Mid-week changes in Participantwise Open Interest

-

FIIs have added 35K short Index Futures, 40K short Index CE, net 80K short Index PE and net 8K long Stocks Futures contracts during the current week besides liquidating 8K long Index Futures and 45K long Index CE contracts.

-

FIIs have been net sellers in equity segment for ₹12507 crore during the week.

-

Clients have added 57K long Index Futures, net 123K long Index CE, 208K long Index PE and 1K short Stocks Futures contracts during the week besides covering 4K short Index Futures contracts, 7K short Index PE contracts and liquidating 14K long Stocks Futures contracts.

-

Props have added 21K short Index Futures and net 58K long Stocks Futures contracts during the current week while shedding Open Interest in Index Options.

Participantwise OI – Daily changes

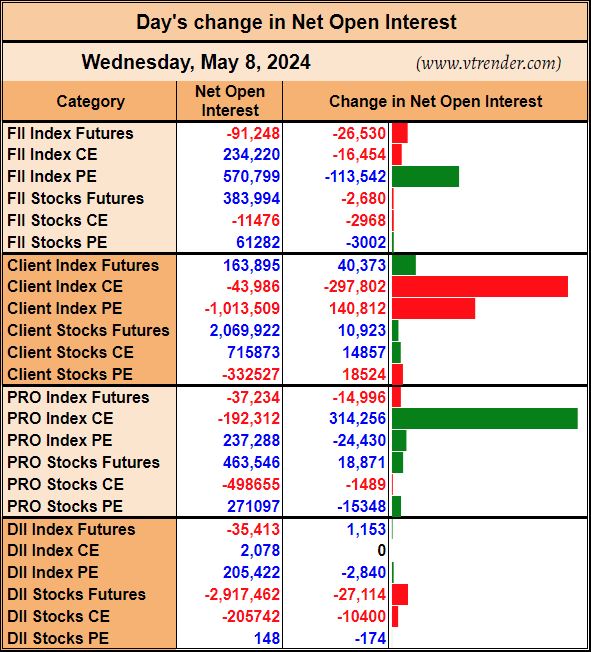

Day’s change in net Open Interest

Daily changes in FII Open Interest

Daily changes in Client Open Interest

Daily changes in Prop’s Open Interest

Daily changes in DII Open Interest