Mid-week changes in Participantwise Open Interest

-

FIIs have added 97K long Index Futures, net 301K long Index CE, net 303K long Index PE and 121K long Stocks Futures contracts during the current week besides covering 30K short Index Futures and 30K short Stocks Futures contracts.

-

FIIs have been net sellers in equity segment for ₹3013 crore during the week.

-

Clients have added 65K short Index Futures, net 52K short Index PE and net 40K long Stocks Futures contracts so far this week besides liquidating 24K long Index Futures contracts and shedding Open Interest in Index CE.

-

Proprietary traders (PRO) have added 20K short Index Futures, 300K short Index PE and 7K short Stocks Futures contracts in the current week besides liquidating 5K long Index Futures, 6K long Index PE and 39K long Stocks Futures contracts. They have also shed Open Interest in Index CE.

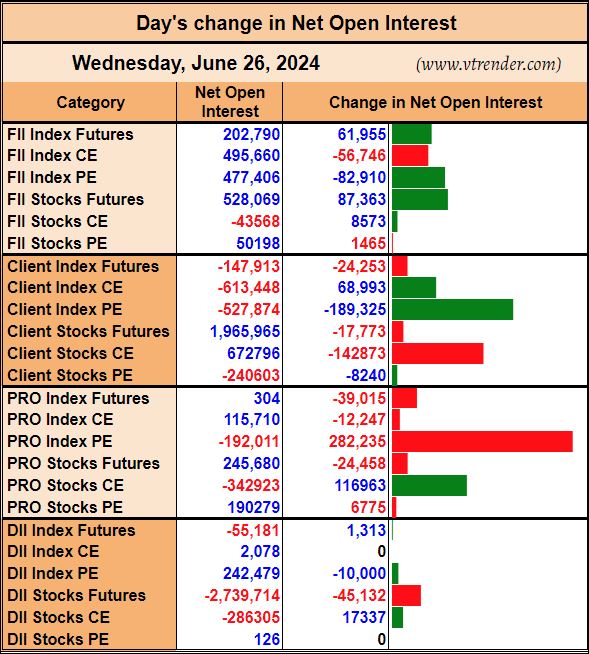

Participantwise OI – Daily changes

Day’s change in net Open Interest

Daily changes in FII Open Interest

Daily changes in Client Open Interest

Daily changes in Prop’s Open Interest

Daily changes in DII Open Interest