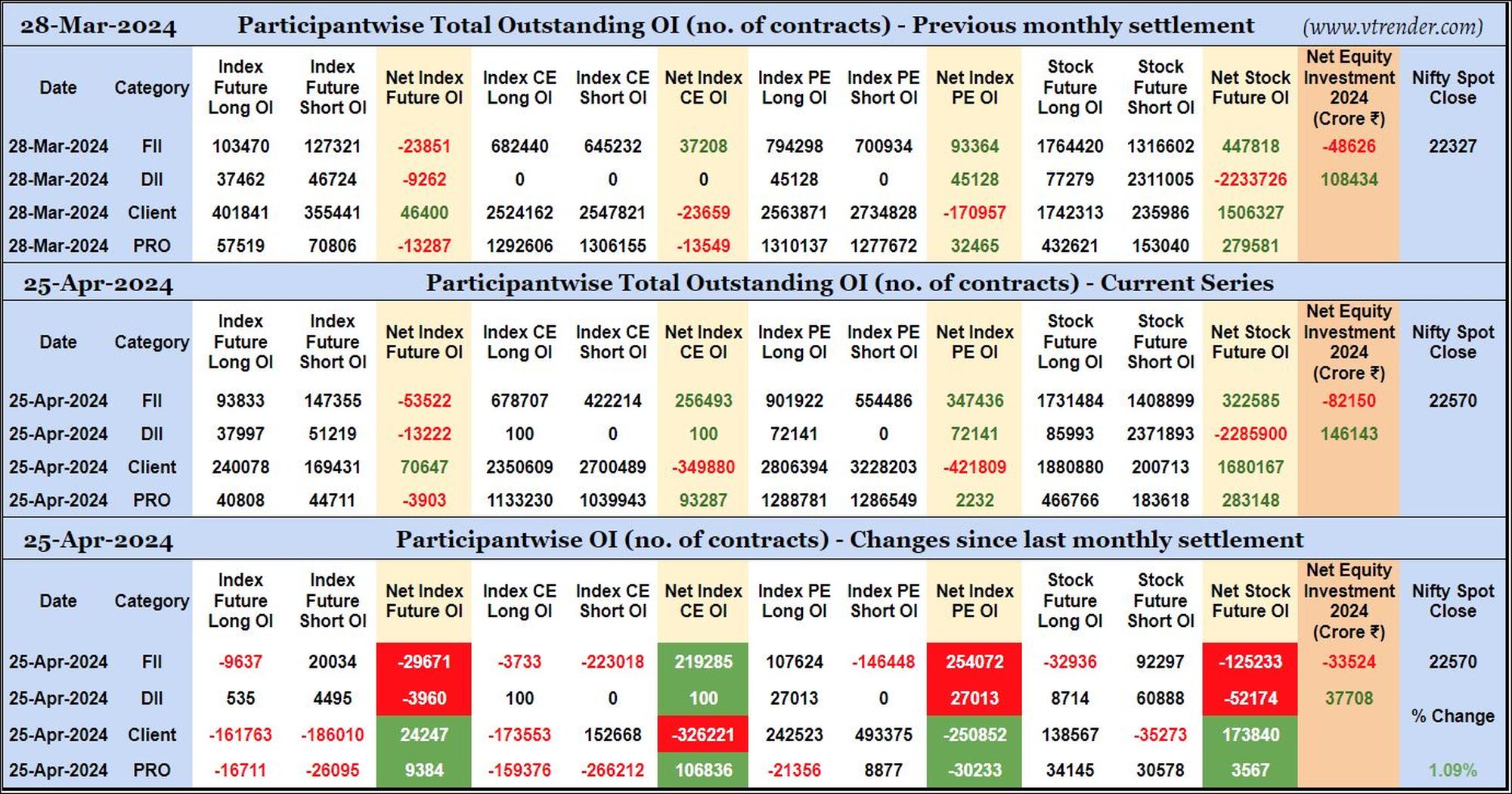

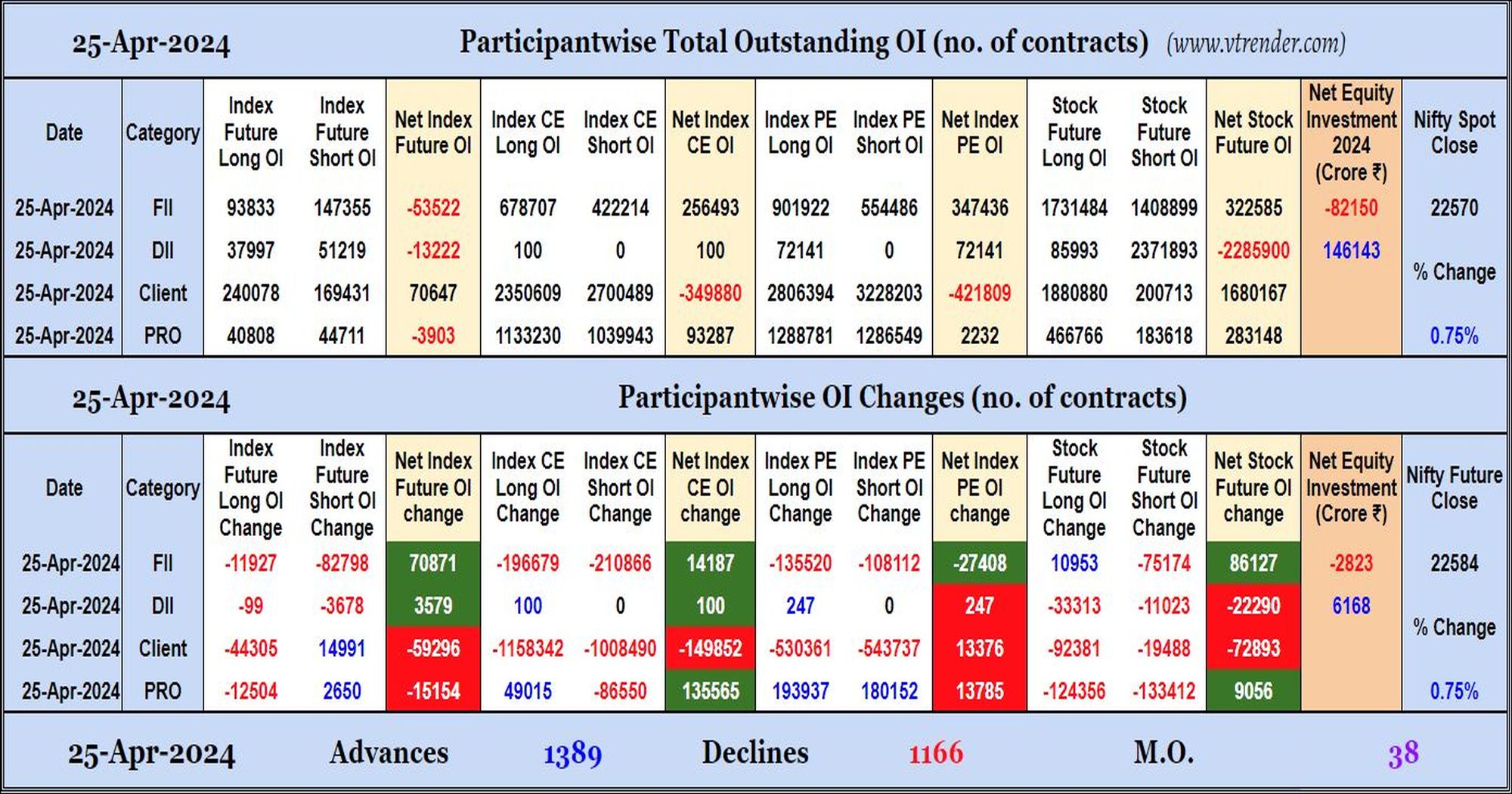

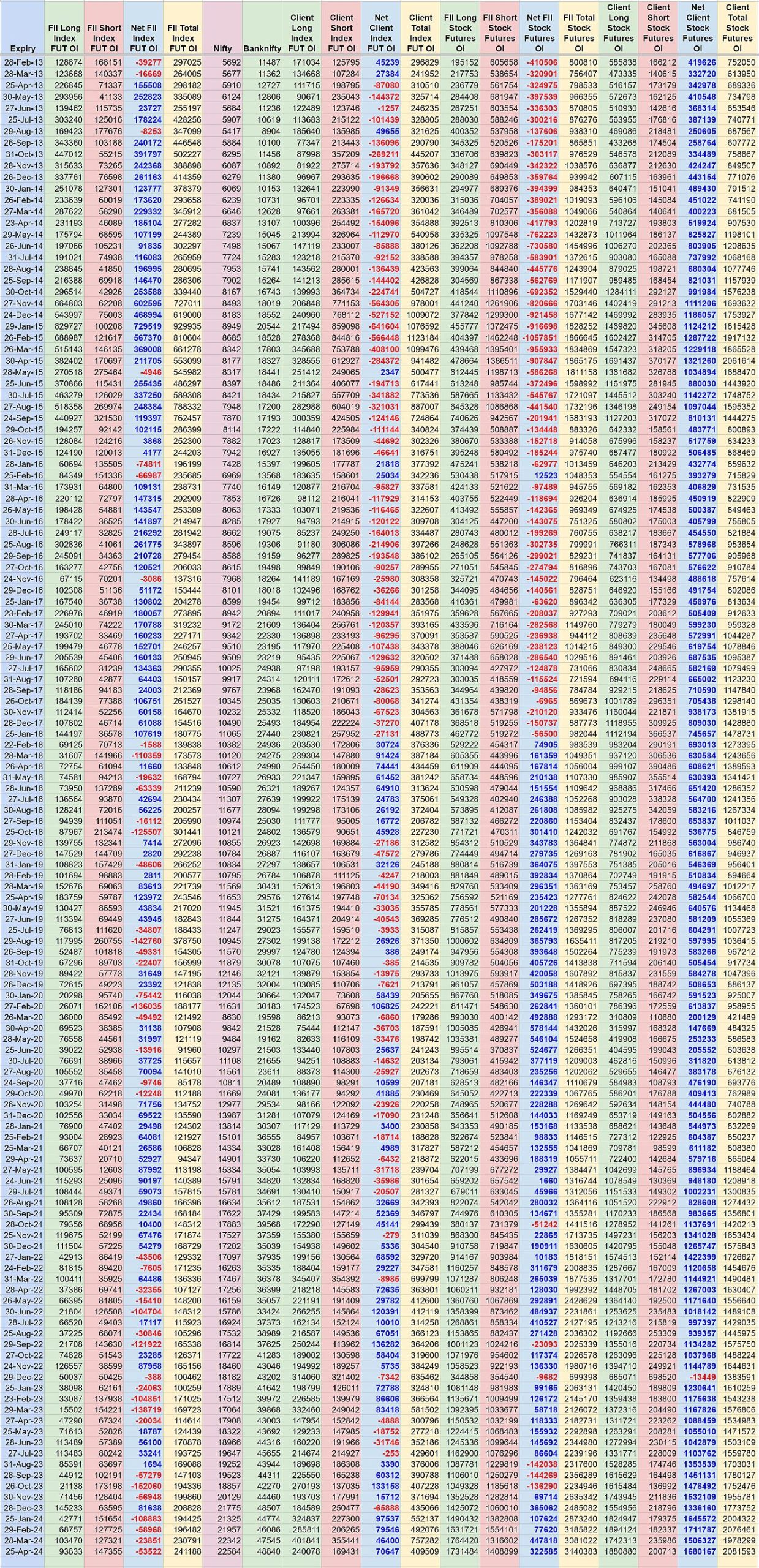

Changes since MAR’24 settlement in Participantwise Open Interest

-

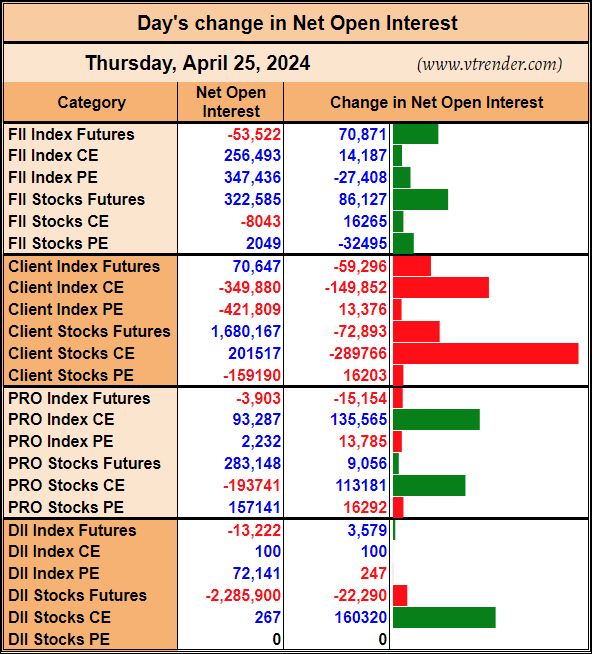

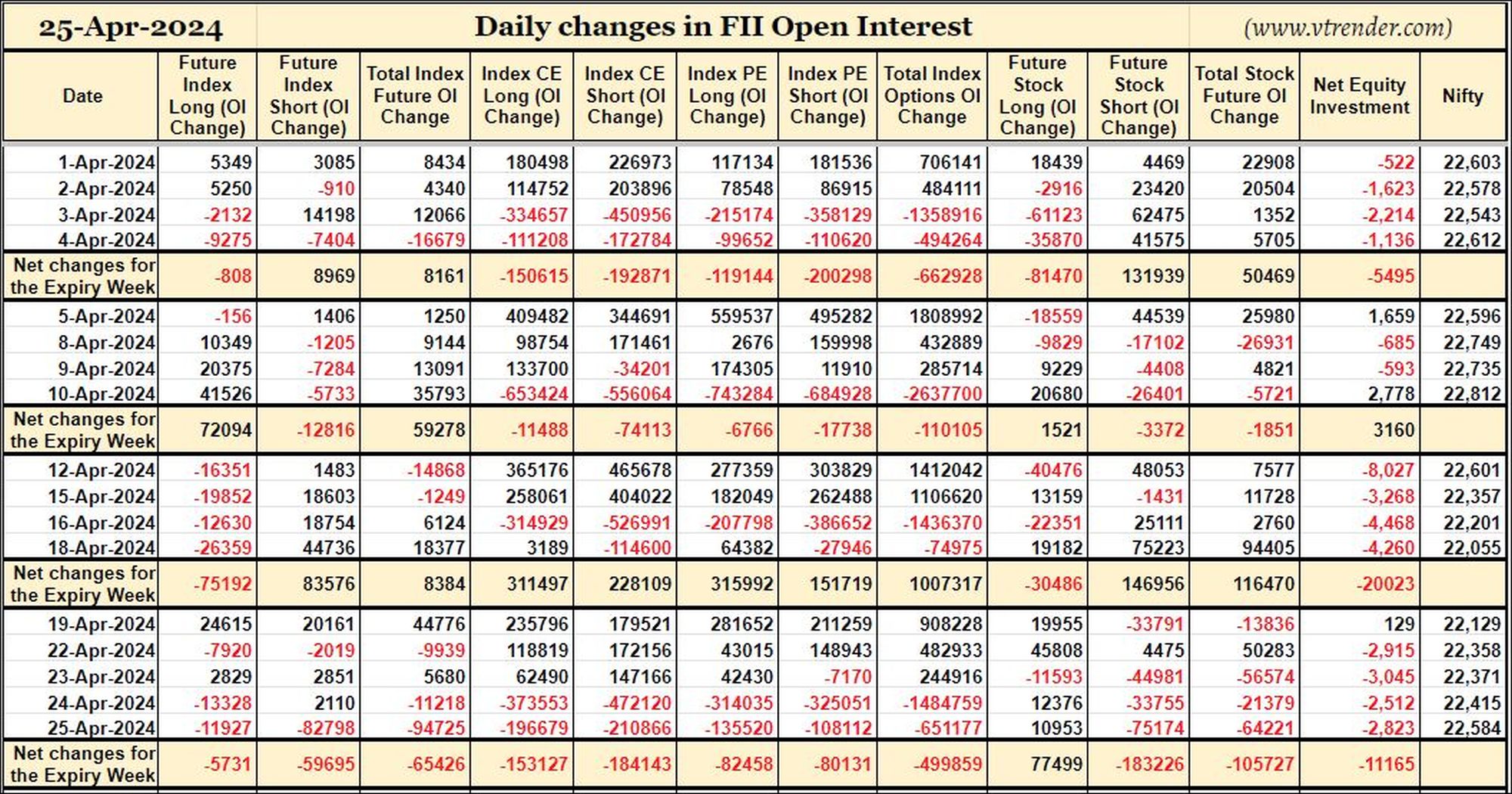

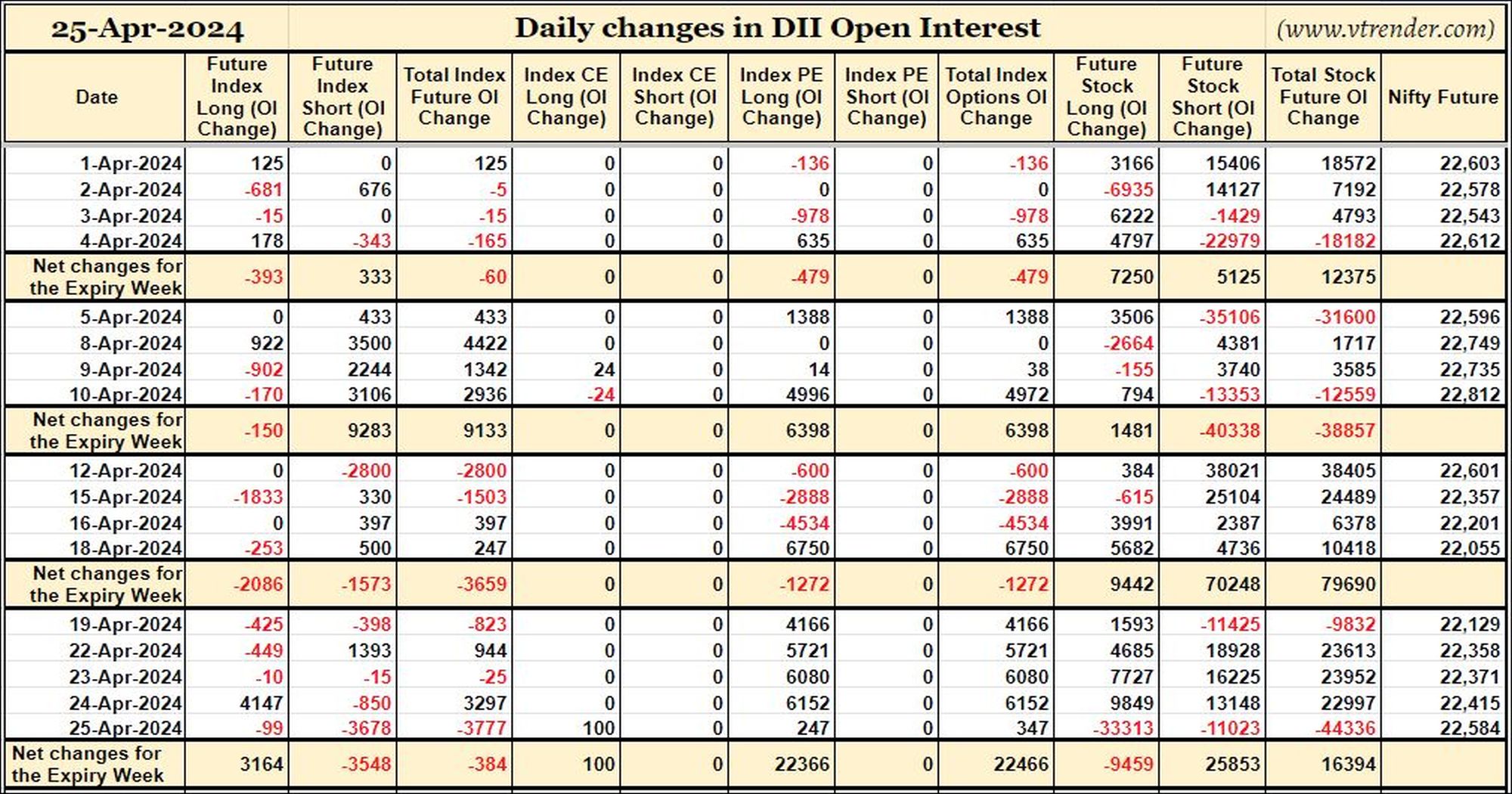

FIIs have added 20K short Index Futures, 107K long Index PE and 92K short Stocks Futures contracts duirng April series besides liquidating 9K long Index Futures and 32K long Stocks Futures contracts. They shed Open Interest in Index CE.

-

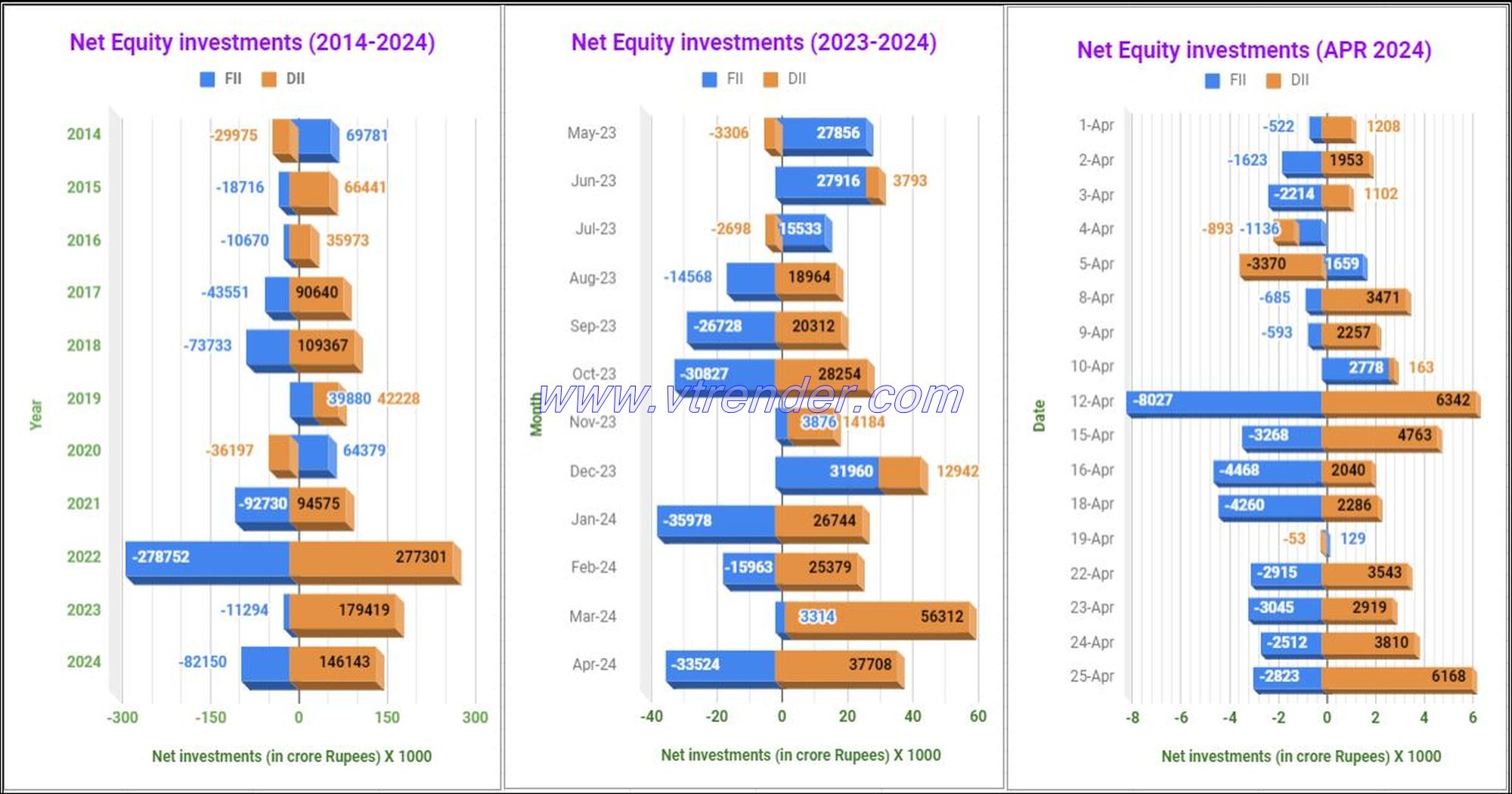

FIIs were net sellers in equity segment for ₹33524 crore during April series.

-

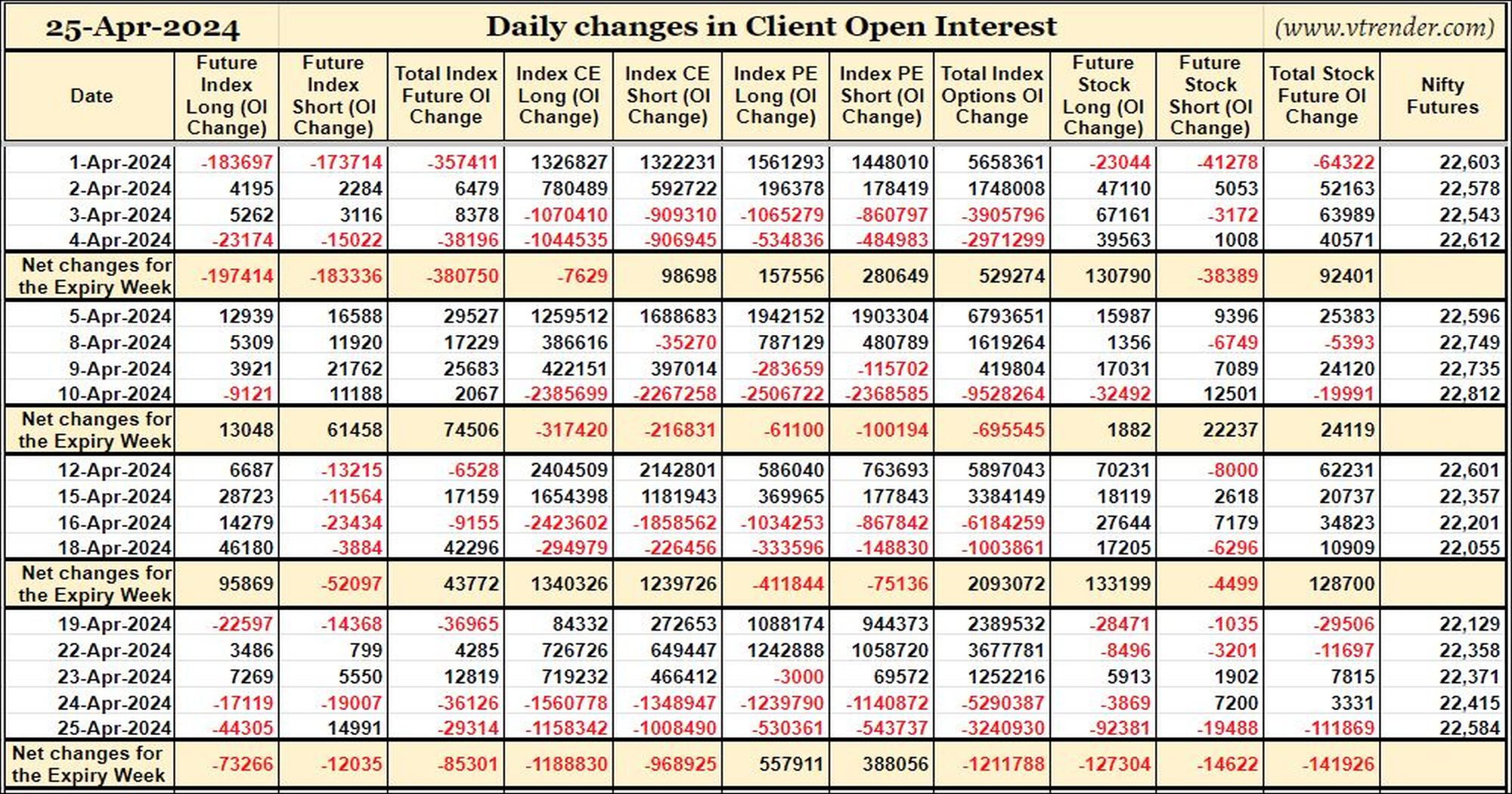

Clients have added 152K short Index CE, net 250K short Index PE and 138K long Stocks Futures contracts in April series besides liquidting 173K long Index CE contracts and covering 35K short Stocks Futures contracts. Clients shed Open Interest in Index Futures during April series.

-

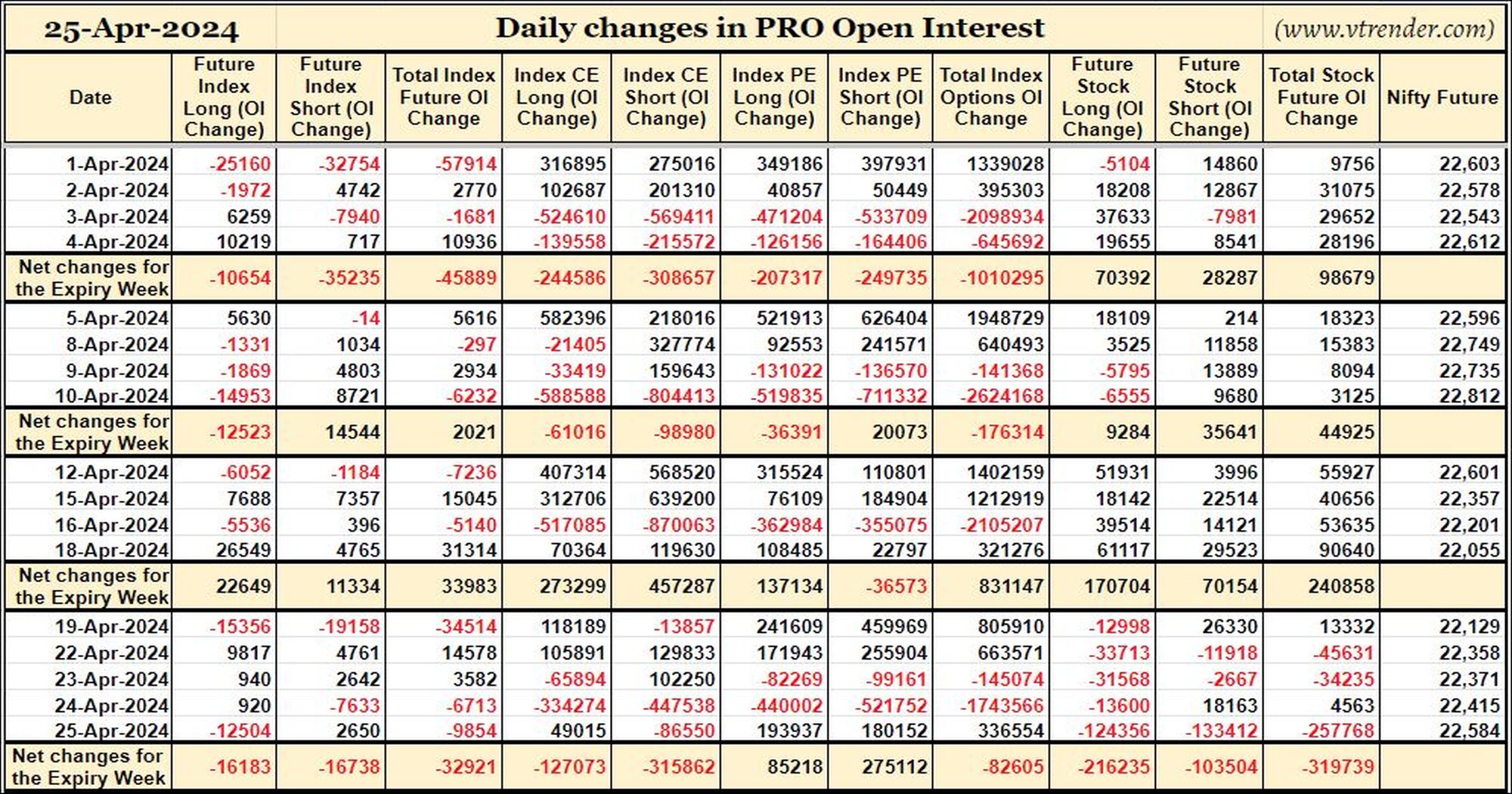

Proprietary traders (PRO) have added 8K short Index PE and net 3K long Stocks Futures contracts since March expiry besides liquidating 21K long Index PE contracts and shedding Open Interest in Index Futures / Index CE

-

Nifty spot has gone up by 1.09% in April series.