Weekly view

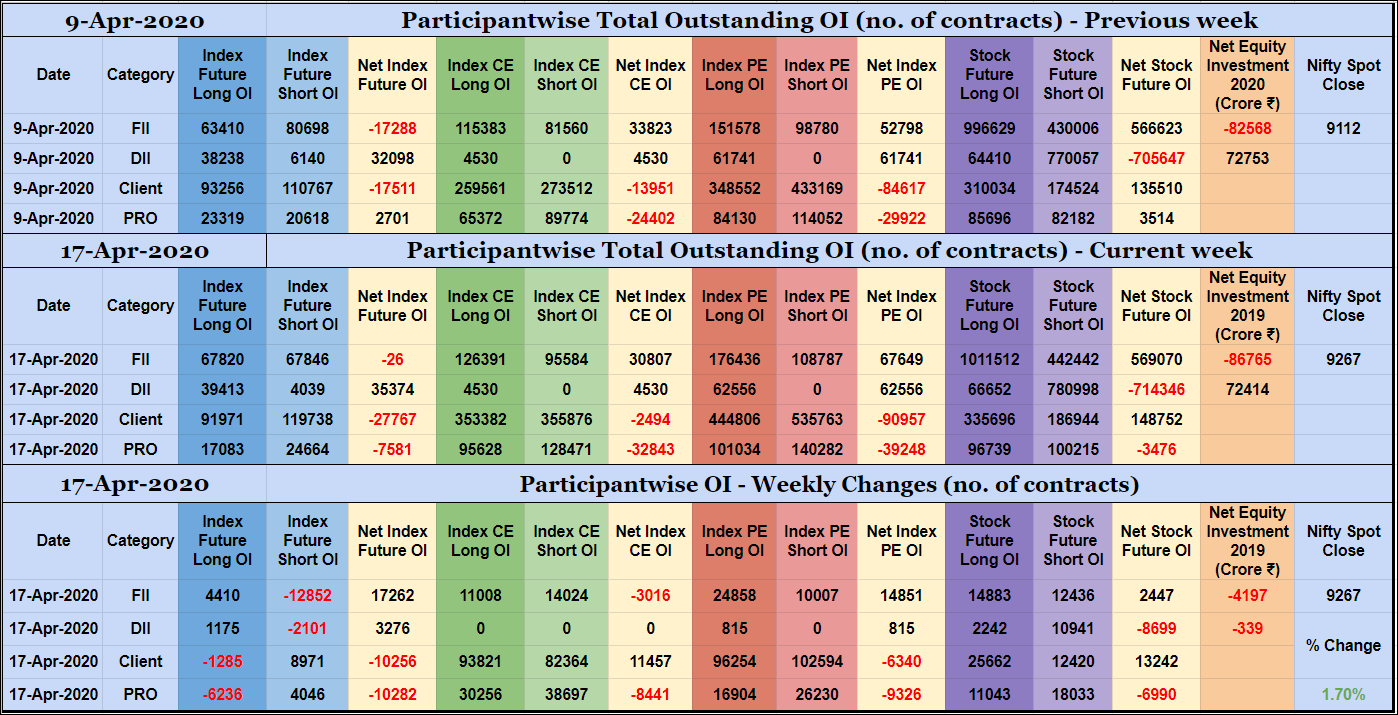

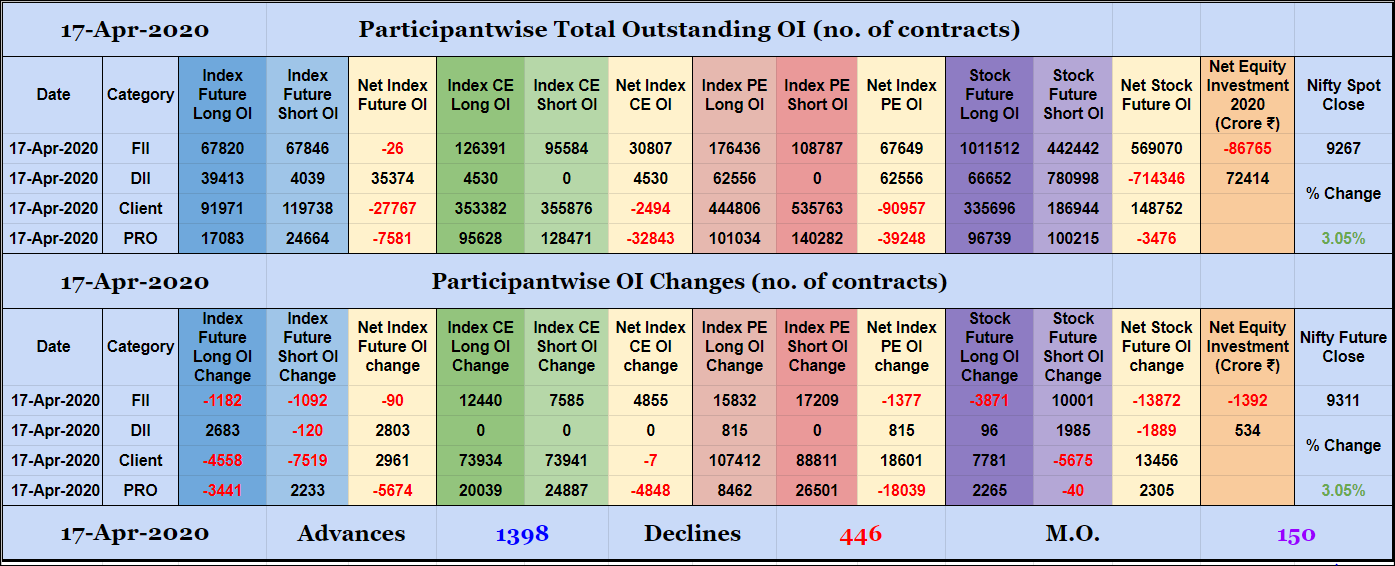

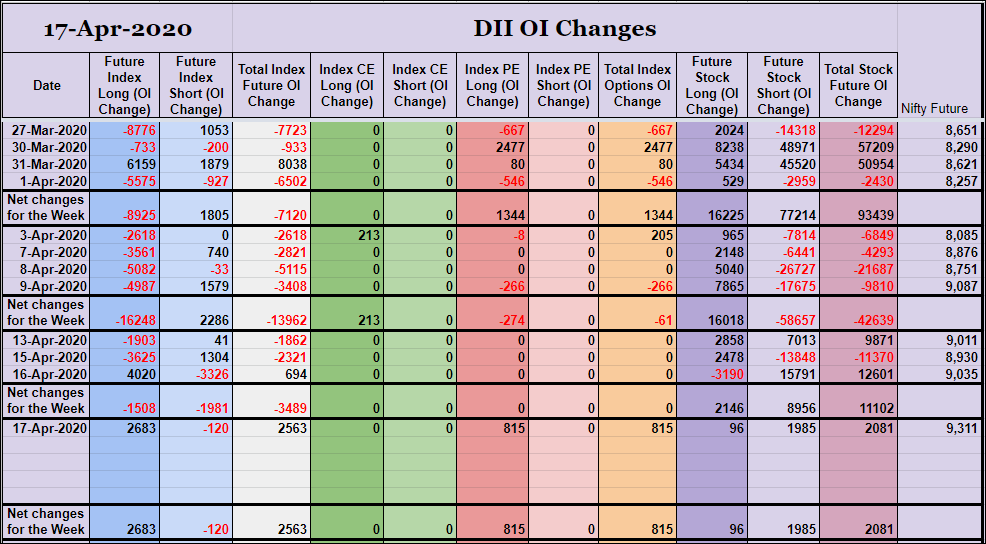

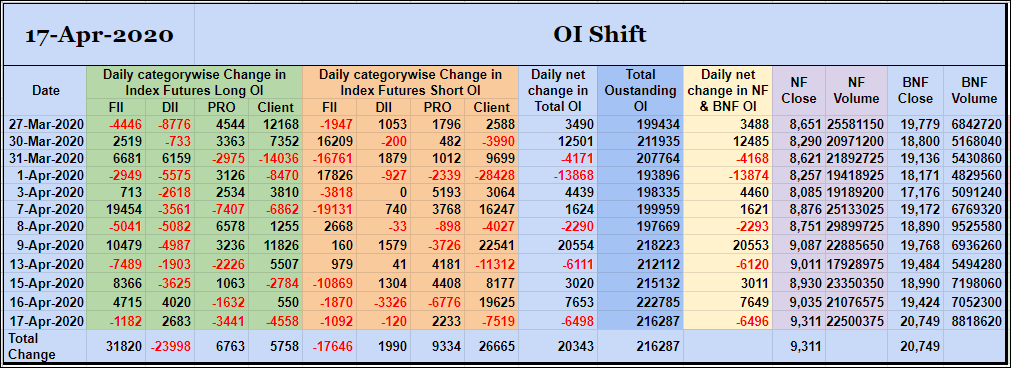

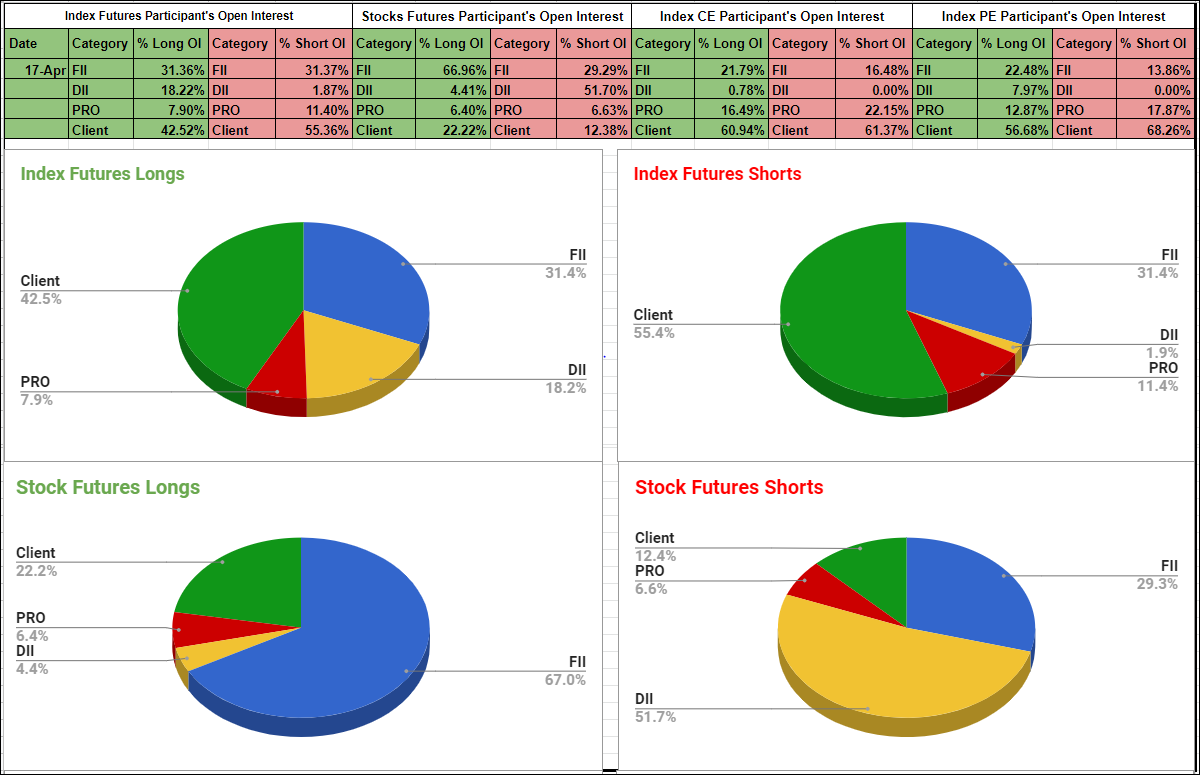

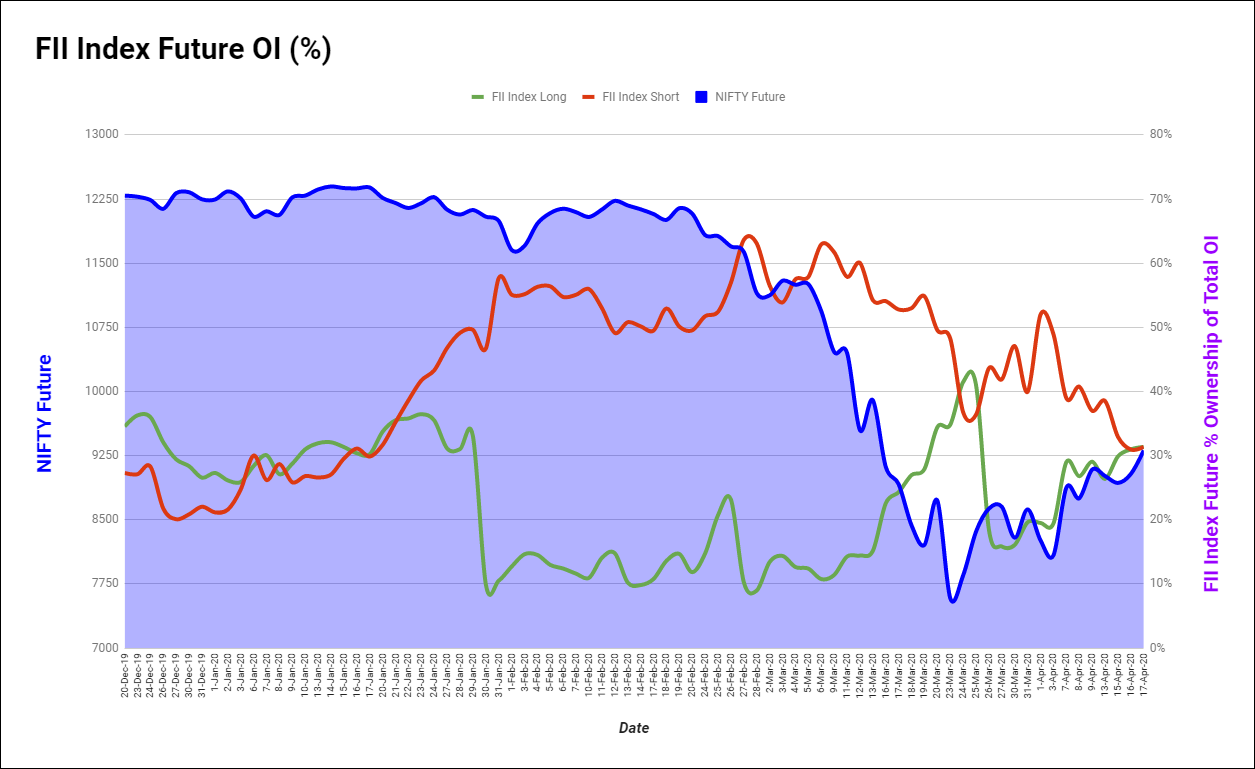

FIIs have added 4K long Index Futures, net 3K short Index CE, net 14K long Index PE and net 2K long Stocks Futures contracts this week while covering 12K short Index Futures contracts. They have been net sellers in equity segment for ₹4197 crore.

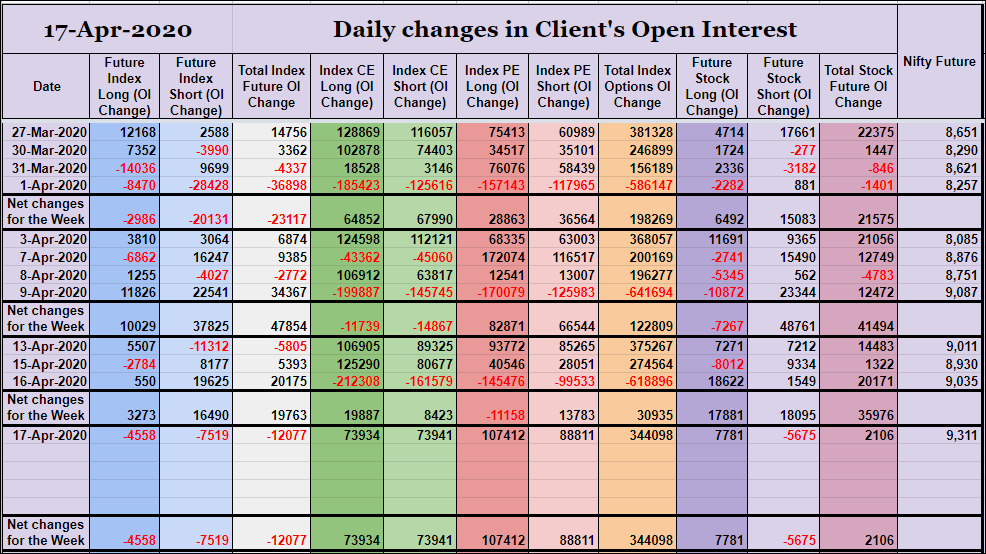

Clients have added 8K short Index Futures, net 11K long Index CE, net 6K short Index PE and net 13K long Stocks Futures contracts while liquidating 1K long Index Futures contracts.

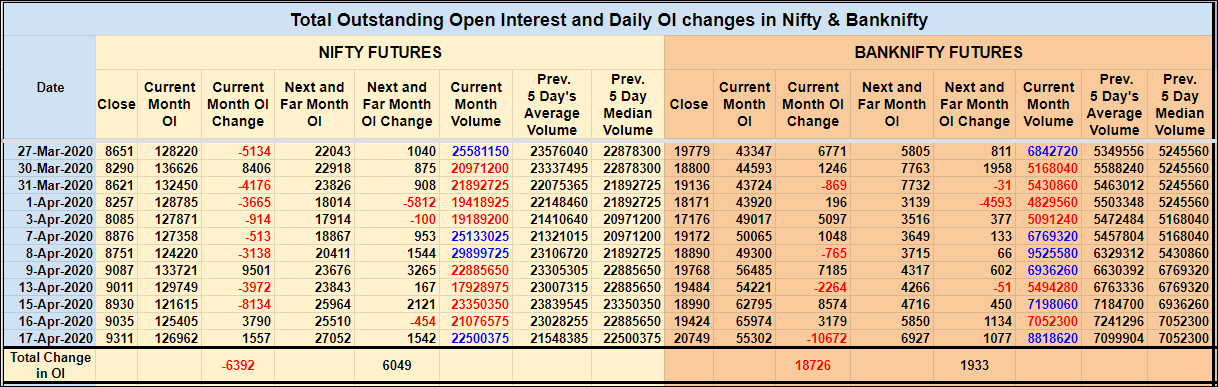

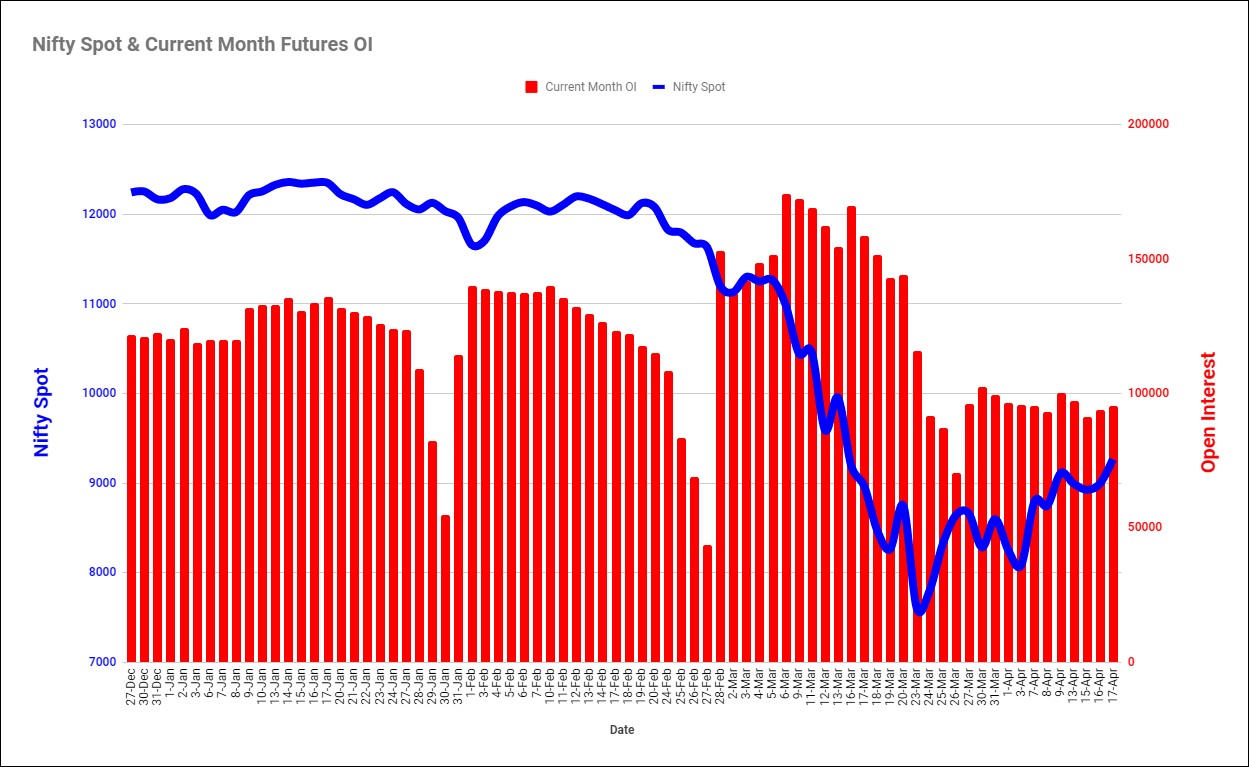

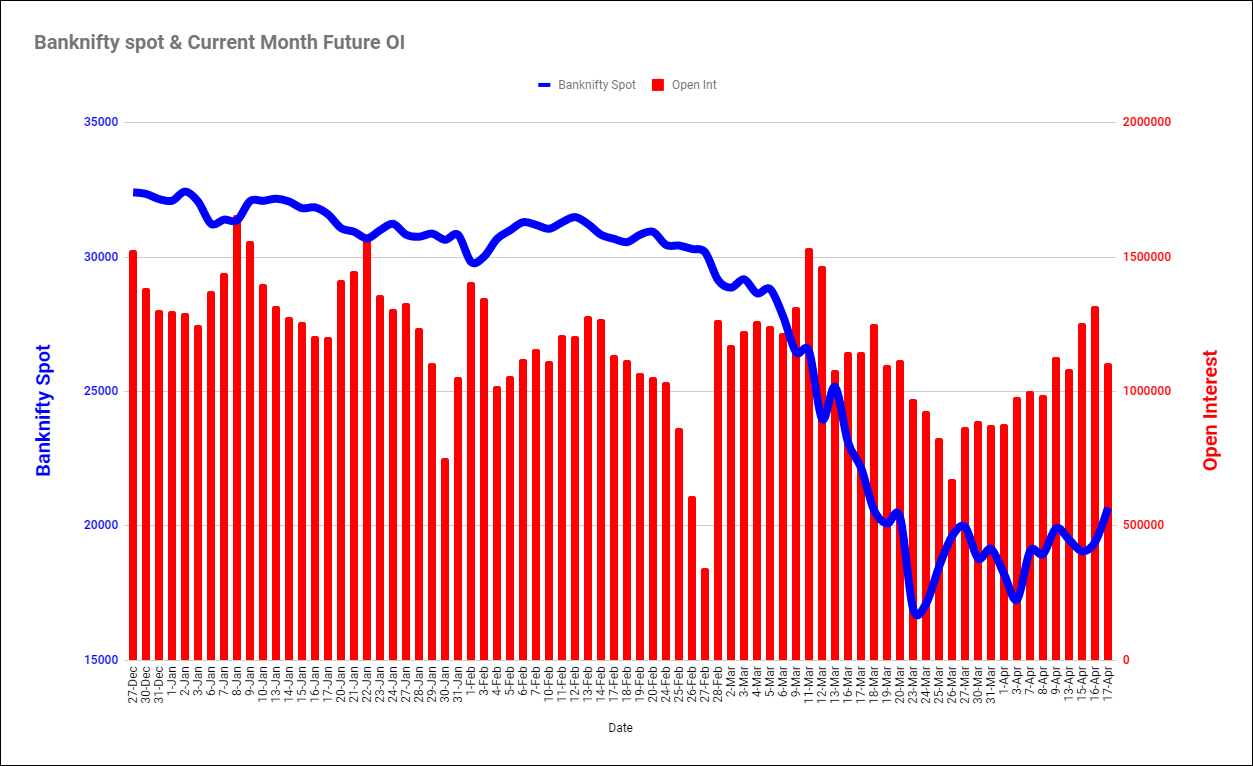

Nifty APR has shed 6759 contracts this week with 3376 contracts added to MAY/JUN Open Interest. Banknifty APR has shed 1183 contracts while MAY/JUN OI has gone up by 2610 contracts.