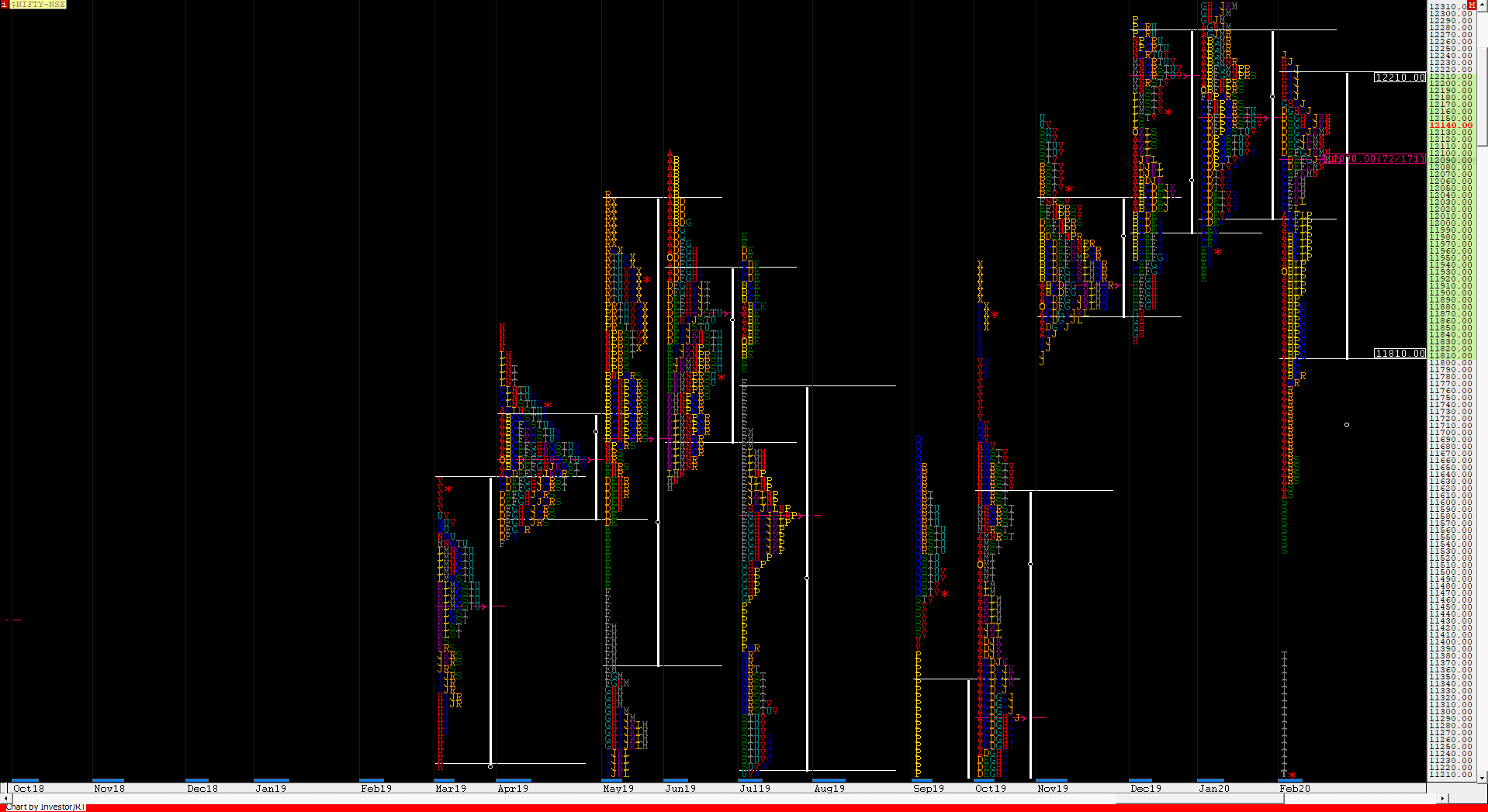

Nifty Spot – 11201 [ 12247 / 11175 ]

Monthly Profile (February 2020)

Previous month’s report ended with this ‘The monthly profile is a well balanced one with the Value similar to that of previous month but the excess at top & close around the lows has set up the coming month for a big move to the downside where Nifty could make an attempt to enter the Value of October and tag the monthly VPOCs of 11290 & 10960.‘

February started with the budget day which opened below the monthly Value & dropped by a huge range of 384 points after confirming a FA at 12017 as it made lows of 11633. The auction made a lower low on 3rd Feb at 11614 but took support right above the October monthly VAH of 11610 which was a sign that the imbalance to the downside was ending and this led to a probe to the upside in the next 3 days as Nifty got back into the previous month’s Value and went on to tag the monthly POC of 12160 to the dot on 6th Feb completing half of the 80% Rule and then gave a retracement to the monthly VAL of 12020 as it made lows of 11991 on 10th Feb but got back into the monthly Value into the close triggering a fresh 80% Rule in the monthly Value and this time it went on to get above the POC of 12160 and looked set to tag the VAH of 12280 but got stalled at 12247 on 14th Feb indicating that the upside probe was coming to a close. This in turn initiated the reverse 80% Rule in the well balanced monthly profile of Jan as Nifty not only broke below the POC of 12160 but went on to get below the VAL of 12020 as it made a low of 11908 on 18th Feb. This 300+ point move down led to a retracement over the next 2 days as the auction got back into the monthly Value but got stalled at 12152 right below the POC which was a sign that the PLR is still to the downside. Nifty then made a trending move lower in the last week of February leaving a Neutral Extreme profile on the monthly time frame as it made new lows for the month getting into October’s Value completing the 80% Rule in the same and in the process tagged that monthly VPOC of 11290 on 28th Feb closing the month in a spike down from 11614 to 11175. The monthly Value was at 11810-12090-12210 which was once overlapping with the previous 3 months giving a nice 4-month balance with Value at 11874-12132-12214.

Monthly Zones:

The VWAP of the February series is at 11944 spot and the POC is at 12125

The settlement day (Mar) rollover volume point is at 11610 F.

The VWAP of the January series is at 12178 spot and the POC is at 12132

The settlement day (Feb) rollover volume point is at 12044 F.

The VWAP of the December series is at 12087 spot and the POC is at 12182

The settlement day (Jan) rollover volume point is at 12193 F.

The VWAP of the November series is at 11954 spot and the POC is at 11910

The settlement day (Dec) rollover volume point is at 12153 F.

The VWAP of the October series is at 11461 spot and the POC is at 11365

The settlement day (Nov) rollover volume point is at 11970 F.

The VWAP of the September series is at 11127 spot and the POC is at 10960

The settlement day (Oct) rollover volume point is at 11630 F.

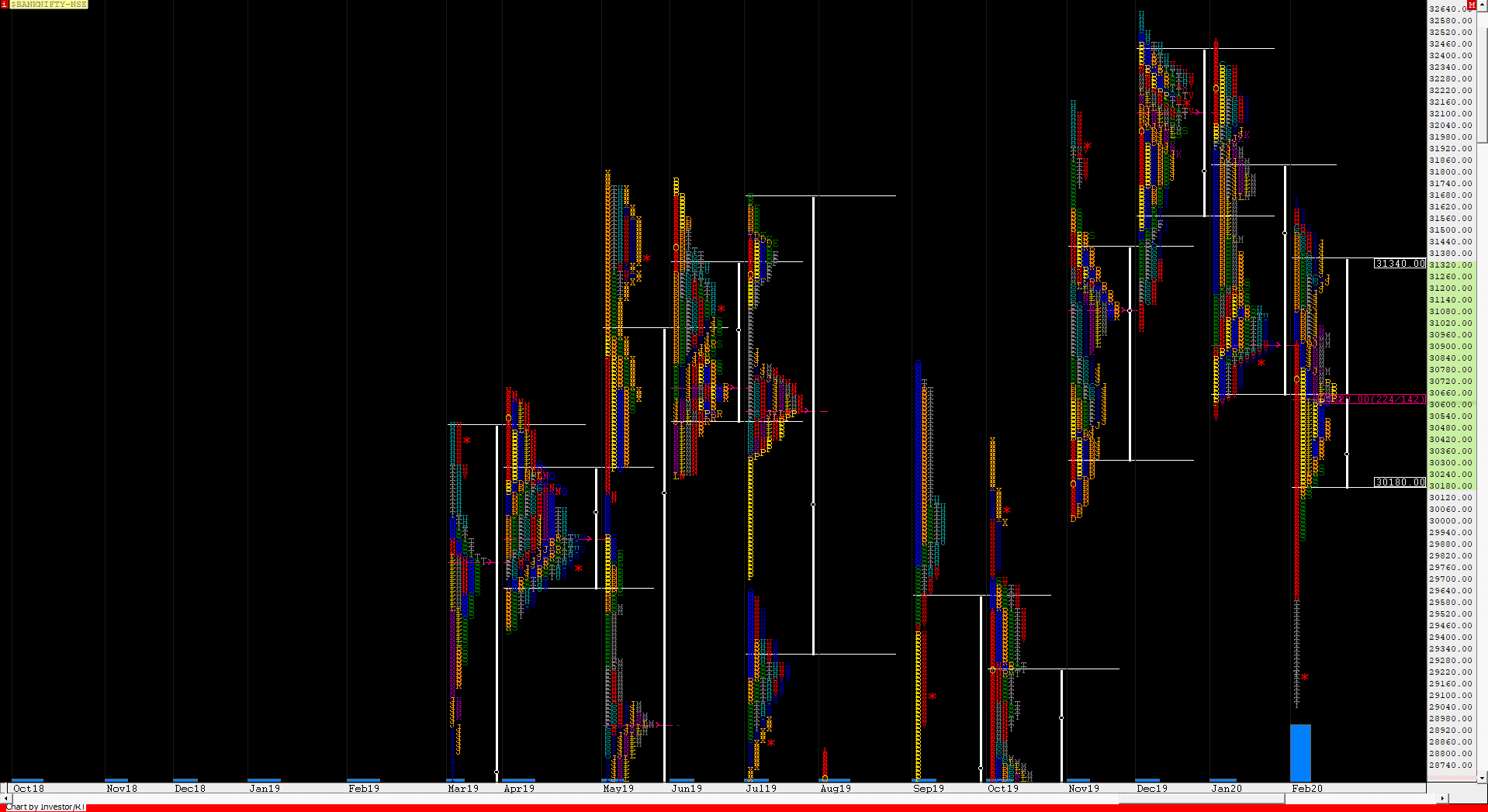

BankNifty Spot – 29147 [ 31649 / 29051 ]

Monthly Profile (February 2020)

Previous month’s report ended with this ‘The monthly Value was mostly lower & expanding to 30660-30900-31860 and acceptance below 30660 could lead to a test of October monthly spike low of 29693 below which we have that month’s VAH of 29220 and the monthly VPOCs of 28540 & 27160 as probable targets in the month(s) to come.‘

BankNifty also opened this month with a FA at 30918 on the Budget Day (1st Feb) and this coupled with the rejection from previous month’s POC of 30900 led to a huge move down of 1166 points on that day followed by the test of October’s spike low of 29693 on 3rd Feb as it made a low of 29612 but gave a bounce back to close above 30000. The auction then probed higher making new highs for the month as it got above the daily FA of 30918 on 5th Feb and took support exactly at the same level the next day after which it went on to make highs of 31470. BankNifty then made a retracement to 30957 over the next 2 days but stayed above that 30918 level indicating that the upside probe is still not over and this confirmation came after the auction then started a new leg to the upside and made new highs for the month at 31649 on 13th Feb but left a multi day FA there which led to a trending move on the downside for the next 3 days as BankNifty broke below that 30918-30900 zone and went on to make low of 30252 on 18th Feb. This imbalance of almost 1400 points then led to a bounce to 31085 on 20th Feb but the trend which had clearly changed to the downside resumed in the last week of Feb which opened with a gap down and stayed below the 30660 level and not only make new lows for the month but went on to tag the October VAH of 29220 on the last day as it made lows of 29050 before closing the month at 29147 leaving a Neutral Extreme profile for February 2020. This month’s Value was overlapping to lower at 30180-30620-31340 and the immediate reference for the next month would be the spike close of 29051 to 29914.

Monthly Zones:

The VWAP of the February series is at 30692 spot and the POC is at 30692

The settlement day (Mar) rollover volume point is at 30520 F.

The VWAP of the January series is at 31425 spot and the POC is at 32104

The settlement day (Feb) rollover volume point is at 30726 F.

The VWAP of the December series is at 31956 spot and the POC is at 32102

The settlement day (Jan) rollover volume point is at 32180 F.

The VWAP of the November series is at 30699 spot and the POC is at 31110

The settlement day (Dec) rollover volume point is at 32160 F.

The VWAP of the October series is at 28784 spot and the POC is at 28415

The settlement day (Nov) rollover volume point is at 30150 F.

The VWAP of the September series is at 28416 spot and the POC is at 27160

The settlement day (Oct) rollover volume point is at 30230 F.