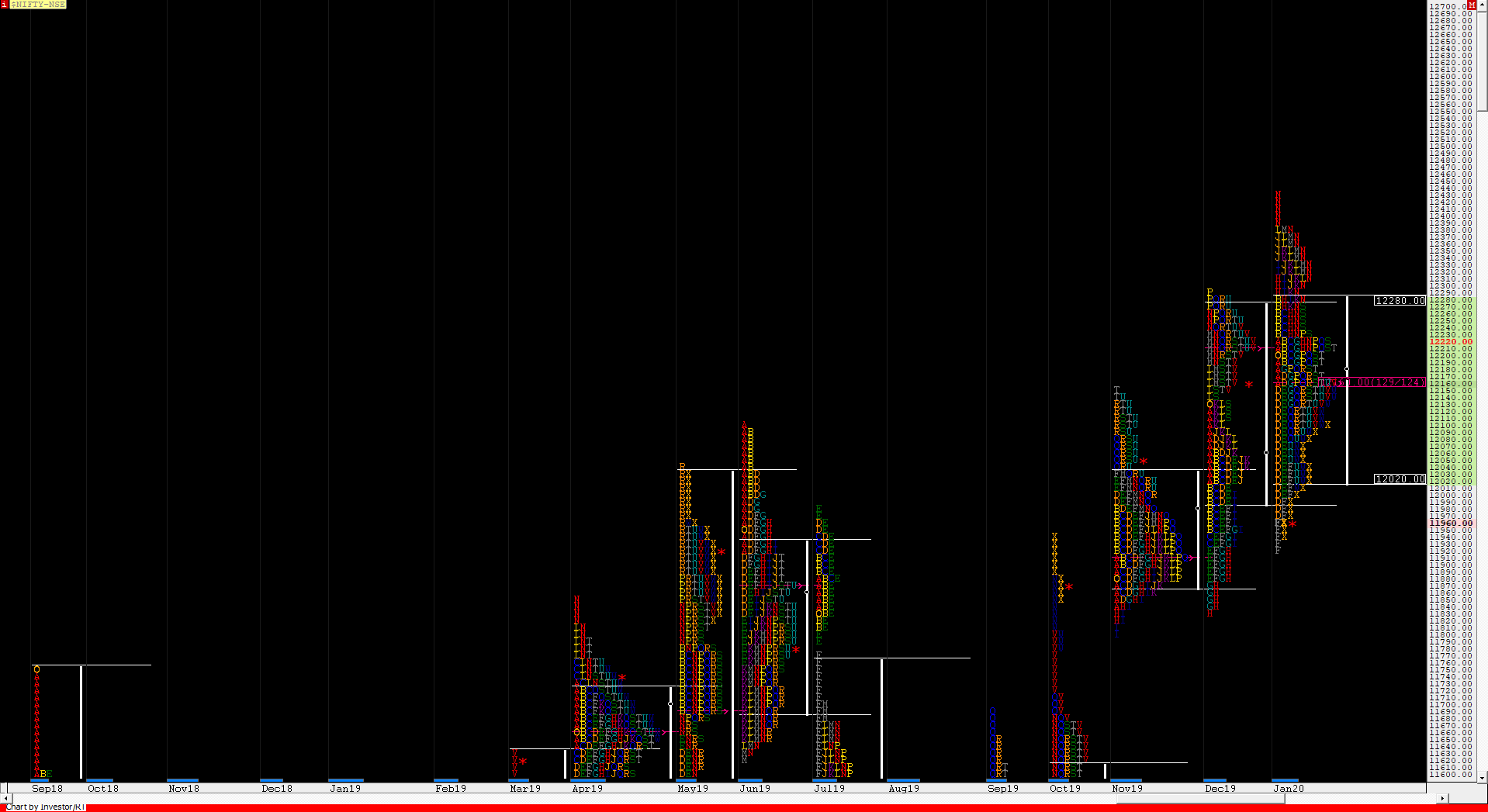

Nifty Spot – 11962 [ 12430 / 11929 ]

Monthly Profile (January 2020)

Previous month’s report ended with this ‘The PLR for the new month & the year 2020 would be to upside till the auction stays above 12152 but will also need to get accepted above 12182 & 12210 for further confirmation of fresh ATH (All Time Highs) coming in January 2020. On the downside, 12087 will be the important reference below 12152 below which the auction could test 11990 & 11962‘

Nifty began the month and the year 2020 forming a balance around the monthly POC (Dec) for the first 3 days after which it gave a move away from the 12180 zone on 6th Jan with a Open Drive Dow breaking below the first reference of 12152 and went on to break below the second reference of 12087 also as it tagged the first objective of 11990. The auction then went on to tag the second objective of 11962 also on 8th Jan as it opened with a gap down but got rejected back into the monthly Value as it left a small buying tail after making a low of 11929 which indicated end of the probe to the downside. Nifty then got above above 12152 on 9th Jan & made new ATH (All Time High) of 12311 on the 10th as it trended higher for the next 4 days but then saw a balance form at these new highs in the week from 13th to 17th Jan which signaled a pause in the upside probe from where a new move away in either direction was expected. 20th Jan will be a date which will be remembered for a long time to come as Nifty opened with a big gap up hitting new ATH of 12430 but gave an OH (Open=High) start to give the second Open Drive Down of the month as it left a huge selling tail from 12430 to 12354 to leave a Trend Day Down as it made lows of 12217 which confirmed that the PLR (Path of Least Resistance) on the larger timeframe has turned to the downside. The auction then made lower lows of 12087 on 22nd and formed a nice 3-day balance hinting at short term exhaustion in the downside and this led to a short covering ‘p’ shape profile on 24th Jan as Nifty made an attempt to move away from this balance with singles in the IB from 12200 to 12154 looking set to tag the Trend Day (20th Jan) VPOC of 12295 but got stalled at 12272 which marked the end of this short covering move. This got more confirmation as Nifty opened the last week of the month with a gap down after which it confirmed a FA (Failed Auction) at 12216 in form of a typical failed C side extension on the daily timeframe which set up the last week to the downside as the auction ended the week & month with couple of ‘b’ shape profiles indicating long liquidation while it completed the 2 ATR objective of 12000 from the FA and went on to make lows of 11945 before closing the month at 11962. The monthly profile is a well balanced one with the Value similar to that of previous month at 12020-12160-12280 but the excess at top & close around the lows has set up the coming month for a big move to the downside where Nifty could make an attempt to enter the Value of October and tag the monthly VPOCs of 11290 & 10960. (Click here to view the October Monthly Profile)

Click here to view the day wise auction of this month

Monthly Zones:

The VWAP of the January series is at 12178 spot and the POC is at 12132

The settlement day (Feb) rollover volume point is at 12044 F.

The VWAP of the December series is at 12087 spot and the POC is at 12182

The settlement day (Jan) rollover volume point is at 12193 F.

The VWAP of the November series is at 11954 spot and the POC is at 11910

The settlement day (Dec) rollover volume point is at 12153 F.

The VWAP of the October series is at 11461 spot and the POC is at 11365

The settlement day (Nov) rollover volume point is at 11970 F.

The VWAP of the September series is at 11127 spot and the POC is at 10960

The settlement day (Oct) rollover volume point is at 11630 F.

The VWAP of the August series is at 10966 spot and the POC is at 10984

The settlement day (Sep) rollover volume point is at 11010 F.

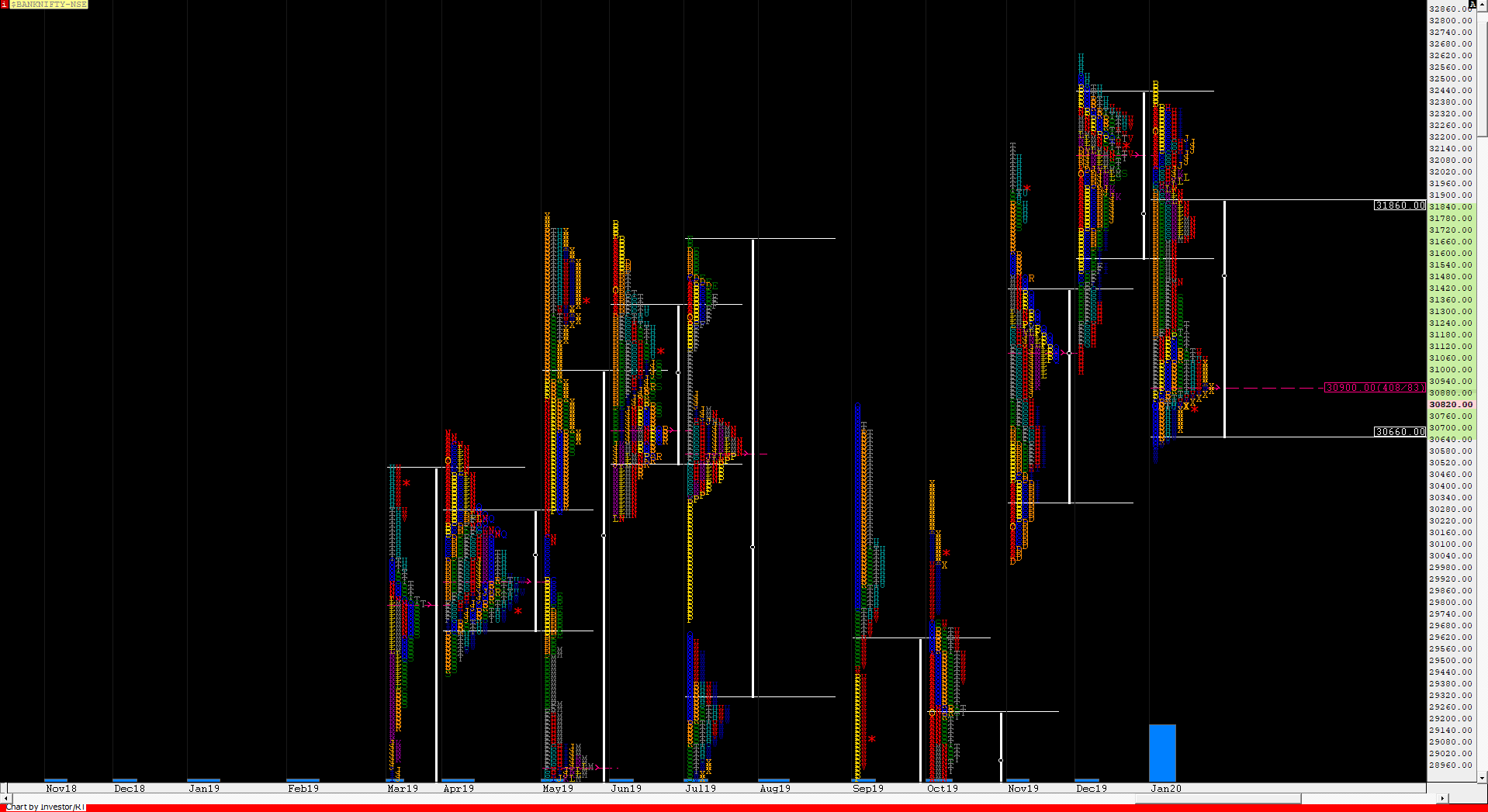

BankNifty Spot – 30834 [ 32465 / 30521 ]

Monthly Profile (January 2020)

BankNifty also opened this month with a 3-day balance around previous month’s POC of 32100 but gave a swift rejection from an attempted probe above the monthly VAH of 32420 on 2nd Jan as it gapped lower on 3rd leaving a selling tail from 32465 to 32257 setting up the probe firmly to the downside for the next few days as it not only completed the 80% Rule in previous month’s Value but went on to break below previous month’s low of 30996 as it made lows of 30899 in the gap down on 8th Jan where it indicated the end of the probe lower with a buying tail from 31050 to 30899. The auction then made a quick retracement of the entire fall over the next couple of days as it got into the selling tail on 10th Jan and made highs of 32347 but was rejected from above the highs of 3rd Jan indicating that the supply is still prevalent in this zone after which it made a 4 day composite ‘p’ shape profile from 9th to 14th Jan with the POC at 32103. BankNifty then trended lower for the next 5 days forming lower Value on the daily with a Trend Day Down on 20th Jan where it left a big selling tail from 31531 to 31923 and went on to tag the start of the buying tail at 31050 with the POC at 31403 which would then on be an important reference for the rest of the month. BNF then negated that buying tail of 31050 to 30899 and made new lows for the month as it even broke 30699 (which was an important reference being the VWAP of the trending monthly profile of Nov) ending the bullish bias on the larger timeframe as it made lows of 30614 on 22nd Jan. The auction then gave a retracement over the next 2 days in form of a short covering bounce as it made highs of 31375 on 24th Jan getting stalled just below the 31403 level which confirmed that sellers were still in control. The last week of Jan began with a FA getting confirmed on the daily timeframe on 27th Jan at 31227 which set up a fresh move to the downside as BankNifty confirmed 2 more FAs on the next 2 days at 31048 (which got briefly negated) and 31082 showing that fresh selling was happening at every rise or RE (Range Extension) to the upside. The auction then gave a Open Drive Down on 30th Jan and even made multiple RE’s to the downside but could not even tag the 1.5 IB extension as it made lows of 30521 leaving a ‘b’ shape profile for the day which meant that the sellers were not doing a good job or that some weak hands have got into the market. BankNifty then opened with a big gap up of 300 points on the last day of the month mostly forcing these weak shorts to cover as it left a Neutral Day but not before it confirmed yet another FA (4th of the week) at 31033 and closed the month at 30834 looking set for the 1 ATR & 2 ATR objective of 30638 & 30242 from the latest FA as probable targets to start with in the new month. The monthly Value was mostly lower & expanding to 30660-30900-31860 and acceptance below 30660 could lead to a test of October monthly spike low of 29693 below which we have that month’s VAH of 29220 and the monthly VPOCs of 28540 & 27160 as probable targets in the month(s) to come. (Click here to view the October Monthly profile)

Click here to view the day wise auction of this month

Monthly Zones:

The VWAP of the January series is at 31425 spot and the POC is at 32104

The settlement day (Feb) rollover volume point is at 30726 F.

The VWAP of the December series is at 31956 spot and the POC is at 32102

The settlement day (Jan) rollover volume point is at 32180 F.

The VWAP of the November series is at 30699 spot and the POC is at 31110

The settlement day (Dec) rollover volume point is at 32160 F.

The VWAP of the October series is at 28784 spot and the POC is at 28415

The settlement day (Nov) rollover volume point is at 30150 F.

The VWAP of the September series is at 28416 spot and the POC is at 27160

The settlement day (Oct) rollover volume point is at 30230 F.

The VWAP of the August series is at 27858 spot and the POC is at 27960

The settlement day (Sep) rollover volume point is at 27450 F.