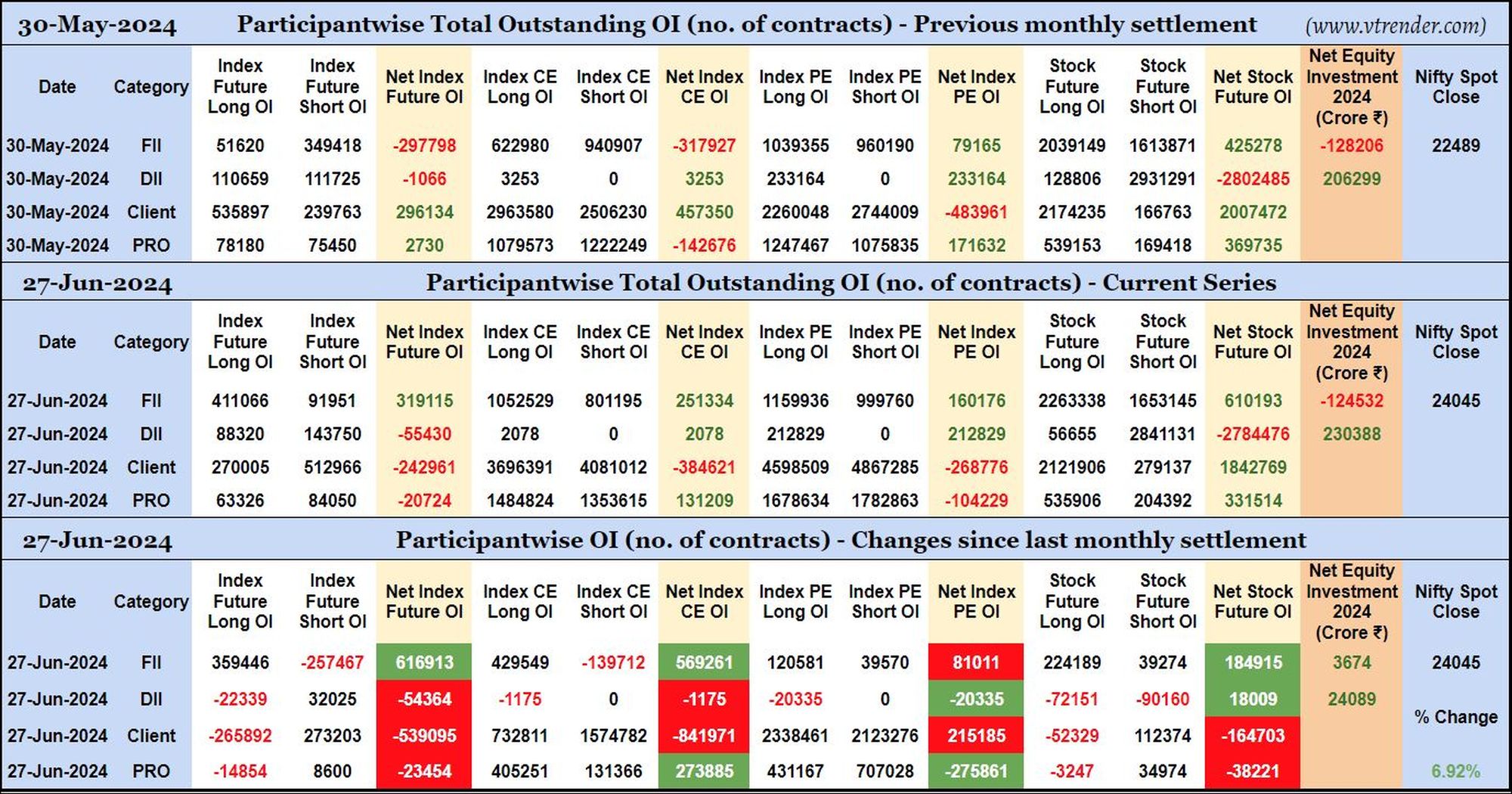

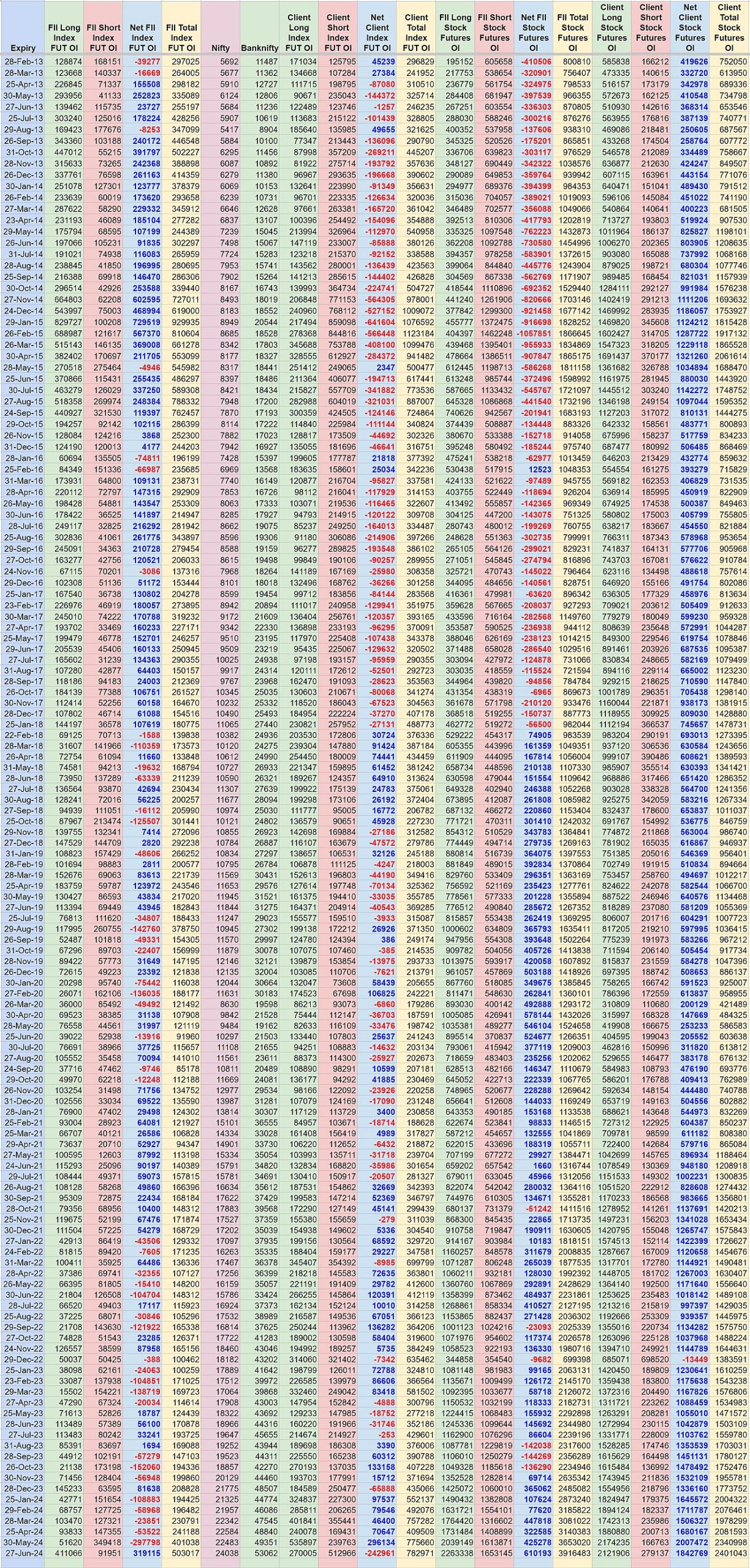

Changes since MAY’24 settlement in Participantwise Open Interest

-

FIIs have added 359K long Index Futures, 429K long Index CE, net 81 long Index PE and net 184K long Stocks Futures contracts in June series besides covering 257K short Index Futures and 139K short Index CE contracts.

-

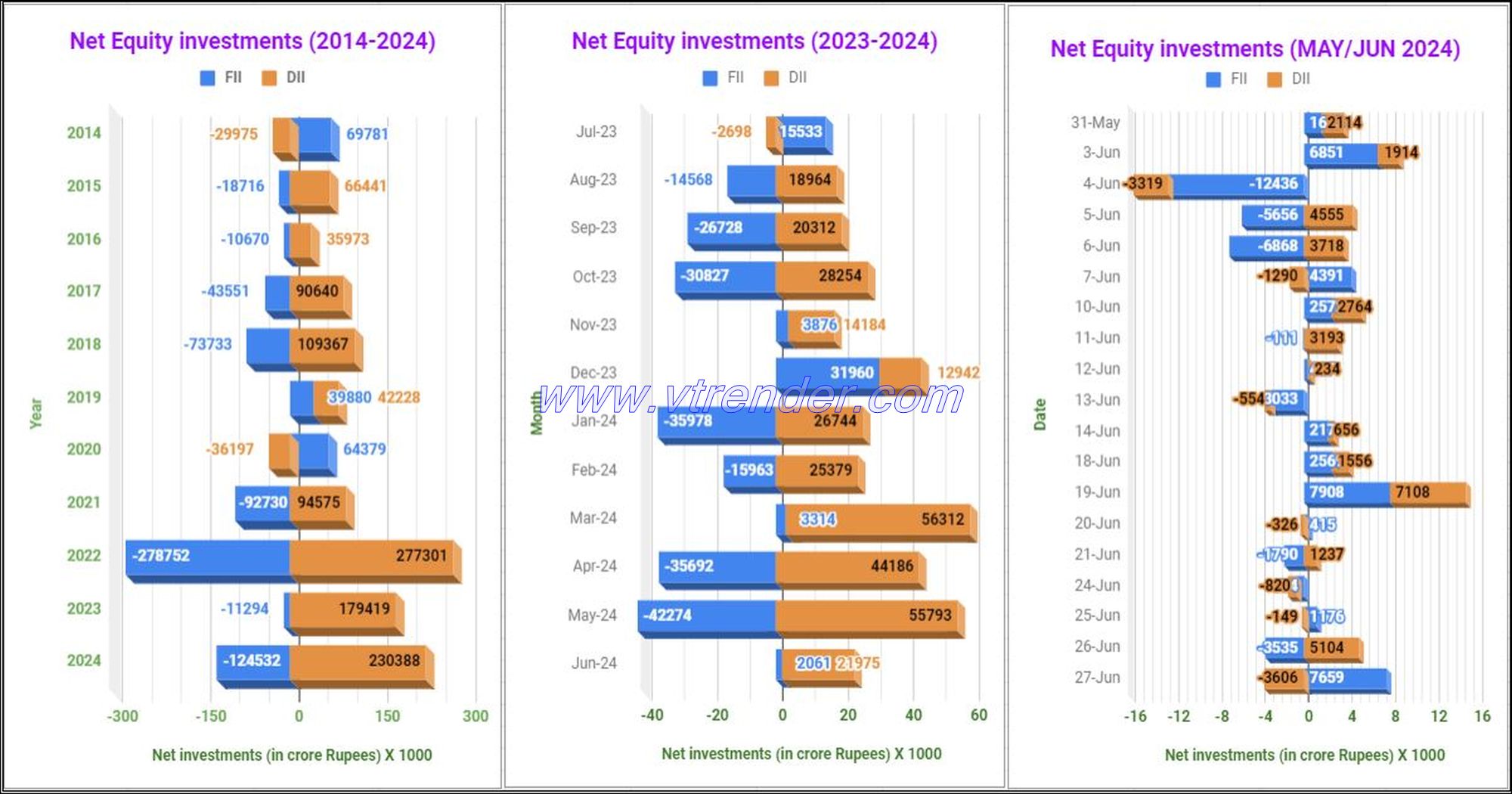

FIIs were net buyers in equity segment for ₹3674 crore during June series.

-

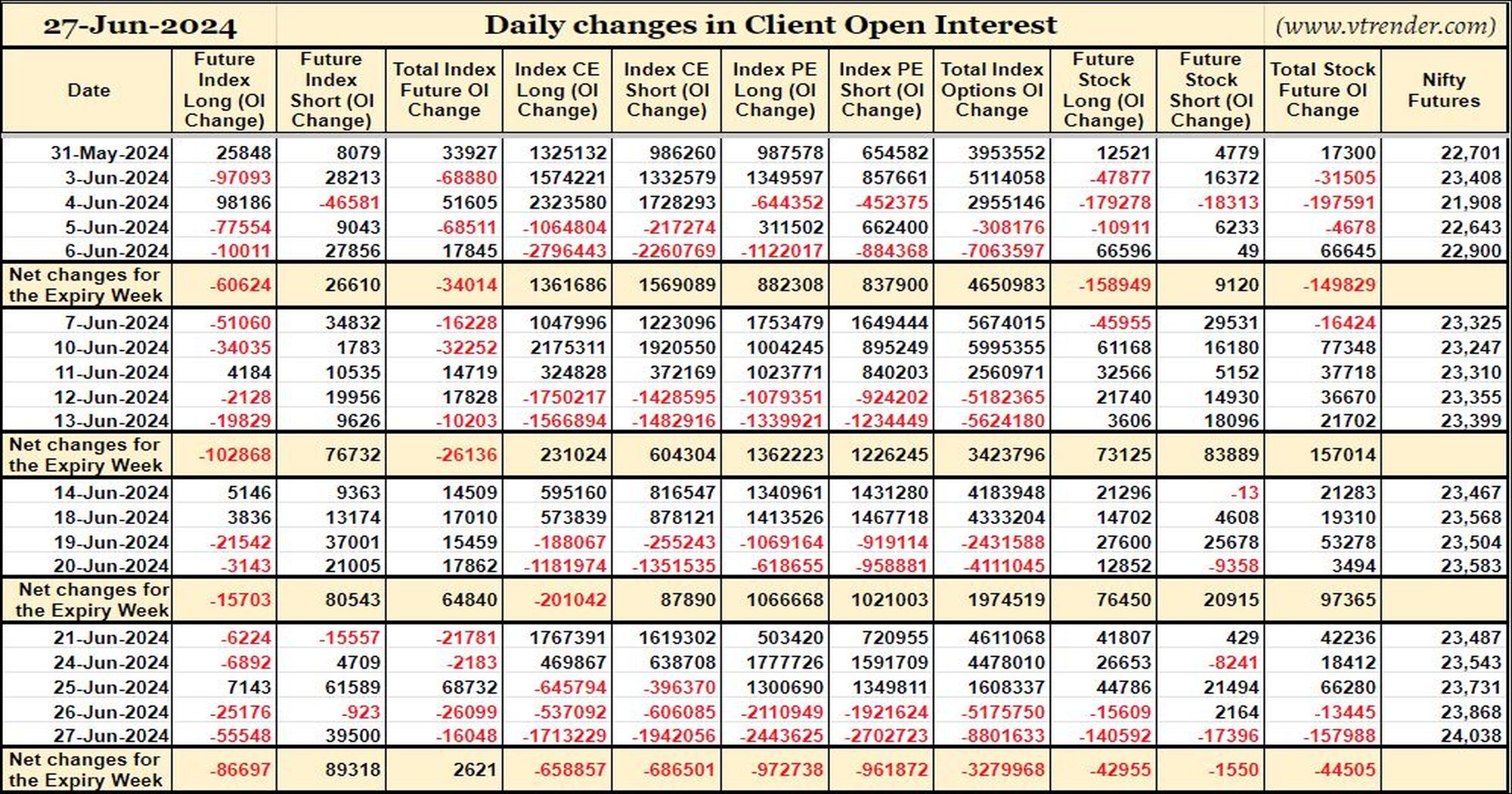

Clients have added 273K short Index Futures, net 841K short Index CE, net 215K long Index PE and 112K short Stocks Futures contracts since May expiry besides liquidating 265K long Index Futures and 52K long Stocks Futures contracts.

-

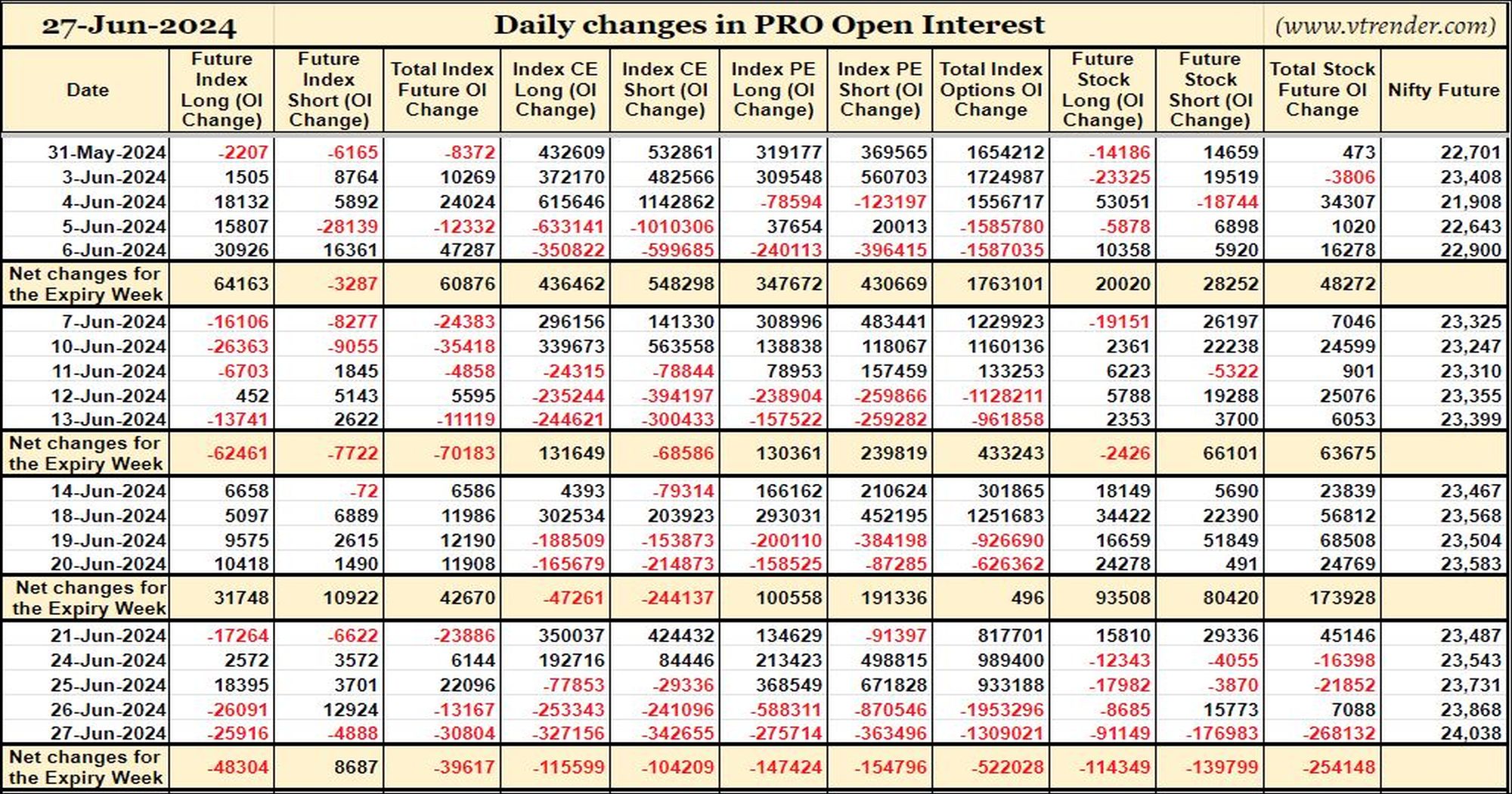

Proprietary traders (PRO) have added 8K short Index Futures, net 273K long Index CE, net 275K short Index PE and 34K short Stocks Futures contracts in June series while liquidating 14K long Index Futures and 3K long Stocks Futures contracts.

-

Nifty spot has gone up by 6.92% in June series.

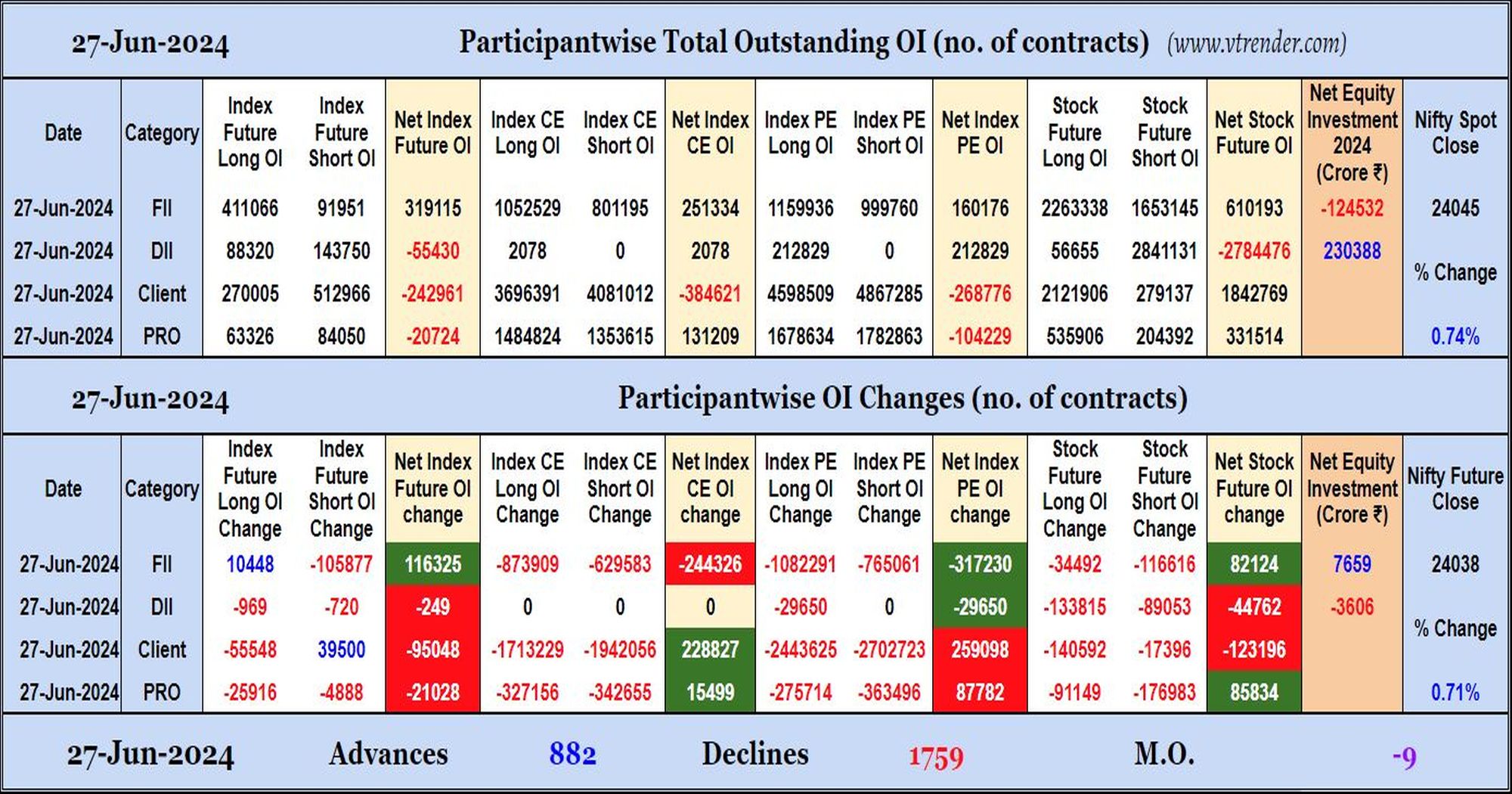

Participantwise OI – Daily changes

Day’s change in Net Open Interest

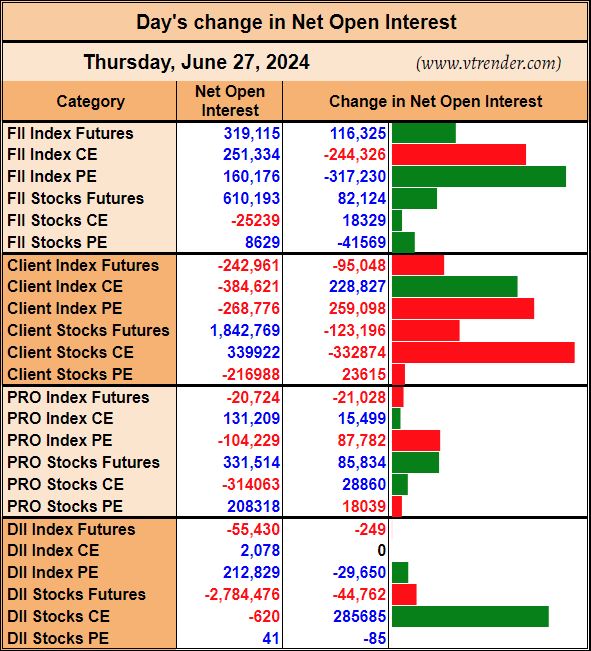

Daily changes in FII Open Interest

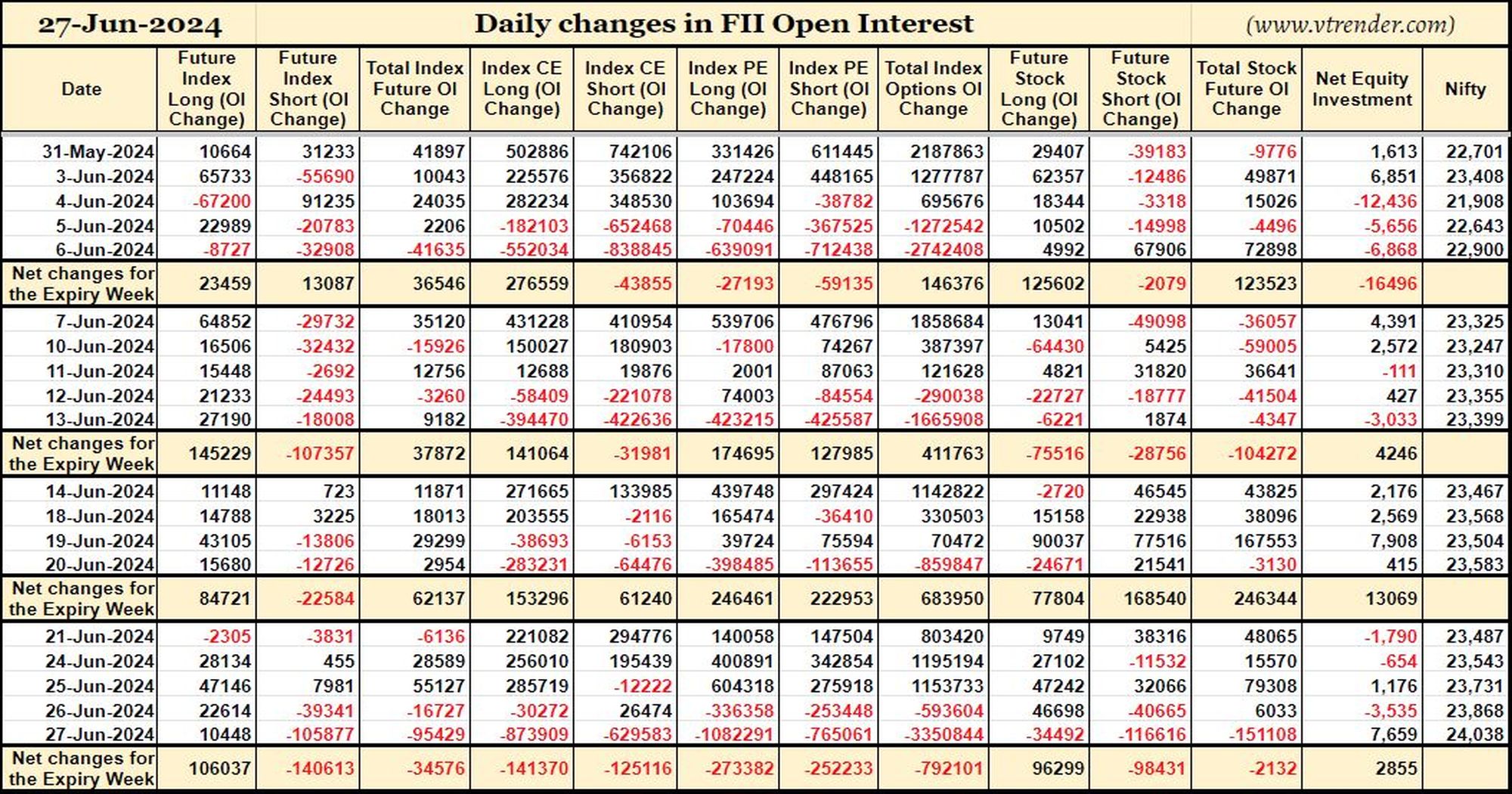

Daily changes in Client Open Interest

Daily changes in Prop’s Open Interest

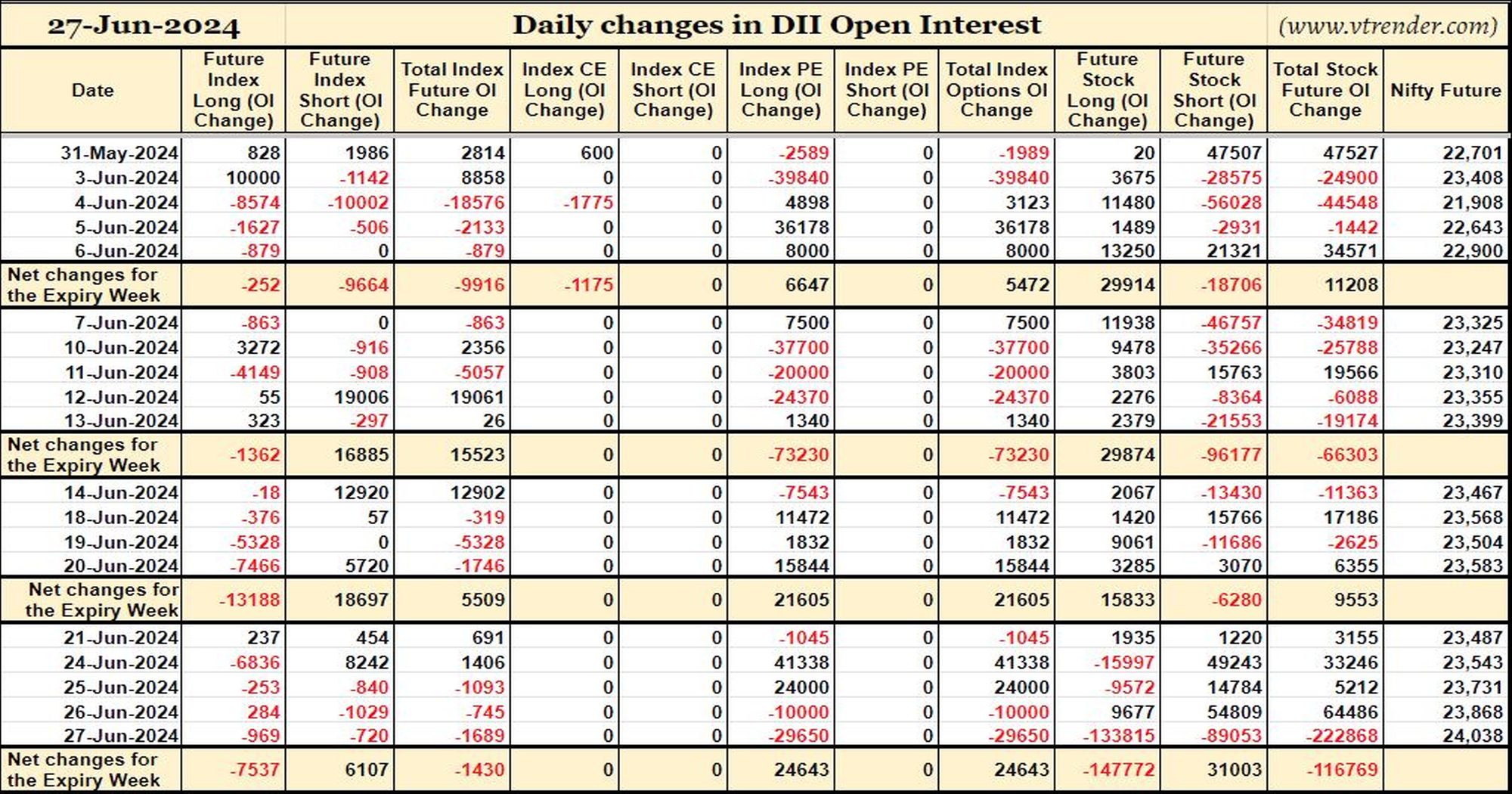

Daily changes in DII Open Interest

Net equity invetments

Expiry OI Stats updated 27th JUN 2024