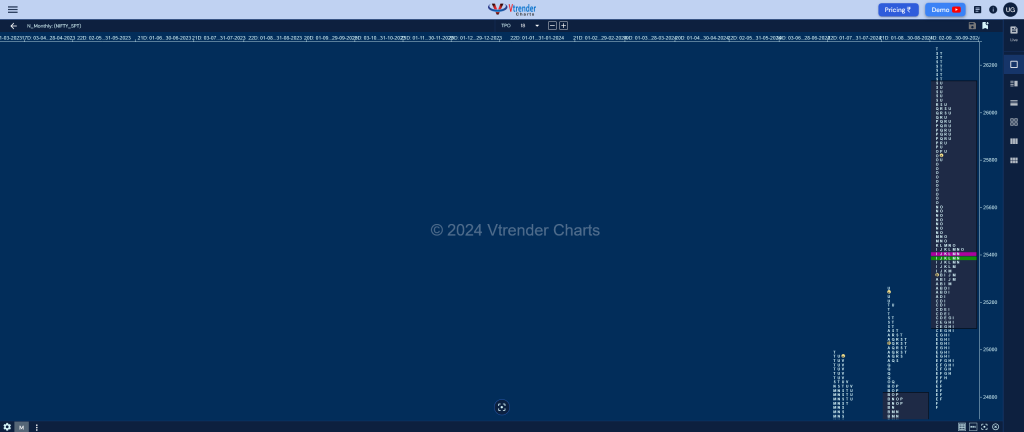

Nifty Spot: 25810 [ 26277 / 24753 ]

Previous month’s report ended with this ‘The monthly profile is a Neutral One as it first dropped by a whopping 1184 points in the first 3 sessions but took support at an important Swing level of 23889 and not only retraced the entire fall but went on to leave an extension handle at 25129 closing in an imbalance and a range of 1375 points forming an outside bar both in terms of range & value which is at 23912-24323-24810 with the August series VWAP at 24588. The September NF RollOver (RO) point of 25270 will be the immediate reference on the upside as we enter a new series staying above which the imbalance can continue towards 25332 & 25490 as immediate objectives whereas on the downside, the nearest VPOC of 25098 along with the FA at 24998 will be the support levels to watch below which we have the lower VPOCs of 24831 / 24727 / 24581 / 24505 & 24157‘

Nifty opened higher hitting new ATH of 25333 but left similar highs and a 2-day balance indicating exhaustion which triggered a probe lower for the rest of the week as it broke below the RO point of 25270 and negated the extension handle of 25129 tagging the VPOC of 25098 which was followed by a break of the FA of 24998 leading to a further drop to the lower VPOC of 24831 as it closed the first week at 24852.

The second week started with new lows of 24753 but the auction took support just above the VPOC of 24727 leaving an initiative buying tail signalling the end of the downside and went on to climb higher hitting new ATH of 25430 into the close of the week after which it consolidated for most part of the third week forming overlapping value and building a composite POC at 25415 before it gave a signal that it is ready to resume the upside on the last Friday of the third week where it left a daily extension handle at 25612 and spike higher from 25807 to 25849 into the close.

The spike zone was accepted at the start of the fourth week with a FA (Failed Auction) getting at 25847 signalling that the buyers were in control and went on to form an irregular trend up profile for the week completing the 2 ATR objective of 26272 while making a high of 26277 on Friday where it left another FA with a typical C side move signalling the end of the upmove and more confirmation came in form of a Trend Day Down on the last day of the month as Nifty completed the 2 ATR objective of 25829 while making a low of 25794.

The monthly profile is once again a Neutral one with completely higher value at 25093-25415-26132 but has closed off the highs leaving a FA at 26277 and a daily VPOC at 26190 along with the 30th Sep’s Trend Day Halfback of 25964 which will be the sell side levels to watch for in the coming month as Nifty is way below the Oct RollOver (RO) point of 26310 whereas on the downside, the closing daily POC of 25810 will be the immediate reference below which a probe to the lower VPOCs of 25702, 25405, 25000 & 24888 is possible with the daily extension handle of 25612 & the series VWAP of 25539 being a small support zone.

Monthly Zones

- The settlement day Roll Over point (Oct 2024) is 26310

- The VWAP & POC of Sep 2024 Series is 25539 & 25415 respectively

- The VWAP & POC of Aug 2024 Series is 24588 & 24323 respectively

- The VWAP & POC of Jul 2024 Series is 24470 & 24338 respectively

- The VWAP & POC of Jun 2024 Series is 23247 & 23535 respectively

- The VWAP & POC of May 2024 Series is 22469 & 22479 respectively

- The VWAP & POC of Apr 2024 Series is 22402 & 22457 respectively

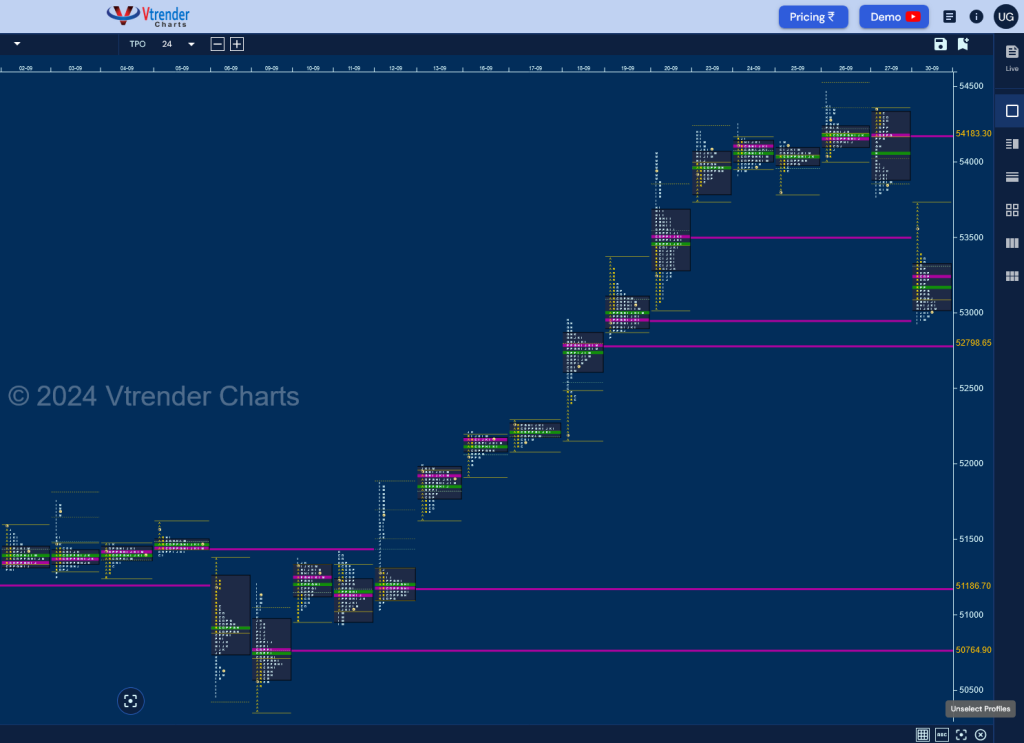

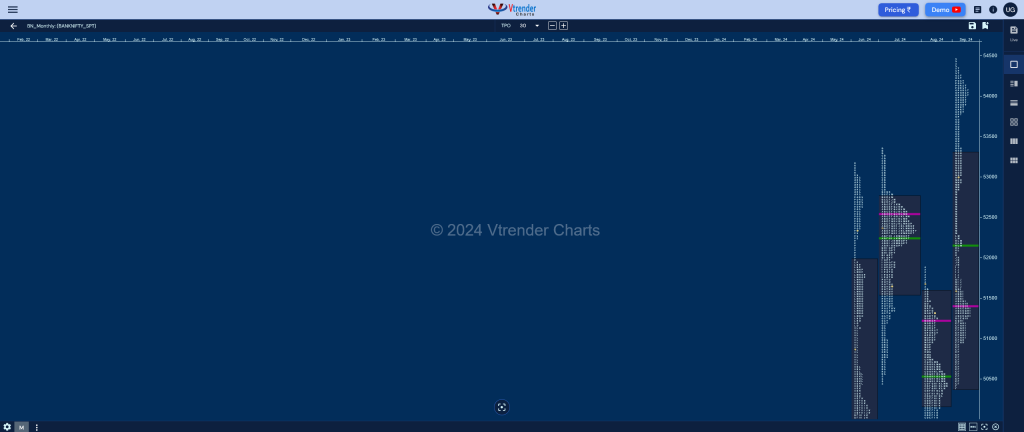

BankNifty Spot: 52978 [ 54467 / 50369 ]

Previous month’s report ended with this ‘The monthly profile is a long liquidation ‘b’ shape one with a selling tail from 51608 to 51877 and mostly lower Value at 50181-50415-51578 with the series VWAP being at 50629. For the coming month, the FA at 51466 will be the immediate supply point to watch above which it can go for a test of 01st Aug’s VPOC of 52133 whereas on the downside, the prominent 4-day POC (26-29 Aug) of 51214 will the the first support below which BankNifty can go for a test of the 21st Aug VPOC of 50520‘

BankNifty took out 51466 & made an attempt to get into previous month’s selling tail from 51602 to 51877 in the first week but got rejected from 51750 confirming a weekly FA there as sellers seized the initiative by dropping it down to 50447 with a Trend Day Down on Friday and made new lows of 50369 at open at the start of the second week looking set to tag the 1 ATR objective of 50223 but left an A period buying tail marking the end of the downside after which formed a 3-day balance above Monday’s POC of 50765 building a prominent POC at 51186 as it was the turn of the buyers to build a base from where they took off in style not only tagging Aug high of 51877 but scaling above it with new highs of 51994 into the close of the week.

The auction started the third week with an initiative buying tail not just on Monday but repeated the same over the next 2 sessions as it got into the Jul 4th ATH profile almost tagging the VPOC of 52961 while making a high of 52954 on 18th Sep leaving a Double Distribution Trend Day up of 800 points and followed it with a narrow miss of the ATH of 53357 the next session where it hit 53353 but the buyers were persistent and not only did they manage to get above 53357 on Friday but forced a meltup from 53712 to 54066 into the close.

BankNifty opened the last week with a buying tail above the reference of 53712 and went on to record new ATH of 54467 on Thursday but left a responsive selling tail confirming profit booking by the buyers which was followed by a Trend Day Down on Friday as the sellers took control to bring it back to 53763 forming a nice Gaussian Curve on the weekly timeframe and confirmed an Open Drive Down on the last day of the month falling by another 800 points negating the extension handles of 53712 & 53353 while tagging the 19th Sep’s VPOC of 52944.

The monthly profile is an elongated 4098 points range Neutral one with overlapping to higher value at 50378-51404-53291 which has made a deep 1500 point range retracement from the ATH of 54467 after leaving an important responsive selling tail right at the RollOver (RO) point of 54340 along with a daily VPOC at 54183. The immediate support will be the daily VPOC of 52798 and a break of which can get the 18th Sep halfback of 52554 along with the extension handle of 52284 into play whereas on the upside, 30th Sep’s halfback of 53326 is the first hurdle along with the SOC of 53741 which can prove to be a major supply point for the coming month.

Monthly Zones

- The settlement day Roll Over point (Oct 2024) is 54340

- The VWAP & POC of Sep 2024 Series is 52236 & 51404 respectively

- The VWAP & POC of Aug 2024 Series is 50629 & 50415 respectively

- The VWAP & POC of Jul 2024 Series is 52133 & 52233 respectively

- The VWAP & POC of Jun 2024 Series is 50519 & 49947 respectively

- The VWAP & POC of May 2024 Series is 48367 & 47726 respectively

- The VWAP & POC of Apr 2024 Series is 48176 & 47994 respectively