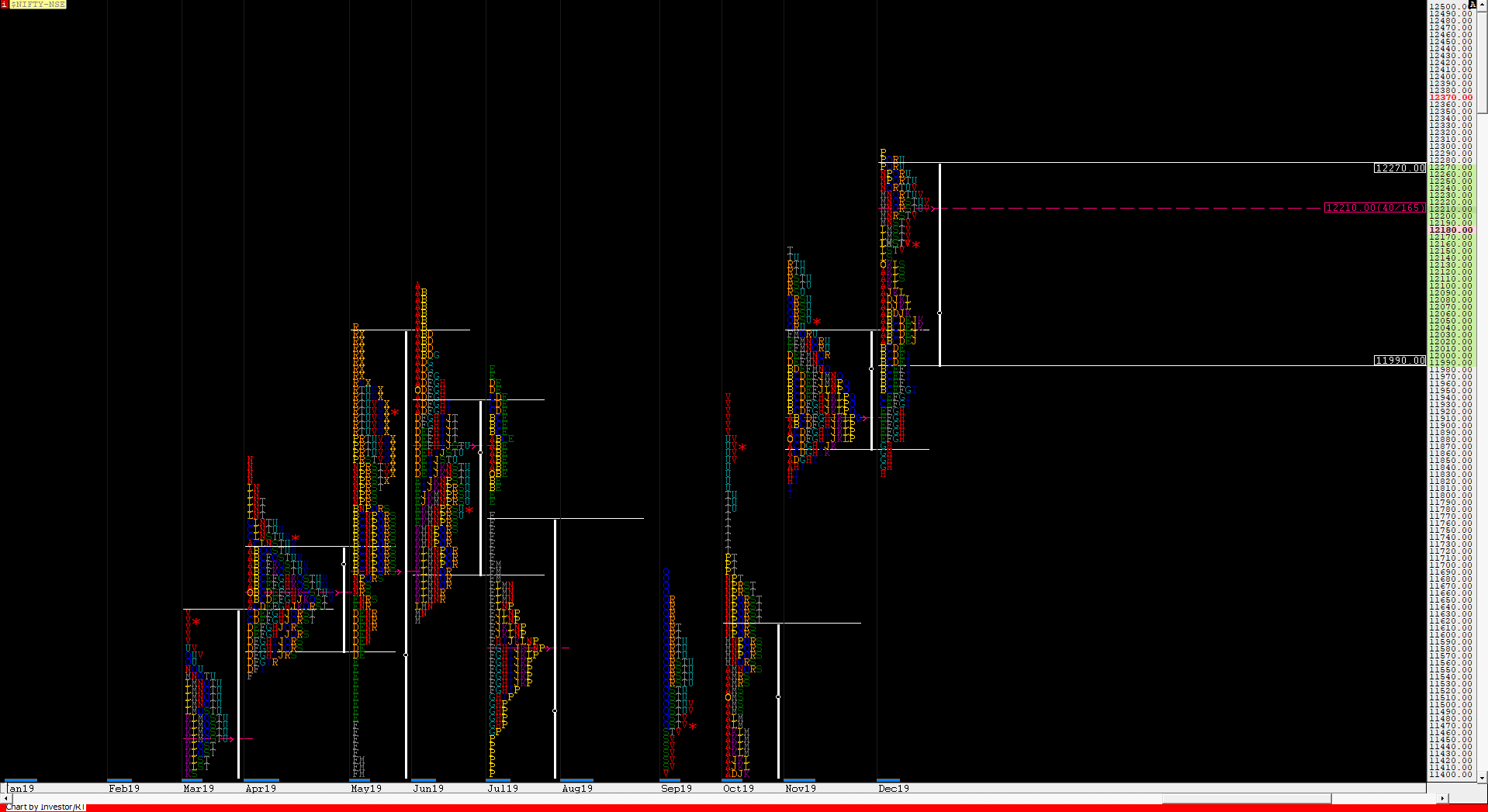

Nifty Spot – 12168 [ 12294 / 11832 ]

Monthly Profile (Decmber)

Nifty opened the month with a big gap up but was also an OH (Open=High) start at 12137 which set up a probe on the downside as the auction entered the previous month’s Value Area and completed the 80% Rule on the monthly time frame over the next 8 sessions as it made a low of 11832 on 11th Dec but got swiftly rejected from the monthly VAL to give a reverse 80% move in the monthly Value of 11870 to 12030 in the next 2 sessions itself as Nifty closed the second week at 12087. The probe to the upside continued in the third week as the auction scaled above the monthly OH start of 12137 on 17th Dec and went on to make new all time highs of 12183 and probed higher all week as it made highs of 12294 on Friday before closing around the highs. The next week however made an inside bar indicating that the upside in Nifty for the time being was done as the auction gave a retracement to 12152 on 31st Dec before closing around the monthly POC of 12182 giving a Neutral Centre profile with the Value being mostly higher at 11990-12182-12270. The PLR for the new month & the year 2020 would be to upside till the auction stays above 12152 but will also need to get accepted above 12182 & 12210 for further confirmation of fresh ATH (All Time Highs) coming in January 2020. On the downside, 12087 will be the important reference below 12152 below which the auction could test 11990 & 11962.

Monthly Zones:

The VWAP of the Dec series is at 12087 spot and the POC is at 12182

The settlement day (Jan) rollover volume point is at 12193 F.

The VWAP of the November series is at 11954 spot and the POC is at 11910

The settlement day (Dec) rollover volume point is at 12153 F.

The VWAP of the October series is at 11461 spot and the POC is at 11365

The settlement day (Nov) rollover volume point is at 11970 F.

The VWAP of the September series is at 11127 spot and the POC is at 10960

The settlement day (Oct) rollover volume point is at 11630 F.

The VWAP of the August series is at 10966 spot and the POC is at 10984

The settlement day (Sep) rollover volume point is at 11010 F.

The VWAP of the July series is at 11547 spot and the POC is at 11576

The settlement day (Aug) rollover volume point is at 11315 F.

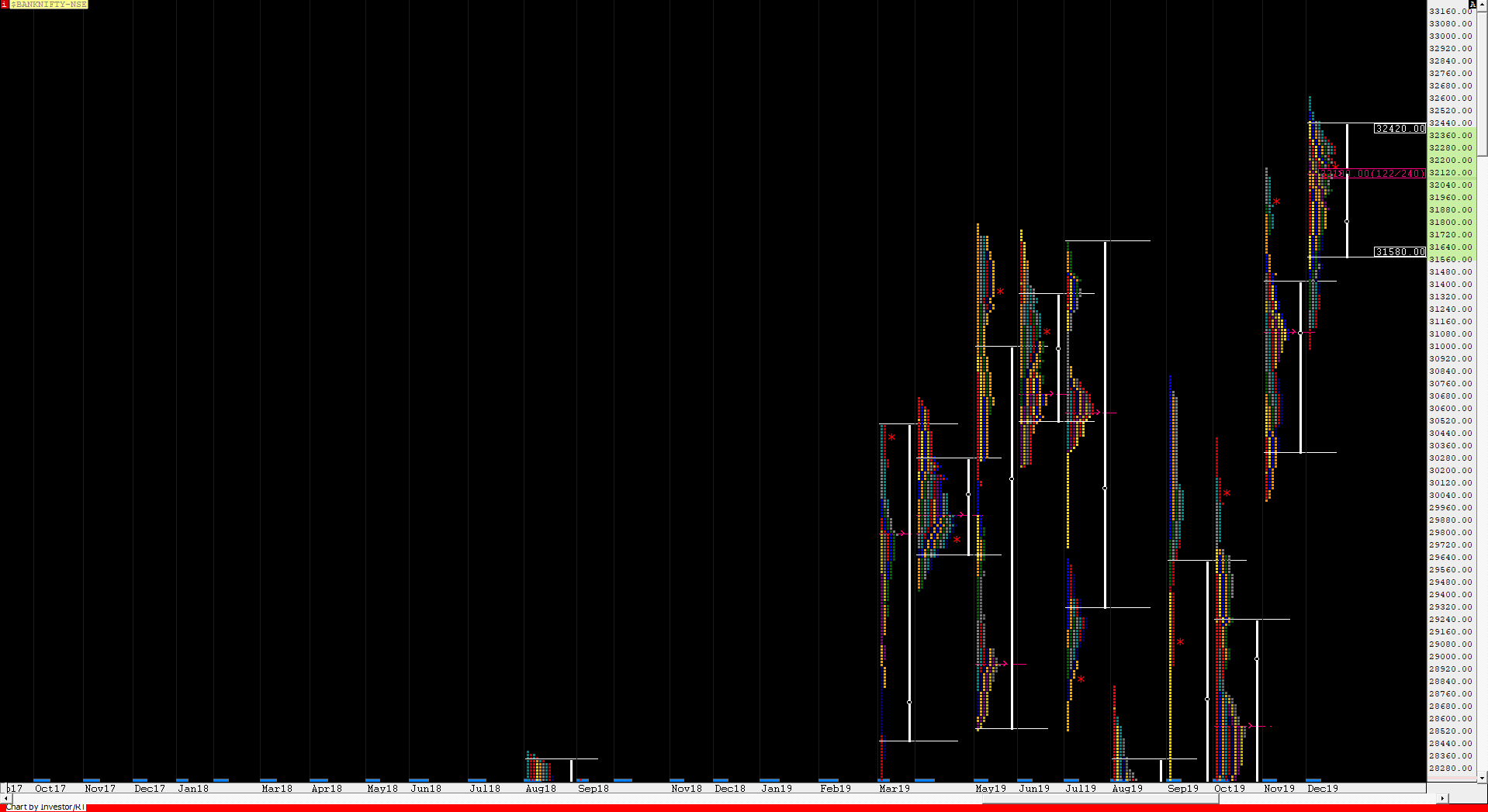

BankNifty Spot – 32162 [ 32613 / 30996 ]

Monthly Profile (December)

Previous month’s report ended with this ‘Value for the month was higher with a huge gap of more than 1000 points at 30320-31110-31400 and the immediate reference for the coming month would be the zone of 31590 to 32158 and being a Trend Up profile, this month’s VWAP of 30699 with be an important positional reference for the month(s) to come‘

BankNifty opened higher this month but got rejected at 32127 on 5th Dec as it was unable to get above the upper reference of 32158 and even confirmed a weekly FA at 32127 as it probed lower over the next 4 days breaking below the lower reference of 31590 as it got into the previous month’s Value and went on to tag the monthly POC of 31110 as it made lows of 30996 where it got swiftly rejected leaving a tail at the monthly POC which reversed the probe to the upside. The auction then trended higher over the next 8 sessions scaling above 32158 as it made new all time highs of 32503 on 23rd Dec where it confirmed a daily FA which marked the end of the leg up as BankNifty completed the 1 ATR move of 32139 on 26th Dec and looked set for the 2 ATR move down of 31775 as it trended lower all day making lows of 31963 to close in a spike down. This spike was rejected on 27th Dec as BankNifty opened with a big gap up and continued higher and even went on to make new highs for the month on 30th Dec as it negated the FA of 32503 but once again the new all time highs could not sustain as the auction confirmed a fresh FA at the new highs of 32613 and promptly completed the 1 ATR objective of 32290 on the same day and went on to make lower lows of 32108 on 31st Dec before closing the month at 32103 giving a Neutral Center monthly profile similar to Nifty. Value for the month was completely higher at 31580-32102-32420 and there is a good chance of a move away from the POC happening in the coming new month & the year 2020.

Monthly Zones:

The VWAP of the December series is at 31956 spot and the POC is at 32102

The settlement day (Jan) rollover volume point is at 32180 F.

The VWAP of the November series is at 30699 spot and the POC is at 31110

The settlement day (Dec) rollover volume point is at 32160 F.

The VWAP of the October series is at 28784 spot and the POC is at 28415

The settlement day (Nov) rollover volume point is at 30150 F.

The VWAP of the September series is at 28416 spot and the POC is at 27160

The settlement day (Oct) rollover volume point is at 30230 F.

The VWAP of the August series is at 27858 spot and the POC is at 27960

The settlement day (Sep) rollover volume point is at 27450 F.

The VWAP of the July series is at 30425 spot and the POC is at 30560

The settlement day (Aug) rollover volume point is at 29250 F.